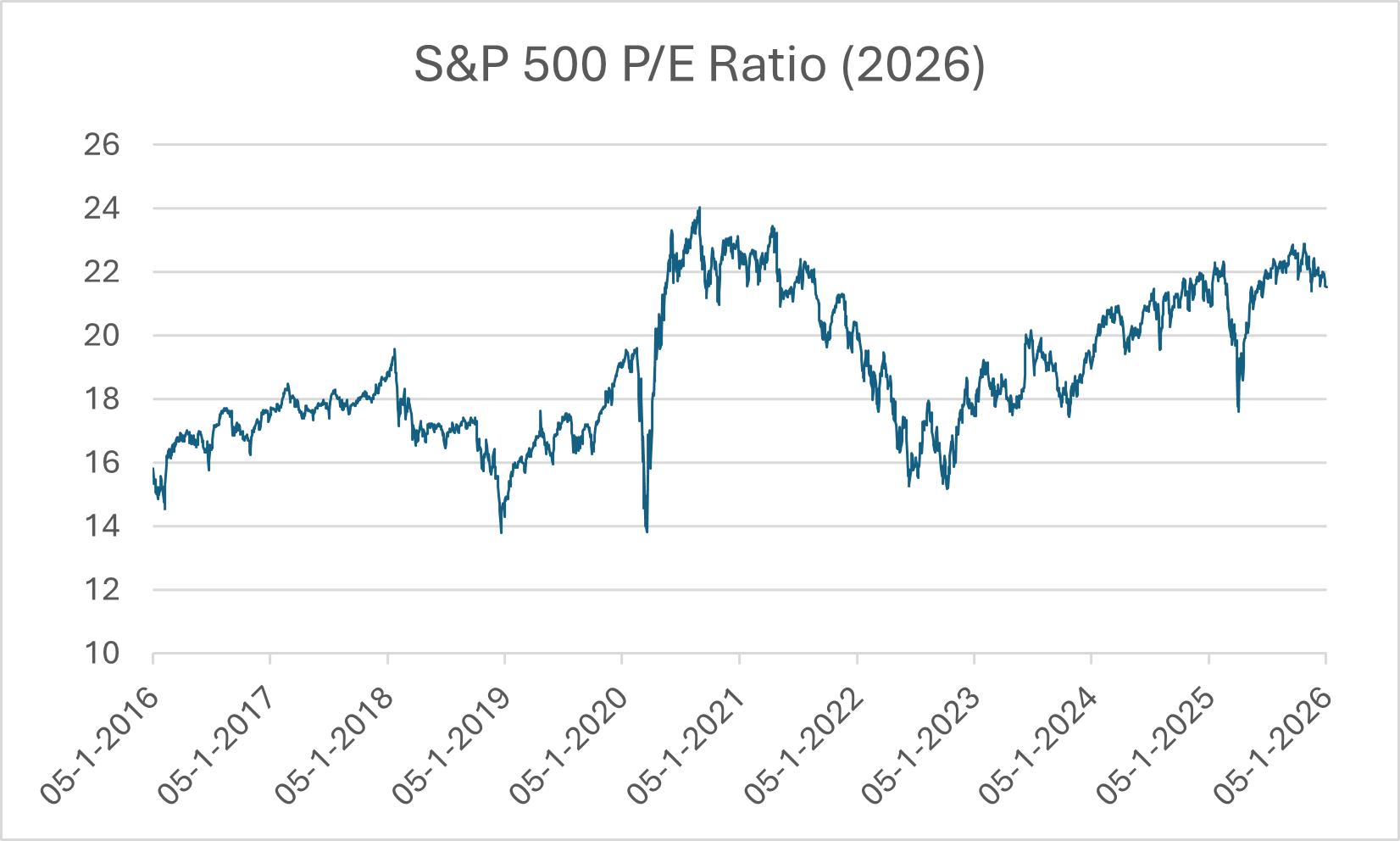

The benchmark S&P 500 index closed near all time highs, returning 16.4% in 2025. This makes the third year in a row with double digit returns and adds to a strong run since 2018 with 6 out 7 years eclipsing 10%. It is natural for an investor to wonder how this can continue from an initial glance, there are flashing lights. The forward P/E ratio for the S&P 500 is 22x, a level that often marks the top of the cycle, not the start. As well, index concentration (the top 10 constituents make up 39% of the index) is at extreme levels only seen in previous cycles.

Figure 1: S&P 500 P/E Ratio over time

Source: Murray Wealth Group, Refinitiv Workspace