Written by President, Jamie Murray, CFA

The trade war has gone global. It appears that Trump is following the same playbook with his overseas contemporaries as he did with his North American ones. Step 1 is creating a fake national emergency to enact executive legislative powers (Canada & fentanyl, Europe/Asia & trade deficits). Step 2 is proposing egregiously high tariff rates. Step 3 is delaying at the eleventh hour, as we just witnessed with a 90-day implementation pause on all countries… except China. This aligns with the view we expressed in our note to clients on April 4, 2025, as we believe the U.S. will need and want support from allies to isolate China.

China has always seemed to be the primary trade target, and we do not expect them to go down without a fight. China announced retaliatory tariffs in response to the U.S.’s initial actions. The U.S. then escalated the situation with effective tariff rates of 104% (which they quickly increased to 125%). These are in addition to tariffs that remain in place from 2018. While tariff relief for the EU and Southeast Asian countries will provide some market relief, China continues to export a significant amount to the U.S. (its trade deficit with China was $295B in 2024). A prolonged trade war between the world’s two biggest powers will put pressure on many industries globally.

The trade war comes at a time when the U.S. economy was already showing signs of slowing. Government spending was projected to decline as Elon Musk’s DOGE team reduced public sector headcounts. The housing market, a major driver of construction employment, was already showing signs of over-supply in the sunbelt states. As well, cyclical sectors such as agriculture and manufacturing are already operating well below capacity, and the recent decline in oil prices will have regional repercussions. Calls for a recession have quieted since the announcement of the pause in the implementation of the tariffs, but we continue to view the market as pricing higher risk going forward until deregulation and tax cuts become the focus of the new administration.

The technology sector has seen significant volatility this year, starting with pressure from the Deepseek model release in late January and continuing through the tariff tantrum. However, beneath the surface, we still believe that fundamentals warrant our bullish stance. AI models keep expanding in scale, allowing more information to be retained and analysed by AI programs. Enterprise adoption of AI remains in its infancy, with only 10% of data ready to be utilized in AI applications. Amazon’s shareholder letter indicated that its AI revenue is growing >100% and has achieved a multi-billion dollar run rate. The datacenter build out should continue in earnest through 2030.

The next phase will be AI integration with robotics and machinery, which has the potential to re-industrialize industry. Amazon has deployed 750,000 robots across its operations network and has built AI capabilities into some of its robots that can now use computer vision to sort packages. In South Carolina, BMW uses robotic systems in the assembling of its vehicles and is testing humanoid robots in the production line. We continue to believe the current technology leaders have the scale, employee bench strength, data and user bases to scale AI applications.

