By: Bruce Murray, CFA

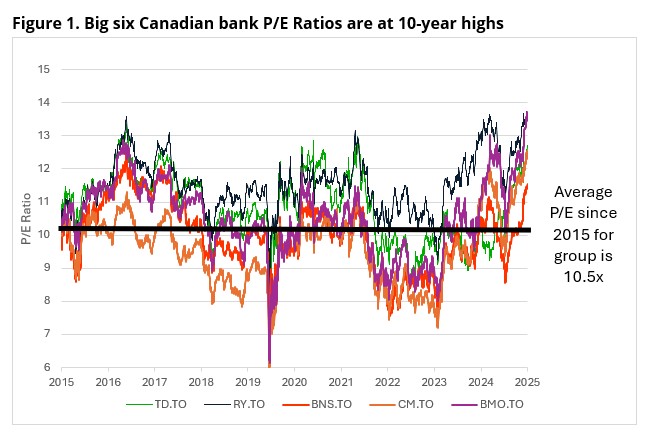

Canadian banks have rallied to the highest multiples since 2011. At that time, our Canadian banks were viewed as a safe bet as much of the rest of the world faced the hangover from a global financial crisis triggered by excessive real estate pricing and lending in the U.S. housing market. Canada, which avoided the 2008 crisis, may now face the consequences of overvalued housing here at home. Banks have traditionally commanded lower P/E multiples due to the substantial leverage inherent in borrowing and lending large sums. Given the leverage built into global banking systems, when things go wrong, they can unravel quickly, with equity capital disappearing within weeks, as happened in 2008.

I started my career as a bank analyst at Crown Life Insurance Company in 1976 and saw mortgage rates rise to a high of 19% by 1980. Bank P/E multiples crashed to levels of 4-5x as fear rose. At the time, you could get 15%+ returns with government GICs.

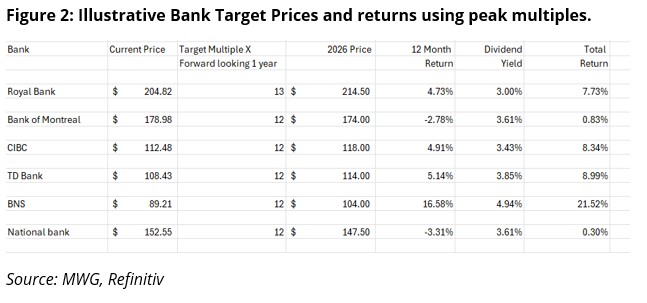

Classic investment theory suggests adding 3-5% to the long bond rate for equity risk in arriving at an appropriate P/E multiple for a stock. Thus, with the Canadian banks currently selling at 12x eps or higher (suggesting 8% discount rates), we are approaching fully valued territory. We recently updated our target prices and based on 2027 eps and using a 12x P/E multiple (13x for RBC as Canada’s premier bank, which may or may not be deserved), there is little room for further substantial price appreciation. National Bank’s acquisition of Canadian Western Bank may also allow for a better P/E as Alberta has the most obvious growth opportunities as hydrocarbon export facilities allow for higher volumes and better pricing for oil and gas producers.

It is still too early to estimate the impact of Artificial Intelligence (AI) on the banks. We know it will increase productivity, as indicated by J.P. Morgan’s announcement that 4,000 positions have been replaced as the result of AI. I expect most AI gains will be passed on to consumers over time as new low-cost competitors emerge.

Source: MWG, Refinitiv

As can be seen in Figure 2 below, we believe that the only bank showing an above average return is The Bank of Nova Scotia, which suffered from poor management under the prior regime. Operations in the Caribbean and Latin America have also been discounted. The bank’s new CEO is Scott Thomson, who was formerly the CEO of Finning, the world’s largest Caterpillar dealer with rights to Western Canada and parts of South America, including Peru and Chile where BNS has operations. It was very unusual for a bank to bring in an outsider to fill the top position. In Scotia’s case, a change of culture was needed and Thomson’s experience at Finning made this possible. It should be noted that Thomson sat on Scotia’s Board of Directors prior to taking the reins. I have known Scott Thomson from his years at both Finning and previously Talisman Energy (where he was CFO). We expect that a realigned BNS will steadily narrow the valuation discount to its Canadian peers.

Given elevated trading multiples, we have reduced our holdings in other Canadian banks, namely TD Bank, which we aggressively added to both of our portfolios a year ago amidst its money laundering scandal. Historically, TD has been the best performing Canadian Bank as it was first to expand banking hours in Canada, offered better products to lower income residents and successfully entered the Eastern U.S. market. A new CEO and the company’s ability to navigate the consequences of its money laundering issues resulted in a significant recovery in TD’s stock price and P/E multiple, providing us with a tidy profit. Outside of BNS, we believe the upside potential of the remaining Canadian banks is limited to the single digits.