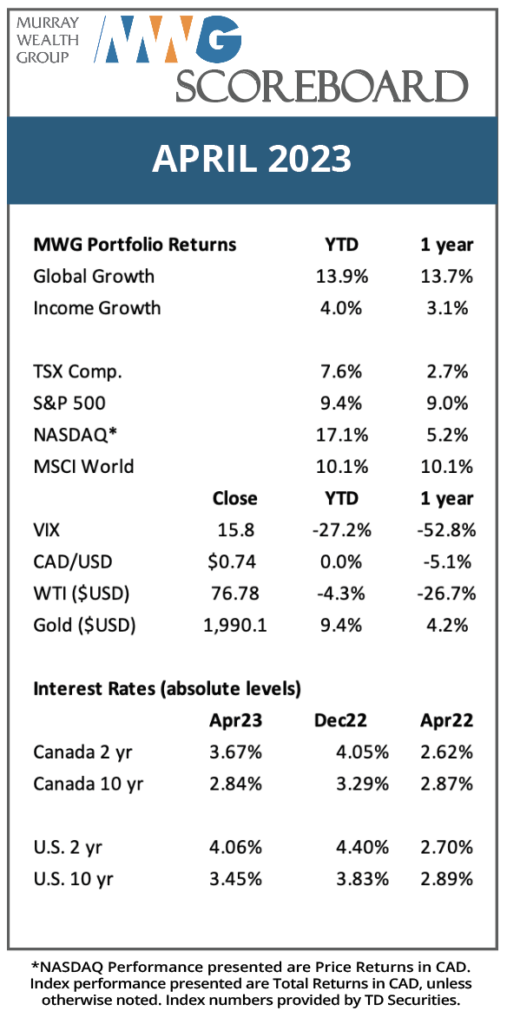

Thoughts on the Market: April Edition

Earnings season is in full swing, with hundreds of companies reporting quarterly financial results. These reports are a valuable tool to gain insights into a business or industry, benchmark a company versus its peers or test whether an investment thesis is working. However, some investors tend to place excessive importance on a single earnings report, mischaracterizing the strength or weakness of a company’s short-term financial performance as durable, missing the cyclical or temporary factors that may have caused the earnings surprise, and failing to understand the principle of reversion to the mean.

However, there are a couple of earnings reports every quarter that definitively prove that the strength of a business has been misunderstood. This quarter, Microsoft and Meta Platforms stood out in this regard. While the earnings results were good, with both companies beating revenue estimates by 3-4%, it was the guidance for next quarter that really stood out.

After an initial reaction of 3-4% in the price of the stock in the aftermarket, Microsoft rose another 5% after it released guidance that its fiscal 4th quarter (ending June 30, 2023) Azure cloud revenue is expected to grow 26-27% versus expectations of growth in the low-20% range. As well, Microsoft raised its capital spending for AI-based server capacity and now expects revenue generated from AI-based activity to contribute meaningfully beginning next quarter.

Meta Platforms’ guidance for its 2nd quarter (also ending June 30, 2023) indicated revenue could be as high as US$32B versus expectations of $US29B. As well, profitability is much stronger than expected. Figure 1 shows the consensus estimate for Meta’s 2024 EPS. Notice how it fell (dramatically) through 2022, culminating in a November low. Meta’s share price tends to follow EPS estimates, and thus the price bottomed around $90 shortly thereafter. However, the company’s renewed focus on efficiency and cost (while it delivers best-in-class advertising technology) has quickly reversed this trend. Following Q2 reporting, consensus estimates rose 14% from $12.44 to $14.22.

Figure 1. Meta Platform Consensus 2024 EPS Estimate

Source: Refinitiv Workspace

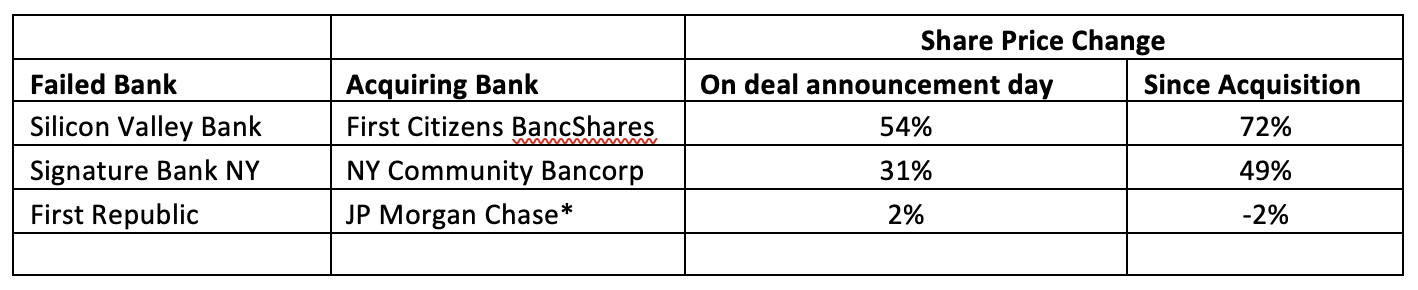

In the banking world, JP Morgan acquired the assets of First Republic Group shortly after the end of the month, marking the 3rd major regional bank failure in 2023. We continue to believe these failures are the result of last year’s sharp increase in interest rates on specific companies (that were adversely positioned) as opposed to a systemic risk to the market. The three bank failures to date all had very high ratios of uninsured deposits (deposits in excess of US$250k are not covered by FDIC in the case of failure and thus are more likely to flee to a perceived safer bank) and, as a result, were most at risk of a bank run. We are also encouraged by the process used to sell First Republic, as the FDIC ran an open auction process that included the large money center banks like JP Morgan, allowing a seamless transition for depositors and customers. We note that the stock market has responded favourably to acquirers of the three failed banks (as can be seen in Figure 2). Thus, additional consolidation could be viewed positively, particularly with the ongoing pressure in the regional bank sector.