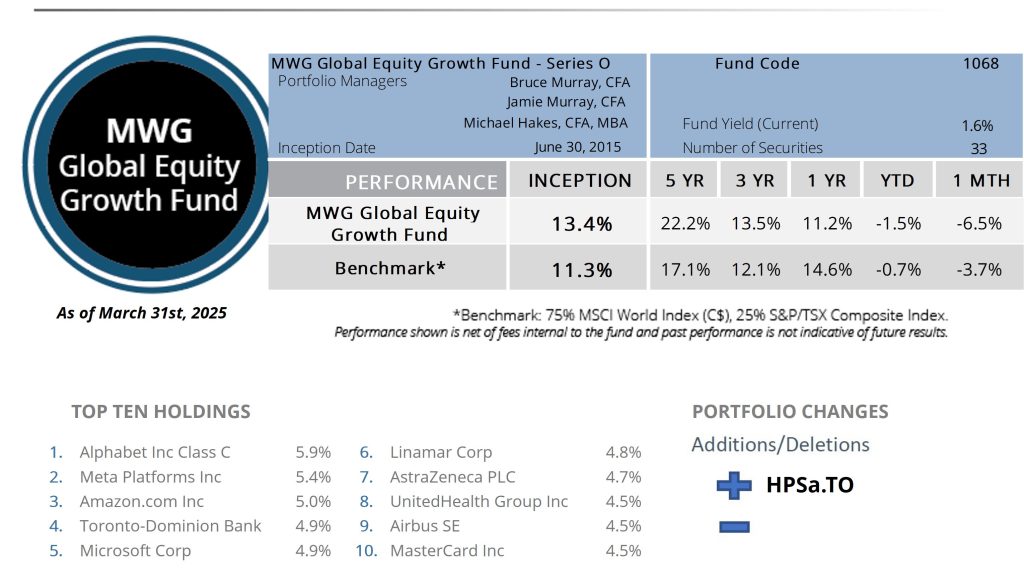

GLOBAL EQUITY GROWTH FUND

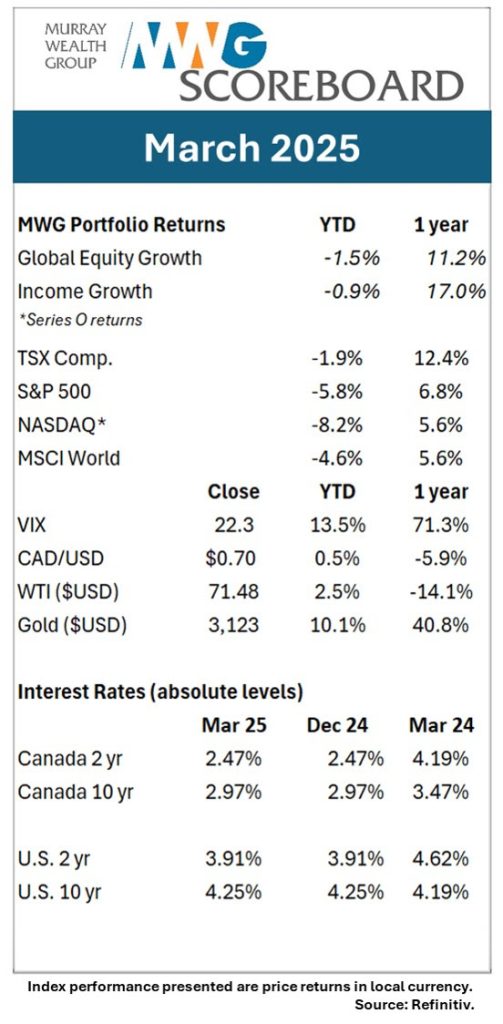

The MWG Global Equity Growth Fund declined 6.5% in March, underperforming the 3.7% decline in its benchmark, and is now down 1.5% year to date. The Fund’s top three performers in the month were Prudential PLC (19%), UnitedHealth (+11%) and Hudbay (+7%), while Aritzia (-24%), Broadcom (-16%) and Air Canada (-15%) were the biggest detractors.

Portfolio Managers Summary

Markets negatively responded to the broad tariff program and higher risk that Trump’s economic policies pose, with the S&P 500 and NASDAQ declining 6% and 8%, respectively. In this environment, the portfolio gave back the gains achieved from its strong start to the year. This pressure has continued into the second quarter. However, we remain optimistic that the net result of tariff and trade discussions will not be overly disruptive to global economic activity (acknowledging that the process of discussions is disruptive). Currently, the mega-cap technology stocks are trading near trough multiples. In our view, the weakness in the technology sector should abate as the AI narrative regains momentum. Consumer discretionary names will likely tread water until the economic picture for second half of 2025 is clearer.

During the month, we acquired shares in Hammond Power Systems. Hammond Power is a North American leader in dry transformers, electrical systems used at large industrial properties to convert electricity from the grid to usable currents. The shares have been pressured due to worries about a more measured datacenter build-out but as indicated, we see a healthy pipeline ahead and Hammond should benefit from this activity. The stock is attractive trading at just 10x P/E ratio.

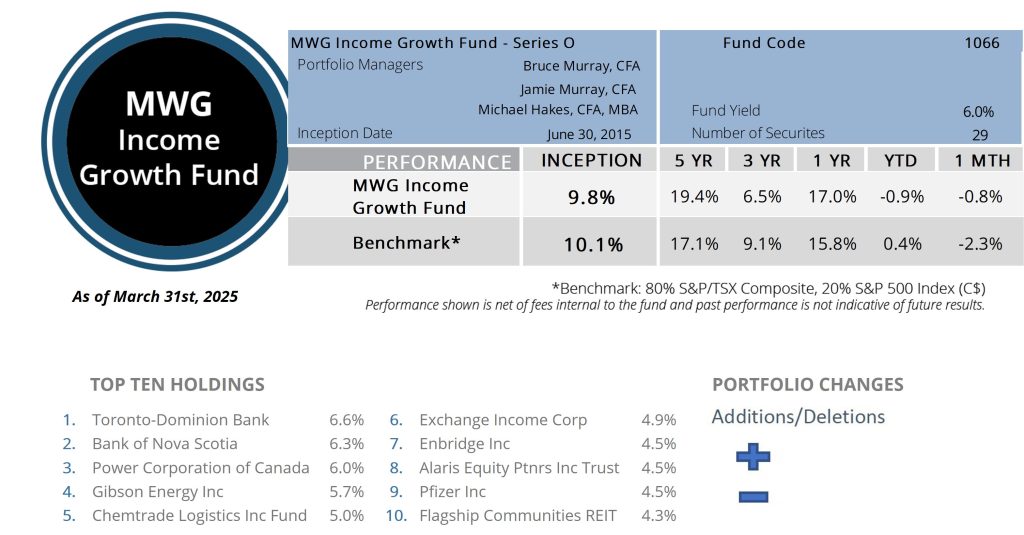

INCOME GROWTH FUND

The MWG Income Growth Fund was lower by 0.8% in March, beating the -2.3% return for its benchmark. The Fund is down 1% year-to-date. Flagship Communities REIT (+12%), Canadian Natural Resources (+10%) and Kingfisher (+7%) were the top performers, while Kering (-26%), Cogent Communications (-15%) and Evertz (-11%) were the top detractors. The fund yield was 6.0% at month-end.

Portfolio Managers Summary

After a poor start to the year, energy stocks responded well in the month. As well, our larger REIT holdings reported improved financial results and continue to trade at discounts to their net asset values. On the detractor side, many companies are trading at cyclical low multiples, with both revenue and margin improvement expected in future years.

This Month’s Portfolio Update is written by our Head of Research, Jamie Murray, CFA.

The purpose is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.