By: Jamie Murray

In June 2025, we initiated a position in PHX Energy Services for the Income Growth Fund, following our second meeting with the company’s highly experienced management team within the year. The company’s founder, John Hooks, remains Executive Chairman, and both the current CEO and CFO have been with PHX since the late 1990s. This long-tenured leadership is a distinct advantage in that it provides the company with significant stability and deep industry knowledge.

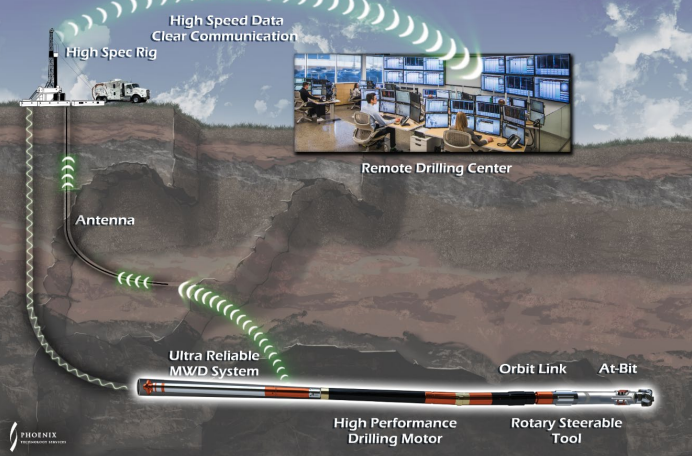

PHX specializes in directional drilling and steering services for oil and gas companies, providing the essential downhole components that guide the drill pipe precisely into targeted formations. Its advanced tools enable faster, more accurate drilling. With horizontal drilling being the dominant technique in North American shale production, PHX’s services are in demand as they are critical for maximizing the productivity of wells.

Figure 1. PHX Energy Services Tools are downhole from the drill rig and improve drilling performance

Source: PHX Energy Services

Source: PHX Energy Services

PHX’s ability to gain market share was clearly demonstrated by its performance in 2024. In the U.S., despite a 13% contraction in the overall drilling market, PHX’s operating days declined by only 4%. A similar story unfolded in Canada, where the company’s operating days grew by 12% in an underlying market that expanded by only 5%. This outperformance reflects the efficiency gains customers achieve using PHX’s technology.

Furthermore, industry consolidation has improved the competitive landscape. With fewer tier 1 competitors, and smaller players lacking the capital for modern equipment like that produced by Rotary Steering Solutions, the market has become more disciplined. While PHX must continue to innovate and provide high-value services, we believe competitive pressures are lower than they have been in past decades.

From an income perspective, PHX offers a dividend yield of approximately 9%. The dividend is well-supported, with a payout ratio of just 35−40% of cash flow from operations. The company maintains a strong balance sheet, with only $12 million in net debt, and has opportunistically used excess cash to repurchase shares.

Looking ahead, we believe the demand for natural gas will continue to grow, driven by LNG exports and power generation, as outlined in our previous note on Tourmaline Oil. Even with no increase in natural gas drilling activity, we can see annual returns for PHX in the 10−12% range.