Thoughts on the Market: August Edition

Never let a good crisis go to waste.

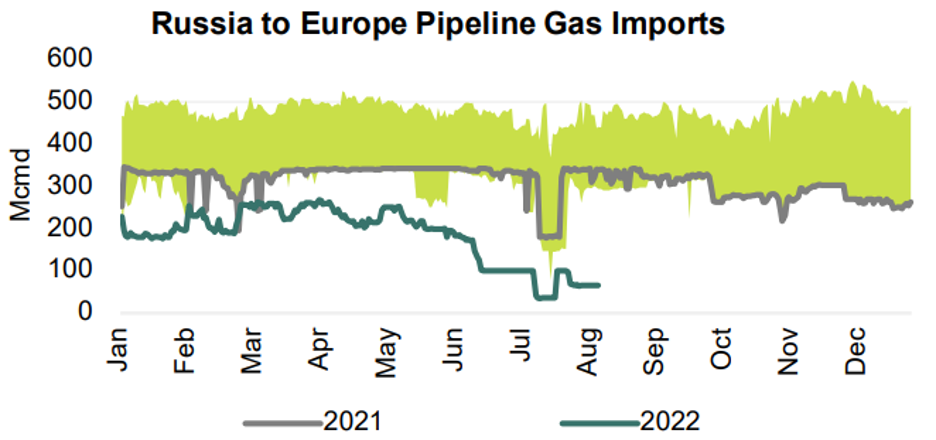

Russia has now shut off gas to Europe (figure 1). The timing could not be worse as it follows a summer of heat waves and droughts as well as a large French nuclear power maintenance cycle. It is clear that Putin is trying to tighten the financial noose around the West and equally clear that his strategy is having an impact as protests erupt in Europe over rising electricity costs. Europe has attempted to front run the shut-off by limiting industrial usage and buying every LNG cargo available (LNG imports were up 190% year-to-date through July 2022).

Figure 1. Russia to Europe Pipeline Gas Imports

Source: Bernstein Research

However, the rapid rise in natural gas prices that is fueling surging power prices is predicated on shortages during the peak winter season, and winter demand is based primarily on the severity of winter temperatures. Thus, the largest variable on the demand side of the equation is still unknown. Also unknown is how consumers will respond to higher prices. There is some level of heating and electricity use that is necessary for minimum quality of life. However, there is also a larger portion of demand that is based on Western world comfort. Bernstein Research indicates that lowering a thermostat one degree equates to a 6% reduction in natural gas use. It is likely that governments will mandate lowered temperatures for public buildings and that consumers will oblige in order to avoid much higher bills and out of a sense of duty. When combined with plans to reduce industrial usage by 15%, Europe may exit the winter in a much healthier gas storage position than expected (to reiterate: weather will play a huge role). Ultimately, Europe will figure out its energy problems (although it may take a right-wing wave of politicians if the current regime continues to bumble about), but elevated costs are a given as long as the Ukraine conflict continues.

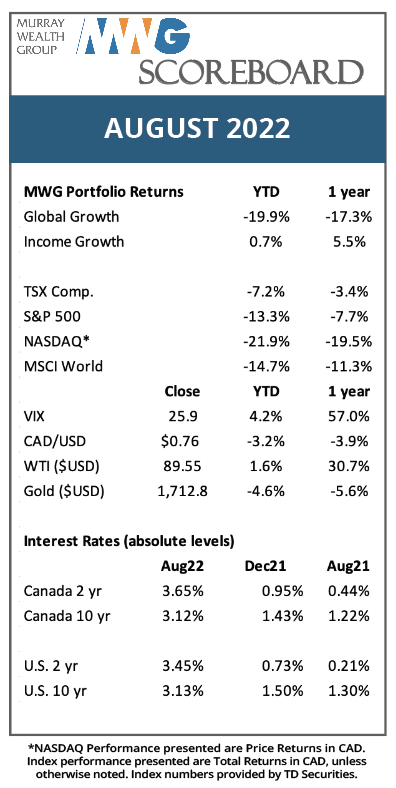

We have noted in prior months that we believe inflationary forces will dissipate faster than the market generally believes. August data continues to help that case. Wholesale gasoline prices moved lower once again and now sit below the price at the onset of the Russian invasion of Ukraine. Home prices are falling. Car prices should ease as OEM production levels normalize back to pre-covid levels. These changes are reflected in the latest U.S. breakeven inflation rate, a measure of expected inflation that is determined by the difference in bond yields of nominal and inflation-protected securities. Although still elevated from pre-covid levels, the rate has fallen to 2.55% from a high of 3.6% in March 2022.

Figure 2: U.S. 5-year Breakeven Inflation Rate

Source: St. Louis Federal Reserve

North America economic activity continues to surprise to the upside despite higher interest rates. The aggressive Fed rate hikes will continue through the remainder of 2022, following Fed Chairman Powell’s speech at Jackson Hole on August 26 where he reaffirmed the Fed’s commitment to burying inflation. Current expectations (as priced by bond futures curves) are calling for a 75 bps rate hike in September and another 25-50 bps by year-end. We believe the inflation data will continue to be a driver of near-term sentiment. If inflation can slow closer to the 2% Fed target, it will give Powell some room to assess the Fed’s actions to date (particularly as Quantitative Tightening continues). With the Q3 GDP real time forecast sitting at 2.6% and real rates at 0.75-1% going forward, Powell may engineer an economic soft landing after all.

