By: Jamie Murray, CFA

The forestry sector is notorious for its boom/bust volatility, with 2025 proving to be no exception. Sinking lumber prices, tariffs and trade disputes, as well as an anemic homebuilding outlook in North America have driven the sector to multi-year lows. However, we believe there is an attractive opportunity in Doman Building Materials. The company offers a compelling counter-narrative: a steady, dividend-paying logistics play that is insulated from the violent swings of commodity prices.

The “Un-Commodity” Play

Investors often mistakenly bucket Doman with pure-play forestry producers like West Fraser or Canfor. True, Doman treats and sells wood products like treated lumber and fence posts to retail customers like Lowes and Home Hardware, but its business model is fundamentally different from forestry companies that compete in a commodity business. Doman, relies on value-added services like processing and distribution, earning a small margin on every piece of wood it touches. While distribution is also a competitive business, Doman has spent years building scale through several large acquisitions in the United States and thus is able to use its scale to operate more efficiently and offer the higher service level required to attract large national accounts. Note that its legacy Canadian business, Canwel, has been a market leader for years, although geographical disparity and a seasonal building calendar in Canada provide less efficiency than the concentrated sunbelt U.S. market.

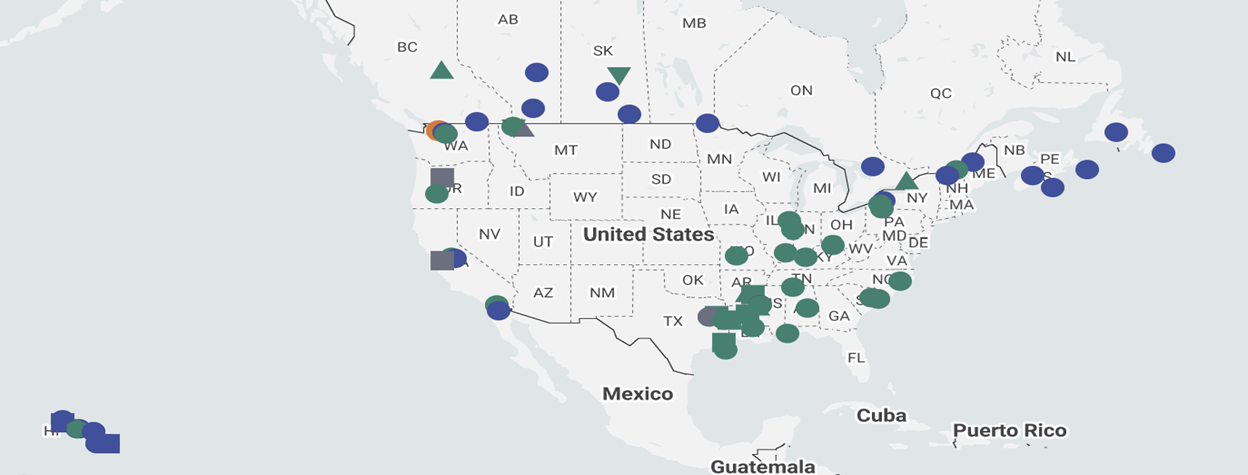

Figure 1 provides an overview of Doman’s operations. As the map highlights, Doman is a North American leader. Since 2021, the company has deployed over US$630 million into U.S. acquisitions, including the transformative purchases of Hixson Lumber and, more recently in 2024, CM Tucker Lumber. These acquisitions have made Doman a top-5 player in the U.S. pressure-treated lumber market. The map shows operations stretching across the U.S. South and West, regions with favorable housing demographics and renovation trends. This vertical integration yields tangible advantages in procurement, freight, and pricing power that smaller regional competitors are unable to match.

Figure 1: Doman locations across Canada and the United States.

