Following the announcement of tariffs earlier this year, the Canadian economy has slowed, as some export businesses were forced to pass higher costs on to U.S. buyers. News reports have highlighted auto plant closures and layoffs at steel and aluminum fabricators.

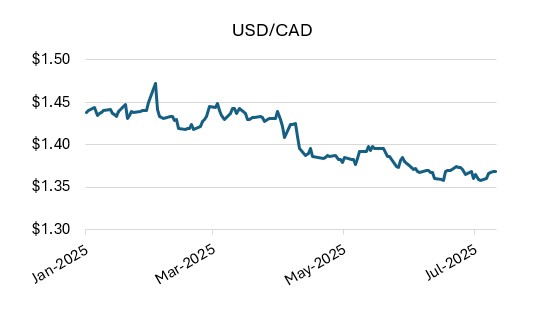

Canadian consumers have tightened their belts and reduced spending, leading to a sharp drop in housing sales and falling prices on the transactions that are occurring. Yet despite concerns that Trump’s policies are damaging our economy, the U.S. dollar has weakened against the Canadian dollar, falling from over $1.44 late this winter to as low as $1.36 recently, a decline of about 5%.

Figure 1. CAD has appreciated versus USD year-to-date

So, what’s going on? We’re sure Mark Carney would like to take credit for it. While reduced U.S. travel by Canadian consumers may have helped slightly, larger forces are at play. The Trans Mountain Pipeline expansion will deliver over 500,000 barrels of oil per day for export. At a price of US$60 per barrel, that equates to an additional $40 million per day, or roughly $14.6 billion annually, in contributions to GDP (Gross Domestic Product). This amounts to approximately $365 per Canadian each year.

Meanwhile, LNG Canada is ramping up operations and will export 1.8 billion cubic feet of natural gas per day. At US$10 per MCF (1,000 cubic feet), this adds another $24 million per day, or $8.7 billion annually, to GDP. Phase 2 of the project will double the capacity. Together, The Trans Mountain and Canada LNG projects are currently contributing about $23 billion per year to GDP, which is equivalent to roughly $550 per capita.

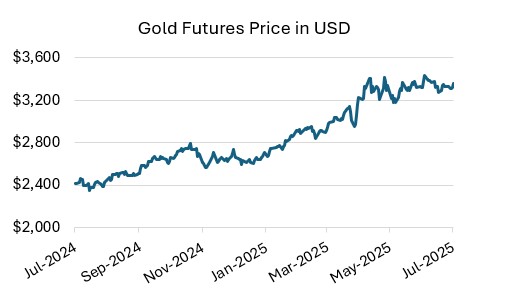

Let’s now look at another growing source of income that many Canadians may have overlooked: GOLD! Canada produced approximately 6.4 million ounces last year, and 2025 production is expected to be similar. Last year’s average price of US$2,386 per ounce translated to roughly C$21 billion in revenue, or about $525 per capita. If current prices hold, gold’s contribution in 2025 could increase by around 20 percent, reaching approximately $26 billion, or $650 per person. In the most recent GDP report, gold production surpassed auto parts and vehicle assembly to become Canada’s second-largest industry.

Figure 2. Gold Prices have increased substantially

Several major mines and mine expansions are currently being completed, and Canada’s gold production is expected to continue rise significantly over the next few years as several new mines are entering production and some big mines are expanding. If the current price of US$3,350 per ounce holds, gold could contribute to Canada’s GDP. These developments are key drivers of future GDP growth and broader national prosperity. Together the completion of these projects could add nicely to our GDP. We also expect that Carney and Trump will reach an agreement later this month that could ease economic concerns among Canadian consumers. This would likely lead to a rebound in consumer confidence, a further strengthening of the economy, and a recovery in the housing market.

MWG Funds should continue to perform well in this environment.