Thoughts on the Market: November Edition

Equity Market 3-peat

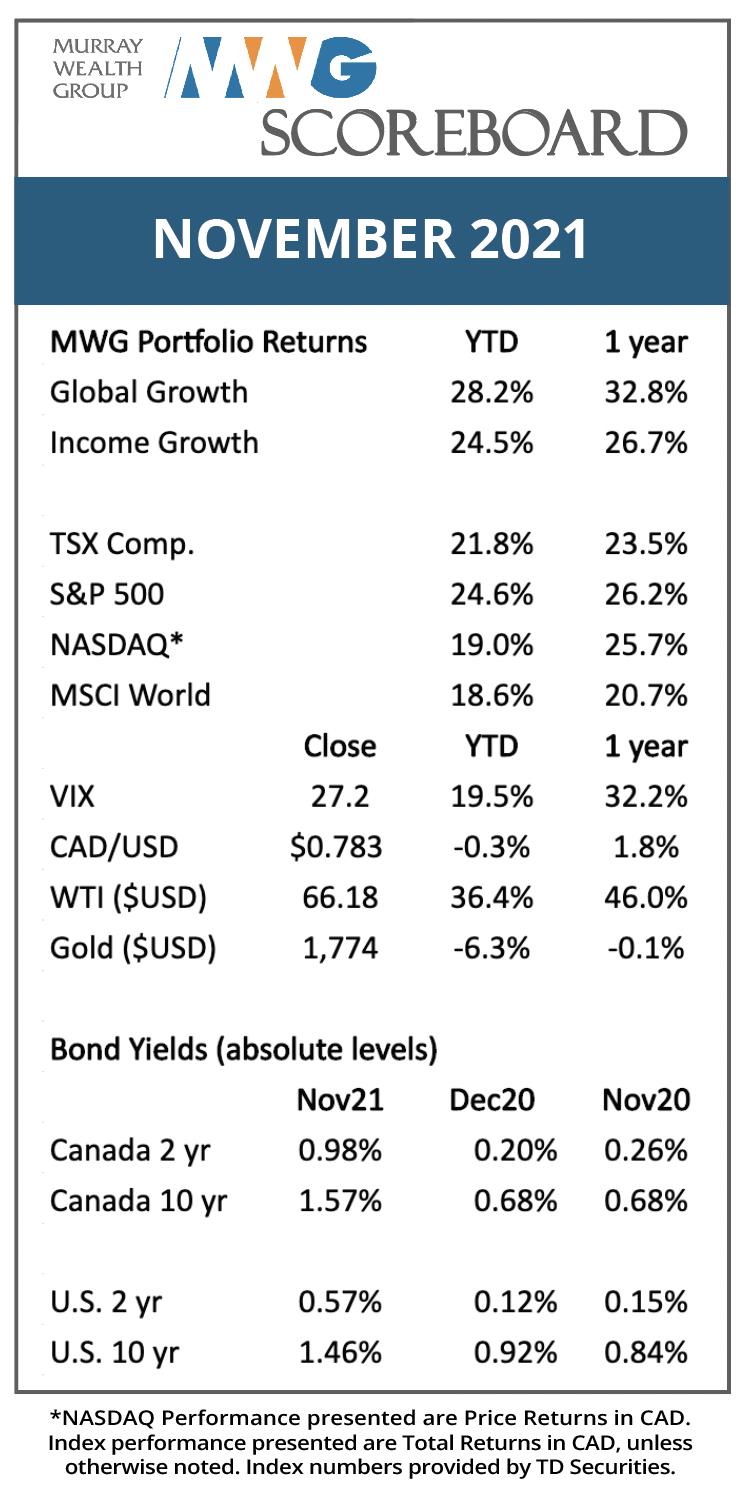

Markets are chugging higher as we write in between some brisk selloffs in those sectors with cyclical underpinnings. Despite the volatility, the benchmark S&P 500 is up 25% YTD through November 30th. 2021 will go down as another stellar year in the equity markets, a 3-peat considering the double-digit gains in 2019 and 2020.

