December 2025 Review: Can equity markets repeat a three-peat?

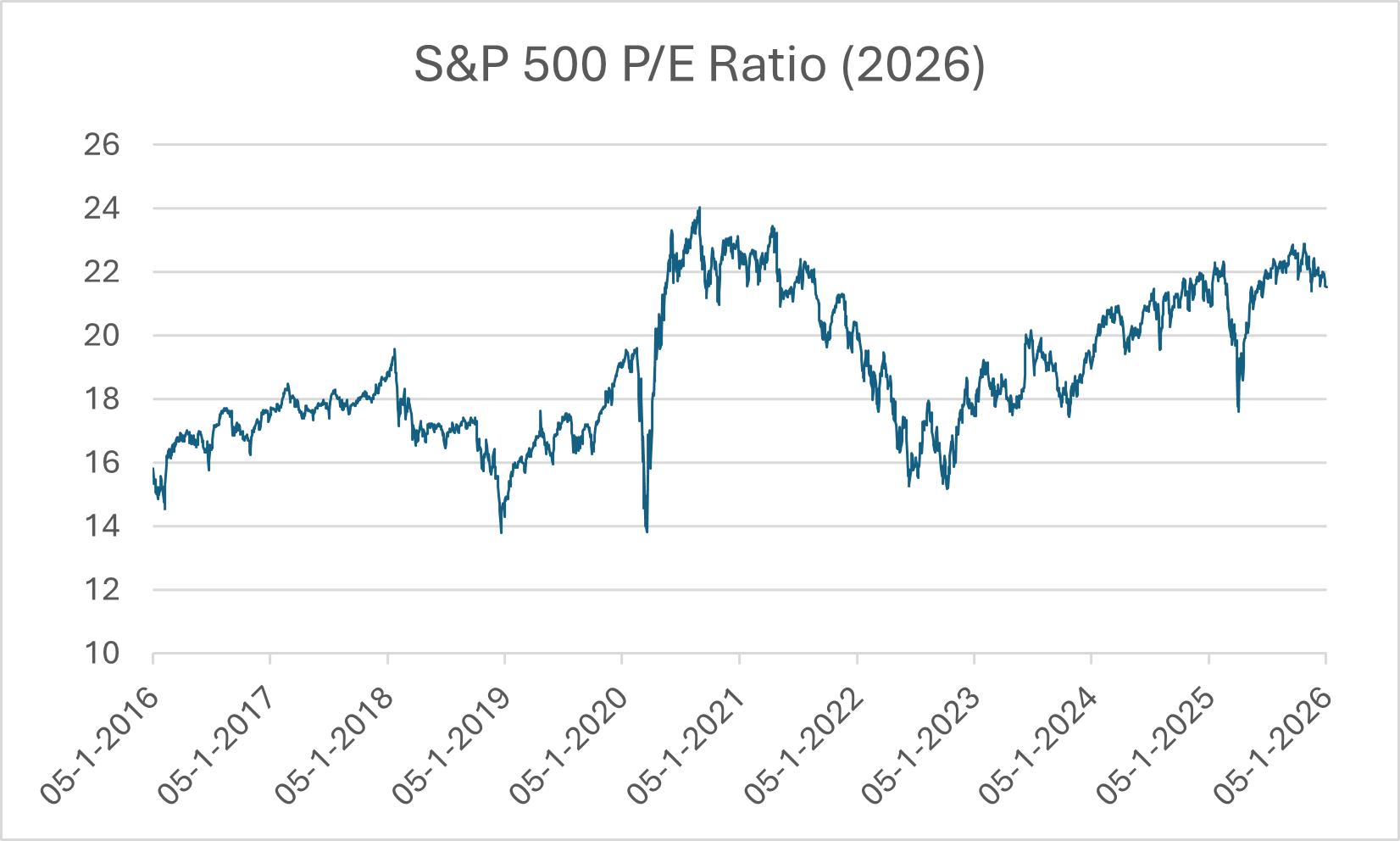

The benchmark S&P 500 index closed near all time highs, returning 16.4% in 2025. This makes the third year in a row with double digit returns and adds to a strong run since 2018 with 6 out 7 years eclipsing 10%. It is natural for an investor to wonder how this can continue from an initial glance, there are flashing lights. The forward P/E ratio for the S&P 500 is 22x, a level that often marks the top of the cycle, not the start. As well, index concentration (the top 10 constituents make up 39% of the index) is at extreme levels only seen in previous cycles.

