Prudential Plc (PUK.N)

Written by Senior Portfolio Manager, Michael Hakes, CFA, MBA.

We recently added Prudential Plc to the Global Growth portfolio at a 2% weight.

Prudential Plc is a life and health insurance company with direct exposure to the rapidly growing markets of Southeast Asia and China. Having spun off its U.S. Jackson Financial division (Ticker JXN)) in September 2021, the company is now a pure play for the region. It has operated in Southeast Asia for almost 100 years and has over 19 million customers in the region.

Why is Prudential Plc such an attractive investment?

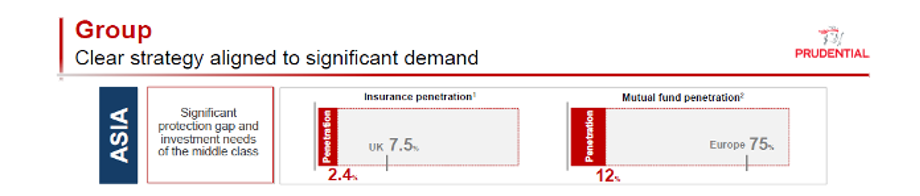

Penetration of life and health insurance products is low in many of its markets, with a significant ‘protection gap’ when compared to more developed markets. For example, as shown in Figure 1, insurance penetration as a % of GDP is about 7.5% in the U.K. but only about 2.5% in developing markets. As the middle class continues to grow in these markets, so will the insurance penetration rates. Prudential also has a small asset management business in the region. Mutual fund penetration in Asia sits at 12% versus 75% in the more developed European market.

Figure 1: Protection Gap

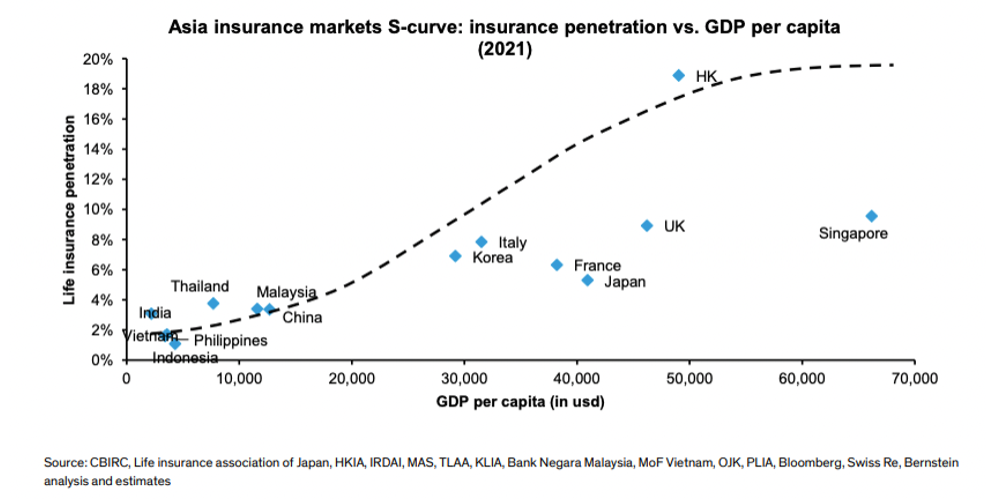

To illustrate this another way, see the Asian Insurance S-curve in Figure 2 below:

Figure 2: Asian Insurance S-Curve

On the x-axis, you have GDP per capita, and on the y-axis, life insurance penetration. Countries with low GDP per capita have low life insurance penetration. Prudential Plc has healthy exposure to many of these developing markets, including India (15% market share) Malaysia, Vietnam and Indonesia (#1 market share), as well as more mature markets like Singapore and Hong Kong.

Also, now that China is reopening and the mainland Chinese population are travelling again to Hong Kong, Prudential should experience a robust period of new business growth as these MCV’ s (Mainland Chinese visitors) buy insurance and health products when they travel to Hong Kong. Historically, these visitors have purchased high-end medical insurance, high-security major disease products, savings dividend products and life insurance.

We think Prudential Plc is well positioned to benefit from the long-term tailwinds in Southeast Asia and China.

This Focus Stock is written by Senior Portfolio Manager, Michael Hakes, CFA, MBA.

The purpose of this is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.