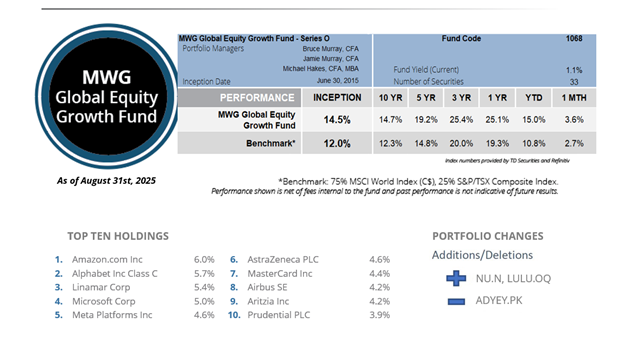

The MWG Global Equity Growth Fund Series O rose 3.6% in August, beating the 2.7% rise in its benchmark, and is now up 15.0% year to date. The Fund’s top three performers in the month were Hudbay Minerals (+29%), UnitedHealth (+23%) and Linamar (+12%), while Moderna (-19%), Microsoft (-6%) and Meta (-5%) were the largest detractors.

Portfolio Managers’ Summary

Despite robust results from AI-focused firms in late July, the AI trade largely took a breather in August. We continue to view AI favourably and believe it to be a multi-year growth story but, as always, there will be pullbacks along the way. We are encouraged by the Fund’s outperformance despite some of our largest holdings being among those taking a breather.

There was broad optimism for further interest rate cuts in the US and Canada following some weakness in monthly jobs data as well as indications from Fed Chair Jerome Powell that it weighed a weak job market as a larger risk than inflation. Strength was evident in laggards like healthcare, luxury and base metals stocks. Small cap stocks also had their best month since November 2024.

During the month, we re-initiated a position in Lululemon. The shares are down more than 50% from where we sold our holding in December 2024. The weakness stems from negative sales momentum in the United States and a slowdown in sales internationally. We believe this revenue trend is part macroeconomic conditions, part rising competition and part self-inflicted. While competition is inevitable in any retail market and consumer confidence will always ebb and flow, Lululemon is dealing with a stale product line and a store base that remains too small (typical stores average 3-4k square feet). We believe that a refreshed product line in Spring 2026 and potentially some pressure from an activist investor (to be determined) will re-ignite U.S. sales. Of note, the company has a large runway for international growth and a very strong balance sheet. It also has a history of hit products that extends to as recent as 2023 with its wildly successful belt bag.

We also added Nu Holdings to the portfolio and exited our position in Adyen.

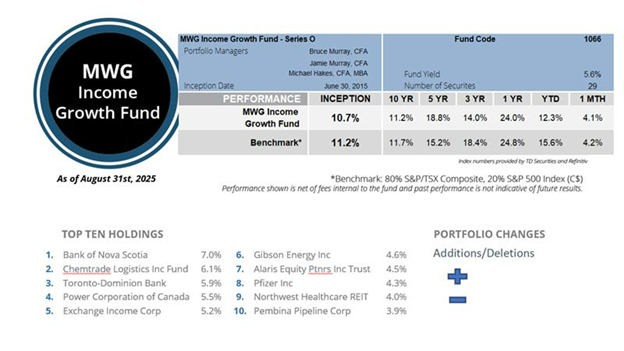

MWG Income Growth Fund Performance

The MWG Income Growth Fund Series O increased 4.1% in August, in line with the 4.2% return for its benchmark. The Fund is up 12.3% year-to-date. Chemtrade (+17%), Doman Building (+14%) and Bank of Nova Scotia (+11%) were the top performers, while Cogent Communications (-15%), PHX Energy Services (-7%) and European Residential (-5%) were the top detractors. The Fund’s yield was 5.6% at month-end.

Portfolio Managers’ Summary

As discussed above, short term interest rates are expected to decline this fall. This should provide support for bond-like equities (utilities and real estate equities) whose strong, contracted distributions should be more enticing than GICs yielding ~2%. It will also lower the financing cost for variable rate debt, freeing up cash flow for equity holders.

Following our write-up on Chemtrade in August, we were pleased to see the company continue to execute on its strategy with a ‘beat-and-raise’ quarter as well as a significant acquisition. The shares ended the month at a multi-year high. Encouragingly, the CEO and CFO purchased shares in the open market following the results, providing further validation that there is more upside to come.