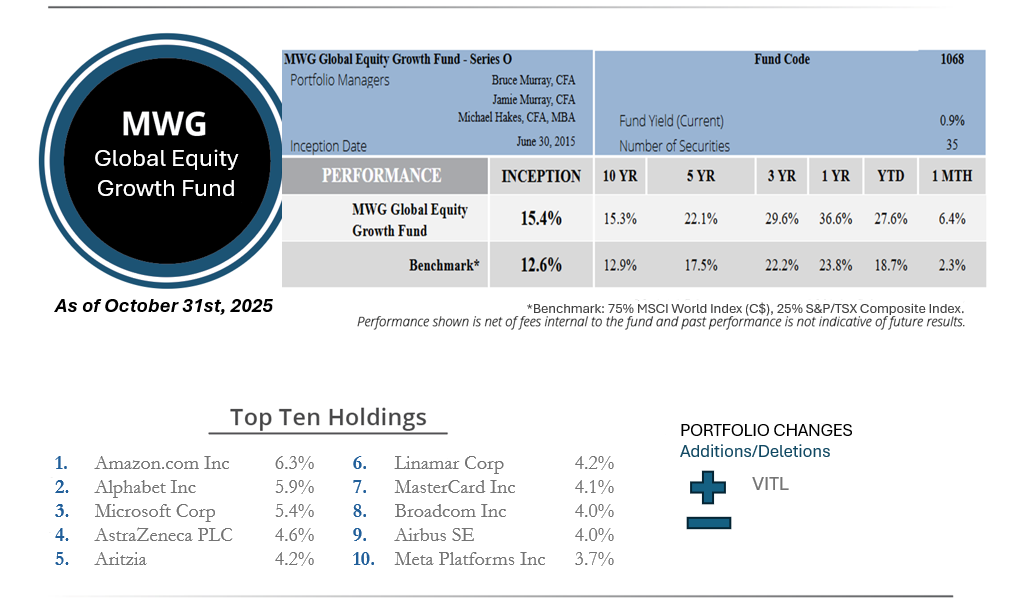

MWG Global Equity Growth Fund Performance

The MWG Global Equity Growth Fund Series O rose 6.4% in October, beating the 2.3% rise in its benchmark, and is now up 27.6% year to date. The Fund’s top three performers in the month were Hammond Power Solutions (+73%), Herc Holdings (+23%) and Thermo Fisher Scientific (+18%), while Meta (-11%), Docebo (-7%) and Aon (-4%) were the largest detractors.

Portfolio Managers’ Summary

The government shutdown in the U.S. has starved investors of timely economic data at a time when it seems like the economy outside of the AI datacenter build-out is weakening. Tariffs and inflation continue to affect consumers, while the job market is impacted by weak hiring conditions. The U.S. Federal Reserve has responded with interest rate cuts, and we see some inflationary relief from declining housing, gasoline and auto prices, all of which could provide some relief in 2026.

During the month, we initiated a small position in a U.S -based food company, Vital Farms. Vital Farms is the largest seller of pasture raised eggs, a premium egg category with high barriers to entry. Vital Farms works directly with independent farmers who meet its strict production guidelines and is responsible for distribution and marketing from farm to retailer. We believe that this network of farms gives Vital a strong lead in this category and one that is difficult to replicate. The company is building out its packaging infrastructure and should see volumes and revenue grow (revenue is expected to grow 28% this year) as new capacity comes online, given that it has been unable to meet the strong demand from national retailers. While pasture-raised eggs will ultimately reach some level of market saturation, Vital Farms true competitive advantage lies in its brand, with its black box being a strong identifier that consumers trust, and we believe can be leveraged into new products. As the world of food marketing becomes increasingly confusing, a premium brand that can back up its value proposition is a valuable entity.

