This week, Airbus, one of the world’s largest commercial aircraft manufacturers, announced a lowering of its expectations for aircraft deliveries due to the weak travel market. With the Coronavirus pandemic grounding global air travel, driving affected equities down 50-70% from their pre-COVID highs, it’s worth revisiting the sector to see if there is opportunity to invest for a rebound. In this piece, we will examine the issues at hand to see which factors are the most significant in figuring out when or if a rebound can be expected.

The airline industry has a checkered history as an investment sector. At a glance, it’s easy to understand why. Let’s start with capital requirements. Aircraft are expensive. An Airbus 320 NEO is listed at US$110.6 million. Typically, airlines will receive discounts on list prices, but to afford the expansion or replacement aircraft they require, companies often rely significantly on financing (typically in the form of operating leases). As demand expands, an airline must either raise capacity or risk a competing airline encroaching on its routes, potentially with even newer, more efficient aircraft (leading to lower prices). As airlines invest to meet demand, it’s not unusual for a large demand-destroying event to suddenly crater the market (like a global flu pandemic, terrorism, or a financial crisis). Ample capacity and high operating leverage often lead to price wars, low returns and, in many cases, bankruptcies. Throw in strict safety regulation, labour union issues and pilot shortages and it becomes apparent why Warren Buffett derided the sector for so long.

So why did Mr. Buffett invest in several airliners in the 2nd half of 2016? According to him, the airlines had revamped their strategies to focus on price discipline and return on capital metrics, and that combined with significant share buybacks meant a more attractive industry structure. Maybe he was right. Onex took WestJet private in 2019 and airline stocks performed very well up until COVID-19 lockdowns grounded air traffic.

Perhaps Mr. Buffett should have heeded the fact that airlines are cyclical, should be bought at market lows, and sold when the times are good. We were lucky or smart enough to sell our small Air Canada position in our Global Growth Fund in May of 2019 for $37. However, we failed to sell our stake in Airbus (and its 7 years of backlog) and our position in Chorus Aviation in our Income Growth Fund. Chorus has a strong contract with Air Canada that pays a fixed fee to operate the fleet of Air Canada Rouge, but invested its excess cash in aircraft leasing operations (lending to airlines) which is a riskier proposition. But past opportunities and omissions cannot be dwelled on. The question before us today is whether there is an opportunity in the airline sector at today’s prices and, if so, what a recovery could look like.

