The stock market panic of late February, due to fears to COVID-19 and a Bernie Sanders presidency, led to one of the sharpest selloffs in recent history. However, a resurgent Joe Biden has emerged as the frontrunner for Democratic nomination and health care stocks are recovering. We expect the virus will reduce GDP with the travel industry being the most obvious victim. We feel the damage was discounted by more than enough last week and will proceed with fully invested portfolios. A potential positive of these events is that the current economic cycle may be extended yet again.

Thoughts on the Market: February Edition

The risk of global contagion increased in February as Coronavirus case counts grew in countries outside of China with Italy, South Korea and Iran being most affected. Initially, markets were willing to overlook a China-contained outbreak but as the virus spread globally, the market started to sweat and sold off.

Clearly, the virus is having a pronounced short-term impact on supply chains (just-in-time inventory chains can break down when plants are disrupted) and travel-related revenue (cruises, airlines, tourism spending). However, our view is that supply chains will simply need to work overtime to catch up and while travel/tourism spend is likely lost in the short-term, normalization of revenue should return quickly.

In our view, this virus represents a temporary disruption to the current economic cycle. The current re-pricing of equities reflects the immediate impact on the global economy in the first half of 2020. While alarming, it is unlikely that we will continue to see as violent a sell-off in the near term, however, it will take a few weeks for volatility to decline.

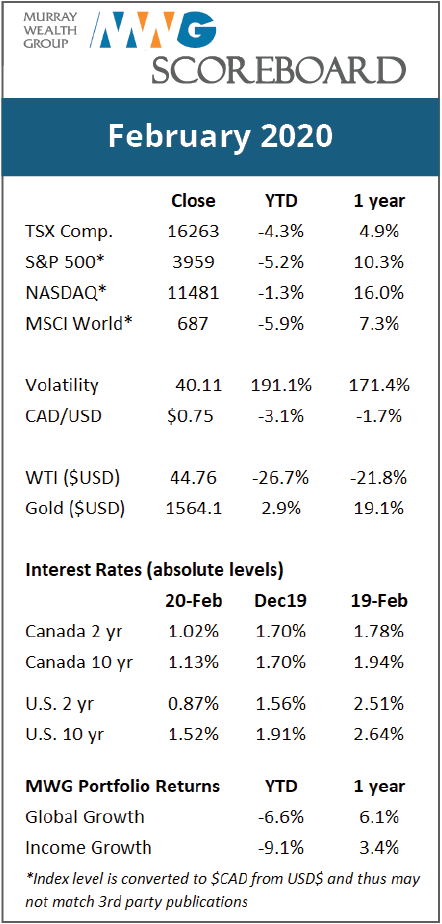

**Scoreboard Performance presented are Total Returns in CAD, unless otherwise noted.

*NASDAQ Performance presented are Price Returns in CAD.

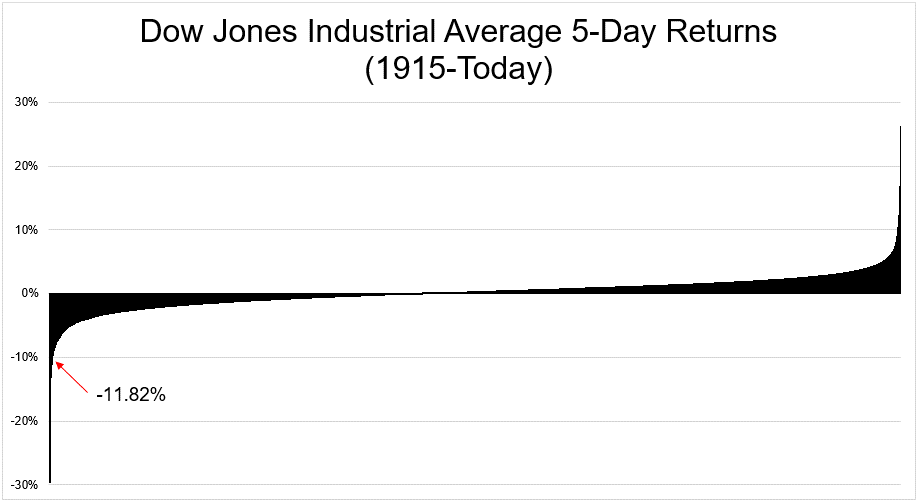

The chart below presents cumulative 5-day returns for the Dow Jones Industrial Average. The 5-day trading period ending Thursday, February 27, 2020, represented the 47th worst out of a 25,504 period sample (99.8 percentile outcome). Only major events such as the Dotcom Bubble, World War 2, the 1987 Crash and the 2008 Financial Crisis have exceeded this decline. We do not believe this virus will have the same lasting financial effect and is very likely only a 2020 event.

