By: Jamie Murray, CFA

Chemtrade Logistics Income Fund (CHE.UN) is a compelling, under-the-radar turnaround story that we believe is deeply misunderstood by the market.

The company produces essential chemicals used in a wide range of industries. The company’s products are the “boring but essential” chemicals that are critical for everything from disinfecting drinking water and manufacturing paper to refining gasoline and producing high-value semiconductor equipment. The stability of these end-markets, together with Chemtrade’s operational capabilities, forms a durable foundation for its business.

A key competitive advantage for Chemtrade lies in its access to low-cost hydropower for its electricity-intensive chlor-alkali process, which produces chlorine and caustic soda. This positions Chemtrade as one of the lowest-cost producers globally, a competitive edge that has widened in a world of rising energy prices. Similarly, its water business has been innovative in developing higher value coagulants that smaller, local competitors are unable to replicate, securing a stable, revenue stream from municipalities.

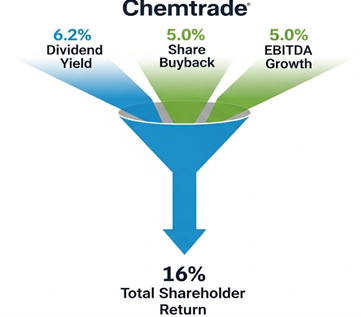

For years, Chemtrade was saddled with high debt from a period of aggressive acquisitions. In addition, it faced a number of headwinds, including a price-fixing lawsuit from a prior acquisition and the economic fallout of the COVID-19 pandemic. This culminated in a distribution cut in 2020 that left many investors questioning the company’s future. However, a new management team has since taken the reins, fundamentally transforming the company’s financial health and strategic direction. With a low debt load and strong free cash flow, we believe Chemtrade can generate a 16% annual return (Figure 1). We believe the market has yet to fully appreciate this transformation and the value it will create, presenting a unique and timely opportunity for investors.

Figure 1: We think Chemtrade can generate a 16% total shareholder return annually

Source: MWG, Gemini AI

The promotion of Scott Rook as CEO in 2021 marked a significant turning point. Under his leadership, the focus shifted to financial prudence and operational excellence. The results have been substantial. Notable accomplishments to date include:

- reduced its debt by nearly half since 2022

- reduced fully diluted shares by 12 million units, buying back its stock and retiring convertible debentures in the past year;

- increased its dividend for two consecutive years, with indications of future annual increase, and

- improved communication with investors, with the company exceeding its initial annual guidance four years in a row.

Despite these fundamental improvements, Chemtrade is being valued by the market at an enterprise value to EBITDA multiple of just 5x, the same level at which it traded prior to the transformation. This is a valuation typically assigned to a struggling, highly cyclical company, not a business with stable cash flow, a solid balance sheet, and a clear growth strategy. Management has articulated a plan to grow EBITDA by 5-10% annually through 2030, targeting a significant increase in profitability (Figure 2).

Figure 2: Chemtrade expects to grow 5-10% through organic growth and acquisitions in addition to paying its regular dividend.

Source: Company Reports

We believe Chemtrade’s clear capital allocation framework, which includes a robust 6.2% dividend yield (with dividends backed by strong cash flow coverage) and an active share buyback program, offers investors a compelling return. Chemtrade’s share price could reach $14 in the next two years based on earnings growth alone. If the market eventually re-rates the company to a valuation more in line with its industrial chemical peers, the price could have even greater upside toward $20. In our opinion, this investment is a compelling combination of a high dividend yield, a powerful cash-flow engine, and a business on a clear path to both organic and inorganic growth.