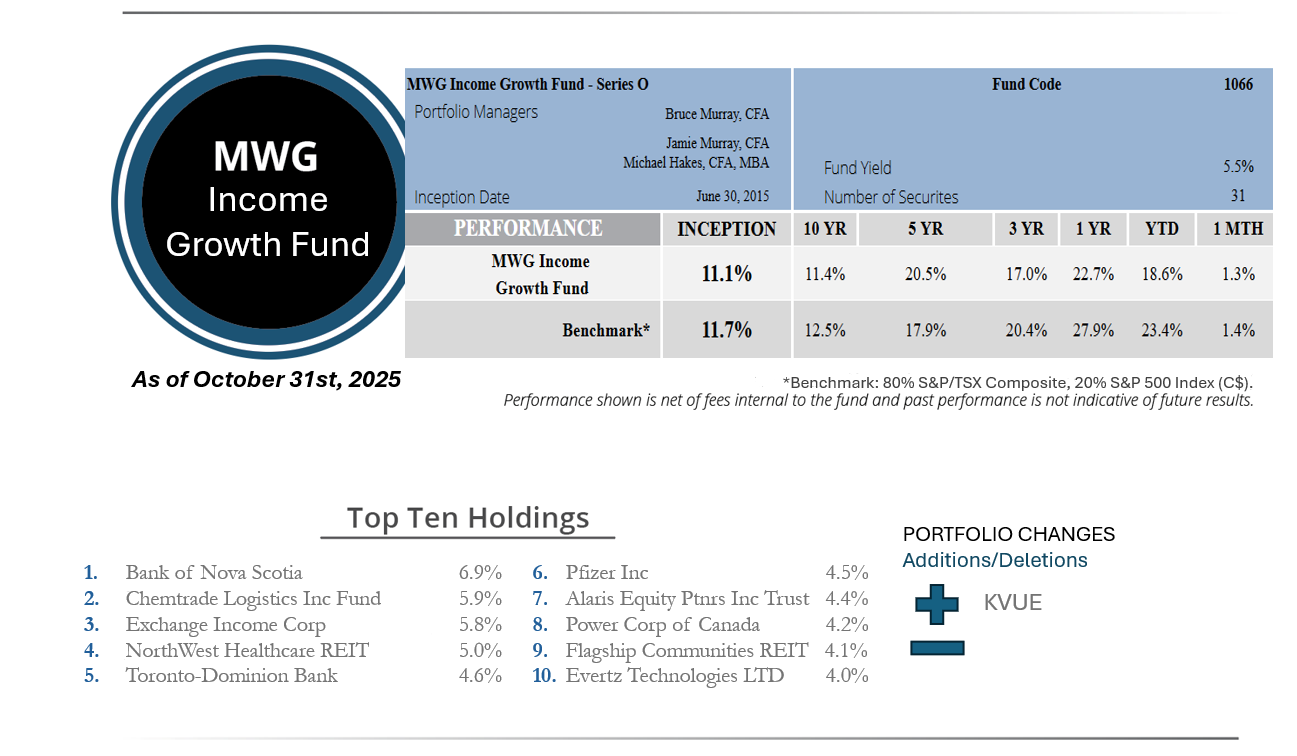

MWG Income Growth Fund Performance

The MWG Income Growth Fund Series O increased 1.3% in October, slightly below a 1.4% increase in its benchmark. The Fund is up 18.6% year-to-date. Northland Power (10%), Rio Tinto (+9%) and Power Corporation (9%) were top performers, while Opera (-28%), Gibson Energy (-7%) and Enbridge (-7%) were the top detractors. The Fund’s Yield was 5.5% at month-end.

Portfolio Managers’ Summary

In October, we added Kenvue to the Income Growth Fund. Kenvue is a consumer packaged goods company with a focus on health and medical products such as Tylenol, Band-Aid and Listerine. The stock was negatively impacted by the Trump Administration’s claims that Tylenol use during pregnancy is linked to autism, leading to concerns regarding declining sales and potential lawsuits. Not only is there no medical evidence supporting this claim, but numerous medical societies advocate for Tylenol use during pregnancy. It’s worth noting that other over-the-counter pain medications like Advil or Aspirin are not safe for use during pregnancy. As well, untreated fever during pregnancy can potentially cause complications. In early November, Kimberley-Clark reached a deal to acquire Kenvue in a stock and cash deal that will benefit our unitholders.