Thoughts on the Market: February Edition

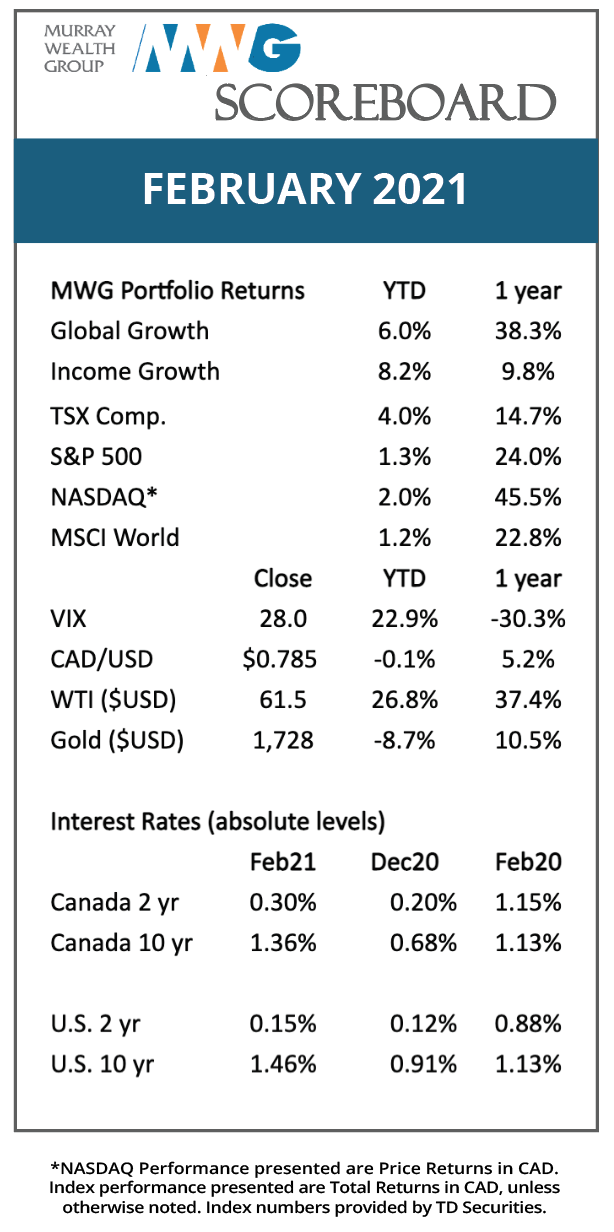

The concept of interest rate duration should be front and center in investors’ minds. Duration is an asset’s sensitivity to change in interest rate. For years, falling interest rates provided a tailwind to markets…real estate, bonds, equities, you name it. With the reopening of economies on the horizon, rates are beginning to increase, with the U.S. 10- year Government yield rising 60 bps year-to-date. This move likely explains the underperformance in many large-cap growth stocks as these companies derive most of their value from their long-dated cash flows five-plus years out. Whether this move in rates is a simple adjustment or the start of a longer move higher is yet to be determined.

Figure 1: U.S. 10-year Government Yield

Positive vaccine news continues to flow, increasing our confidence that economies should start to see a return to more normal economic activity by summer 2021. We believe the reopening stocks, including travel, media, real estate and financials, should continue to recover, with share prices likely eclipsing previous highs given that COVID-19 forced these companies to quickly adapt to a more competitive reality. Demand for experiences remains pent up and will likely lead to a spending boom. Some stocks, like Live Nation (Ticketmaster) and Booking Holdings (Priceline/Booking.com), are already discounting this surge in consumption. We expect the laggards will play catch-up over the next quarter.

