Moët Hennessy Louis Vuitton (LVMH)

We added LVMH to the Global Equity Growth portfolio in the fall of 2021 and have been adding to it through 2022. We now have a 3% weight.

LVMH is the world’s leading luxury goods group with numerous well-known brands across a variety of segments: Wines and Spirits, Fashion and Leather Goods, Perfume and Cosmetics, Watches and Jewelry and Selective Retailing. Its most prestigious brands include Louis Vuitton, Fendi, Givenchy, Stella McCartney, Celine, Sephora and TAG Heuer.

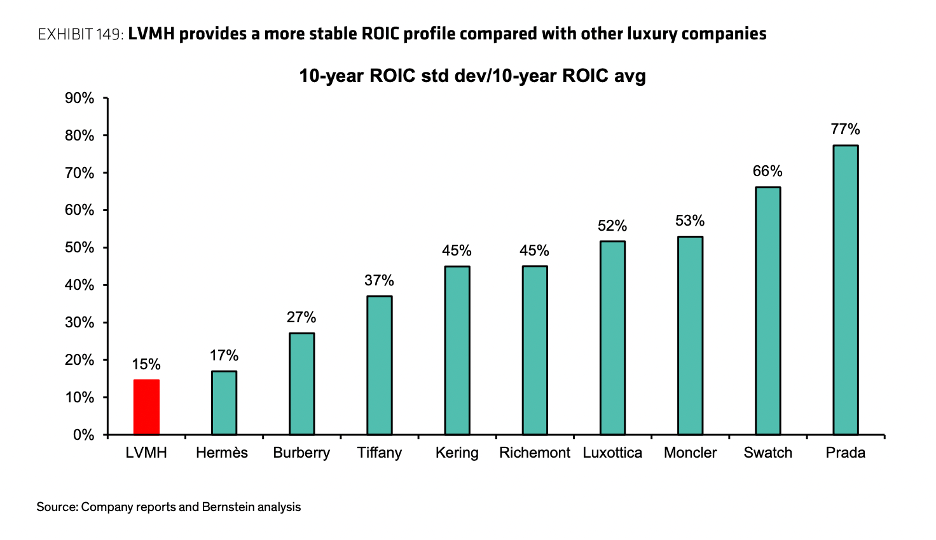

LVMH can be called a best-in-class compounder. What does that mean? It is a company with high-quality businesses and dominant and durable intangible assets (brand recognition) that can deliver consistent, recurring revenues. It also has pricing power and low capital intensity. Other characteristics include a return on invested capital (ROIC) that is both high (about 17%-18%) and sustainable. As illustrated in Figure 1 below, the standard deviation of LVMH’s ROIC is the lowest (most stable) of its peer group. At the Murray Wealth Group, we like stability and predictability in the companies we hold.

Figure 1 LVMH: Most resilient ROIC of all luxury good companies.

The entire brand portfolio within LVMH is one of the strongest in the luxury sector and gives it scale advantages over its competitors in marketing, retail, and sourcing. This translates into a company with extraordinary financial metrics: 35% EBITDA margins, 27% EBIT margins, 19% net margins and massive free cash flow. LVMH’s cash flow from operations is expected to exceed €20b in 2023. With low capital intensity, this cash will be either re-invested or paid out to shareholders via dividends.

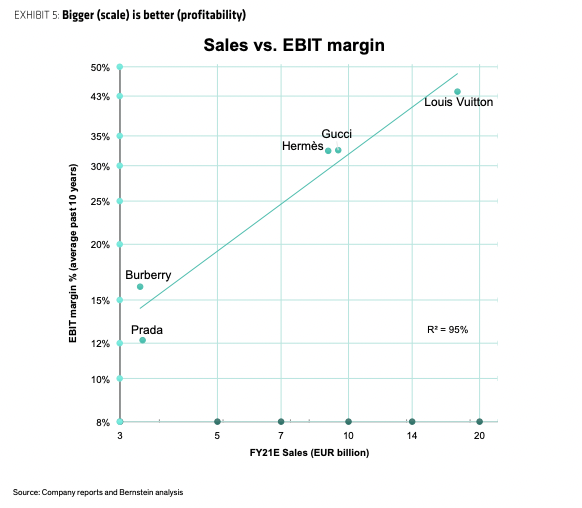

The biggest brand within LVMH is Louis Vuitton, which is part of the Fashion and Leather Goods segment. In Figure 2 below, you can see that Louis Vuitton has almost €20b in revenue and a whopping 44% EBIT margin, which is far superior to Prada, Hermes, and Gucci. No one haggles for a Louis Vuitton Mini Dauphine!!!!

Figure 2 Louis Vuitton. Brand, Scale and Margins.

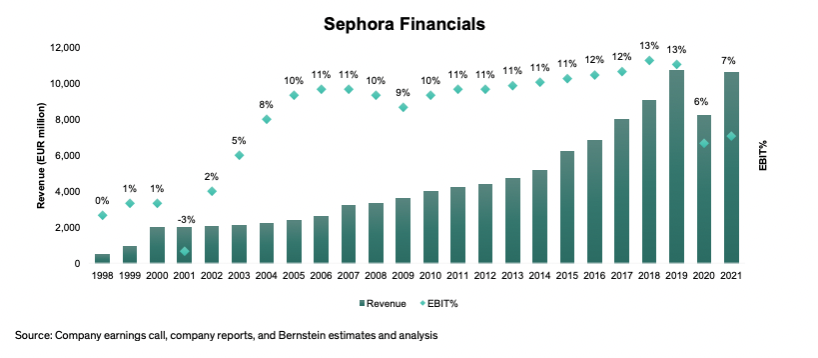

Within their Selective Retail Division, Sephora has become an important business since its purchase in 1997, growing its top line at a 14.1% CAGR over the last 24 years! Sephora’s historical EBIT margins have been around 11%-12%, although COVID did negatively impact them. Figure 3 shows how its margins and sales were impacted by COVID. Sales have almost returned to pre-pandemic levels, and we expect margins will approach historical levels over time.

Figure 3. Sephora Revenue and Margins

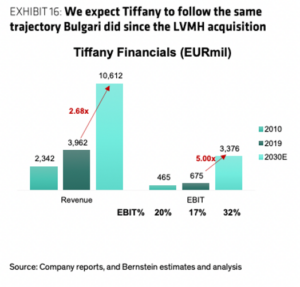

LVMH has made several other successful acquisitions over the years, including Bulgari in 2011, Christian Dior in 2017 and, most recently, Tiffany in 2019.

It is expected that Tiffany will follow a revenue and margin growth trajectory similar to that of Bulgari. Figure 4 below shows the impact on Tiffany’s financials out to 2030 should it be able to duplicate Bulgari’s success at Tiffany.

Figure 4 Tiffany Revenue and EBIT projections to 2030.

Overall, we expect LVMH to deliver high single-digit revenue growth and low double-digit EPS growth for the foreseeable future as management continues to execute its long-term strategy. The stock trades at about 23X FY2022 EPS of €28.00.

We would expect it to be able to maintain that multiple moving forward. In 2024, it is expected LVMH will earn €34.00. That would put our price target at €780, 22% above current levels. We get a similar price target if we use a DCF approach.

This Focus Stock is written by Sr. Portfolio Manager, Michael Hakes, CFA.

The purpose of this is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.