Less than a decade ago, Netflix embarked on the international expansion of its eponymous video-on-demand streaming service, a significant shift from its DVD-by-Mail strategy that had delivered more than one billion DVDs to its members. Netflix’s success can be evidenced by its revenue growth, rising from US$2.2B in 2010 to US$20.2B in 2019. At the heart of this growth is the Flywheel strategy it uses to perpetuate its growth.

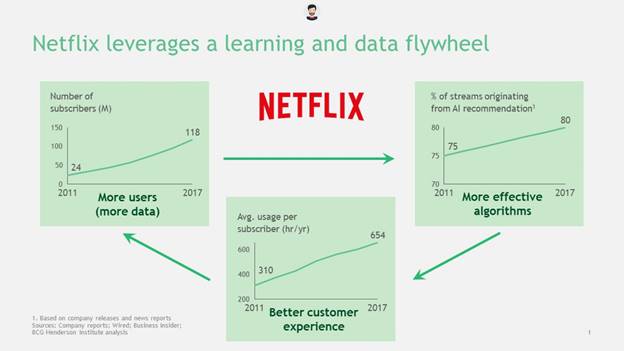

The Flywheel strategy starts with increasing overall product engagement, accomplished by increasing the subscriber base and the usage per subscriber. This provides the company with two key resources: data and revenue. More data provides Netflix with more insight into what its customers want to watch. More money allows the company to invest in additional and better content, thus increasing the size and quality of its content library. This evergreen growth of content retains existing users and attracts new ones, thus further increasing its subscriber base (rinse and repeat).

This strategy has worked successfully against the traditional cable media companies that, limited by capital and channel time slots, are not able to offer the scope and scale of content that Netflix can. Netflix has used its newfound scale to push content that would otherwise be limited to wide audiences. For example, the recent documentary Tiger King, about the seedy underworld of big cat breeding, is the latest documentary to find success overnight. Another sensation, You, originally aired on Lifetime Network to limited success before Netflix picked up its rights and found the series a larger audience. After a successful Season 2, You has been renewed for a 3rd season.

Figure 1: The Netflix Flywheel Strategy is a Virtuous Circle of Subscribers, Data, Content and Capital

However, the competitive landscape continues to shift as new entrants enter the video streaming market, with most heavily investing in this strategy. Examples are as follows:

- Disney (owner of ABC/ESPN television networks) with its launch of Disney Plus and its ownership stakes in Hulu

- Amazon through its Prime Video offering

- Apple through its new Apple TV streaming offering

- Facebook through Facebook Watch

- YouTube (3rd party generated content)

- AT&T (Time Warner/Direct TV) through DirectTV Now/HBO Now

- Comcast through Xfinity Stream

In addition, new companies such as Roku and Quibi are creating alternative streaming services.

Thus, while Netflix has a distinct first-mover advantage in video streaming, the space is becoming more crowded. With this onslaught of competition, we believe Netflix will need to start creating additional products and features to further cement its subscriber base.

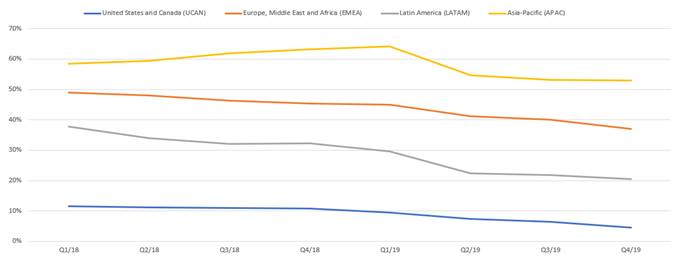

Netflix is already approaching saturation in North America. As shown in Figure 2, its subscriber growth has slowed to mid-single digits in North America. Thus, in order to keep its subscriber base growing at a high level, it will need to rely increasingly on international expansion.

Figure 2: Netflix Subscriber Growth by Region (year-over-year)

As more content providers emerge, consumers are going to have a larger content library available to them. This isn’t necessarily an impediment to Netflix as it accelerates the transition away from linear (cable tv) to over-the-top (OTT, aka streaming services). However, in order to keep the flywheel turning, it needs to continuously increase the stickiness of its platform and attract new users.