The Chinese stock market bottomed on January 31, approximately two weeks after the initial CVOD-19 spread. Thus, barring any severe escalation of the virus, we believe that the extreme volatility we are seeing this week may mark the end of the initial selling.

We will continue to monitor developments closely while adhering to a prudent, steadyinvestment perspective.

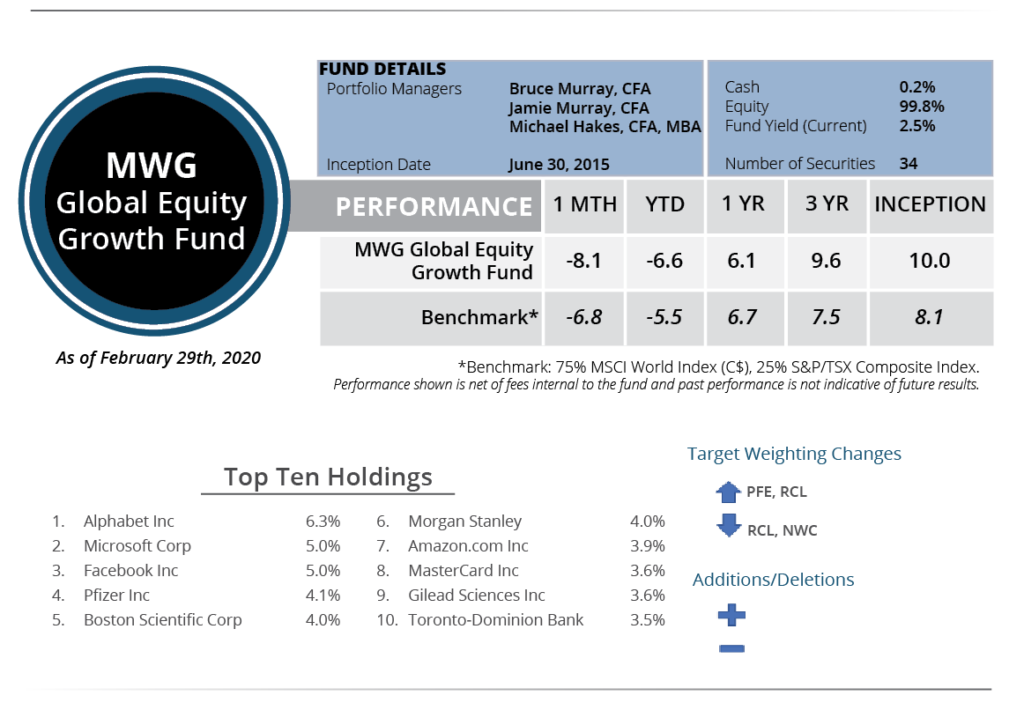

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund fell 8% in February and is now off 6.6% for the year. This said, our portfolio companies were performing quite strongly in the first two weeks of February, with the fund rising 4.8% month-to-date as of February 15, 2020.

We did not believe it was prudent to sell into any panic, instead, we made several rebalancing decisions to target weightings in the portfolio. Selling was fairly indiscriminate with the market pricing companies based on immediate impact as opposed to a longer-term viewpoint. Case in point, Netflix (NFLX) is one of our riskier holdings as it is dependent on debt markets to finance its large content budget. NFLX will generate negative free cash flow until its subscriber base grows large enough to offset content costs. As the market assumes quarantines will increase subscribers, NFLX was the second-best performer in the portfolio after drugmaker, Gilead Pharmaceuticals (GILD). GILD has a number of anti-viral drugs in their arsenal that may be effective in treating Coronavirus. Shares of Peloton Interactive saw similar strength (if anyone hears about a $3,000 Peloton purchase due to virus concerns, please let us know!).

