Tariffs and Our View on Share Buybacks

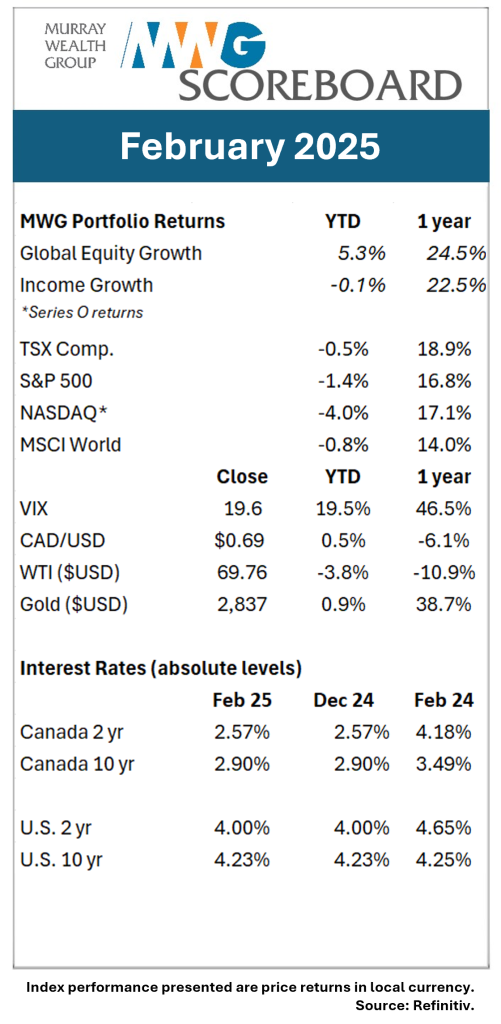

As the Canadian economy and companies are under the threat of tariffs, markets entered March with the expectation that tariffs would not be widely applied. However, there was an acknowledgment that policy uncertainty is a growing risk within the economy. For instance, on February 28, U.S. Treasury Secretary Bessent indicated that Canada and Mexico should impose tariffs on Chinese goods in conjunction with the U.S. This followed President Trump’s announcement of tariffs on Canada two days earlier, tariffs that had initially been set for April 2, then moved to March 4. As of this writing, USMCA goods are exempt until April 2, with additional steel and aluminum tariffs (for all countries) slated to take effect on March 12, 2025.

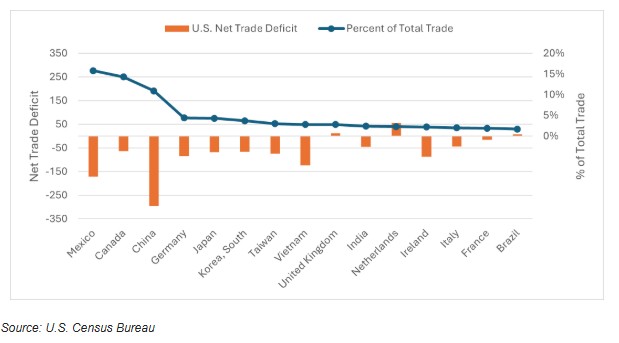

Figure 1. U.S. trade deficits (orange bar) and percent of total trade (blue line) with top 15 partners

Markets have now fallen ~10% from their peak in late February on concerns that tariffs and spending cuts may push the U.S. into a recession. In our view, it is likely that the Trump administration has adopted an extreme negotiating posture at the outset to set a goalpost for future trade deals. Another possibility is the implementation of permanent tariffs to fund a large tax cut. This explains the focus on Mexico, China and Canada, its three largest trading partners. Given that Canada has fairly balanced trade with the United States (excluding energy), a tariff war between the two nations will likely be detrimental to both countries.

The United States maintains priority access to Canada’s energy resources. Imposing tariffs on energy imports (even 10%) has created urgency and unity across Canada to find new markets for all products. Meanwhile, President Trump is attempting to revive the Keystone XL oil pipeline, which was vetoed by the Biden Administration. The contradictory stance of “we don’t need your resources” and “build us a giant pipeline” in the same week is a classic case of doublethink.

