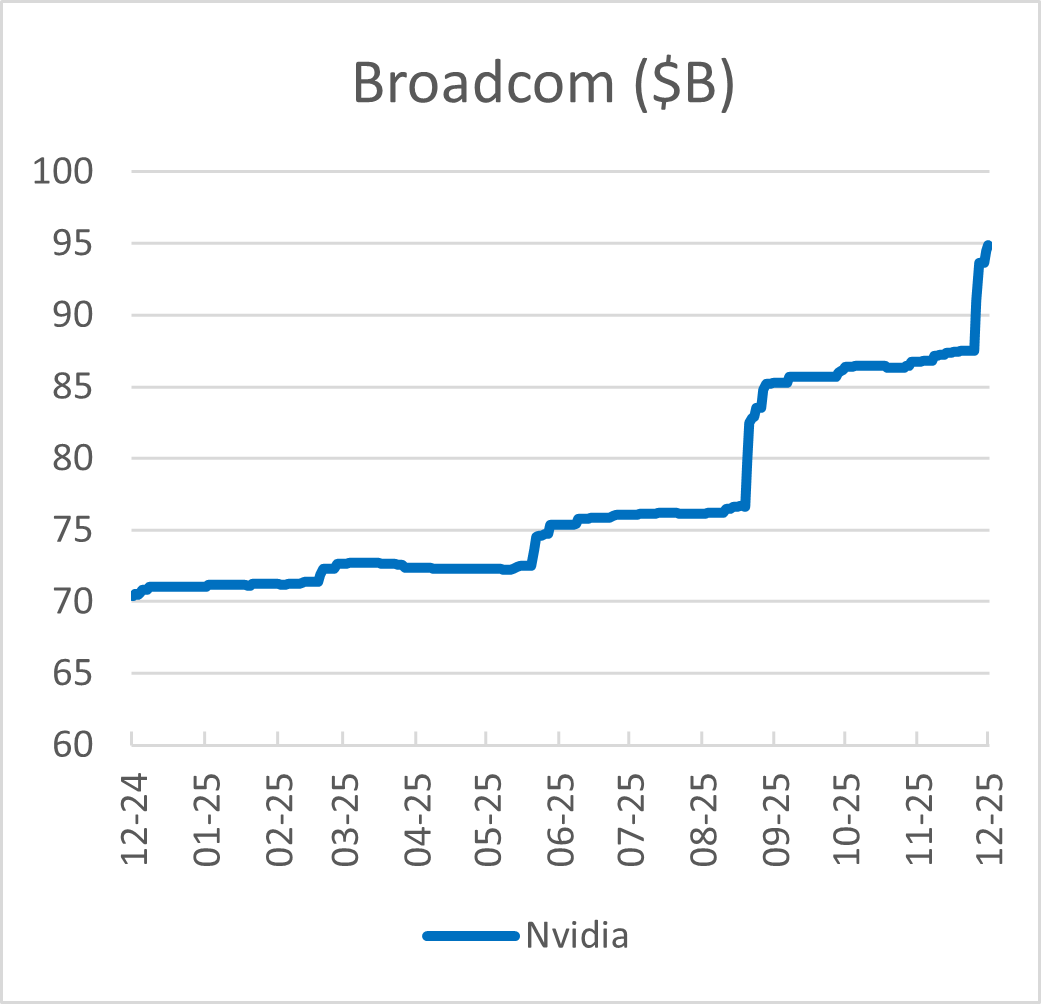

MWG Global Equity Growth Fund Performance

The MWG Global Equity Growth Fund Series O rose 0.5% in November, slightly behind the 0.8% rise in its benchmark and is now up 28.2% year to date. The Fund’s top three performers in the month were Eli Lilly (+24%), Alphabet (+13%) and Aritzia (+13%), while 3i Group (-28%), Hammond Power (-19%) and Docebo (-16%) were the largest detractors.

Portfolio Managers’ Summary

We made no changes to the Fund in November as equity markets consolidated following a strong six months. AI enthusiasm remains strong, with data points out of Google highlighting continued exponential adoption of Large Language Models (LLMs) like Gemini and ChatGPT. We expect 2026 will build on advancements made in 2025. LLMs continue to scale, offering more intelligence at a lower cost per query, but demand continues strong, and thus, overall spending is forecasted to grow through 2027.

