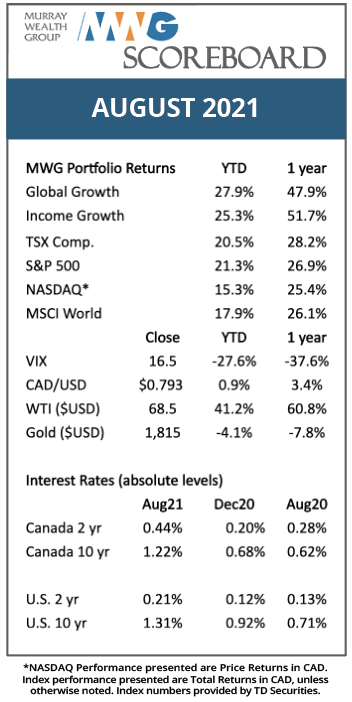

Thoughts on the Market: August Edition

18 Months Later…

We believe that the day the Western world woke up to the risks of COVID-19 was March 11, 2020, when actors/couple Rita Wilson and Tom Hanks announced they had tested positive. If Forrest Gump could catch it, anyone could. At that point, markets had already priced in much of the pandemic and would bottom a couple of weeks later (35 days peak-to-trough).

18 months later, society is still fighting a viral battle, with the State of Florida just recording its deadliest week since the onset. 18 months later, markets sit 34 percentage points higher than the February 19, 2020 pre-pandemic peak. It begs the question: how many investors, if given the foresight of the global pandemic duration, would expect markets to be up, let alone up 34%? The question highlights the difficulty inherent in forecasting. With hindsight, one can justify the market’s performance over the past year and a half, but we recognize that there were other courses the pandemic could have taken. It required a strong global policy response, scientific breakthroughs, a determined public and the rapid adoption of new technology.

As we look forward to the next 18 months, there is a different set of challenges and obstacles for markets to work through. How persistent is inflation, and relatedly, the course for interest rates and U.S. Federal Reserve tapering? Can the digital world maintain growth rates to justify high valuations? Are certain asset classes impaired for the medium term (e.g., office space, airline/hotels)? Are global supply chains permanently broken and therefore lead to persistent shortages?

It is worth reinforcing this point. We would argue that even with perfect information about short term risks, investors have little ability to forecast the magnitude and direction of the broad market. For this reason, we tend to avoid buying companies that we believe will only outperform under certain economic assumptions. Instead, we choose to invest in companies with strong management teams and the malleability to grow earnings due to a unique set of opportunities available to them.

A shining example of such a company is Aritzia, the Canadian women’s fashion retailer. Aritzia is a founder-led company that has a broad expansion opportunity in the United States. Aritzia believes in the benefit of a strong customer buying experience, which it manages with a direct-to-customer approach. This has allowed the company’s ecommerce business to thrive during the pandemic (as it already had investments in distribution prior to its onset). Case in point, its sales in the first 12 months of the pandemic fell only 12.5% despite widespread boutique closures throughout the year. As economic activity normalizes and expansion plans accelerate, Aritzia’s revenue is expected to rise 23% above pre-pandemic levels. As we look ahead, Aritzia will almost certainly face challenges such as supply chain constraints or commodity inflation, but we have a strong belief that the company’s consumer proposition and growth opportunities will continue to create value for shareholders.