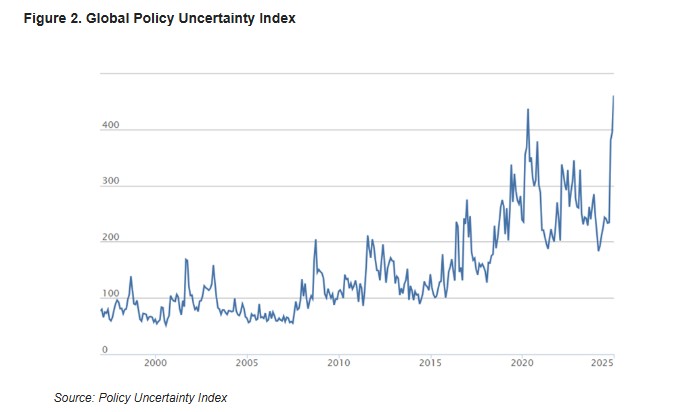

When policy uncertainty exists, companies respond by reducing their business risk. Business owners and managers seek stable and predictable policies to make hiring and investment decisions. This policy uncertainty is already impacting the U.S. economy, as highlighted by the Atlanta Fed GDPNow Index, which showed a broad slowdown in February.

The Policy Uncertainty Index, an index maintained by three university professors, is a strong gauge of policy risk. It measures newspaper mentions of policy uncertainty, tracks changes to the U.S. tax code and calculates data dispersions related to inflation expectations. While not a perfect measure, the short-term movement in the index to all-time highs indicates significant policy risk in the market.

Investing in companies most at risk from this uncertainty but with substantial long-term upside remains appropriate when a company has excess cash flow and an authorized share buyback program. Stock buybacks have increased in recent years as investors have indicated a preference for the tax consequences and flexibility offered by buybacks versus dividends. Financial theory suggests that buybacks and dividends are equal in terms of returning capital to shareholders, taxes aside. However, dividends often have higher associated income and withholding taxes, whereas stock buybacks have minimal tax implications (although this is changing with countries like Canada and the U.S. implementing buyback taxes). Additionally, North American investors expect dividends to grow steadily. Share buybacks allow a company to return excess cash flow to shareholders without the expectation that a dividend increase would create.

As the Canadian economy and companies are under the threat of tariffs, equity prices have weakened. While acknowledging the uncertainty that comes with tariffs, we also see tremendous value in a number of companies that we believe will not only endure this tariff period but emerge stronger. Industrial companies like Chemtrade, Air Canada and Linamar are earnestly buying back shares at attractive multiples (single-digit P/E ratios) while their shares trade at bottom cycle earnings and low expectations. We believe that when markets recover, the upside will be much greater, given they can retire approximately 10-20% of their outstanding shares, meaning each share owns about 15-25% more of the company.

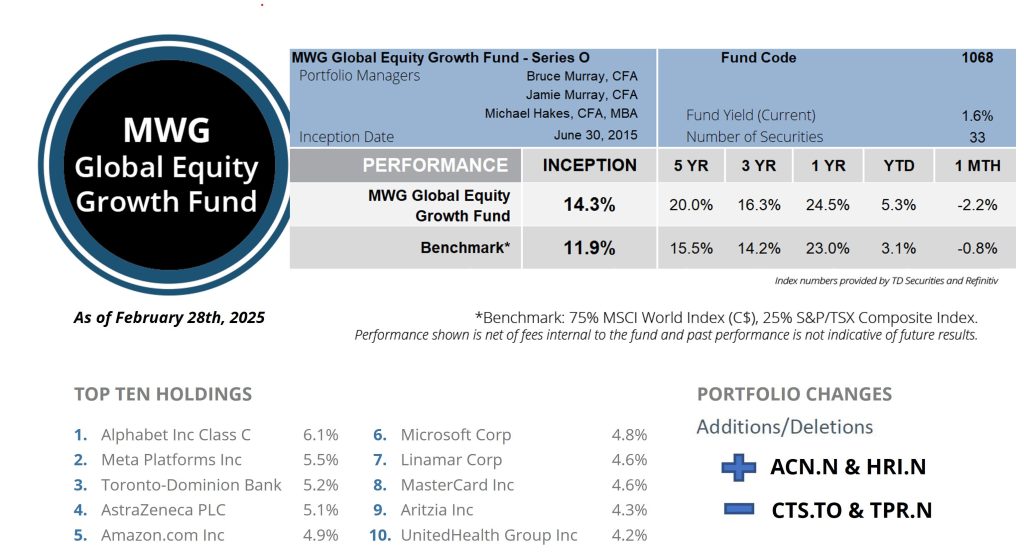

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund declined 2.2% in February, underperforming the 0.8% decline in its benchmark, and is now up 5.3% year-to-date. The Fund’s top three performers in the month were Converge (60%), Tapestry (+15%) and Eli Lilly (+13%), while Docebo (-24%), Alphabet (-16%) and Air Canada (-15%) were the biggest detractors.

