Thoughts on the Market: March Edition

The last 373 days.

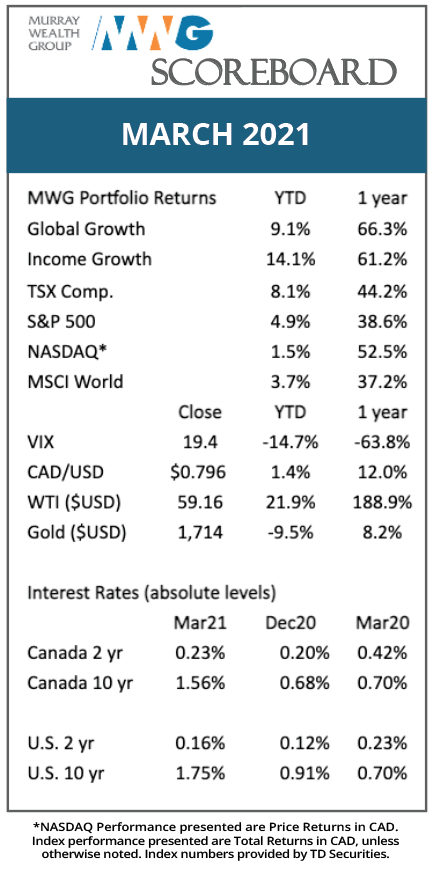

From March 23, 2020 through March 31, 2021 the S&P 500 returned 77.6% (before dividends), making it one of the greatest investment periods in history. Hindsight is 20/20 of course, but even with perfect foresight of the severity of the coronavirus and its impact on global economic activity, an investor that sold at the February 2020 high would have missed out on a 17% gain (again before dividends) in the subsequent 13 months. So how can investors navigate markets that are seemingly detached from reality?

At MWG, we turn to our investment philosophy, based on the following tenets. The first one can be summarized in different ways, including the stock market is not the economy/the random walk of wall street/nobody knows a thing, all of which allow us to ignore noise, stay fully invested and participate in the long-term compounding of the stock market. The second tenet could be summarized as micro over macro as our focus remains on buying strong companies that we are comfortable owning with indifference to the macro environment. Finally, think long term. While the pandemic was devastating on a variety of levels, the opportunity to buy companies like Starbucks or Airbus, for example, at a price ~50% lower than the prior month was extremely attractive to us as we viewed long-term coffee consumption and air travel as unaffected by the pandemic (the emphasis on long-term cannot be understated). In short, don’t waste a good crisis.

So where to from here? Your guess is as good as ours. But we feel comfortable owning companies like Alphabet, Facebook and Amazon that are the new digital landlords for e-commerce. Or Aritzia, which used the pandemic to hire best-in-class talent in fashion e-commerce SKU count as it continues to grow its design, lease premier real estate and expand its influence in women’s apparel. Or Linamar, a company that has consistently added to its capital base and grown its full cycle earnings potential. Case in point, in the 2002-2007 cycle, Linamar’s EPS peaked at $1.58. In 2012-2020, its EPS peaked at $8.94. We expect this cycle’s EPS peak will far eclipse its historic levels in the coming years.

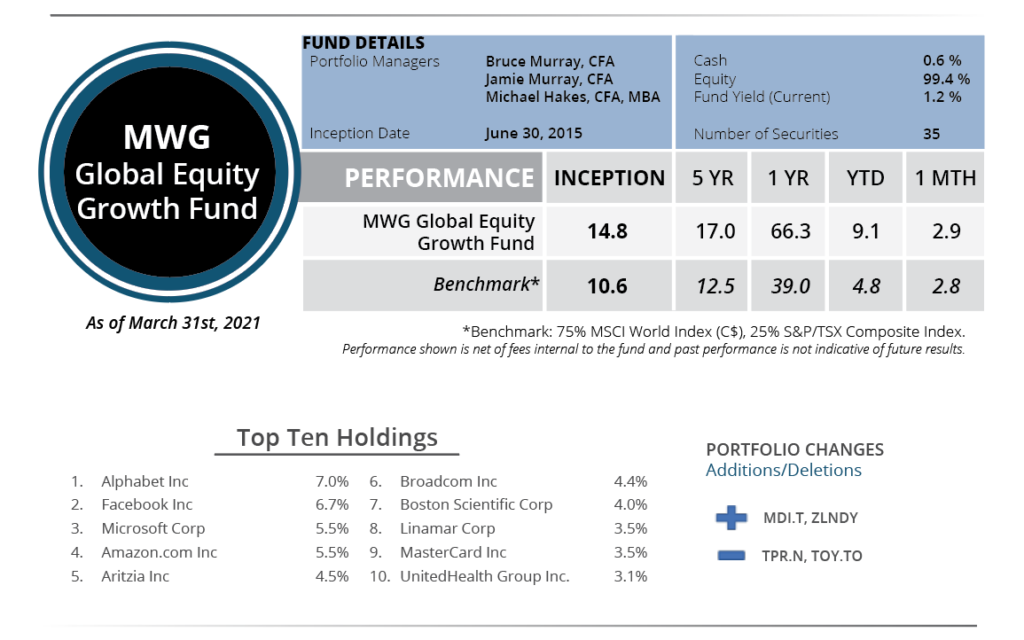

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund

returned 2.9% in March, bringing its year-to-date return to 9.1%. The top performing portfolio companies were Spin Master (+36% at exit), BMW (+19%), and Alliance Data (+15%), while Twilio (-14%), Royal Caribbean (-9%), and Adyen (-5%) underperformed.