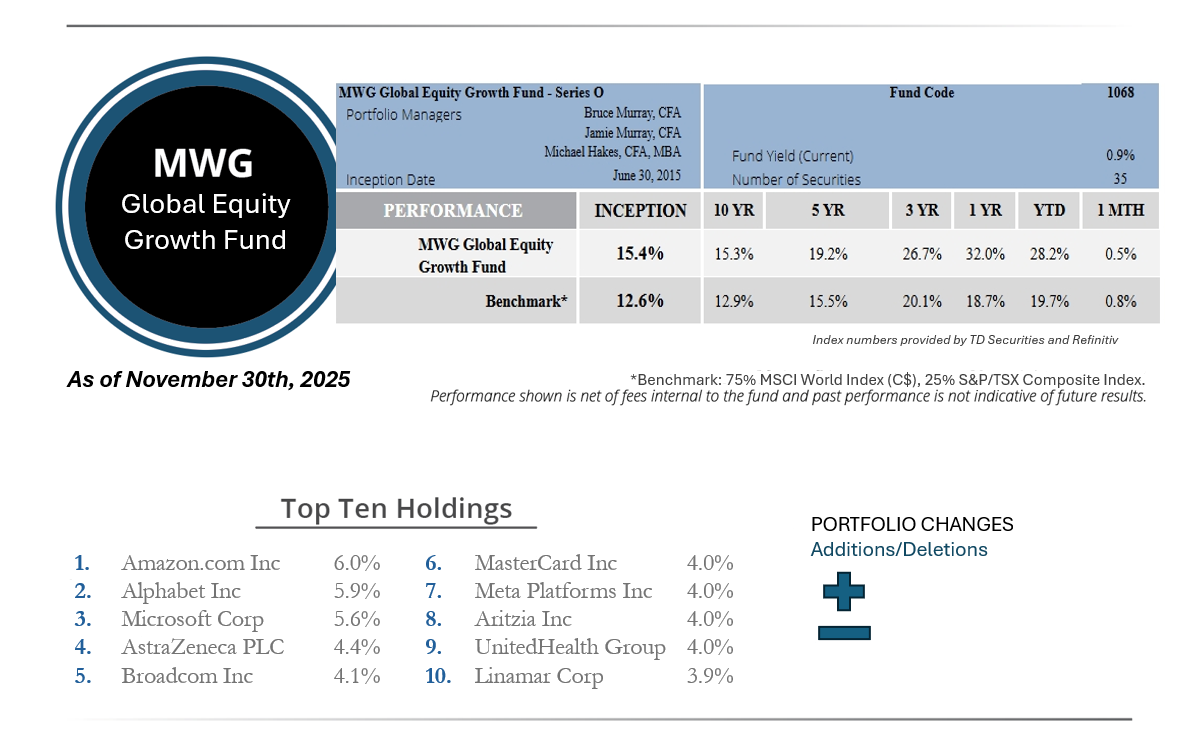

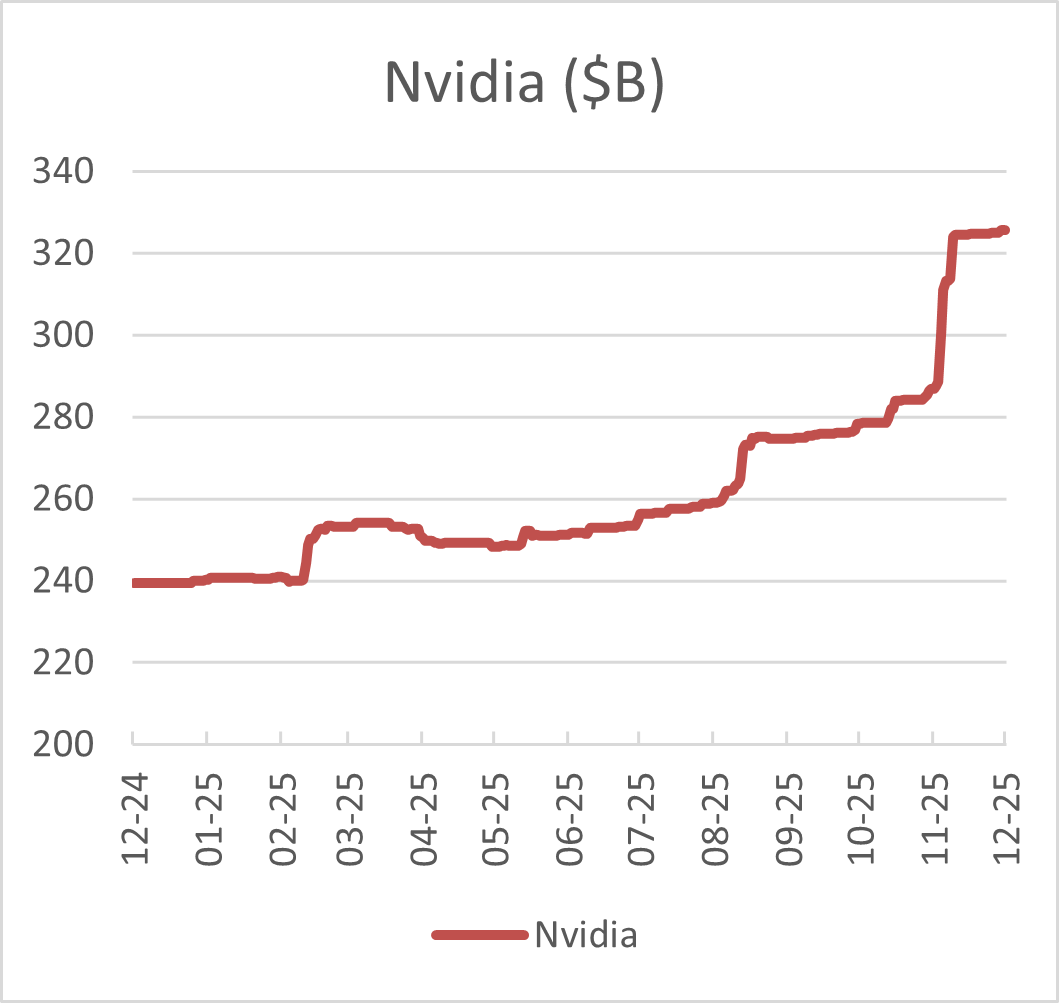

To illustrate this trajectory, we need to look no further than revenue estimates for two of the Global Equity Growth Fund’s most direct AI plays, Nvidia and Broadcom. With both companies recently reporting their earnings, Wall Street analysts have compiled up-to-date financial projections. Figure 1 below highlights the change in 2026 revenue estimates for both companies over the past year. Put simply, a year ago, Nvidia and Broadcom were expected to generate $240B and $70B, respectively, of revenue in 2026. Today, as we sit on the cusp of the new year, estimates are now 35% higher for both companies, at $325B and $95B, respectively.

Figure 1. 2026 Revenue Estimates for Nvidia and Broadcom over past year

Source: Workspace

MWG Income Growth Fund Performance

The MWG Income Growth Fund Series O increased 1.0% in November, below the 3.0% increase in its benchmark. The Fund is up 19.8% year to date. Kenvue (+22%), Whitecap (+13%) and Wajax (+11%) were top performers, while Cogent (-58%), Northland Power (-31%) and Capital Power (-13%) were the top detractors. The Fund’s Yield was 5.2% at month-end.

Portfolio Managers’ Summary

While gold has dominated discussion on the TSX throughout much of 2025, we would be remiss not to mention the strong performance of Canadian financial companies. The group was up 4% in November and has now returned 29% year to date. We believe the sector is benefitting from recovering sentiment following the trade war scares in early 2025, as well as a global movement to reduce capital regulations across the board. We have highlighted our views on the financials in our pieces on Canadian Banks and Power Corp. Our Income Growth Fund has a 25% weighting to Canadian Financials, although we have been reducing our weighting as price/earnings ratio rise to multi-year highs, compressing dividend yields.