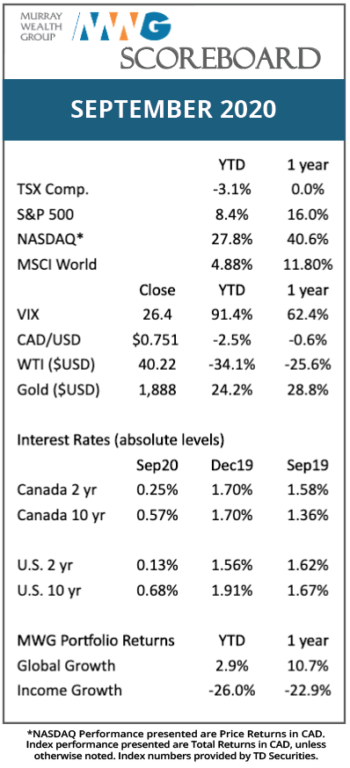

Thoughts on the Market: September Edition

Moving Through the Second Wave…

Last month, we stated our belief that it was unlikely a second wave of the Coronavirus would lead to a revisiting of the market lows. This belief was tested in September as more countries around the world entered the second wave (Canada, Europe, Japan). The virus is not proving as deadly as it was in March 2020 as death/ hospitalization rates remain low relative to published case counts. This is having the effect of lessening the perceived risk of contracting the virus. Moreover, with social distancing regulations in place and businesses making the necessary adjustments, governments are more hesitant to encourage lockdowns for economic reasons.

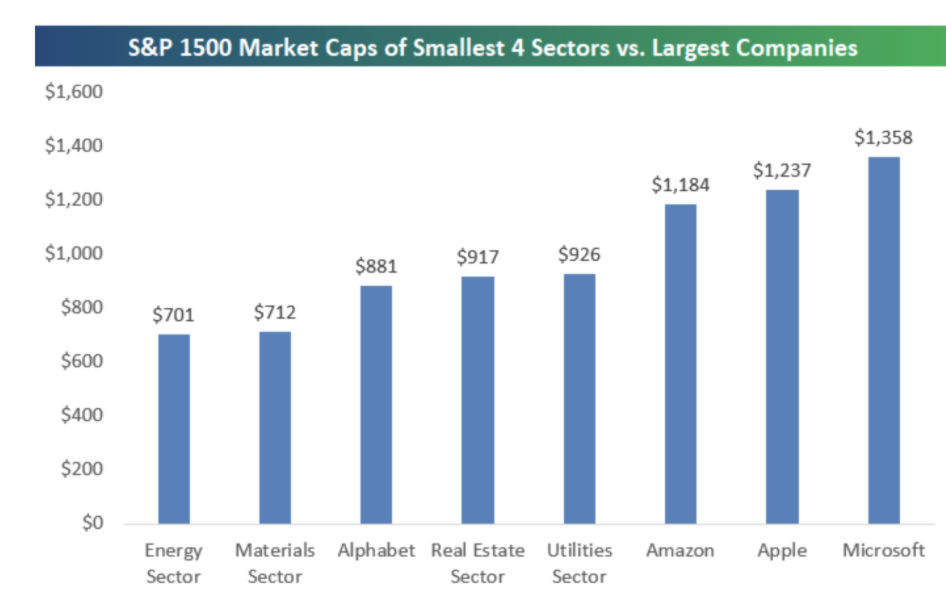

As well, sector valuations adequately adjust for the risk of a prolonged virus impact. Consider that a company like Zoom Video currently sports a US$137 Billion market cap, on par with Exxon Mobil, and it becomes more obvious why markets can only fall so much on COVID alone. There is only one Exxon (and a Chevron), but there are numerous other companies like Zoom sporting 11-12 figure market caps ( i.e., Adobe – $229B, Salesforce – $225B, Shopify – $124B, ServiceNow – $95B, Workday – $52B, etc.). We haven’t even touched on the mega-cap tech companies that can be summed up best in this chart, courtesy of Bespoke Group. The data is from April, and while a bit stale, it mostly captures the impact of the various sectors on the markets.

Figure 1: S&P sector market caps vs. mega-cap tech companies

As we move through 2021, even on the basis of a continued economic recovery, we are starting to view valuations of the general market as a larger risk factor. In Figure 2, we highlight the change in 2021 EPS estimates for the S&P as a whole. On January 1, 2020, the S&P was trading at a P/E of 18x. Since then, however, earnings estimates have fallen from 178 to 162. As the S&P 500 is up slightly year-to-date, the P/E ratio has risen to 21x. Lower interest rates are one aspect of the higher multiple, but ultimately earnings growth will need to be strong to generate sustained strong returns.

Figure 2: S&P 500 Index level and EPS estimate

Source: Refinitiv, Murray Wealth Group

We see the pullback from September as a run-of-the-mill correction and used the opportunity to average down into equities that were leading the market as we suspect they will recover swiftly. We view ongoing improvement in the outlook for COVID-19 (better treatment, vaccine, herd immunity) as a reason to stay invested through short-term noise associated with the U.S. election.

