By: Jamie Murray, CFA

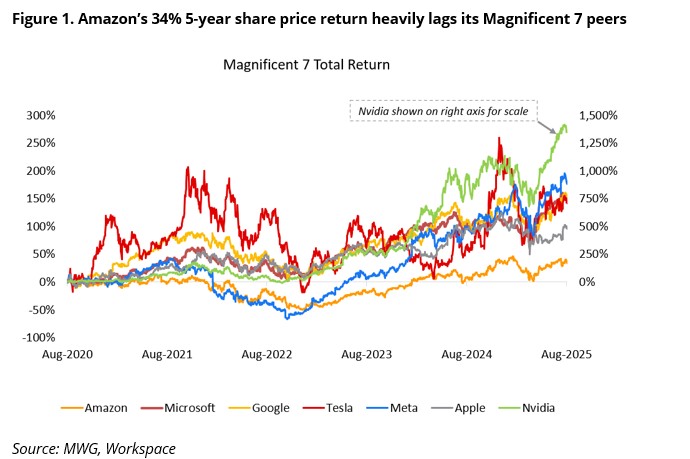

In August, we increased our target weight for Amazon (AMZN) in our Global Equity Growth Fund to 6%, making it the largest single position in the portfolio. This decision is rooted in a significant dislocation in the market. Despite impressive top-line growth, Amazon’s stock has lagged its mega-cap peers. Since 2020, its shares have posted the lowest returns among the “Magnificent Seven” (ex-Nvidia, the remaining five members have averaged 143%), creating a valuation discount relative to both technology and retail competitors. We believe this discount is unwarranted, as Amazon’s growth outlook is superior to its peers, driven by two powerful and profitable engines: Amazon Web Services (AWS) and its maturing Retail and Advertising business.

AWS: The AI-Powered Profit Engine

AWS: The AI-Powered Profit Engine

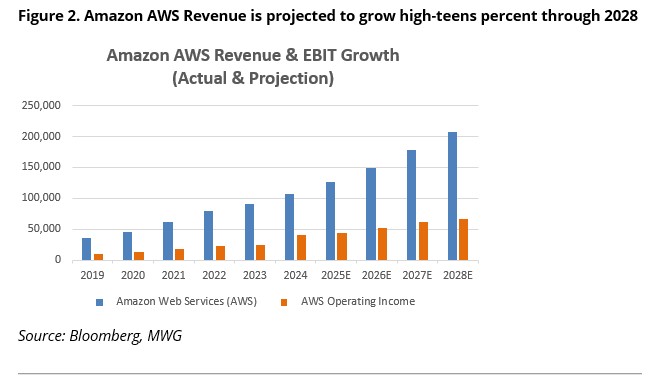

Amazon Web Services remains the undisputed leader in the cloud infrastructure market, commanding an estimated 31% market share. This division, which provides computing and cloud services to a vast corporate client base, is Amazon’s primary source of profitability. It consistently delivers operating margins north of 30%. As a standalone business, it is one of the largest in the world, with revenue and pre-tax profit expected to reach more than US$120B and US$40B, respectively, in 2025.

Over the past five years, AWS has increased its revenue at a formidable 23% compound annual growth rate (CAGR). Now, it is capitalizing on a new tailwind, the explosion in enterprise artificial intelligence. AWS is essential for training and running inference for large language models (LLMs), a role fortified by its strategic partnership with and investment in AI leader Anthropic, an AI services company recently valued at US$183B.

We expect AI-related services, such as Amazon Bedrock, which allows companies to build generative AI tools without having to manage the costly infrastructure or train the models themselves, to become a significant driver. Furthermore, Amazon’s development of custom silicon, like its Trainium 3 chips, provides a powerful, cost-efficient solution for clients, deepening its competitive position against rivals like Microsoft Azure and Google Cloud. As enterprises move from AI experimentation to implementation, AWS is perfectly positioned as the foundational platform for this transition.

Retail: King of the Jungle

For years, Amazon’s retail strategy prioritized “growth over profits,” a mantra that helped build an unparalleled e-commerce and logistics network through a willingness to outspend and under-earn the competition. At the time, established retail leaders were unwilling to invest in online delivery for fear of cannibalizing their existing store footprint with a lack of clarity on future returns. Now that Amazon is firmly entrenched at the top of the e-commerce funnel, with over 200 million Prime Members that make Amazon a first stop for online shopping, its strategy has pivoted to “growth with profits,” optimizing its infrastructure for higher margins and harvesting its cash flow. Recently announced second quarter results highlight the promising effect on financials.