Figure 1: S&P 500 P/E Ratio over time

Source: Murray Wealth Group, Refinitiv Workspace

However, a look under the hood reveals a more bullish view. As discussed in our piece on valuation here, The largest companies trade at more reasonable multiples considering their growth prospects than in previous cycles at 29x P/E forward earnings and revenue growing 15% per annum.

The AI market is expected to remain active in 2027 with Nvidia ramping deliveries of its next generation rack solution for datacenters, continuing with its annual product cadence. Last month we highlighted the increased computer chip demand as evidenced by Broadcom and Nvidia’s surging revenue estimates. We take it a step further and look at the total change over the next three years compared so six months ago (Figure 2 & 3). We find that Nvidia and Broadcom are expected to generate an additional $354B and $117B in cumulative revenue, mostly geared towards data centers for AI services.

The next indicator we watch for is improved model performance and lower inference costs (the actual running of the models) which will provide for faster and higher quality output. Longer term, we see additional upside from new products such as robotics and autonomous vehicles.

Figure 2: Nvidia Revenue Forecast comparison (today vs. 6 months ago) in billions of dollars

Source: Murray Wealth Group, Refinitiv Workspace

Source: Murray Wealth Group, Refinitiv Workspace

Figure 3: Broadcom Revenue Forecast comparison (today vs. 6 months ago) in billions of dollars

Source: Murray Wealth Group, Refinitiv Workspace

Source: Murray Wealth Group, Refinitiv Workspace

MWG Global Equity Growth Fund Performance

The MWG Global Equity Growth Fund Series O fell 0.9% in December, slightly behind the -0.3% fall in its benchmark. For 2025, the fund returned 27.0% vs. a 19.3% increase in the benchmark. The Fund’s top three performers in the month were Hudbay (+15%), Moderna (+11%) and Lululemon (+11%) while Broadcom (-15%), Hammond Power (-8%) and Uber (-8%) were the largest detractors.

Portfolio Managers’ Summary

We capped off another successful year for the Global Equity Growth Fund with a 27% return, which increased our return since inception to 15.4%. We had some tremendous winners in 2025, many of which we increased our position in during the April Tariff Tantrum. Three stocks posted triple digit returns including Hudbay (+133%), Aritzia (+120%) and Hammond Power (+100% from our initial purchase around $80 in April 2025). Some of our largest positions rose strongly through the year including Prudential (90%), Alphabet (+58%), Major Drilling (57%), Linamar (48%) and Broadcom (44%). We continue to hold all these names but are prudently trimming them to redeploy into higher return opportunities.

Winners are great but we also look to avoid losers but we will always have some in a diversified portfolio of 30-40 holdings. UnitedHealth was our only position of size that fell on very tough times although it has recovered 30% from its lows. We continue to see long term value in the name, more so now that it trades at a lower multiple with similar growth opportunities and has a clear earnings recovery trajectory.

Docebo (down 57%) was affected by two large customer losses and general software malaise. We exited our holding in December, acknowledging a tough road ahead and to aid in offsetting capital gains realized during the year.