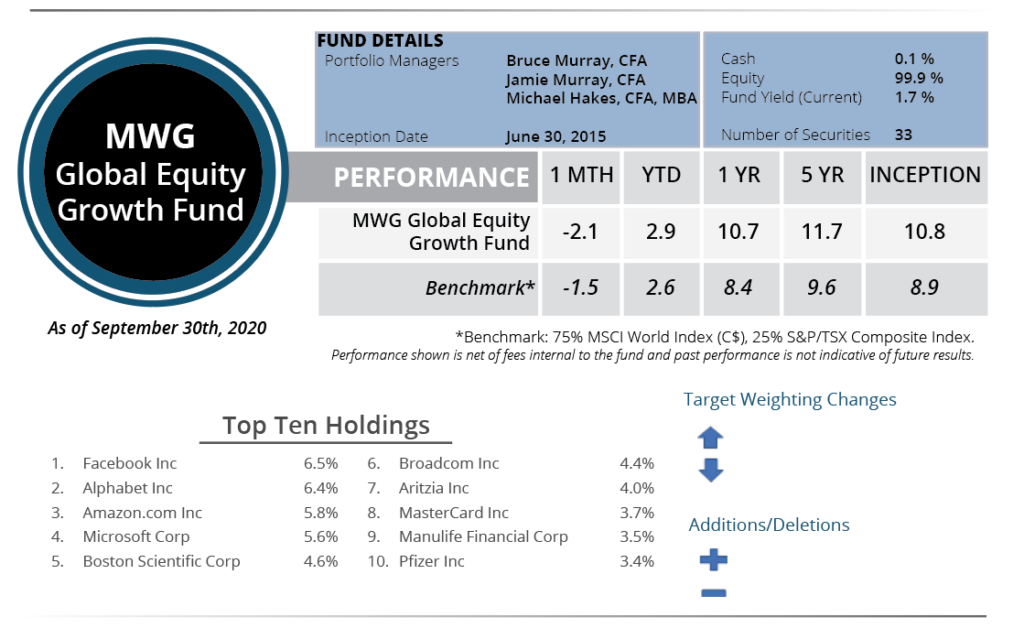

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund fell –2.1% in September, bringing its year-to-date return to 2.9%. Over the past twelve months, the portfolio has returned 10.7%. The top performers in September were Stelco (+20%), Nike (+15%) and Newell (+10%). Airbus (-10%), Facebook (-9%) and Alphabet (-8%) were the laggards during the month.

We made no additions or deletions to our holdings. However, we did add to our technology holdings, namely those of Amazon, Alphabet, Facebook and Twilio as the shares corrected following strong performance. We believe Twilio is a good case study as to how we employ our portfolio rebalancing strategy. In order to maintain a 2% weighting in the name, we trimmed our position three times as the shares moved from our initial purchase range of US$110-120 to a high of US$280. After the shares corrected from US$280 to US$225, bringing the portfolio weight to 1.5%, we added to the name to bring it back to its target weighting of 2.0%. The company recently provided a strong short and long-term outlook, sending the shares back to $US280. If the shares continue to move higher, the weight will increase to 2.5%, at which point we will decide to either adjust our target weighting up or re-balance by trimming the position again.

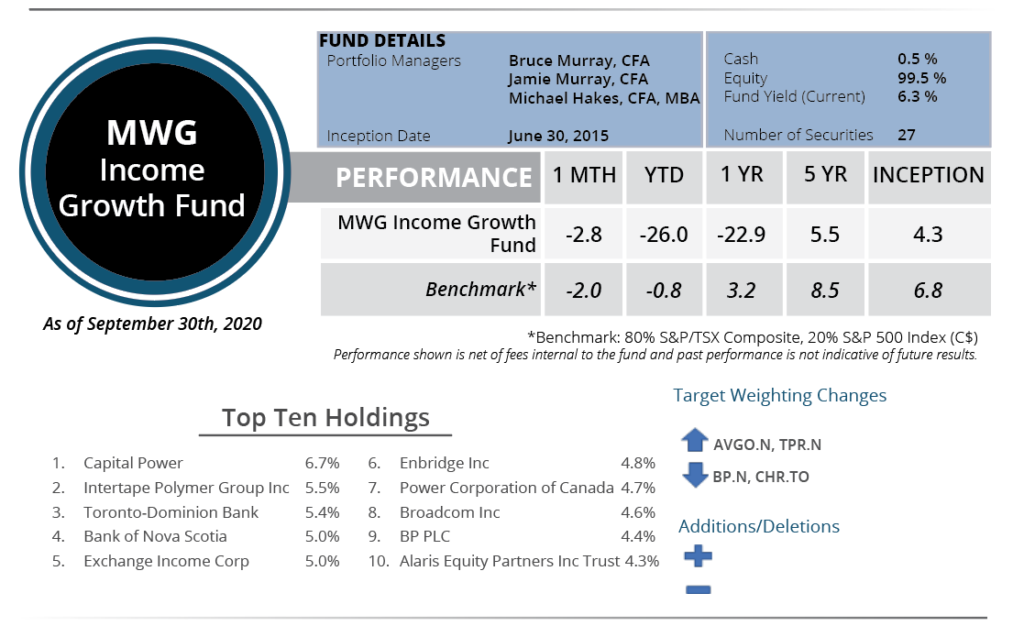

INCOME GROWTH FUND

The MWG Income Growth Fund fell -2.8% in August, bringing its year-to-date return to -26.0%. Over the past twelve months, the portfolio has returned –22.9%. The top performers in September were Newell Brands (10%), Tapestry (8%), and Broadcom (8%). The largest negative impacts were from Chorus Aviation (-18%), Chemtrade (-17%) and BP (-15%).

The Income Growth portfolio continues to be negatively impacted by the economic effects of COVID-19 and the “hard” asset nature of the portfolio. Nevertheless, we believe our companies are financially strong and will rebound as economic activity normalizes. In the interim, the portfolio yields 6.3%.