What has changed in 2021 is that the technology sector is lagging. When stripping out the mega-cap tech stocks (FAANGM as they are colloquially referred to, although new members such as Tesla and Nvidia will require a second Alphabet*), there are pockets of large underperformance under the hood. In the NASDAQ 100 index, 35 constituents have negative YTD returns, including companies such as T-Mobile (-14%) , PayPal (-21%), DocuSign (-35%), Zoom (-55%), and Peloton (-72%). Likewise, we have experienced weak yearly performance in shares of Uber, Twilio, and Zalando in our Global Equity Growth portfolio. It is clear that the market is adjusting to a slowing post-pandemic growth rate and that the corporates themselves are still searching for the growth equilibrium. In the medium term, this resetting of expectations and valuations for technology companies is healthy and should lead to a resumption of a technology bull market.

We’re ready to travel again.

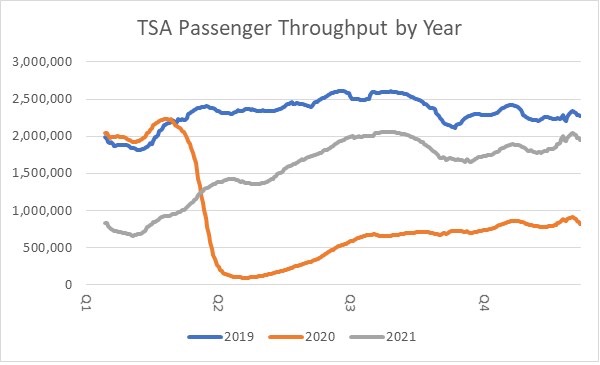

A twice-postponed Murray Family vacation should finally happen in September 2022, two years after it was originally scheduled. With vaccinations and boosters widely available and vaccination programs ramping up in the developing world, we believe that, at minimum, variant-fatigue will set in in earnest once we pass through the Omicron wave. Of course, it’s possible restrictions could be re-introduced, but after surviving Delta this fall, it seems unlikely that Western governments will take a hard line on the new variant. This should be bullish for travel stocks, which took a hit on the Omicron discovery.

A quick look at U.S. domestic travel shows that the recovery is 85% complete, with international flights entering the final recovery phase in 2022.