Source: Doman Building Material

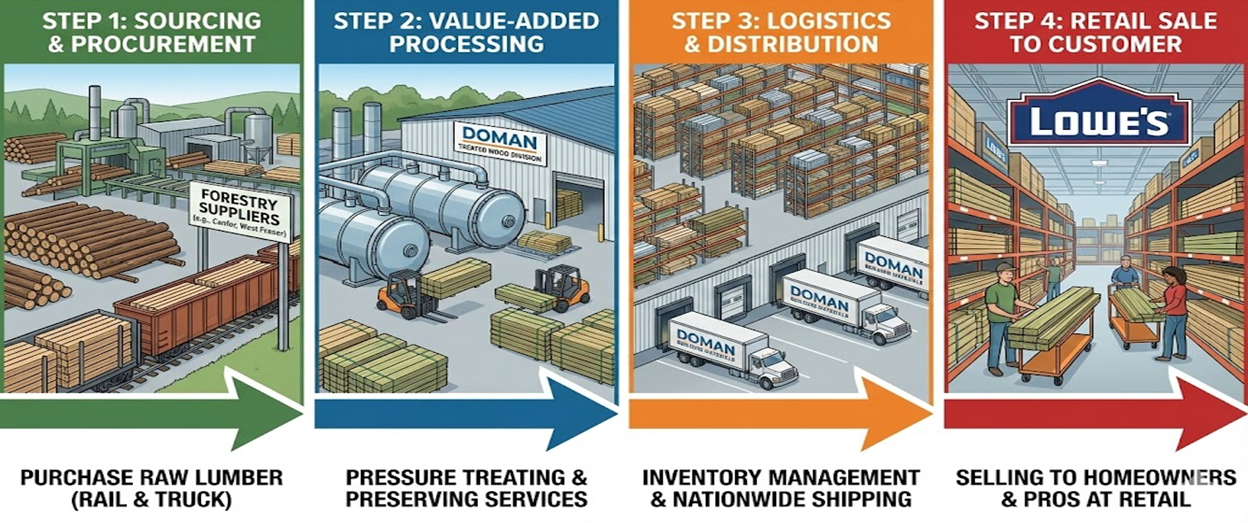

Doman operates on a “price spread” model. Whether lumber prices are sky-high (like in 2021) or depressed (like currently), Doman earns its margin on the volume of wood it moves and the value it adds. Figure 2 highlights its operations in the wood products value chain.

Figure 2: Wood products value chain

Source: MWG, Google Gemini

Step 1 & 2: Sourcing, Processing & remanufacturing:

Doman purchases raw lumber and, critically, applies pressure-treating services to create durable wood that can withstand nature’s element. It is also expanding its specialty sawmill operations that cuts the wood into retail-ready sections. These value-added services create a stickier product with higher margins than raw green lumber.

Step 3 & 4: Logistics & Retail:

By managing inventory and nationwide shipping for giants like Lowe’s, Doman becomes an indispensable infrastructure partner rather than just a vendor. These large retailers rely on Doman to provide the inventory on a just-in-time basis, freeing up the retailer’s floor space and capital. This is a very sticky service as Doman is typically integrated into the retailers’ inventory management system.

Performance in Practice

The success of this model and its resilience is visible in the stock’s long-term performance. Looking at the comparative performance chart in Figure 3 below, the black line (Doman) has significantly decoupled from the underlying commodity indices and peer groups (represented by the lagging blue, red, and green lines). While the price of lumber has crashed back to earth from its pandemic highs, dragging pure producer stocks down with it, Doman has continued to compound value.

This outperformance is clearly driven by the company’s ability to maintain margins throughout the cycle. In our view, the market still fails to reward Doman not as a cyclical resource stock, but as a stable industrial distributor, and thus the continued opportunity in owning shares.

Figure 3. Doman has strongly outperformed its peers

Source: Refinitiv Workspace

Source: Refinitiv Workspace

We believe Doman Building Materials offers a rare combination of growth and income, providing the protection of a defensive stock and the growth of an industrial distributor. By insulating itself from commodity volatility through value-added services and aggressively expanding into the U.S. sunbelt, Doman has built a moat that few competitors can cross. With a 4.0% target weight in the MWG Income Fund and expectations for 6-8% annual dividend growth through 2030, we maintain high conviction in Doman as a core holding for long-term wealth compounding.