By: Ty Sullivan, MWG Summer Analyst

Nu Holdings is our most recent purchase in our Global Equity Growth Fund. Nu Holdings (“Nubank”) has built its success on a simple but powerful concept: offer a no-fee, low-cost, credit card with an easy-to-use digital platform. Since its founding in 2013, this model has allowed the company to grow rapidly in Brazil, where it now serves over 50 million cardholders. By removing fees and focusing on user-friendly technology, Nubank has become the go-to bank for millions of people who were underserved by traditional banks.

After proving the strength of its model in Brazil, Nubank is now replicating its playbook across Latin America. In Mexico, it already serves 13% of the population, with 6.3 million credit card customers as of mid-2025, up from 4.3 million just one year earlier. In the past twelve months, 28% of all new credit cards in Mexico were issued by Nubank, and half of those went to first-time cardholders, creating loyalty early in the relationship. Customer satisfaction is dramatically higher than at traditional banks, which suggests that NU can continue taking market share for years to come. In Colombia, about 10% of the population already uses Nubank, and while the contribution is still small, the opportunity mirrors Mexico given the country’s low banking penetration and reliance on inefficient incumbents. With a lightweight digital infrastructure and low cost-to-serve (there are no branches), the company is well positioned to expand into additional Latin American markets over time.

Expanding Loan Products and Deepening Relationships

In Brazil, Nubank has already reached a 15% share of the credit card market but still sees room to double its market share over the long term. Growth is increasingly coming from existing customers, as new AI-powered models allow NU to raise credit limits and drive higher spending per user. Beyond credit cards, the company is also expanding into payroll loans, a fully secured product that further builds customer loyalty and creates opportunities to cross-sell other products like overdrafts and investments.

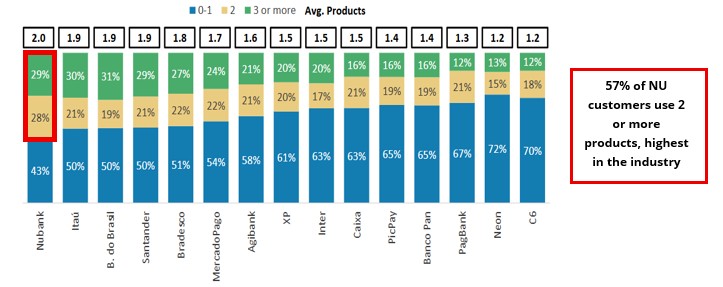

A key measure of Nubank’s strength is the number of products used by each customer. A recent Morgan Stanley study indicated that 57% of Nubank’s clients use two or more products. This is the highest among major Brazilian financial institutions, ahead of incumbents such as Itaú, Banco do Brasil, Santander, and Bradesco, which average closer to 50% (Figure 1). This demonstrates not only the success of NU’s cross-sell strategy but also the stickiness of its platform, as customers consolidate more of their financial lives with Nubank.

Figure 1: Nubank leads the way in product penetration (red bar)

Despite economic challenges in Brazil, Nubank’s loan portfolio has remained resilient. Interestingly, delinquency rates are higher among wealthier customers, while lower-income users, who often have Nubank as their only credit card, tend to prioritize repayment. At the same time, the company is expanding its profitability by improving its net interest margin, funding more loans with cheap deposits in Brazil and Mexico, which should drive structural earnings growth.

Despite economic challenges in Brazil, Nubank’s loan portfolio has remained resilient. Interestingly, delinquency rates are higher among wealthier customers, while lower-income users, who often have Nubank as their only credit card, tend to prioritize repayment. At the same time, the company is expanding its profitability by improving its net interest margin, funding more loans with cheap deposits in Brazil and Mexico, which should drive structural earnings growth.

The Upside in NU Holdings

Nubank currently has more than 120 million customers, supported by one of the lowest cost structures in global banking at less than one dollar per customer per month. Revenue is projected to grow roughly 68% over the next three years as the company expands both its customer base and the number of products and services customers have with the bank. We believe the market is underestimating the durability of this growth, particularly as Mexico and Colombia scale and payroll loans expand.

Nu Holdings is no longer just a Brazilian story. Its disruptive no-fee credit card model is taking root across Latin America, with Mexico and Colombia showing strong momentum and the potential for expansion into other countries in the future. This, combined with disciplined lending, product diversification, and an exceptionally low-cost platform, make Nubank well-positioned to deliver outsized earnings growth. We believe that the company could approach a $100 billion valuation by 2026, corresponding with an $US18 target price. This represents a 32% return potential over our purchase price.