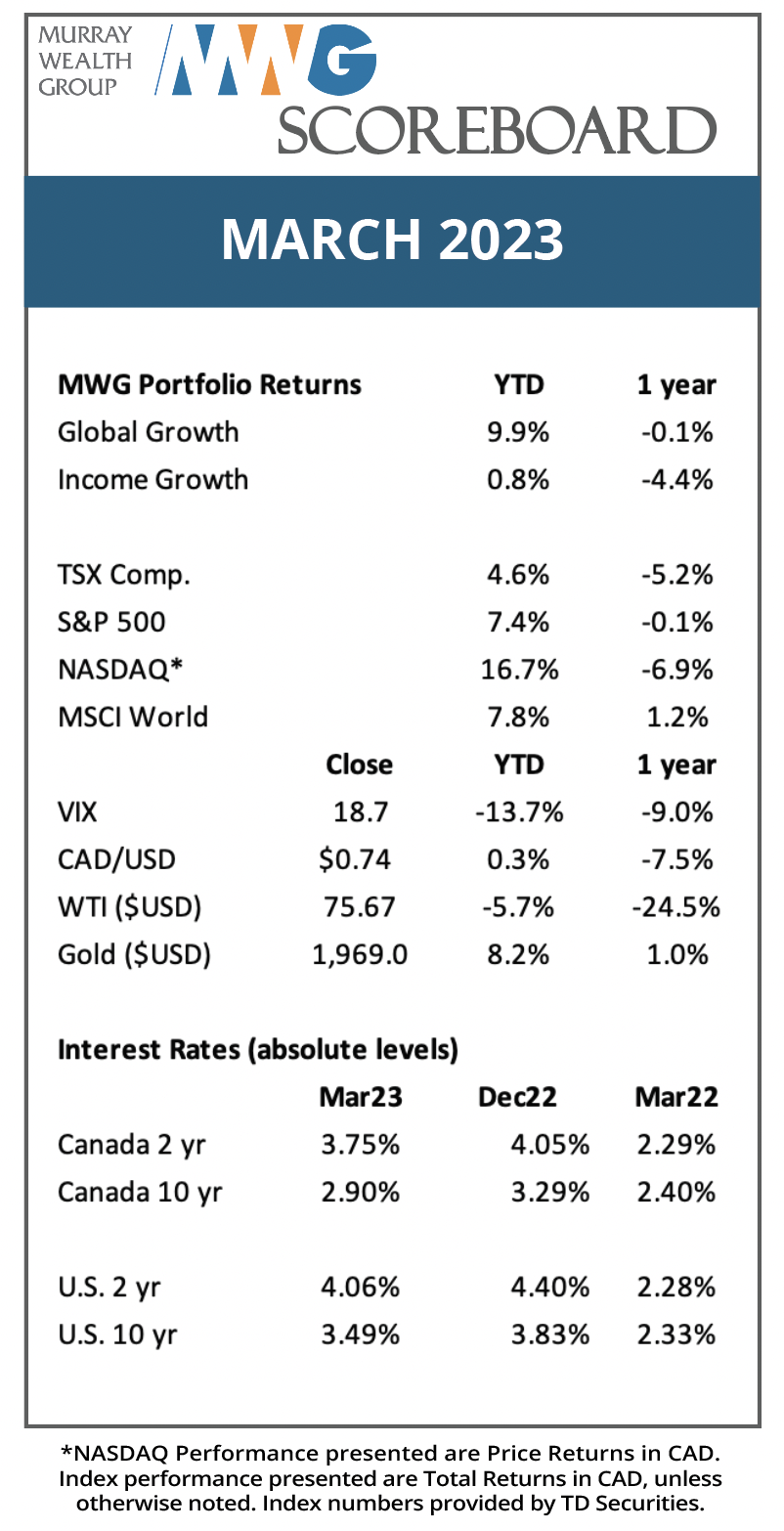

Thoughts on the Market: March Edition

A banking crisis or a bank crisis?

The failure of Silicon Valley Bank (plus Signature Bank of NY) in March 2023 and the subsequent panic brought back shades of 2008 and Bear Sterns’ collapse in March 2008. At that time, it was known that certain assets held on the books of financials were challenged, with many sub-prime and asset-backed securities incurring elevated losses as early as February 2007. It would be another 6 months post-Bear Stearns for the banking collapse to come to fruition, with the fall of 2008 providing the climax of risk.

