Zalando and the eCommerce Department Store

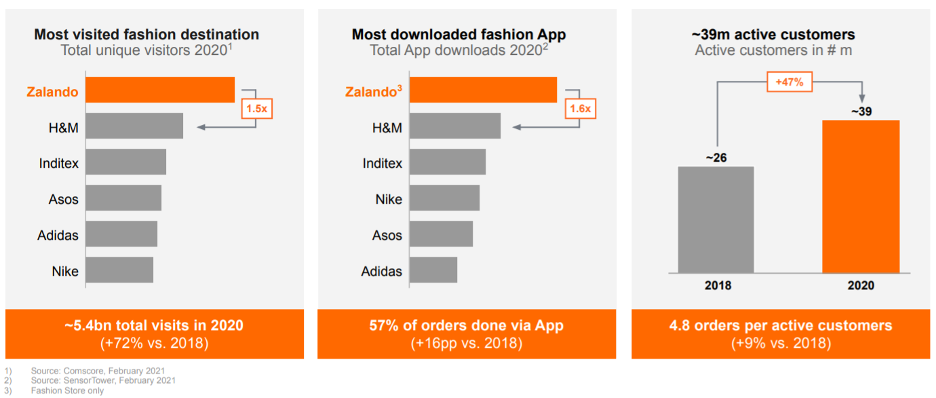

Zalando (ZLNDY) is a leading European ecommerce apparel company with 39 million active customer accounts that should generate sales with a Gross Market Value (GMV) of EUR14B in 2021. The customer value proposition revolves around Zalando offering a vast assortment of brands and products and provides an easy shopping experience that includes delivery and return of unwanted items. This value proposition and the company’s broad European reach have made Zalando the starting destination for fashion in Europe, with operations in 27 countries. Figure 1 demonstrates Zalando’s leadership and growth in active customer accounts.

Figure 1. Zalando customer accounts

We believe Zalando is building a department store for the online world. Up until now, department stores have offered consumers a single stop in a prime real estate location with an assortment of brands. Sellers have benefited from leveraging the department stores’ customer base, real estate and marketing. Today, Zalando offers many of the same conveniences to consumers but also provides inventory, marketing and online real estate to sellers.

Zalando started with a traditional wholesale model, purchasing inventory from brands with full risk and responsibility for selling and delivering that inventory profitably. After going public in 2014, the company successfully grew its GMV from EUR2.7B to EUR6.6B by 2018. However, the market evolved as ecommerce became more and more mainstream, and brands wanted more control over their pricing, marketing and data by shifting to a direct-to-consumer model. Zalando’s flexible asset base allowed the company to pursue a new strategy, its Partner Program, that provides a valuable suite of tools and services to fashion brands. In contrast to its wholesale model, the Partner Program offers the following services:

Connected Retail –Brick & Mortar (B&M) retailers can sell products on Zalando’s ecommerce platform with a direct connection to their inventory systems. In this way, the seller can manage both the available assortment and pricing. When an order is placed through Zalando, the goods are delivered through its fulfillment network.

Fulfillment – Zalando can manage inventory logistics and delivery while sellers maintain inventory ownership. Once again, the seller controls pricing and selection. Sellers may maintain their B&M stores and add Zalando as an additional sales channel or maintain an ecommerce only presence. Zalando’s broad geographic reach is an asset in fulfillment as it can help local brands immediately expand to adjacent markets.

Zalando Marketing Solutions – Sellers can leverage Zalando’s technology, data and customer base to increase conversion or sales through a variety of marketing programs.

As Zalando’s platform continues to gain critical mass, the company should be able to leverage its infrastructure into incremental revenue and productivity. Some examples include a B&M retailer selling excess inventory on Zalando at a larger discount to its normal sale prices; an online brand leveraging Zalando’s existing warehouse and fulfilment infrastructure to focus on marketing and fashion design, and a new brand advertising on Zalando to generate sales traction.

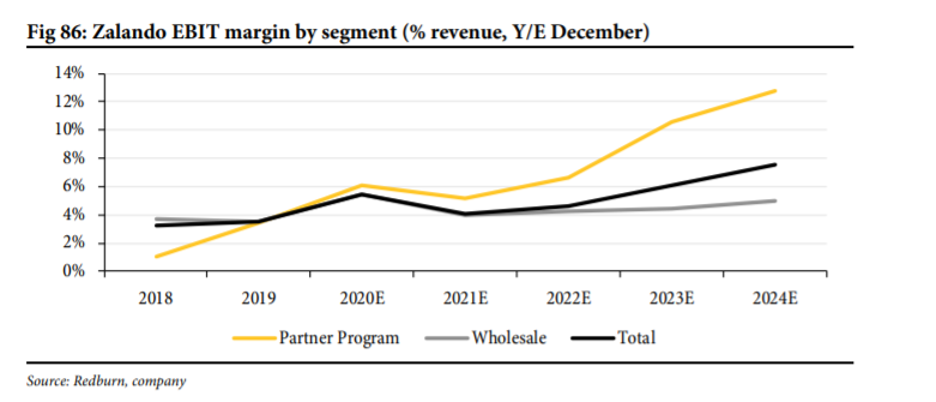

As additional sales take place on Zalando’s platform, margins and return on capital should increase proportionately. Figure 2 highlights Redburn’s forecast for Zalando’s Earnings Before Interest and Tax (EBIT) once the company’s partner program ramps up and gains scale. Over time, this increase in profitability should lead to increasing return on equity and earnings per share. The company believes it can grow its GMV to EUR30B by 2025, doubling its current sale base. With increasing margins and efficiency, its share price should respond positively.

Figure 2. Zalando EBIT Margin by Sector

This Focus Stock is written by our Head of Research, Jamie Murray.

The purpose of this is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.