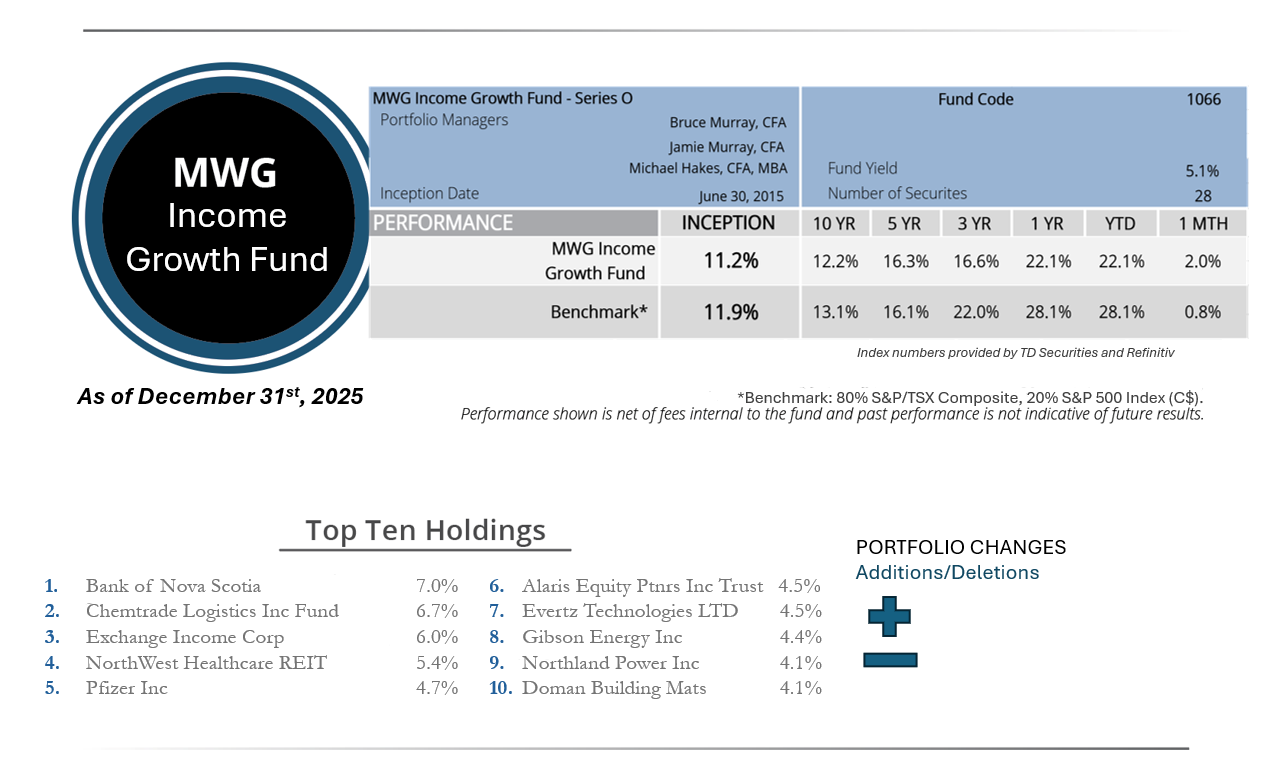

MWG Income Growth Fund Performance

The MWG Income Growth Fund Series O rose 2.0% in December, above the 0.8% increase in its benchmark. For 2025, the fund returned 22.1% vs. a 28.1% increase in the benchmark. The Fund’s top three performers in the month were Evertz Technologies (11.2% price return plus a $1 special dividend), Flagship Communities (10%), and TD Bank (10%) while Northwest Healthcare (-6%) ,BP (-5%) and Pfizer (-4%) were the largest detractors.

Portfolio Managers’ Summary

The MWG Income Growth Fund’s 22.1% increase is the 4th time in the past seven years the fund returned in excess of 20% annually. It’s TSX-leaning benchmark can be disproportionately affected by gold stocks and Shopify, neither of which fit our mandate of high-income equity securities (even gold royalty companies yield dividends on only 0-1%). The portfolio Beta in 2025 was 0.78, which means it was less volatile than the market. This re-enforces the funds defensive position and an excellent alternative to fixed income products for those with a time horizon beyond three years. We are pleased to continue achieving double digit returns since inception of 11.2%.

We found strength in the financials space in the likes of TD Bank (77%), Power Corp (70%), IGM (41%) and Scotia (38%). We also hold large positions in Chemtrade and Exchange Income, returning 45% and 43% respectively.

Our largest losing position came in the form of Cogent Communications. Unfortunately, a strategic transformation progressed slower than expected and while we see value in the company, a dividend reduction below our target threshold required us to sell the units.