Thoughts on the Market: December Edition

We wrap 2021 with another outstanding year in the equity markets. In U.S. dollar terms, the S&P 500 rose 27%, building on a first half return of 15% with a 10% return in the second half of the year.

Among the winners, pandemic-affected names like mall retailers (easing of lockdowns), energy stocks (rebounding demand, constrained supply) and semiconductors (supply shortages) were standouts, while payments (increased competition), telecom (slowing growth) and travel-related names (cruise lines, airlines) underperformed.

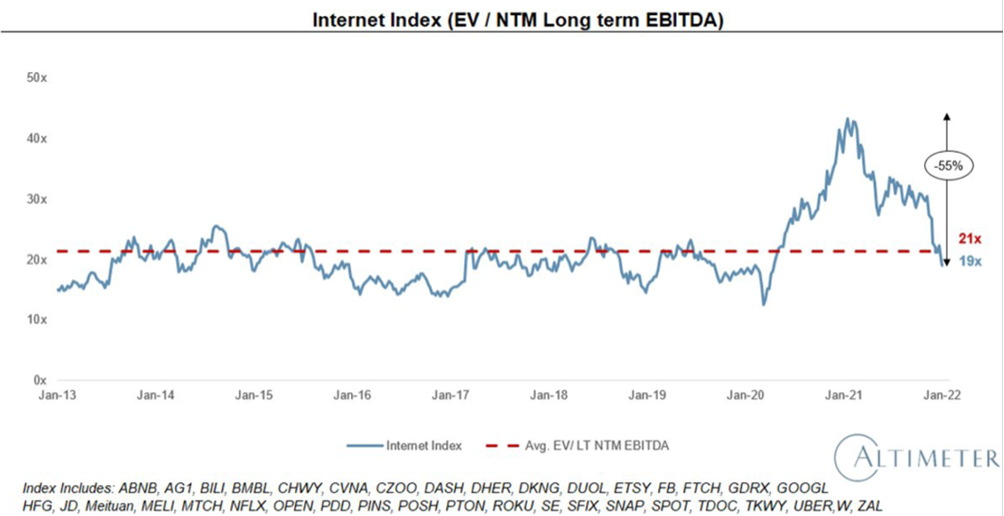

2021 also provided a watershed moment for unprofitable, high-growth companies that saw valuations peak in February and continually drift lower through the year despite the underlying quality of the businesses. This is a result of three factors: a hawkish interest rate outlook (elevated inflation and the expected Federal Reserve tightening), slowing growth expectations and a regressing retail investor (no more evident than in discount broker Robinhood’s November results, which showed transactional revenue fell 41% from the previous quarter.

Price action drives sentiment, and internet technology shares are currently viewed poorly despite valuation metrics reaching much more attractive levels (Figure 1). While a large majority of these companies will take years to recover to previous highs, a number will be looked back on as obvious buying opportunities.

Figure 1. High Growth Technology Valuations have re-rated lower back to long-term average

Source: Altimeter Capital

We will provide our outlook for 2022 in January’s mid-month research report but would like to touch briefly on inflation here. The November Core Personal Consumption Expenditures Index rose 4.7% year over year. For reference, this measure was a muted 1.5% in December 2020. We believe supply chain shortages are affecting the cost base of companies, with the additional costs being passed on to consumers. It is likely that improved supply chains will solve part of the inflation problem. However, labour and wage costs continue to come under pressure despite increasing automation. Wage inflation has remained meagre as global economies have recovered from the financial crisis, but with a smaller Gen Z cohort failing to offset the retiring baby boomer population, sustained wage pressure may return.