Figure 2: Acquisition of Failed Banks

Source: Refinitiv Workspace

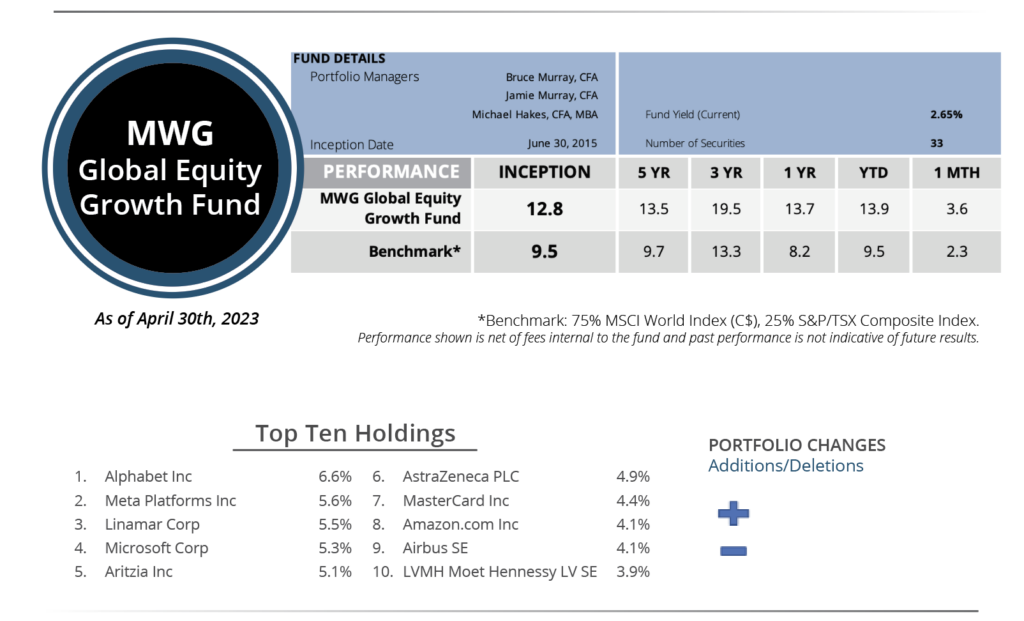

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund rose 3.6% in April versus 2.3% for its benchmark. Year-to-date, the Fund has returned 13.9% versus the benchmark return of 9.5%. The Fund’s top three performers in the month were Intuitive Surgical (+18%), Eli Lilly (+16%) and Meta Platforms (+13%), while Converge (-19%), Qualcomm (-8%) and Docebo (-4%) were the biggest detractors.

We made no changes to the portfolio during the month.

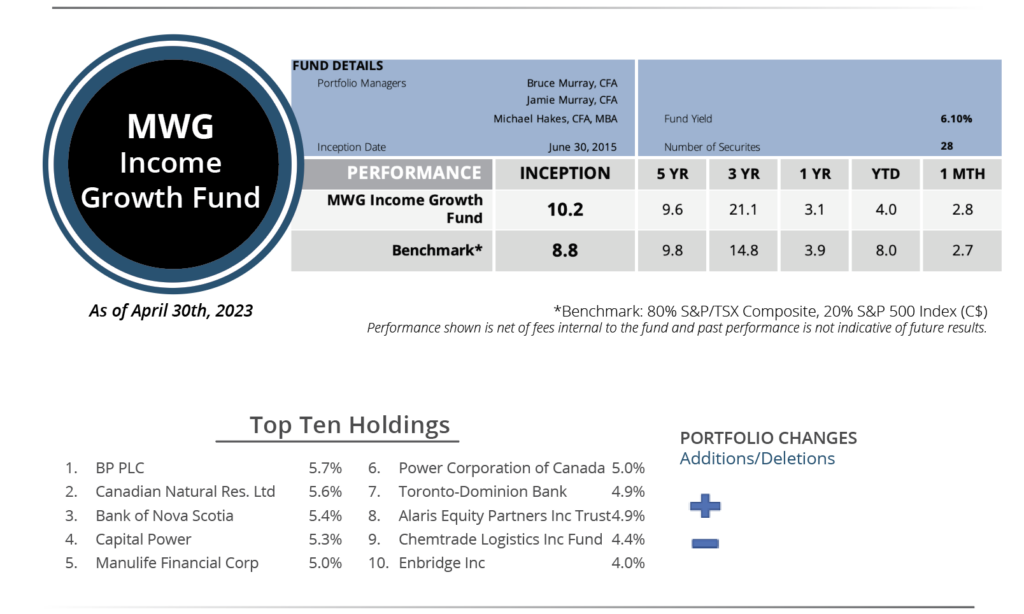

INCOME GROWTH FUND

The MWG Income Growth Fund rose 2.8% in April versus a 2.7% increase for its benchmark. The Fund is up 4.0% year-to-date versus the benchmark increase of 8.0%. Canadian Natural Resources (+10%), Cogent Communications (+9%) and Manulife (8%) led the portfolio, while Rio Tinto (-6%), Pro REIT(-6%) and Doman Building Materials (-5%) were the top detractors. The fund yield was 6.0%.

We made no changes to the portfolio during the month.

This Month’s Portfolio Update is written by our Head of Research, Jamie Murray, CFA.

The purpose is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.