By: Bruce Murray, CFA

We continue to get reports from across the industrial sector that supply chain issues are still restraining production to below pre-pandemic levels. Recent news like the Nexperia chip shortage and NY aluminum plant fire are reflective of these reports. The automotive industry is the largest in the industrial sector, accounting for 3.5% of the US GDP. Thus, we decided to take to look at available statistics for the industry.

Upon examination of automotive production and pricing data, it becomes clear that the automotive industry still has not totally recovered from the Covid shutdowns and has, in fact, a significant way to go.

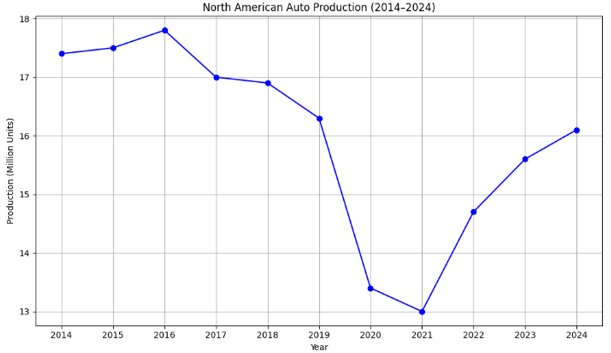

As illustrated in Figure 1 below, not enough cars have been built since the pandemic due to the disruption shutdowns. Historically, North America has made and sold approximately 17 million plus cars a year. However, since 2019 the industry is cumulatively 12-13 million short on supply. Production in 2025 is expected to be about 15.6 million units, slightly below last year likely due to the addition of tariff uncertainty.

Figure 1: North American Auto Production Remains Below 2014-2019 levels

Source: ChatGPT

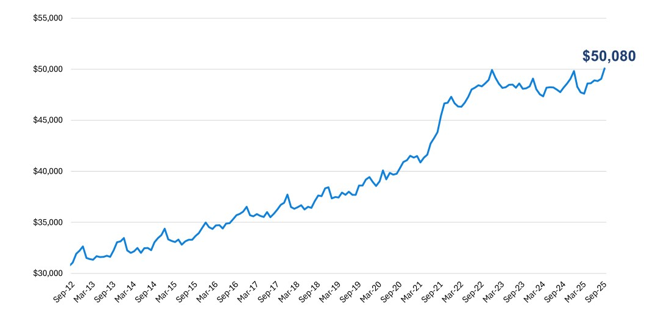

What happens in a supply shortage? Prices go up! Dealers make a fortune on inventory. Manufacturers raise prices and reduce discounts. As Figure 2 below illustrates, new car prices rose by over 30% (a $12,000 increase) in the first two years of the pandemic and then gradually declined as production levels rose. We suspect new car prices will continue to moderate as auto production normalizes over the next few years. The current year may be an exception, with prices rising back towards $50,000 due to a surge in buying of higher end vehicles as a result of higher tariffs, the announced cancellation of subsidies for electric vehicles and significant wealth creation from stock market gains.

Figure 2: Average new car prices have flatlined for three years after a decade of growth

Source: Cox Automotive’s Kelley Blue Book

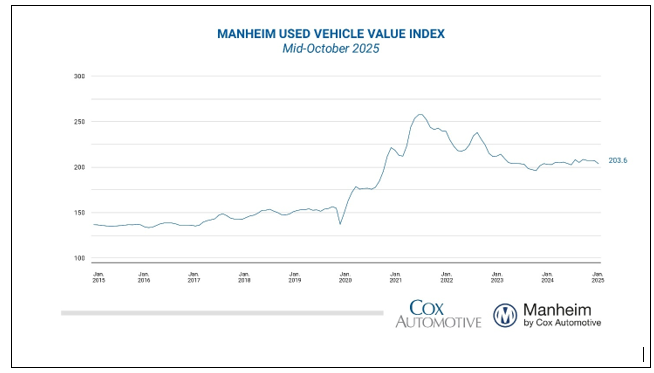

With the shortage in the availability of new cars, the average used automobile doubled in price, rising by $10,000 during the first two years of the pandemic. As illustrated in Figure 3 below, used car prices remain high by historic standards but are also coming down as auto production recovers. I believe this trend will also continue as the new car supply deficit continues to moderate.

Figure 3: Mannheim Used Car Vehicle Value Index

Source: Cox Manheim Index

In conclusion, we expect automotive production to continue increasing, with prices reaching greater stability in the next few years, leading to both job creation and a moderating influence on inflation.

Currently, our only direct exposure to the auto business is a holding in Linamar (LNR.TO), a Canadian industrial with growing global operations in auto parts, access equipment and specialized farm machinery. In its auto business, Linamar focuses on high precision parts for the automotive drive, structural and steering systems. The company has made two recent acquisitions that have expanded its product range, a heavy-duty casting facility in Leipzig Germany from Georg Fischer and the North American structural assets of Aludyne, with frame, suspension and steering components.

Despite the agricultural business being depressed, LNR is expected to earn over $10 per share this year. A recovery in the agricultural business and a continued rise in auto production toward historic levels should result in earnings per share of $15 in 2-4 years out. While not included in our estimates, Linamar is one of Canada’s leading companies with structural and machining capabilities, making it a very likely beneficiary of the increase in Canadian military spending. The company will report earnings next week.

Linamar‘s weighting in our Global Equity Growth Fund is 4%. The stock is up 60% from its spring low, at the height of tariff fears. During the selloff that followed the tariff announcements, we increased our share count holding by some 48% in a series of purchases (at an average price of about $59). On the recovery, we reduced our holding by 27% (at an average price of just over $70). We continue to remain very comfortable with our 4.0% position as the company continues to expand as a world leading manufacturer. We are convinced it has a strong future.