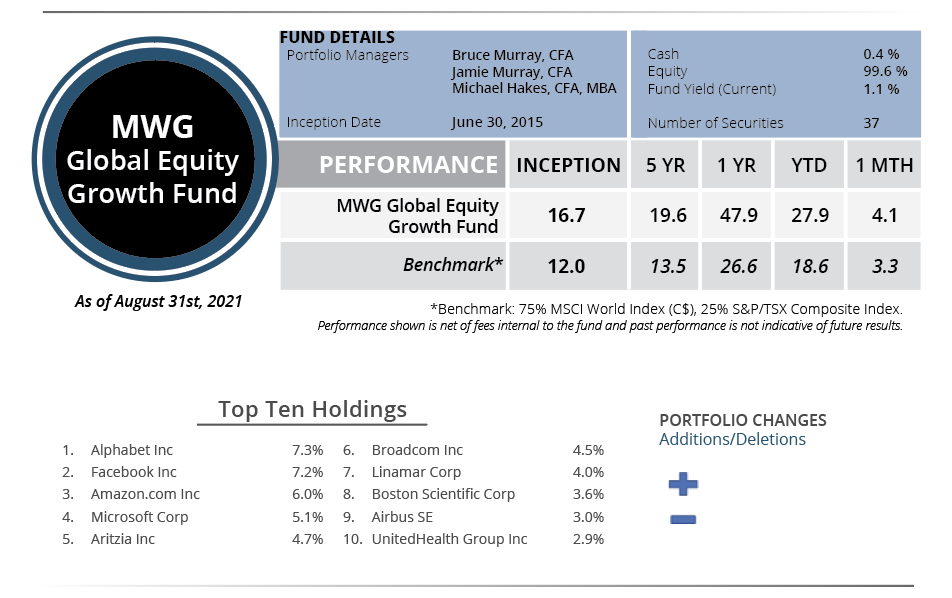

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund returned 4.1% in August and has now returned 27.9% year-to-date. The top three performers in the portfolio were Adyen (+20%), Stelco (+20%) and Aritzia (+13%), while Mastercard (-9%), Uber (-9%) and Dollar Tree (-7%) were the bottom performers.

We made no additions or deletions to the portfolio during the month.

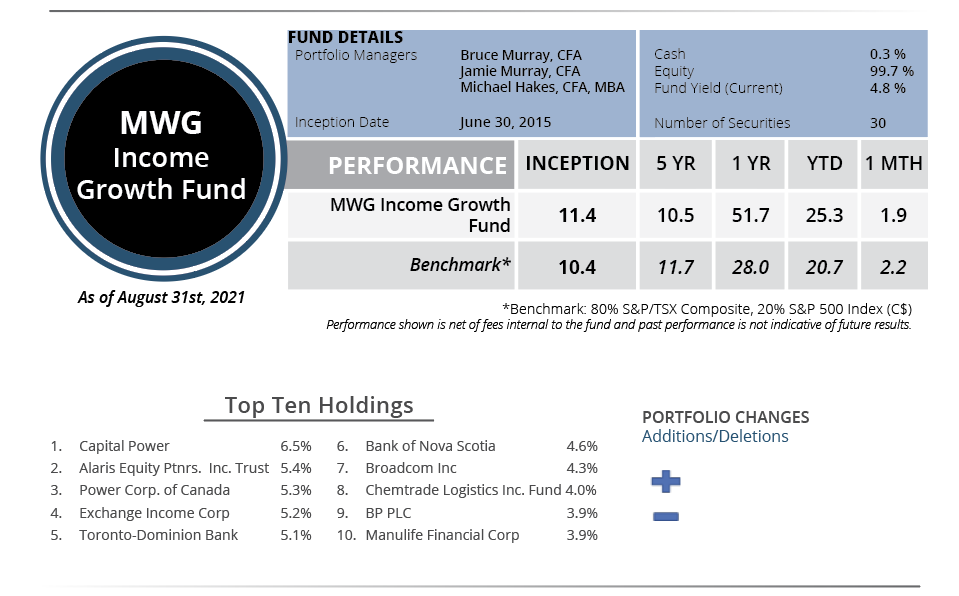

INCOME GROWTH FUND

The MWG Income Growth Fund returned 1.9% in August and has now returned 25.3% year-to-date. At month-end the fund yield was 4.8%. The top three performers in the portfolio were BSR REIT (+17%), Medical Facilities (+15%) and Power Corp. (+9%), while Chorus Aviation (-9%), Evertz (-7%) and Rio Tinto (-6%) were the bottom performers.

We made no additions or deletions to the portfolio during the month