A Note on Artificial Intelligence

– Written by Jamie Murray, CFA

Michael Lewis’ 2003 book Moneyball chronicles the use of improved data to better predict the probability of winning vis-a-vis the more traditional, outdated methodologies, and how the early adoption of statistical analysis by the low-budget Oakland Athletics helped the team triumph over large-market teams with far greater budgets. The movie version ends with Athletics General Manager Billy Beane (the main protagonist and proponent of the new statistics) being interviewed by Red Sox Owner John Henry at the iconic Fenway Park in Boston. Henry wants Beane to become his new GM. What was the significance of this meeting? Moneyball was about to go mainstream.

Billy Beane doesn’t take the Red Sox job (20 years later, Billy Beane still heads the Athletics) but the Red Sox do adopt a Moneyball approach to their team. Only they’re still the Red Sox, and the Athletics are still the Athletics. In 2022, the Red Sox payroll was $193M, while the Athletics payroll was $50M.

Artificial Intelligence (AI) and machine learning (ML) have been topical with the recent release of ChatGPT by OpenAI. ChatGPT is a Language Learning Model (LLM) that can create responses to virtually any query. For example, it can summarize text, write computer code or create a recipe with specific ingredients. The key point is that ChatGPT forms the answer through its learned information and training, in comparison to a search engine like Google that simply retrieves stored information from sources. I asked ChatGPT to explain artificial intelligence and machine learning to me in layman’s terms:

Query: Explain artificial intelligence and machine learning in layman’s terms.

Artificial intelligence (AI) refers to the simulation of human intelligence in machines that are programmed to think and learn like humans. AI can be used to perform tasks that would normally require human intelligence, such as recognizing speech, identifying objects in images, and making decisions.

Machine learning is a type of AI that allows systems to learn and improve from experience without being explicitly programmed. It involves feeding a computer large amounts of data and using that data to train a model, which can then make predictions or decisions without human intervention. For example, a machine learning system might be trained to recognize images of cats by looking at many pictures of cats and learning to identify the characteristics that are common to all of them. After being trained, it can then look at new images and accurately identify which ones contain cats.

In short, AI is the broader concept of machines being able to carry out tasks in a way that we would consider “smart” and Machine learning is one approach to achieving AI.

Figure 1: ChatGPT can answer queries, forming complete and unique answers using artificial intelligence.

Clearly, ChatGPT is a large step forward in automation and is being briskly rolled out in numerous applications after Microsoft’s recent US$10 billion investment into OpenAI (following an early investment in the company in 2019) by building capabilities into its Microsoft Office suite. Outside of Microsoft, developers are briskly creating new products from digital assistants, data engineering, and software code assistants. It is worth wondering what this means for the technology sector and if this will change the current “Technology World Order”.

In short, we believe it means everything and nothing. On the everything side, we believe that AI/ML will change the way companies operate and provide them with new tools to run more efficiently. Airlines can better schedule their crews and maintenance, saving money and reducing network interruptions. Retailers can improve inventory ordering, increase conversion from eCommerce advertising campaigns and gain customer insights. IT companies can reduce costs by optimizing server usage or assisted software coding. Many are currently implementing these changes.

On the nothing side, the Boston Red Sox are still the Boston Red Sox, and the Oakland Athletics are still the Oakland Athletics. Like Moneyball, we believe the financial strength of the mega-cap technology companies will provide the resources necessary to best develop and commercialize AI an thus will enable them rather than disrupt. One differentiator between the tech companies in the 2000 bubble and today is their much greater consumer focus. ChatGPT is just the beginning in terms of consumer use applications. Considering the substantial cost involved in building infrastructure, training, and commercializing AI technology (billions of dollars), the better capitalized mega cap tech companies have been quietly building their leads over the past decade.

- Alphabet acquired AI start-up DeepMind in 2014 for $600 million and, after years of investment, generated $1B in revenue in 2021.

- Amazon Web Services and Microsoft (in addition to OpenAI) are providing AI services to clients and using AI to manage cloud data more efficiently.

- Meta Platforms and Alphabet are using AI to improve ad targeting and provide content to increase user engagement. Both firms have also launched an LLM (Google Bard and Meta LLaMA)

- Interestingly (and unrelated to their core businesses), Alphabet (through DeepMind) and Meta AI are leaders in predicting protein structures based on DNA sequences. This could accelerate the breakthroughs in biotechnology.