As our CEO Bruce Murray often points out, banking failures are not uncommon in the United States. Before the great depression, there was the Panic of 1893, which was triggered by widespread failures following the railroad bubble of the 1880s. Clearly, the Great Depression was not a good time for banking, with close to 2,000 failures in the first two years. There was then a relative period of stability before the onset of globalization changed banking from regional to international, bringing with it a new set of risks. Citicorp (now Citibank) lost 30% of its equity in the Latin America debt crisis in 1987, the savings & loans crisis through the 1990s forced the closure of 1,000 thrifts, and the 2008 collapse saw the largest failure in history, with the US$307B failure of Washington Mutual. Over time, regulations and deposit insurance from the FDIC have attempted to build a more resilient banking system.

Silicon Valley Bank (SVB) and Signature Bank (SBNY) shared several characteristics that led to their collapse, namely a high growth, non-sticky base of large (i.e., uninsured by FDIC) deposits from risky tech/crypto new ventures and poor asset-liability management (ALM). As the technology market weakened in 2022, early-stage tech companies were unable to raise new funding. This led to the drawing down of deposit bases at banks. At the same time, higher interest rates had a two-fold effect: first, depositors started to look for interest rates higher than returns provided by chequing accounts, and second, higher rates led to paper losses on companies’ bond portfolios. When SVB attempted to raise $500M of equity (a meagre amount) to help stabilize its balance sheet, a bank run was ignited as the uninsured depositors sought to diversify their bank relationships. An exodus of reserves ultimately led to the banks’ downfall. Intervention by the U.S. Federal Reserve in the form of the Bank Term Funding Program, a program that allows banks to pledge discounted bonds for collateral at full value, has helped prevent further contagion.

On the other side of the pond, Swiss authorities are trying to push through a UBS acquisition of Credit Suisse to shore up domestic banking stability. While it is tempting to draw a connection to the U.S. banking issues, apart from higher interest rates, Credit Suisse’s extinction was sowed in its own doings. Despite its standing as a Global Systematically Important Bank, the culprit of its demise was years of mismanagement (including fraud, criminal clients, and idiosyncratic losses) rather than a liquidity issue.

Figure 1. Credit Suisse Share price over past 10 years

Source: Refinitiv Workspace

While the two banking episodes are not directly related, it’s clear that financial conditions are sufficiently tight for the Federal Reserve (and other global central banks) to face the prospect of additional liquidity issues if rates continue to increase. The bond market is starting to price in a pause by the Federal Reserve this spring, and if inflation data continues to improve, we would expect an increasingly dovish Fed. Thus, at this stage, we do not believe a banking crisis is unfolding, particularly with most banks maintaining strong regulatory capital.

In relation to our investment process, we tend to favour Canadian financial institutions given their historical resilience. The Canadian financial companies have a symbiotic relationship with the Office of the Superintendent of Financial Institutions that regulates the sector and face less competition than their American peers (although many have operations or subsidiaries in the U.S.). Our only financial holdings outside of Canada are Morgan Stanley, an investment bank with a much larger wealth management focus, and Prudential PLC, an Asian life insurer currently run by the former Head of Manulife Asia.

