Thoughts on the Market: October Edition

Do your holiday shopping early unless you’re buying on Amazon.

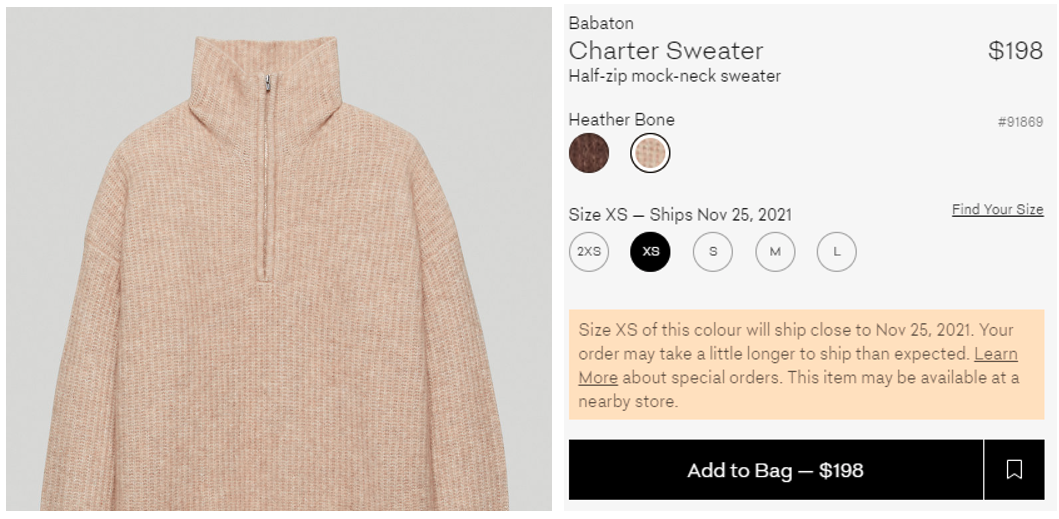

The world’s supply chains are plugged up. This isn’t new. Nike warned in March 2021 that container shortages and port congestion were delaying shipments of goods, and the situation has only deteriorated since then. Fortunately, brands like Nike and Aritzia that sell DTC (direct-to-consumer) can offset these challenges with increased sell-through at full prices given the scarcity of product. One advantage of online stores is their ability to show the customer the lack of stock or lead times for an item. As shown in figure 1, Aritzia can essentially pre-sell items, which is also a big boost to its working capital.

Figure 1. Aritzia Sweater, sold out online, available for shipping in four weeks.

Source: Aritzia

As the value of available inventory is higher in this environment, Aritzia can afford the skyrocketing logistics costs and maintain healthy margins. Certainly, there is a risk that it is not meeting demand, resulting in lost revenue, but the sales that do occur are very profitable. As such, Aritzia can afford to use alternative shipping methods such as air freight rather than container ships.

Contrast this with retailers that sell more commoditized items where it can become difficult to raise prices, particularly if low-cost competitors (such as Walmart, Home Depot and Target) can better manage supply chain challenges. Dollar Tree warned of $300M in excess supply chain costs related to logistics issues in the second half of 2021 alone. Amazon, owner of the most sophisticated supply chain infrastructure in North America, warned that its Q4 profit will be significantly impacted by about $4B from higher labour and logistics costs.

Amazon is in the fortunate position to spend freely on supply chain bottlenecks given the company’s culture of high customer satisfaction and a shareholder base that values growth over profits. However, those that lag Amazon’s scale and capital liquidity will see a relatively more significant impact from the cost pressures.

We expect the holiday season will represent peak tightness in supply chains. Texas Instruments, a provider of silicon chips to the electronics industry, is indicating some release of supply chain tension with fewer expedited order requests from customers and fewer products on backlog. As well, the transportation industry is tackling the chaos in the port system, and while shortages persist across the entire transportation chain, a renewed focus on the actual bottlenecks should lead to some reduction in wait times.