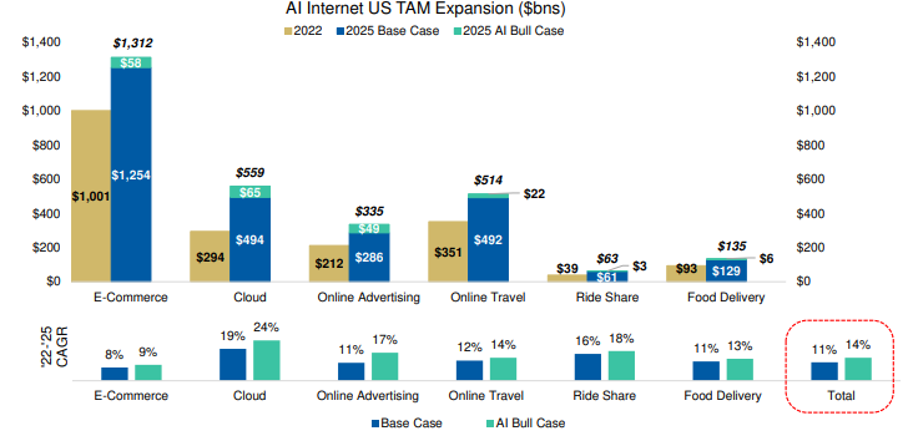

Artificial intelligence and machine learning represent a large opportunity. Morgan Stanley research estimates that AI will drive an additional US$200B in digital revenue opportunities through 2025 (Figure 2), with e-Commerce, cloud computing and online advertising generating 80% of that growth.

Figure 2: Morgan Stanley estimates AI presents US$200B of new opportunities.

I queried ChatGPT about the revenue opportunities:

Query: How can Google, Microsoft, Amazon and Meta Platforms use AI to drive revenue?

There are several ways that companies like Google, Microsoft, Amazon, and Meta Platforms can use artificial intelligence (AI) to drive revenue. Some of the most common ways include:

- Cloud-based AI services: These companies offer a variety of cloud-based AI services, such as image and speech recognition, natural language processing, and machine learning, to other businesses and organizations. By renting out access to these services, they can generate a steady stream of revenue.

- Advertising: Companies like Google and Amazon use AI to optimize their advertising systems and target ads more effectively. By using machine learning algorithms to predict which ads will be most effective, they can increase the effectiveness of their advertising and charge higher prices for their ad space.

- E-commerce: Companies like Amazon and Meta Platforms use AI to personalize the shopping experience for customers and make recommendations. By using machine learning algorithms to analyze customer data, they can recommend products that customers are more likely to buy, which can increase sales and revenue.

- Product development: Companies like Google, Microsoft and Meta Platforms can use AI to improve their existing products, such as search engines or virtual assistants, or develop new ones like self-driving cars, and other autonomous systems. In addition, these companies can generate revenue from licensing these products to other companies.

- Industrial Automation: AI and Machine learning can be used in automating Industrial process, such as predictive maintenance, predictive inventory management, forecasting, and demand management. These companies can generate revenue by selling the software and systems to industrial firms, including manufacturing, logistics and supply chain.

One concern for tech investors is the escalating cost of processing power for AI queries. AI queries can cost upwards of 10x the cost of a regular search query, and thus, profit margins for those creating these capabilities may decline. We argue that leading edge technology is always expensive at the onset of adoption, but scale and efficiencies (including those derived from AI) inevitably drive costs lower, providing for adequate return on capital. The big five mega-cap tech companies (Alphabet, Amazon, Apple, Meta and Microsoft) are expected to generate $315B in free cash flow in 2024. Thus, we believe that their AI efforts can scale quite quickly.

And just for fun, I wanted to see if my Moneyball comparison held up.

Query: How is AI similar to Moneyball?

“Moneyball” is a term that refers to the use of statistical analysis to evaluate and acquire players in the game of baseball. The idea behind Moneyball is to use data and analytics to identify undervalued players who can be signed at a lower cost and can contribute to the team’s performance.

Artificial intelligence (AI) is similar to Moneyball in that it also relies on data and analytics to make predictions and inform decision-making. Just as baseball teams use data and analytics to identify undervalued players, companies and organizations can use AI to identify patterns and insights in large sets of data, which can inform decision-making and improve performance.

In the same way, both AI and Moneyball use mathematical models, statistical analysis and data-driven approach to identify patterns, relationships, and make predictions. Both of them also require large amount of data to train and validate the models, and look at past performance to make predictions about future performance.

Additionally, In recent years, sports organizations have started using AI to make predictions, scouting, and analysis to drive their decisions. They also use it to track player’s performance, and to identify patterns and tendencies during a game that can be used for coaching, training and to gain a competitive edge.

In short, AI and Moneyball are similar in that they both use data and analytics to make predictions and inform decision-making. Both aim to identify patterns and trends that can be used to improve performance and gain a competitive edge.

Although we believe AI is set to power the next decade of growth for major technology companies, it is a continuation of the theme of higher productivity enabled by the internet economy. We believe our internet holding discussed in this note (Alphabet, Amazon, Meta, & Microsoft) will all benefit from AI implementation. As well, Broadcom and Qualcomm should benefit through continued demand for semiconductors.

This Focus Stock is written by our Head of Research, Jamie Murray.

The purpose of this is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.