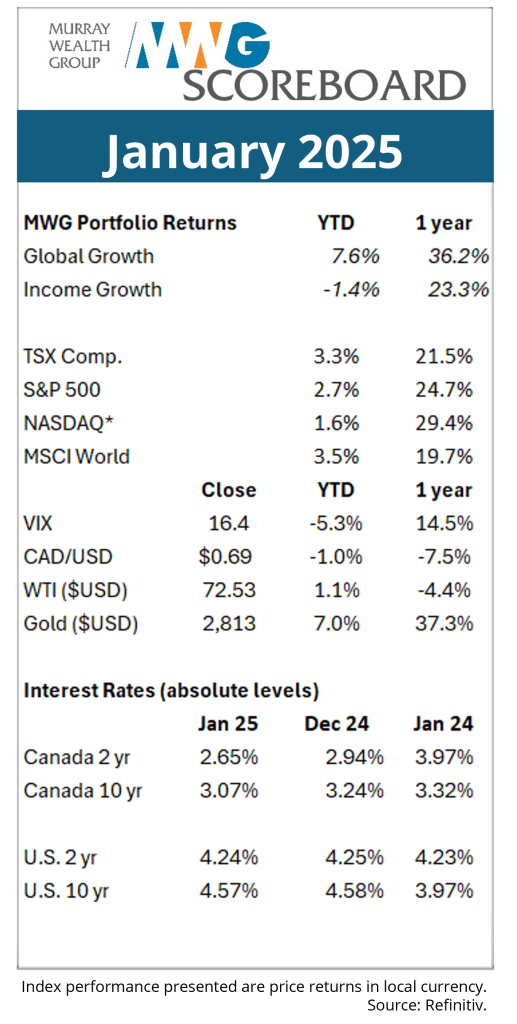

Trudeau trumps Trump on Tariffs

Justin Trudeau may be nearing the end of his tenure with a new Liberal leadership race in progress and a federal election on the horizon, yet his recent actions deserve recognition. In the face of a February 4th threat from the United States of widespread tariffs on Canadian exports, Trudeau decisively called the bluff. Following Canada’s announcement of plans for counter-tariffs, the U.S. quickly retracted its proposal and extended the deadline by a month. While the possibility of a tariff war remains, with nothing off the table when it comes to President Trump – the post hoc comment by U.S. economic officials, “This isn’t a trade war, this is a drug war,” comes across as particularly hollow given previous remarks about trade deficits and references to a “51st State.” It likely won’t be long before policymakers shift their focus to Europe, where tax policy issues could take precedence, potentially sparing Canada from broad tariff measures for the time being.nt policy, will likely be dilutive to equity holders.

Regardless of whether tariffs are ultimately implemented, the persistent threat of policy disruption is far from optimal for economic productivity. In this environment, businesses are forced to reconfigure their inventory and production strategies to avoid potential tariffs rather than maximize working capital. As a result, investment and hiring decisions are frequently postponed and management teams must continually reassess their business models in search of alternative strategies as opposed to simply pursuing greater efficiencies.

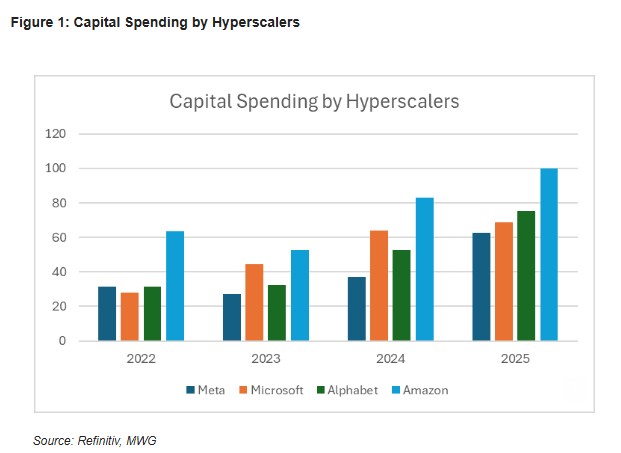

In other significant news from January, attention was drawn to China’s introduction of the Deepseek generative AI model. This new model, which boasts performance levels approaching those of leading systems developed by OpenAI and Alphabet yet at a much lower cost, has generated considerable confusion. Conflicting reports regarding the model’s actual cost, the computing power required and the volume of data used in its training left investors initially uncertain about whether this development would signal a bullish or bearish trend for AI spending in the future. Our view is that more cost-effective AI models will drive greater efficiency and expand the range of potential applications. This should accelerate AI adoption among technology giants such as Meta, Alphabet, Amazon and Microsoft, all of which have revised their AI capital spending outlooks upward for 2025 (see Figure 1).

With their large, captive user bases, these companies are well positioned to leverage their unique datasets and software assets to both increase revenue and reduce costs.

