Written by President, Jamie Murray, CFA

What a difference a tweet makes.

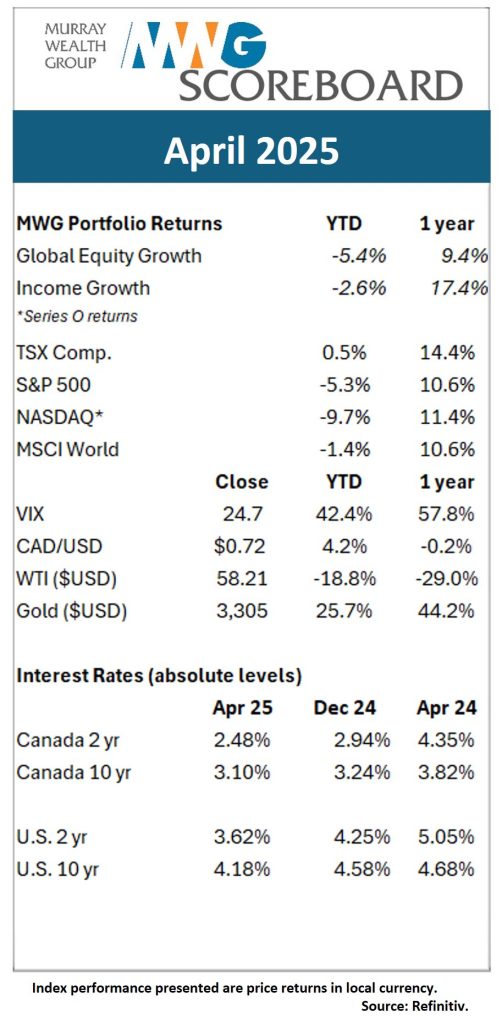

Tariffs went global at the start of April, with “Liberation Day” swiftly turning into “Liquidation Day.” The selloff between April 2-8 was one of the sharpest in history as the S&P 500 fell 14.7% in two trading sessions and the intraday move at the open of April 8. This was quickly reversed by an announcement of a 90-day pause on reciprocal tariffs on all countries but China. We provided an update on our market thoughts in our April 4 Investor Update, which argued that cooler heads would prevail, and our April 17 update, which highlighted the opportunity that comes when buying extreme fear as indicated by the VIX. Thus far, these appear prescient as the S&P 500 went on to record its longest daily winning streak since 2004. Moving forward, we expect the market to continue climbing higher as companies are indicating that the tariffs are either manageable or likely to be revised for key industries if deemed untenable.

In the manageable camp, Aritzia, a women’s fashion retailer we have owned in our Global Equity Growth Fund since 2018, reported financial results and its outlook for the next year on May 1. It highlighted that although tariffs on China (and to a lesser extent on Vietnam and Cambodia) will put a dent in current year profits, the company will largely offset the tariffs by moving 90% of its manufacturing out of China by 2026. This is without raising prices in response to the tariffs. It is a manageable situation, particularly when you deliver 38% sales growth.

In the untenable camp, car makers like GM initially indicated there could be US$4-5 billion of additional tariff costs….and we believe GM is one of the best positioned automakers to mitigate tariff exposure. However, accommodations are already being made to help lower the burden. At the outset, USMCA-compliant parts were made exempt. Further accommodations include the creation of an import offset (tariff rebate) and de-stacking tariffs on aluminum and steel. GM indicated further actions can offset upwards of 30% of its tariff exposure.

Tariffs will continue to be a drag on economic activity until Trump is able to launch his Economic Redemption Tour.

Despite his poor start, with declining approval ratings and high policy uncertainty, there are several avenues available to catalyze economic growth.

- Tax cuts. The Trump Administration has been vocal about its desire to extend tax cuts first implemented in its first term and further lower both personal and corporate tax rates.

- Banking Reform. The 2008 Financial Crisis ushered in stringent regulatory capital reforms for large banks globally. The industry argues that they are now overcapitalized and hamstrung in terms of lending, a view shared by U.S. Treasury Secretary Scott Bessent. JP Morgan’s CEO Jamie Dimon believes that overregulation is costing Americans billions of dollars through higher lending rates and lower access to capital.

- Deregulation. Compliance costs are expected to come down as businesses shift their focus from regulatory reporting requirements to activities that drive economic value.

We believe that as the chaos from the disorderly rollout of tariffs subsides, a more pro-business government will emerge. Investments in artificial intelligence should accelerate, improving productivity and leading to renewed economic optimism and higher earnings. Despite calls for United States economic decoupling, the high degree of integration makes rapid disengagement unlikely.