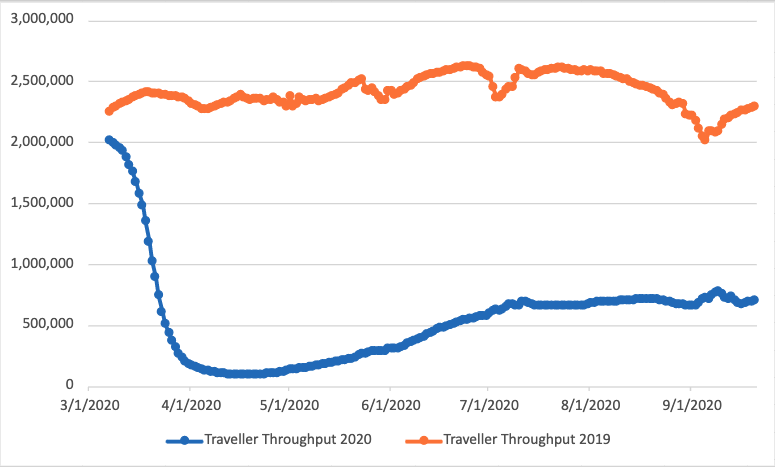

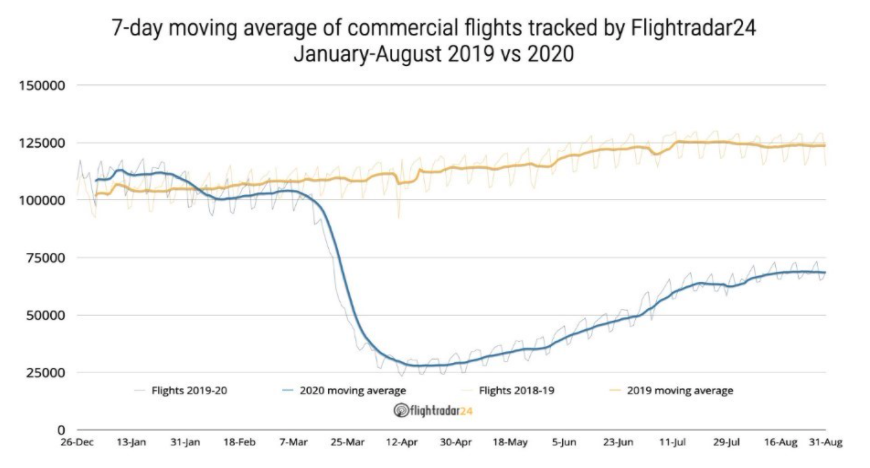

After a severe COVID-induced drop in March, flight activity gradually rebounded as economies around the world re-opened. As shown in the figures below, global flight activity climbed until mid-summer, when it began to plateau. As noted above, Airbus now expects that its new aircraft deliveries will slow as airlines grapple with low utilization.

Figure 1: TSA Traveller Throughput 2019 versus 2020

Figure 2: Global Commercial Flights Tracked

Domestically, U.S. TSA throughput plateaued in June and has remained flat. Even those that have travelled are travelling much less (personally, I took 25 separate flights in 2019; so far in 2020, I have taken 5). I took a quick Instagram poll to gauge travel sentiment among my followers (mostly a 20-40 year old cohort).

142 people responded to my first question, “Have you taken a commercial flight since lockdowns (excluding return to Canada flights in March)?”. 85% of responders indicated that they have not flown commercially since the onset of lockdowns.

The second question, “Would you travel today if there were no travel restrictions (i.e. quarantine and border closures)?” received 152 responses. 45% of responders indicated they would travel if permitted to travel freely. This is a significant jump from the 15% who have taken a commercial flight since the lockdowns. However, more glaringly, 55% were not prepared to travel by air due to COVID concerns. The reasons were many, including contracting COVID, passing it on to more at-risk family members and distrust of fellow travellers, but at the end of the day, each reason requires a downward shift to COVID health risks. This means that we likely won’t see a sustained recovery in air travel until we have a vaccine. Conservatively, a large portion of the population could receive a COVID vaccine by year-end 2021.

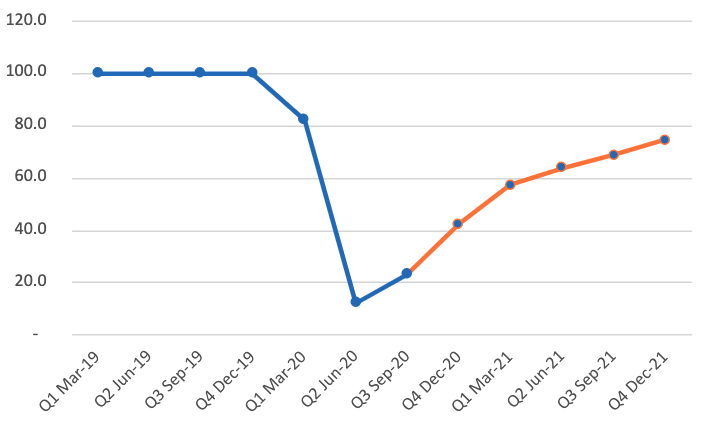

Comparing this outlook with consensus estimates provides a rough idea of what to expect for stock markets. Below we present average revenue levels for the big four North American Airlines (Air Canada, American, Delta, United). To remove seasonality, we have used 2019 quarterly revenues as a baseline from which we can compare future revenues to figure out the speed of an expected recovery. The second quarter clearly represented the trough as lockdowns and travel bans took hold at about 10% of prior year’s revenue (note the solid blue segment is actual reported revenue while the orange line represents consensus estimates). Analysts should, at this point, have strong convictions for third quarter revenue given it ends this week (revenue is just 23% of 2019 revenue). Going forward, analysts are expecting a continued improvement quarter-over-quarter, approaching 80% of the 2019 run rate by the end of 2021. However, with a vaccine not widely rolled out until 2021 at the earliest, and over half those we polled indicating they are not prepared to fly even without travel restrictions, is a rebound to these levels realistic?

Figure 3: Airline Quarterly Revenue Forecast (2019 = 100)

We have already seen the downgraded forecast from Airbus, with the company indicating a slowdown in its recovery. At a high level, it looks like it may still be early in the airline recovery cycle to be increasing exposure. However, we do expect air traffic to fully recover and grow in the long term, aided by the pent-up demand created by COVID.

We maintain exposure to the industry through our holdings in Airbus and Raytheon Technologies (owner of United Aerospace). We continue to watch industry developments and may increase our exposure on recovery expectation in the future.