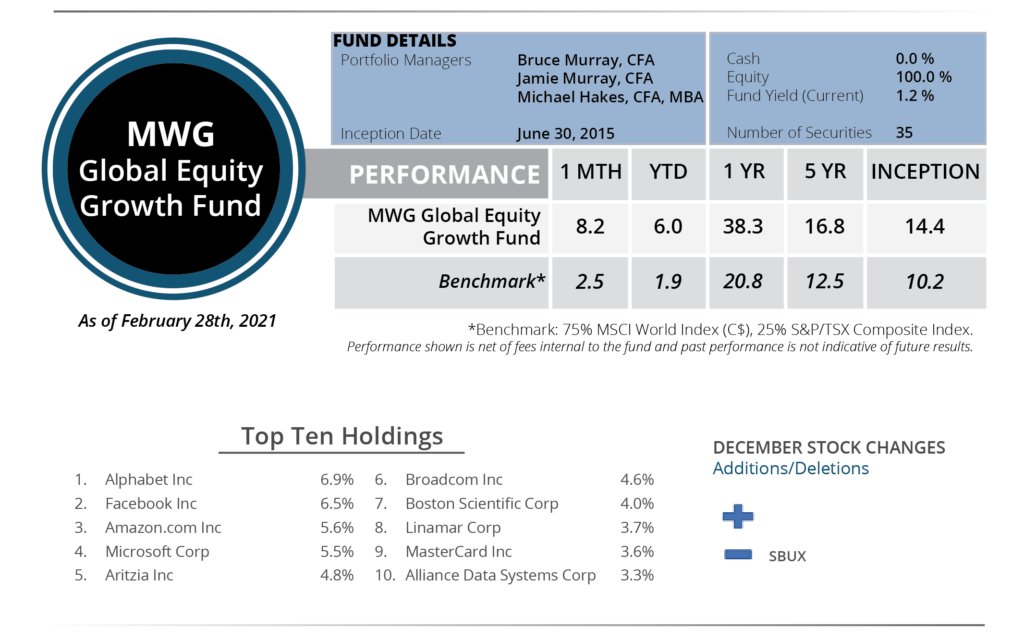

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund returned 8.2% for the month, bringing its year-to-date return to 6.0%. The top performing holdings in the month were Royal Caribbean (+42%), Alliance Data (42%) and Tapestry (+32%), with Amazon (-4%), AstraZeneca (-3%) and Intuitive Surgical (-2%) the laggards.

During the month, we exited our investment in Starbucks as we believe the shares did not offer the same upside as other names, particularly those with reopening exposure that is not fully reflected in their stock price.

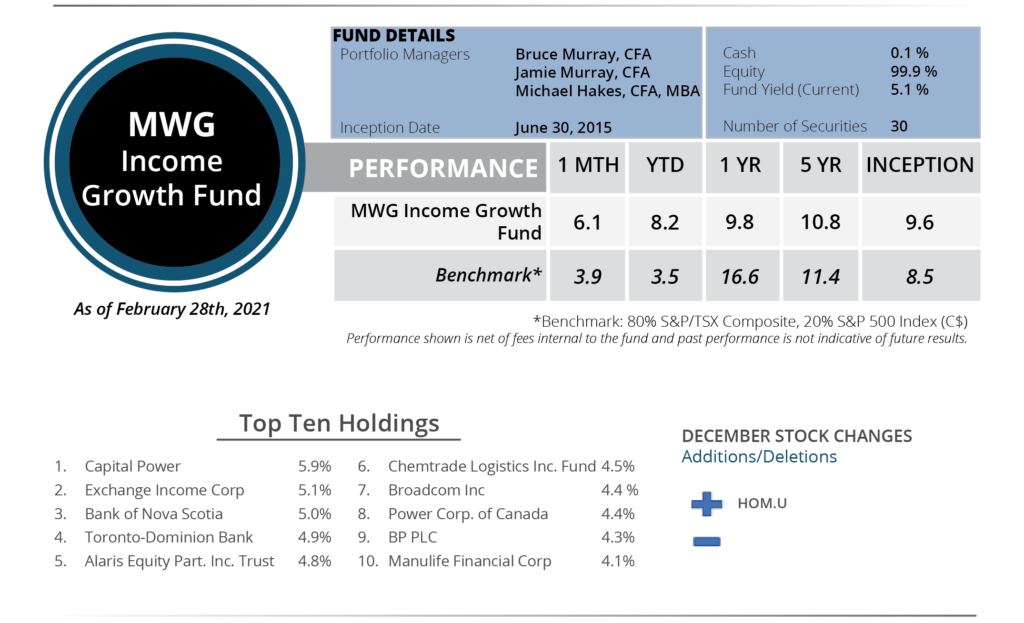

INCOME GROWTH FUND

The MWG Income Growth Fund returned 6.1% for the month, bringing its year-to-date return to 8.2%. The top performing shares in the month were Inter Pipeline (+40%), Chorus Aviation (29%) and Canadian Natural Resources (+20%), with GlaxoSmithKline (-9%), Capital Power (-6%) and Alaris Equity (-4%) the laggards.

In the month, we added BSR REIT to the portfolio. BSR is a U.S. based owner of multi-family residential properties located in the Sunbelt region. The company has been high grading its portfolio by expanding its portfolio in larger, faster growing markets. This investment represents our initial exposure to multi-family residential, which has generated strong returns over the past 20 years.