In the second quarter of 2025, Amazon’s North American retail segment posted a 7.5% operating margin, eclipsing brick-and-mortar peers like Walmart and Costco. This margin expansion is occurring even as Amazon continues to invest billions in long-term projects like its Kuiper satellite network. Key drivers of this enhanced profitability include:

- Advertising: Amazon’s advertising business is a high-margin business hidden within the retail segment with annualized revenue now exceeding $50 billion and growing at a rate of over 20% year over year.

- Logistics & Automation: Using over 1 million robots and regional fulfillment centers, Amazon has dramatically cut shipping costs and improved the number of locations it serves with same-day or two-hour delivery. This speed and efficiency create a virtuous cycle: faster delivery leads to higher order frequency, which leads to greater inventory turns, which leads to higher margins and ultimately increased re-investment opportunities.

- International runway: Its International retail segment recently achieved a record 4.1% operating margin. While a great improvement from essentially breakeven levels, this is still well below North American levels, providing a long runway for continued consolidated margin improvement as overseas operations mature.

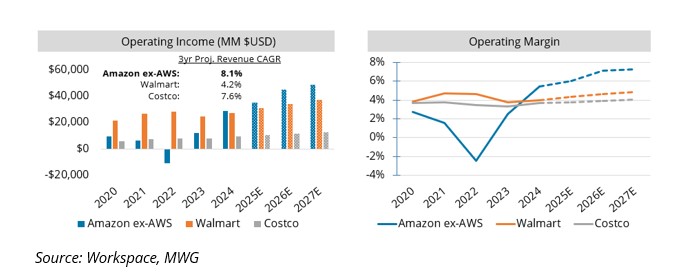

Amazon’s global retail margin improvements are even more pronounced when compared to its closest comparables in retail, Walmart and Costco. These two retailers thrive on a grocery-anchored, best-in-class price/value mix that has led to ever-expanding market share at the expense of local mom & pops, dollar stores, and other department stores. However, our analysis indicates that Amazon is not only growing sales faster than its two contemporaries but doing so at higher margins (Figure 3).

Figure 3. Amazon’s global retail business is growing faster and at higher margins than Costco and Walmart

The skeptics will push back on this analysis with the argument that Amazon’s retail business includes non-retail businesses like Prime Membership, Prime Video, 3rd party shipping, and its large advertising business. To that, we counter that both Costco and Walmart offer memberships and a growing fulfillment-based e-Commerce website and also receive trade spending and promotion incentives from product manufacturers, which can serve as a major profit contributor and a proxy for product advertising revenue. Walmart has also made strides to increase its digital revenue exposure through the acquisition of tv manufacturer Vizio and a proposed acquisition of TikTok’s U.S. assets.

Valuation: Growth at a Reasonable Price

When compared to its peers, Amazon’s valuation appears deeply compelling. Revenue growth of 10% does not jump off the page but considering that the maturing retail business drives most of its sales, we believe profits can grow at a much faster rate. Wall Street analysts forecast that earnings per share (EPS) will grow 18-19% annually through 2030. Despite this strong growth, Amazon’s P/E ratio (based on EPS for the next twelve months) is 31x. Let’s compare this ratio and earnings growth rate with peers in both technology and retail

In technology, peers include Microsoft, Alphabet, Oracle, Shopify, and Netflix. Only Alphabet trades at a lower multiple. However, it is also expected to deliver less EPS growth (closer to the mid-teens). The remainder may experience higher sales growth than Amazon, with pure exposure to fast growing AI or software businesses, but it would be difficult for them to replicate the meaningful margin expansion opportunity at Amazon.

In the retail sector, competitors Walmart and Costco are projected to grow their EPS closer to 10%, below the expectations for Amazon, yet they trade at forward P/E multiples of approximately 34x and 42x, respectively. Again, this seems like an asymmetric opportunity, with better topline growth and margins at Amazon.

We see tremendous upside in the company and value Amazon at US$290 per share.