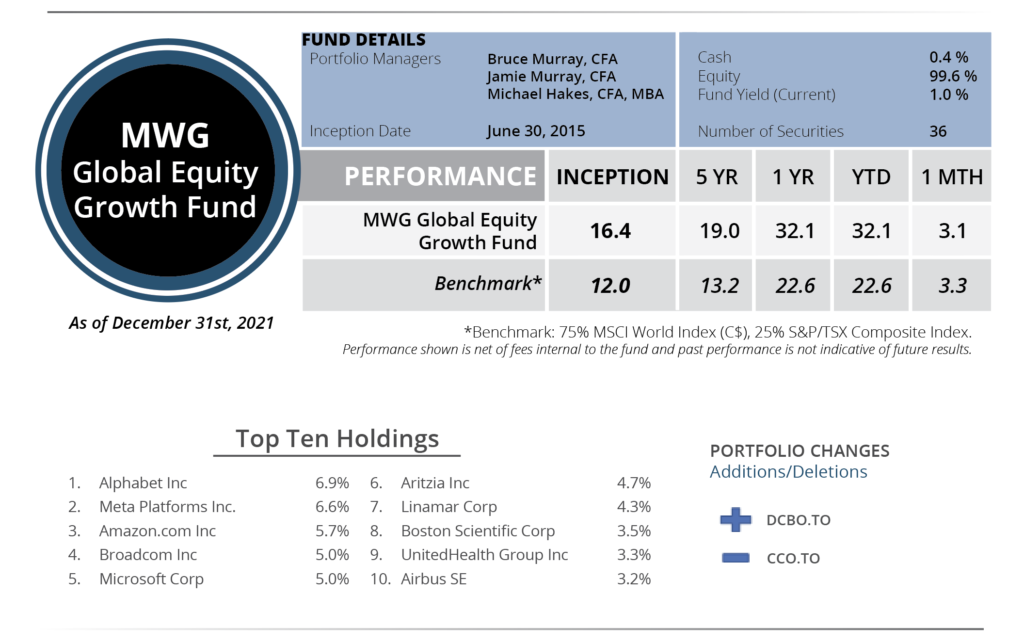

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund returned 3.1% in the month versus the 3.3% benchmark return. In 2021, the fund returned 32.1%, outperforming the 22.6% benchmark return by 9.5%. The top portfolio performers in December were Broadcom (+19%), Bank of Nova Scotia (+14%) and Mastercard (+13%), while Zalando (-13%), Twilio (-9%) and Netflix (-7%) were the bottom performers.

During the month, we added a new position in Canadian software company Docebo, a leader in learning management systems (LMS) technology. Companies require LMS systems to share knowledge, implement learning processes and track productivity. Traditionally, LMS systems were outsourced to 3rd parties (such as regulatory modules) or static systems that were integrated into Enterprise Resource Planning/Human Resource systems. However, Docebo has found success with its cloud-based system, which corporate customers are using both internally with employees and externally with customers. As the world continues to move towards digital, Docebo provides a platform to train and monitor both compliance and output. To fund our purchase, we sold our position in Cameco.

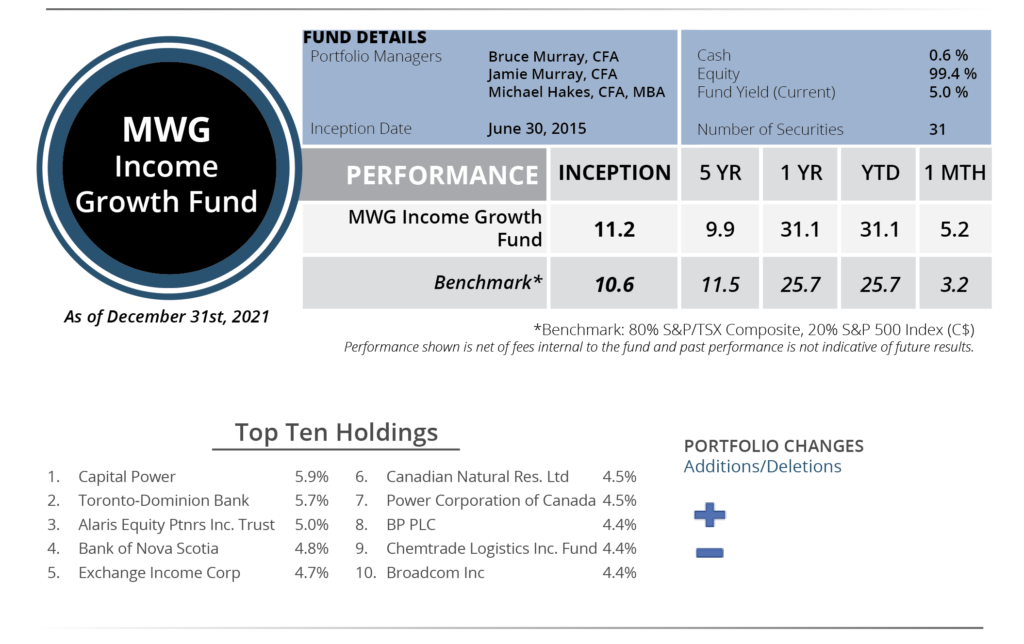

INCOME GROWTH FUND

The MWG Income Growth Fund rose 5.2% in December versus the 3.2% benchmark return. In 2021, the fund returned 31.1%, outperforming the 25.7% benchmark return by 5.4%. At month-end, the fund yield was 5.0%. The top three performers in the portfolio were Medical Facilities (+20%), Broadcom (+19%), Doman Building Materials (+18%), while Chorus Aviation (-4%), American Hotel (-4%) and Cogent Communications (-3%) were the bottom performers.

No portfolio additions or deletions were made in the month