Figure 1. TSA Passenger Throughput by Year

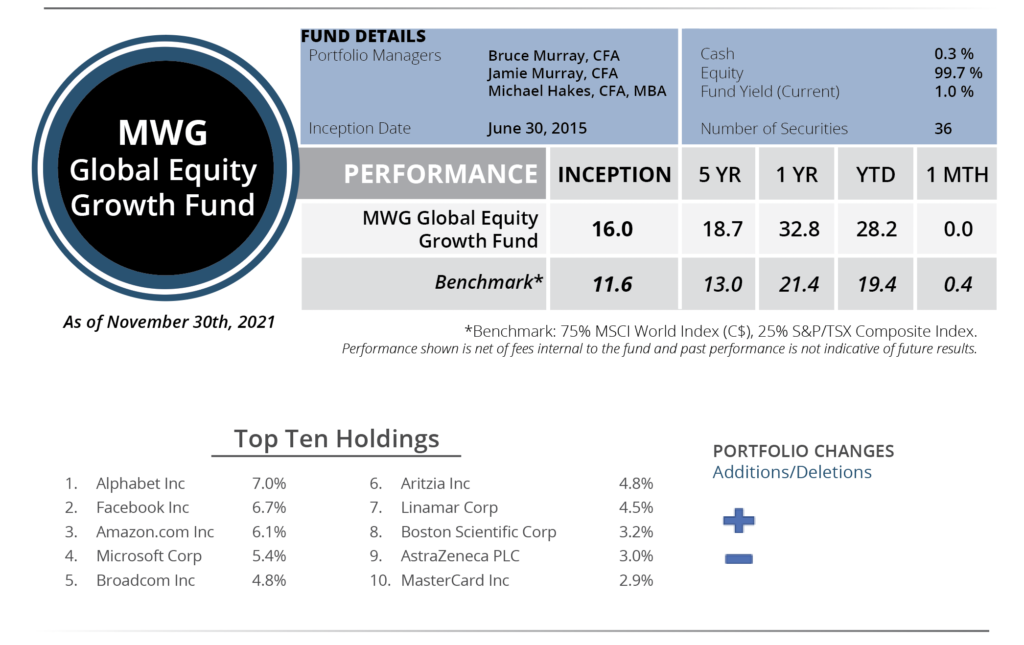

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund remained flat in the month versus the 0.4% benchmark return. The Fund has returned 28.2% year-to-date (versus our benchmark return of 19.4%). The top performers in the portfolio were Dollar Tree (+29%), Linamar (+8%) and Broadcom (+8%), while Alliance Data (-17%), Uber (-10%) and Airbus (-9%) were the bottom performers.

There were no portfolio additions or deletions during the month.

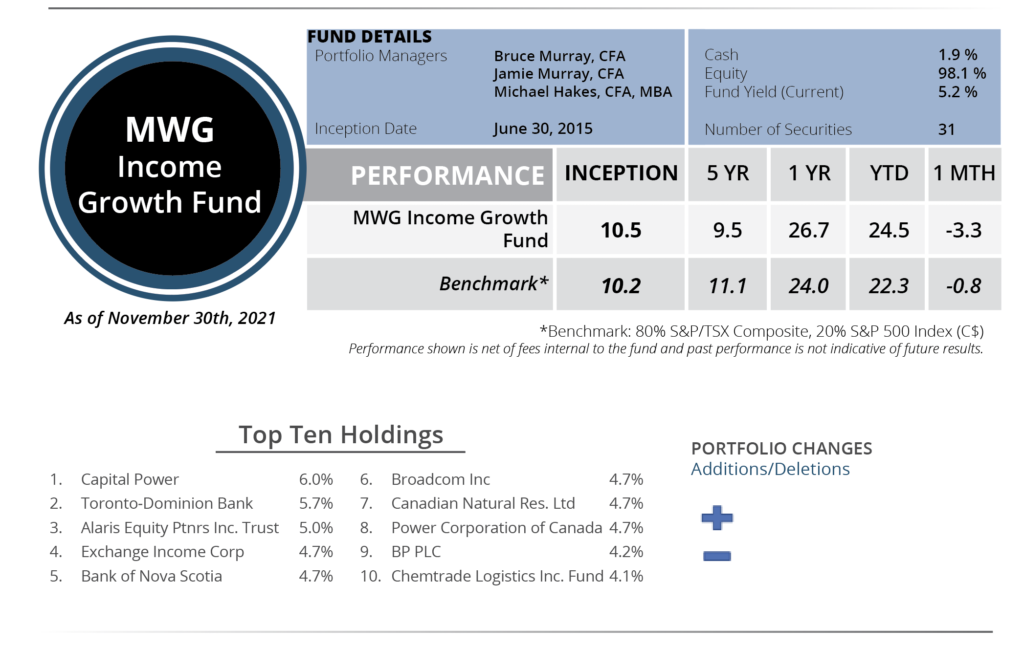

INCOME GROWTH FUND

The MWG Income Growth Fund fell 3.3% in October, underperforming the benchmark return of -0.8%, and has returned 24.5% year-to-date (versus our benchmark return of 22.3%). At month-end, the fund yield was 4.9%. The top three performers in the portfolio were Broadcom (+7%), Russel Metals (+3%) and Rio Tinto (+3%), while Medical Facilities (-15%), Corus (-12%) and Evertz (-8%) were the bottom performers.

There were no portfolio additions or during the month.