Thoughts on the Market: June Edition

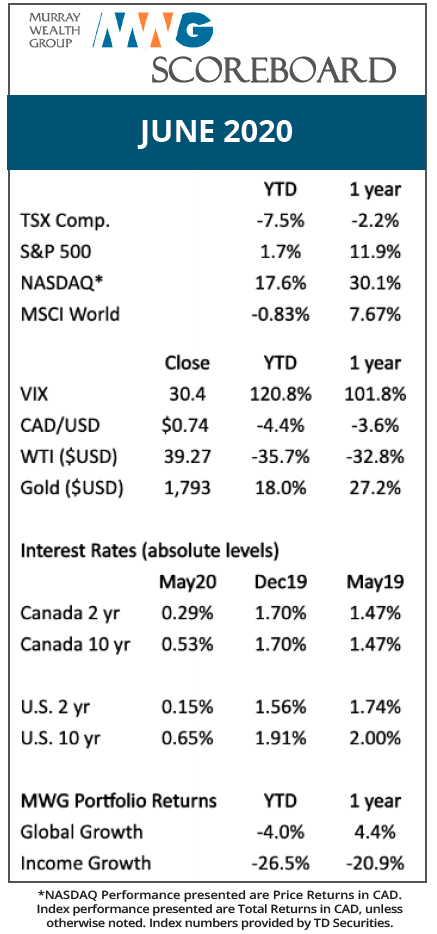

Equity markets closed out the second quarter on a high note, extending the rally off the low of March when investor fears surrounding the economic impacts of the Coronavirus were at their peak. The month was not without volatility, however, as it featured a rapid ascent in early June, a subsequent decline in cyclical stocks and several single days of large declines (including a 6-7% decline in indices on June 11).

News surrounding COVID-19 remains mixed. On the positive side, cases in many developed nations are declining and re-openings are progressing as planned. Hospitals and health care delivery are normalizing, and combined with an increase in testing, should allow economic activity to mostly return save for large events. Conversely, the Sunbelt States of the U.S.A. are experiencing a re-acceleration of cases, which could delay the resumption of some economic activities or lead to increased social distancing/ lockdown requirements. On balance, our belief is unchanged in that we assume challenges to affected industries will persist until a vaccine is available in early 2021, but that there will be a relatively swift recovery and return to normalcy afterwards.

There remains tremendous bifurcation between the haves and have-nots in a COVID world. The digital leaders continue to make new all-time highs as stay-at-home trends persist and new software applications are scaled across industries.

Case in point, on July 2nd, 63% of equities making new highs were tech-related, with the remaining balance being consumer staples, health care and home improvement-related.

Physical asset businesses continue to grapple with uncertain demand dynamics as the market adjusts to work from home and social distancing. However, we believe there is strong recovery potential particularly for strong branded retailers, healthcare delivery and travel once comfort returns to normal distance.

The market will likely remain volatile through the fall as we digest the second wave of COVID-19 in the Southern USA and the upcoming U.S. election. We would expect the market to resume its recovery as the effects of Covid-19 pass either through a successful vaccine or herd immunity and the outcome of the U.S. election is digested. We believe we are in the early stages of a new bull market and see strong years for equities ahead.