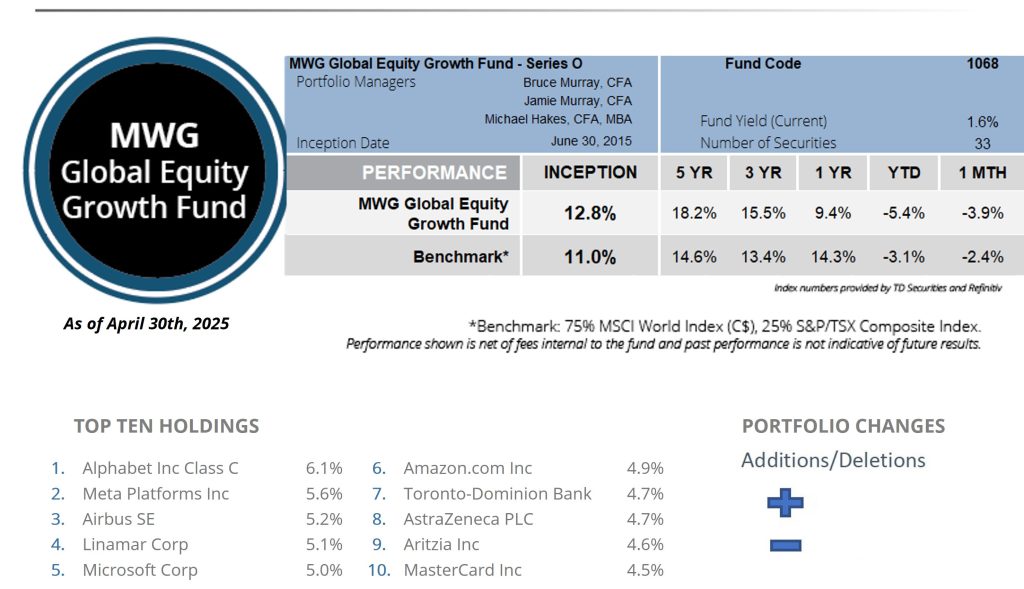

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund Series O declined 3.9% in April, underperforming the 2.4% decline in its benchmark, and is now down 5.4% year to date. The Fund’s top three performers in the month were 3i Group (+15%), Hammond Power (+15%) and Broadcom (+10), while UnitedHealth (-25%), Herc Holdings (-22%) and Starbucks (-22%) were the largest detractors.

Portfolio Managers Summary

The AI trade reignited in mid-April, undermining earlier reports of a slowdown. Not only did mega-cap tech companies like Microsoft and Meta maintain their massive capital datacentre investment plans, but they also indicated that revenue is being constrained by a lack of capacity. We believe this theme will prevail through 2030 given that enterprise customers are still early in the adoption cycle.

Most of the weakness in the month was attributable to pressure on consumer discretionary and industrial stocks amid concerns about a tariff-induced recession. As well, UnitedHealth shares suffered their worst month since 2009 after the company lowered its financial guidance due to higher Medicare expenses.

It should be noted that the rebound in the Canadian/US dollar exchange rate from $0.68 to $0.72 lowered the Canadian dollar-based returns for both the Fund and its benchmark by about 5%.

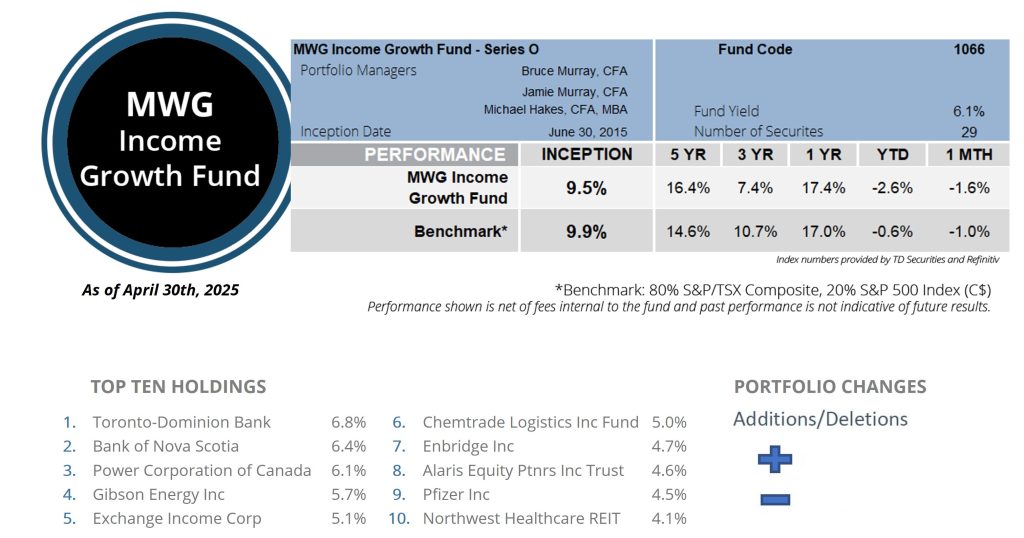

INCOME GROWTH FUND

The MWG Income Growth Fund Series O was lower by 1.6% in April, below the -1.0% return for its benchmark. The Fund is down 2.6% year-to-date. Kingfisher (+11%), Capital Power (+9%) and Evertz (+7%) were the top performers, while BP (-22%), Cogent Communications (-15%) and Whitecap Resources (-15%) were the top detractors. The Fund’s yield was 6.1% at month-end.

Portfolio Managers Summary

The Fund continues to act defensively. That said, surging gold prices have helped prop up the TSX benchmark index over the past month. We believe the dividend coverage of our portfolio remains very strong, with several of our holdings buying back shares in addition to sustaining yields of more than 7%.

The energy sector was a primary detractor to the Fund’s performance, with recession and supply concerns causing benchmark Brent & WTI prices to fall into the US$50-60/barrel range. We believe that a slowdown in North American drilling activity will reduce supply and cause prices to increase back over to the US$60 level. This should support a health level of profitability across our holdings.

This Month’s Portfolio Update is written by our Head of Research, Jamie Murray, CFA.

The purpose is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.