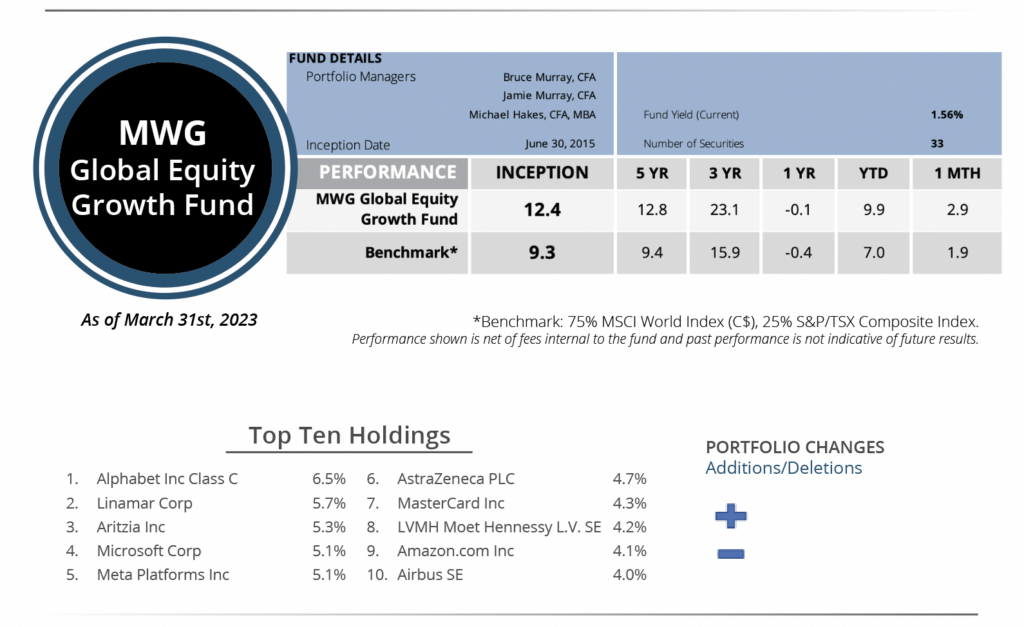

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund rose 2.9% in March versus 1.9% for its benchmark. Year-to-date, the Fund has returned 9.9% versus the benchmark return of 7.0%. The top three performers in the month were Meta Platforms (+20%), Microsoft (+15%) and Docebo (+15%), while Converge (-12%), Linamar (-12%) and Prudential (-10%) were the biggest detractors.

We made no changes to the portfolio during the month.

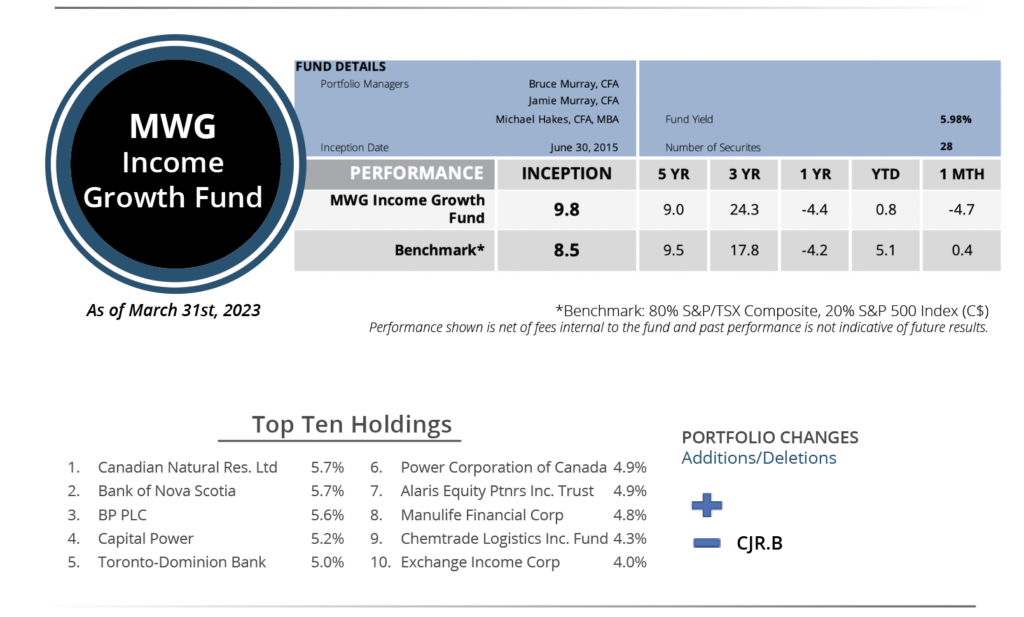

INCOME GROWTH FUND

The MWG Income Growth Fund fell 4.6% in March versus a 0.4% increase for its benchmark. The Fund is up 0.8% year-to-date versus the benchmark increase of 5.1%. Danone (+10%), Exchange Income (+4%) and Rio Tinto (1%) led the portfolio, while Chemtrade (-14%), Doman Building Materials (-11%) and TD Bank (-11%) were the top detractors. The fund yield was 6.0%.

We sold our position in Corus Entertainment during the month. Corus was our smallest position in the portfolio and, despite attractive cash generation, the high debt burden and continued revenue degradation in its Canadian media properties had led to successive dividend cuts over the years. We had expected Corus to stabilize its revenue through new growth initiatives, which should have protected its cash flow, but that has not materialized.

This Month’s Portfolio Update is written by our Head of Research, Jamie Murray, CFA.

The purpose is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.