On the opposite end of the spectrum was Royal Caribbean Cruise Lines (RCL.N), one of our long-term favourites due to its consistent earnings growth outlook. The shares lost 33% of their value in February as the market priced in a substantially weaker cruise market for the next three years. Our strategy was to wait on re-balancing until we believed enough fear was priced in. Initially, we temporarily reduced our portfolio weight in RCL and increased our weight in Pfizer taking it to 4.0% of the portfolio. Late last week, we repurchased RCL back to its target 3% weighting below US$80 per share. There may be an additional weakness in the name through spring and summer but as we learned from past virus events (SARS, Zika), the recovery tends to happen as quickly as the downdraft.

We believe our portfolio of companies is financially strong and can easily weather a 3-6 month slowdown in the economy.

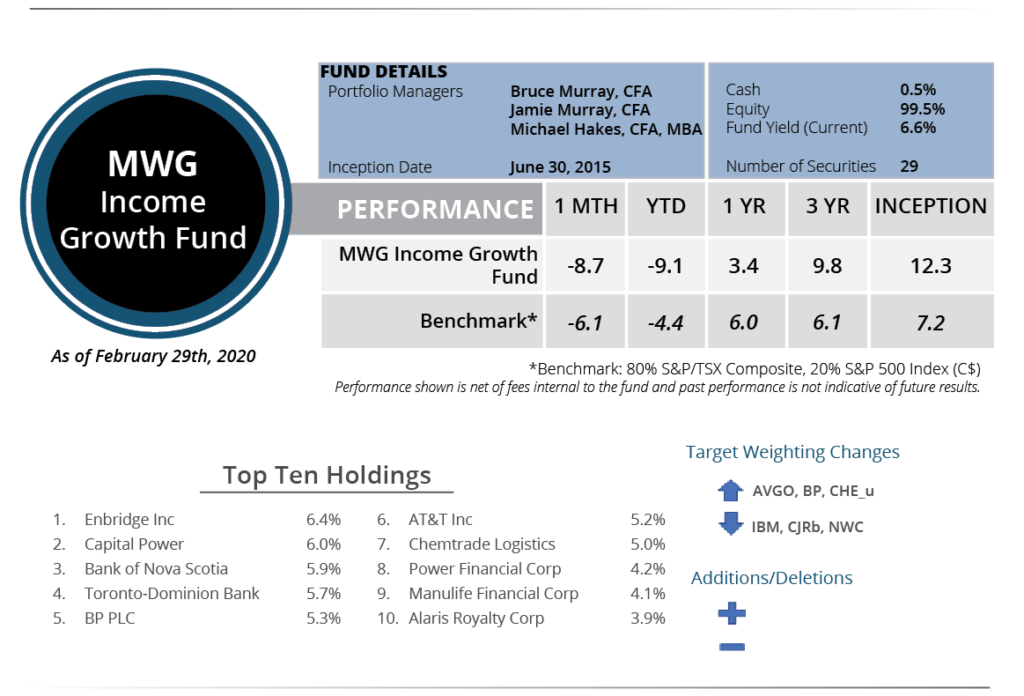

INCOME GROWTH FUND

The MWG Income Growth Fund fell 8.4% in February and is now off 8.9% year-to-date. Several smaller, economically sensitive names such as Chorus Entertainment and Chemtrade were disproportionately affected by the sell-off. Although our real estate and financial services names outperformed, they too were caught up in the selling pressure. IBM was halved from 5% and the 2.5% moved into Broadcom (AVGO) in two tranches. We also topped up BP, increasing its portfolio weight to 5.5 % as the dividend yield is now around 8%. Interestingly BP is implementing plans to be carbon neutral even if it is 30 years from now.

We also moved income trust, Chemtrade (CHE_u.TO) to 5%. CHE_u.TO’s yield rose to over 14% as the market collapsed. There is concern over Chemtrade’s ability to generate enough cash to cover its dividend. Railway strikes and protests have impeded the company’s deliveries in the first quarter. Both Mike and Bruce attended a luncheon with Chemtrade management on Feb 28th in which management stood behind the dividend as cash flow should recover later this year.