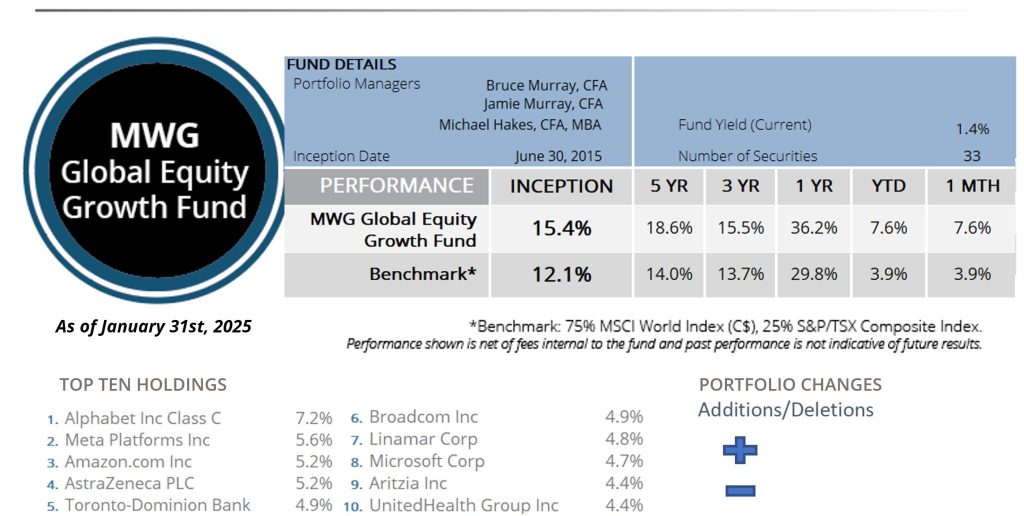

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund rose 7.6% in January, above the 3.9% increase in its benchmark. The Fund’s top three performers in the month were Aritzia (+31%), Starbucks (+19%) and Meta (+19%), while Air Canada (-11%), Docebo (-6%) and Whitecap (-5%) were the largest detractors.

Portfolio Managers Summary

The portfolio had a strong start to the year, with about half of the outperformance coming from our large holding in Aritzia. As we wrote in May 2024, we believe the long-term growth outlook for the company remains intact, with a large opportunity to grow in the U.S. This thesis was validated during the most recent quarter by 24% growth in that region, alongside a resolution of previous product management issues (often referred to as “fashion risk”) that was evidenced by high sell-through rates. We maintain our expectation that the U.S. business, which currently generates slightly higher revenue than its Canadian operations, has the potential to triple its revenue over the next decade through new store openings.

In contrast, the remaining Canadian holdings in this fund underperformed during the quarter, as tariff threats cast a shadow over many of the stocks in the TSX. We remain convinced, however, that any tariff implementation will likely be targeted rather than sweeping, with the prices of many equities already reflecting this risk.

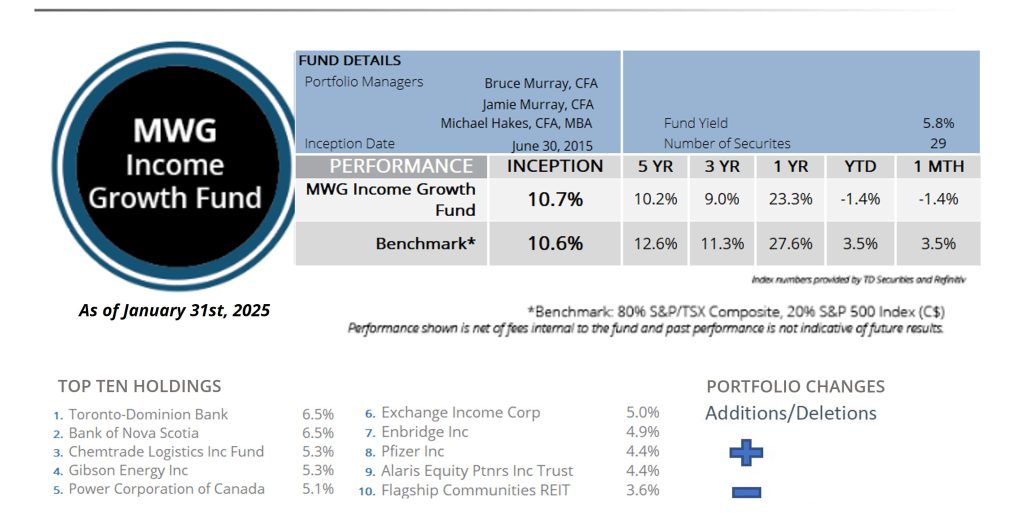

INCOME GROWTH FUND

The MWG Income Growth Fund fell 1.4% in January, trailing behind the 3.5% increase in its benchmark. TD Bank (+9%), Kering (+8%) and BP (+6%) were the top performers, while Capital Power (-16%), Doman Building Materials (-7%), and Whitecap Resources (-6%) were the top detractors. The fund’s yield was 5.8% at month-end.

Portfolio Managers Summary

We continue to maintain a constructive outlook on interest rates, which underpin the growth potential of the fund’s dividend stream. With expectations that short-term central bank policy rates will trend lower, we anticipate a sustained flow of capital into lower-risk utilities and REITs, as investors seek alternatives to GICs and money market instruments.

Capital Power, which had been among our largest holdings for most of 2024, emerged as the worst performer in January. Its shares declined sharply amid concerns surrounding the Deepseek development and escalating AI capital expenditures. AI data centers, in addition to the hundreds of millions of dollars required for land and technology hardware (e.g., NVIDIA chips), demand a reliable and robust power supply. There has been speculation that the company may announce a data center deal at its expansive Genesee Generating Station in Alberta, where surplus capacity and available land could offer a turnkey power solution for data center developers. While we expect the company to secure one or two deals, we believe that market expectations regarding the Capital Power’s financial returns were overly optimistic. Consequently, we reduced our position by more than half during the second half of 2024. We hold the management team and the company’s asset base in high regard and would consider adding to our position should the current weakness continue.

This Month’s Portfolio Update is written by our Head of Research, Jamie Murray, CFA.

The purpose is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.