Portfolio Managers Summary

Following a strong January, the portfolio gave back some gains in February as technology companies lagged due to the short-term AI spending path and ongoing tariff uncertainty.

We had an active month in the portfolio, both adding and selling two names.

We added shares in IT consulting firm Accenture at a 2% weighting. We believe Accenture will help enable generative AI technology at large corporations through data clean-up and migration efforts. Only 10% of existing corporate data is positioned to be leveraged for AI use, and we believe Accenture will see above-trend growth rates while companies refine and implement this technology. The stock is trading off its highs of 2021 but has also seen growth trends slow with corporate belt-tightening amid higher interest rates and inflation. We believe this is set to reverse through the latter half of the decade.

We also initiated a 1.5% weighting in Herc Holdings. Herc is part of a burgeoning triopoly in the construction rental market with United Rentals and Ashtead’s Sunbelt brand. These three companies collectively control about 35% of the rental market, slowly growing their market share through the acquisition of mom-and-pop operations. As the market consolidates, margins and return on assets grow for all three firms. Herc shares sold off sharply as it outbid United Rentals for the #5 player in the market (H&E) amidst tariff concerns. We are comfortable with the acquisition and acquired our position near the US$150 per share level.

To fund the purchase, we sold our position in Tapestry. We initiated the position in December under the thesis that the market was underestimating the brand strength at Coach, and this played out quickly as the shares approached our $90 target price (for a 40% gain on purchase). We also sold our position in Converge Technology Solutions as the company was acquired by private equity.

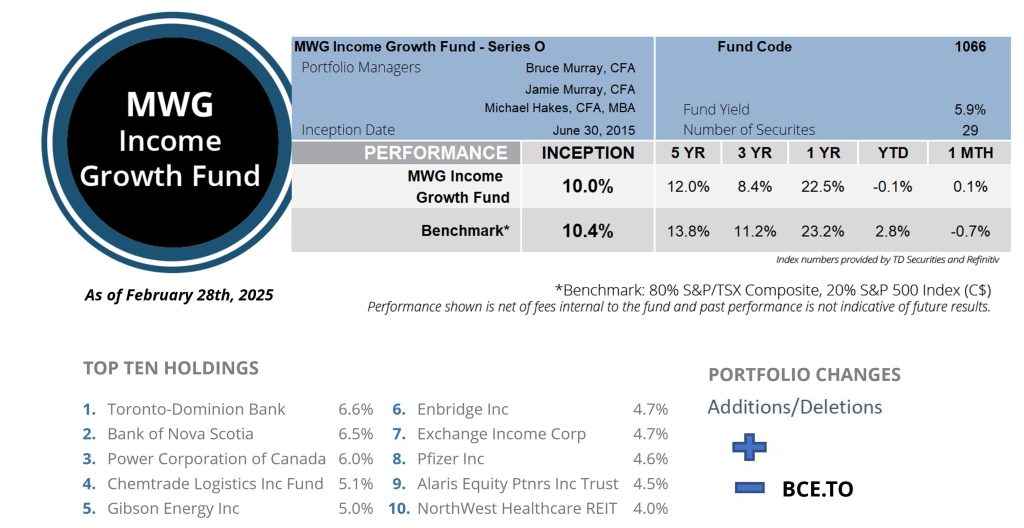

INCOME GROWTH FUND

The MWG Income Growth Fund rose 0.1% in January, beating the 0.7% decrease in its benchmark. The fund is essentially flat year-to-date. Northland Power (+17%), Power Corp (+11%), and Northwest Healthcare (+8%) were the top performers, while Gibson Energy (-12%), Evertz Materials (-10%), and Exchange Income (-10%) were the top detractors. The fund yield was 5.9% at month-end.

Portfolio Managers Summary

Interest rates fell precipitously in February as the market started to react to heightened economic policy uncertainty. While industrial and commodity companies may find operating conditions difficult, certain assets like real estate should see fundamentals improve with lower finance costs.

During the month, we sold our position in BCE, reflecting the risk of a prolonged recovery in telecom markets. We acknowledge the market is expecting a dividend cut from the former dividend darling; however, recent actions by management, including implementing a discounted dividend reinvestment policy, will likely be dilutive to equity holders.

This Month’s Portfolio Update is written by our Head of Research, Jamie Murray, CFA.

The purpose is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.