We see several new product and content avenues that Netflix can pursue to leverage its content spend over its entire subscriber base and position the company for growth beyond Hollywood.

Channels.

Research indicates that Netflix users spend between 7 to 18 minutes choosing what to watch on the platform, with some at times giving up entirely. Netflix’s recommendation algorithm attempts to show the newest and most relevant content to each user and likely does a good job curating its giant library, but this remains a barrier to more viewing time. New services like TikTok and even traditional cable tv have the advantage of presenting content immediately and make it easy to change the content if the viewer is not satisfied. By adding channels, Netflix could provide a way to drive immediate engagement for viewers that are indifferent to what they would like to watch.

Channels could easily be launched within Netflix’s existing categories such as Comedy Movies, Stand-Up, Documentary, Crime TV shows, etc., allowing indiscriminate viewers to easily pick and switch channels. Channels could also function as a discovery tool for content a subscriber may otherwise miss and lead to higher engagement.

Games.

Jackbox Games launched in 2013 as an online gaming platform, creating updated versions of classic party games, with users sharing a common screen and inputting their individual answers via their smartphones. Although the games were designed to be played with everyone in the same room, playing the games remotely has proven to be quite popular during the current period of social distancing and zoom parties.

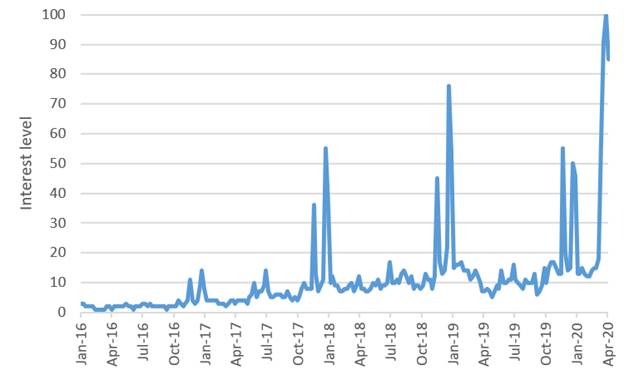

Figure 3: Google Trends Interest in Jackbox Games

Figure 3 shows the Google search interest in Jackbox games over time. Note the large spikes that traditionally take place around U.S. Thanksgiving and Christmas, and this year’s spike in March when interest (which should correlate with purchases) hit an all-time high. We believe building out a games service would be capital well spent for Netflix. We envision two types of games initially, solo and social. Solo games, i.e., games that could be played individually, include versions of classic arcade, free gambling (play money) and card games. Social games could include twists on popular party games like Pictionary (similar to the offering available through Jackbox Games) and board games (games that do not require high latency, a term for the delay experienced using the internet). These games could be relatively simple in design versus the complexity of traditional console or PC games.

This would encourage two viewership tailwinds. Solo games would provide an outlet for Netflix to compete with mobile or computer games. Some viewers would appreciate the comfort of playing on their couches or on large tv screens versus their smartphones or computer desks. The social games described above would create their own type of flywheel effect, as Netflix subscribers would invite other friends, potentially non-subscribers, onto the platform, increasing its number of subscribers, and generate higher levels of viewership per subscriber.

Longer-term, Netflix could use the gaming platform as a launchpad for development for more sophisticated gaming (competing with Xbox/Playstation/PC) as latency improves over time and cloud gaming capabilities replace consoles (a potential scenario under a 5G wireless network buildout). Online gambling represents another potential avenue for Netflix although legislation and social considerations would have to be accounted for.

On-Demand Classes.

We see no reason why Netflix could not create a catalogue of On-Demand special interest classes such as fitness, cooking, gardening, music classes or even specialty content like MasterClass. With the addition of on-demand classes, Netflix would create a large bank of content that would have good replay value. Similar services charge users $5-30/month. It represents a low capital commitment to potentially attract thousands of new users.

Netflix has amassed a strong lead in streaming through its first-mover advantage. However, competition is increasing, and it will likely be more difficult for Netflix to differentiate its product as competitors invest heavily in their own content libraries. We believe Netflix can keep the flywheel spinning by leveraging new content formats, encouraging consumption and attracting new users. The opportunities highlighted in this report would require a small part of its US$17 billion content budget, and not only be additive to its current strategy but also help establish a platform for future growth initiatives.