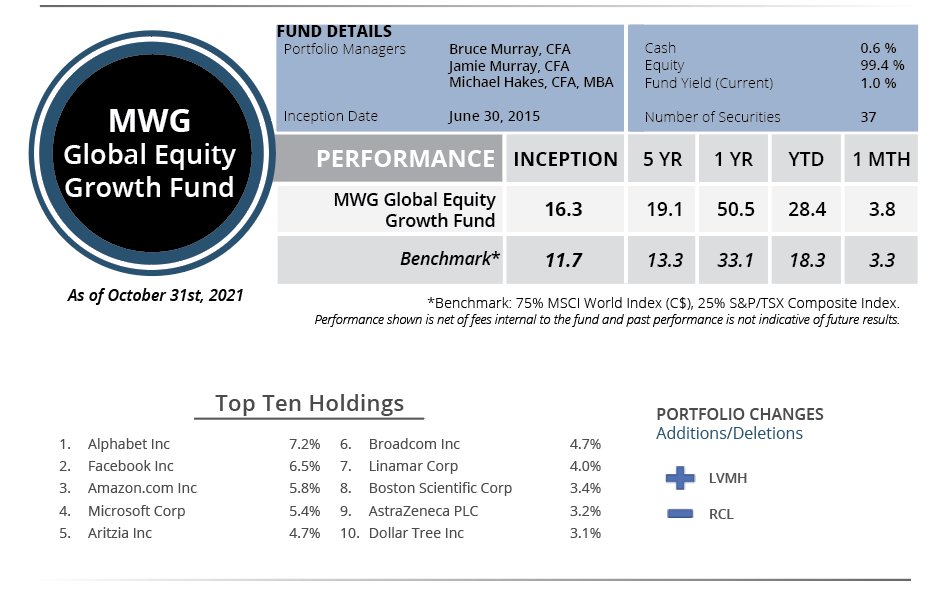

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund returned 3.8% in the month versus the 3.3% benchmark return. The Fund has returned 28.4% year-to-date (benchmark return was 18.3%). The top performers in the portfolio were Aritzia (+20%) and Microsoft/United Health/Stelco (all +15%), while Alliance Data (-17%), Twilio (-10%) and Comcast (-9%) were the bottom performers.

During the month we added a position in LVMH, the parent company of luxury brands that include Louis Vuitton, Fendi and Moet Chandon. LVMH has strategically consolidated luxury brands over the past three decades, culminating in the acquisition of Tiffany earlier this year, and has demonstrated an ability to further grow its brands. The company is led by Bernard Arnault, the chief architect of the company since he wrestled control in a contested battle in the 1980s. Luxury sales are benefitting from the emergence of a new wealthy class in China and should further benefit from increased international travel. We purchased the shares after they pulled back on some weak Chinese economic data.

We also sold the remaining shares in Royal Caribbean Cruises after the shares rallied on declining Delta variant cases. If you recall, we re-purchased the shares in August when the stock declined on Covid variant concerns.

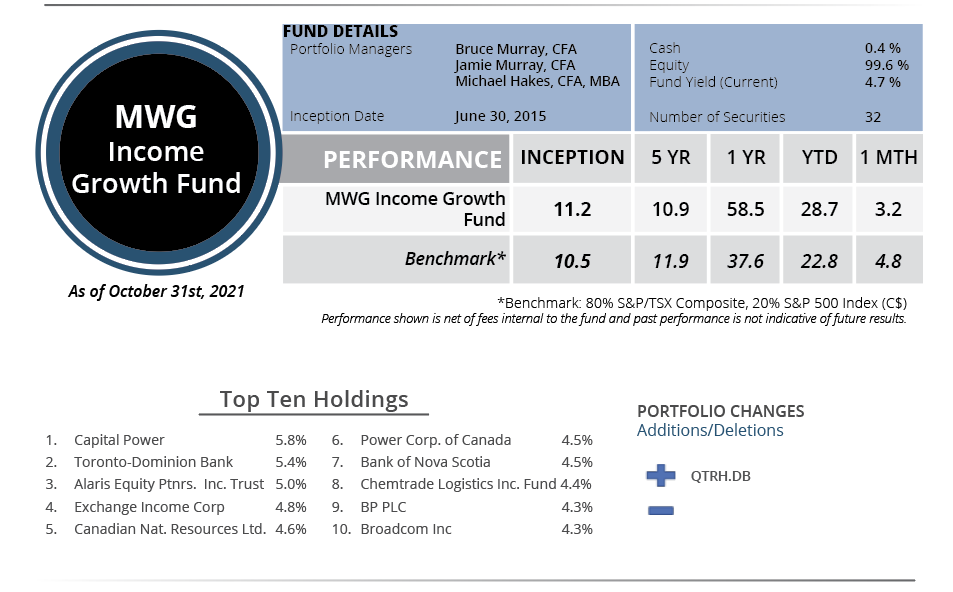

INCOME GROWTH FUND

The MWG Income Growth Fund rose 3.2% in October, underperforming the benchmark return of 4.8% and has returned 28.7% year-to-date (benchmark return was 22.8%). At month-end the fund yield was 4.7%. The top three performers in the portfolio were Cominar REIT (+16%), Canadian Natural Resources (+14%) and Chemtrade (+11%), while IBM (-11%), Rio Tinto (-7%) and Medical Facilities (-5%) were the bottom performers.

During the month, we started a small position in the convertible debentures of Quarterhill Inc. Quarterhill (formerly WiLan) is building out an intelligent transportation system business after completing several acquisitions to supplement its patent royalty portfolio. The debentures pay a 6% interest rate and are convertible into Quarterhill common shares at a price of $3.80 (~40% above the current price). We think there is upside in Quarterhill as governments look at tolling transportation as a new revenue source and require innovative technology to implement these changes.