During the month, we added two names; German e-commerce retailer Zalando and Canadian-based mining exploration driller Major Drilling. Zalando is the largest e-commerce platform for apparel in Europe with 36M customers. The company’s focus on customer-centricity and selection makes it a first stop for consumers browsing for a new item (“if I cannot find an item on Zalando, it doesn’t exist”). The company is expanding its fulfilment and marketing services for European retailers through its partner program, which allows retailers to tap into its customer base but maintain control over their inventory, branding, and pricing. We believe this strategy will lead to an accelerating return on equity through the decade even as the company expands into new countries and product lines (such as beauty and homeware). The company is guiding to a tripling of sales on its platform by 2025.

Major Drilling provides exploration drilling services to mining companies around the world. Following a five-year bear market that saw depressed levels of exploration and capital expenditures for new mines, metal prices surged in 2020. Now, with copper prices eclipsing US$4/lb and gold prices supportive of ongoing exploration, we expect capital spending to increase. Unlike the prior mining cycle from 2004-2012, the company’s drilling rig fleet is in good shape and does not require a large retrofit program, a claim its competitors cannot make as some find themselves in financial difficulty. Major Drilling provides a high-torque play on a broad increase in exploration spending without assuming the geological risks from company-specific exploration results.

To fund the new positions, we exited our positions in Tapestry and Spin Master Inc.

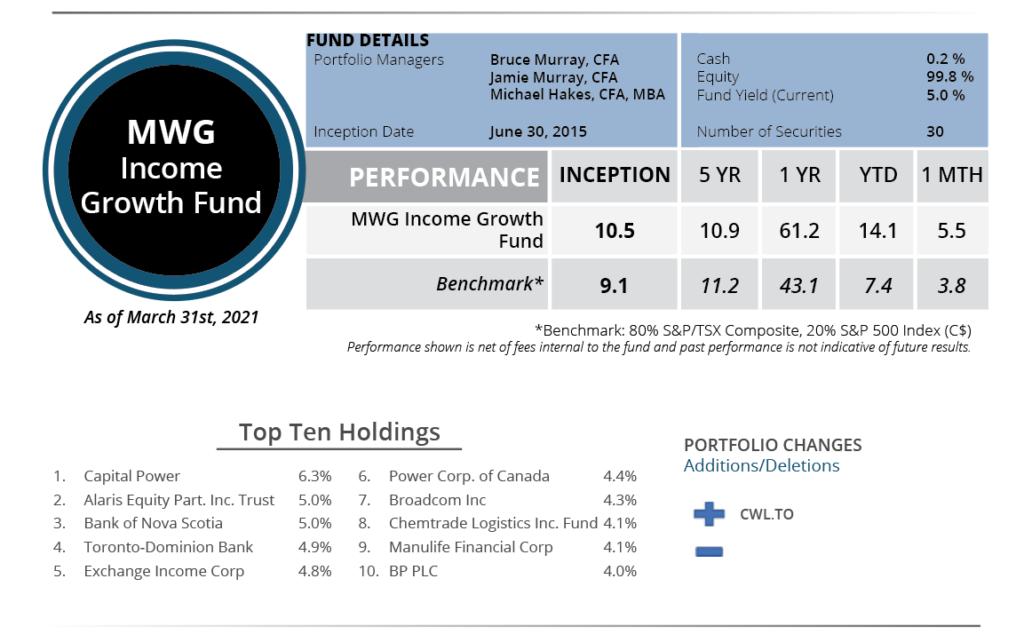

INCOME GROWTH FUND

The MWG Income Growth Fund

returned 5.5% in March, bringing its year-to-date return to 14.1%. The top performing portfolio companies were Intertape Polymer (+18%), Newell Brands (+15%), and Canadian Natural Resources (+13%), while Chemtrade Logistics (-3%), Broadcom (-1%) and BP (-1%) underperformed.

During the month, we added Canwel Building Materials. Canwel is a vertically integrated distributor of homebuilding products such as lumber/wood products, fibres, siding and insulation, with locations across Canada and the Western U.S. The company also owns treating and planing facilities, timberlands and pressure-treated wood production plants (among other assets). The company proved its operating discipline in 2020, as it was able to increase gross margin despite the stresses in the industry, and should benefit from continued strength in home building and renovation activity. We also believe Canwel will continue to consolidate and take advantage of new geographies or vertical integration opportunities. The shares yield 5.3%.