A quick note on earnings for the second quarter. Despite the economic doom and gloom, they were just fine! Companies exposed to the $USD experienced currency headwinds and some retailers experienced weakness from shifting consumer preferences but overall, businesses were able to offset margin pressures with price increases and maintain adequate earnings growth. We believe some companies may see margins expand in the second half of the year if pricing holds and cost pressures soften.

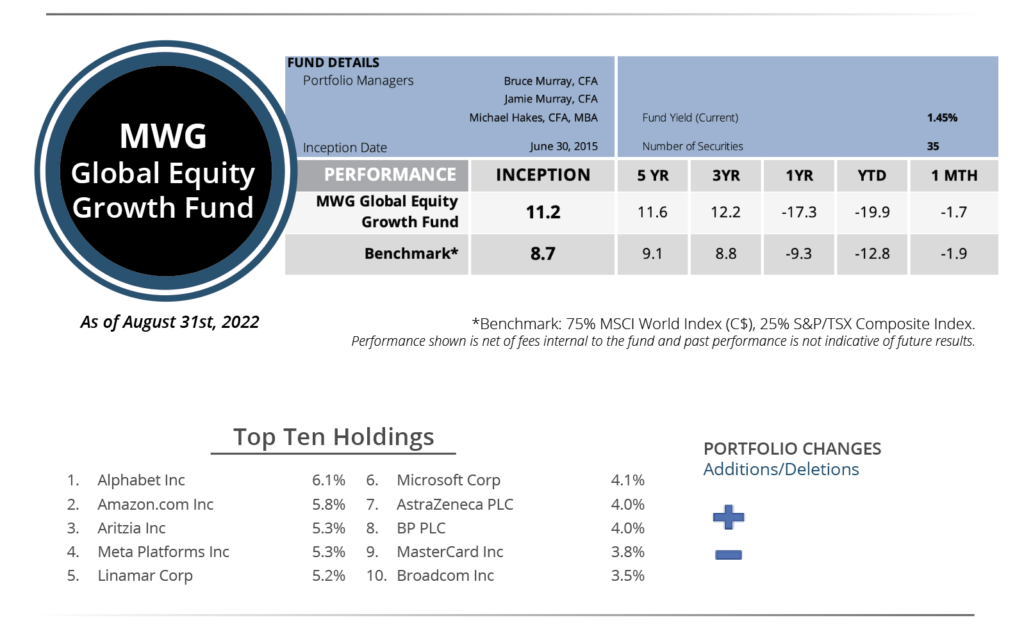

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund fell 1.7% in August, versus 2.0% for its benchmark. Year-to-date, the Fund has fallen 19.9% versus the benchmark return of -12.8%. The top 3 performers in the month were Uber (+25%), BP (+9%) and Linamar (+7%), while Twilio (-16%), Zalando (-16%) and Adyen (-12%) were impacted by the general weakness in the technology sector.

We made no portfolio additions or subtractions in August.

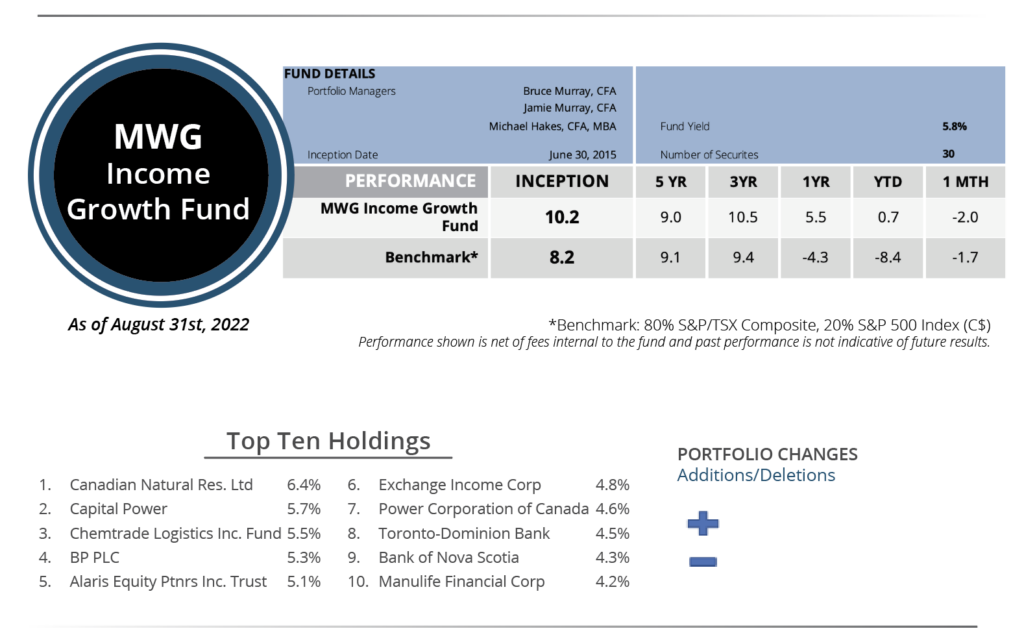

INCOME GROWTH FUND

The MWG Income Growth Fund fell 2.0% in August, more than the 1.7% decline in its benchmark. The fund has returned 0.7% year-to-date versus the benchmark decline of 8.4%. BP (+9%), Russel Metals (+5%) and Canadian Natural Resources (+5%) led the portfolio, while Cogent (-13%), Chorus Aviation (-11%) and Doman Building Materials (-11%) were the top detractors.

We made no portfolio additions or subtractions in August.

This Month’s Portfolio Update is written by our Head of Research, Jamie Murray, CFA.

The purpose is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.