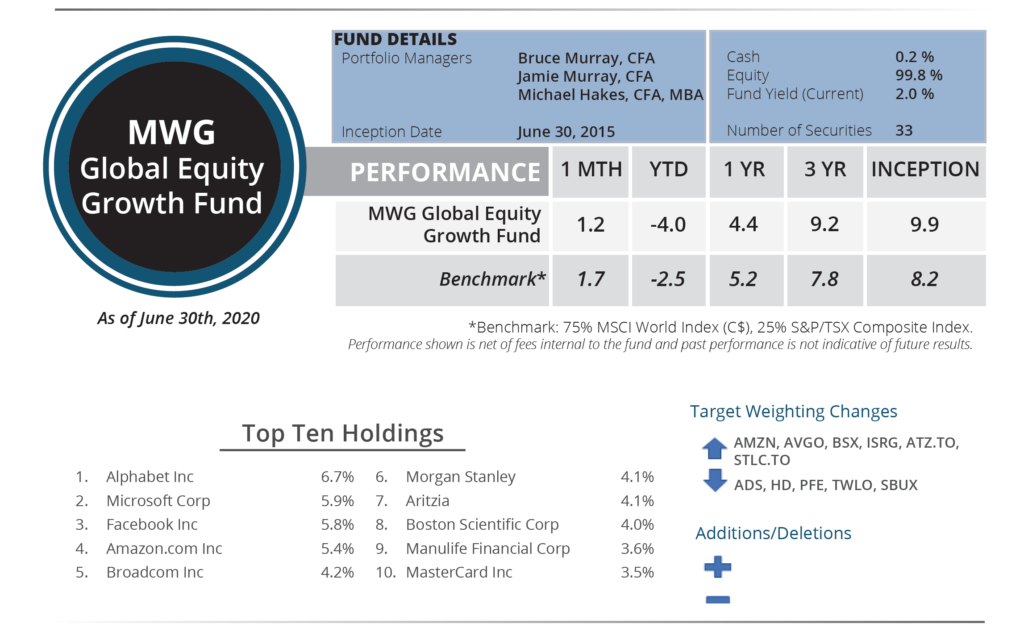

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund rose 1.2% in June, bringing its year-to-date return to –4.0%. Over the past twelve months, the portfolio has returned 4.4%.

The top performers in June were Spin Master Corp (+30% return), Newell Brands (+18%) and Morgan Stanley (+8%). Royal Caribbean and Alliance Data were our weakest performers during the month (-9%), as both companies sold off after very strong starts to the month on growing U.S. coronavirus concerns. As well, a $0.01 move higher in the Canadian Dollar was a headwind to our portfolio, which is 80% weighting in U.S./International equities.

We made no portfolio additions or deletions during the month, although the volatility provided many rebalancing opportunities. Most notably, we increased our target weighting in Amazon to 5.5% as its strong execution through the pandemic and massive re-investment runway should position it for years of growth.

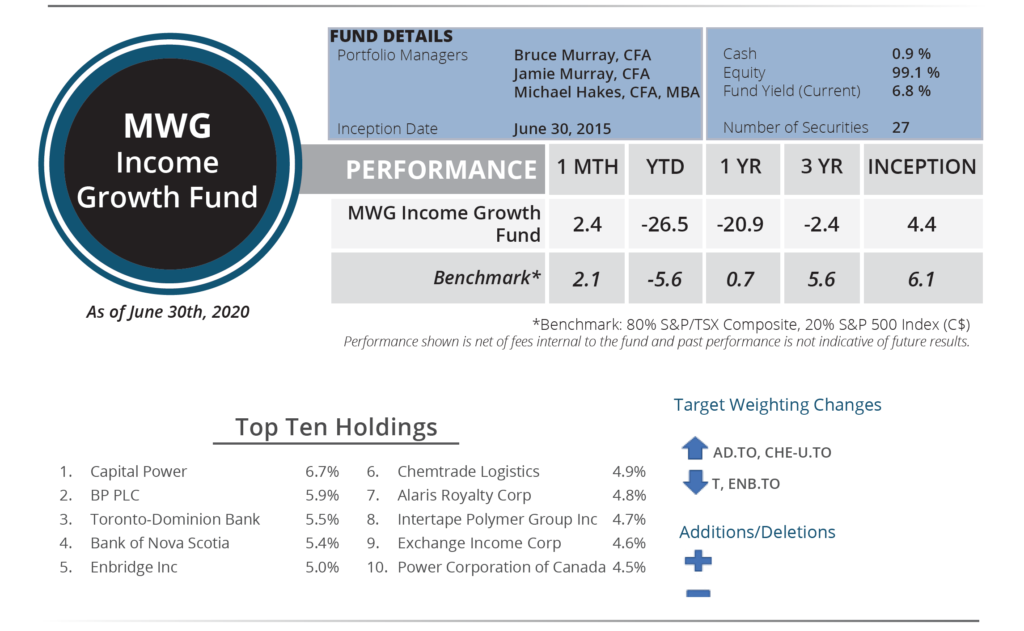

INCOME GROWTH FUND

The MWG Income Growth Fund rose 2.4% in June and is now down -26.5% year to date. Over the past twelve months, the portfolio has returned –20.9%.

Alaris (+24%), Newell (+17%) and Broadcom (+10%) were the top performing equities during the month. Evertz Technologies (-25%), Corus Entertainment (-11%) and Tapestry (-6%) most hampered performance.

We made minor re-balancing changes to the portfolio, increasing our weighting in Alaris Royalty and Chemtrade on recovery expectations. On the other side, we lowered our weighting in AT&T and Enbridge as these companies are less cyclical and would not provide the same upside in a recovery rally.

The Income Growth Fund performance remains negatively affected by its large holdings in financial, real estate and industrial business. Uncertainty among these stocks remains around the potential for bankruptcies and loan losses in the event the economy does not fully recover following COVID-19. However, we believe that the companies in our portfolio can weather the pandemic and provide strong appreciation potential to a rebounding recovery.