Thoughts on the Market: December Edition

2020

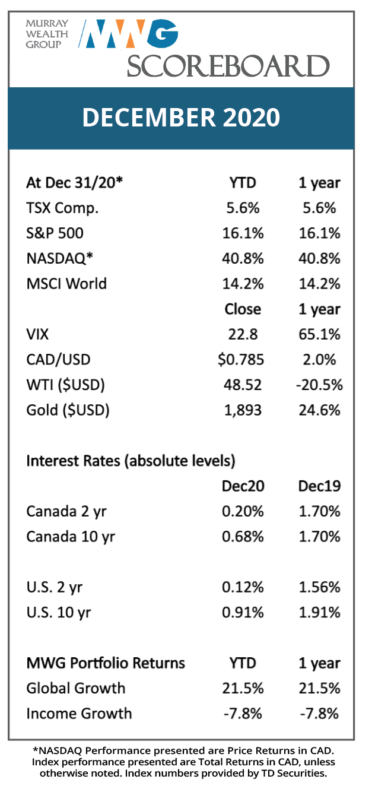

The holidays are often a time to reflect, and there was a lot to think about over an unostentatious Christmas period with restricted travel and gatherings. We will delve into our performance in more detail below, but let’s review how your investments performed in 2020.

MWG Global Equity Growth Fund: 21.5%

MWG Income Growth Fund: -7.7%

We buy companies that we believe will provide a strong rate of return over the long term. With strong discipline to our rebalancing process, we are often afforded short opportunities to purchase shares in companies at more attractive prices. These opportunities are typically in times of turmoil such as the steep market collapse in March. To illustrate, we will examine our trading in the 4-week period (March 10-April 6) surrounding the March 2020 market bottom. During this time frame, positions we exited would have returned 28% had we held them through year-end. Our purchases, on the other hand, returned 73% through year-end. The S&P 500 returned about 55% in that period. By simply maintaining our conviction and long-term focus, we could easily decipher extreme dislocations in the market. This rebalancing process continued to work through the summer as we avoided chasing the technology sector and made the most of our new purchases in undervalued cyclicals, which rebounded handsomely in the fall.

That’s not to say lessons were not learned. We have made our share of errors over the years, and our biggest this past year was underestimating the effect of the pandemic on mobility. As a result, investments in companies with real assets, such as real estate, airplanes or industrial plants, were impacted negatively, affecting financial companies with loans to these industries. We are confident, however, that the real economy will continue to recover and normalize as COVID-19 vaccines are rolled out and utilization of these assets increases.

As we look forward to 2021, we see a new set of risks and opportunities. Rock bottom interest rates and strong expectations for GDP growth have driven equity valuations to the high end of historical ranges. It is unusual, however, to see large selloffs in markets that are recovering from recessions. Technology and productivity are driving profitability higher. Consumers are ready to spend and explore. We think 2021 will be a good year for the markets.

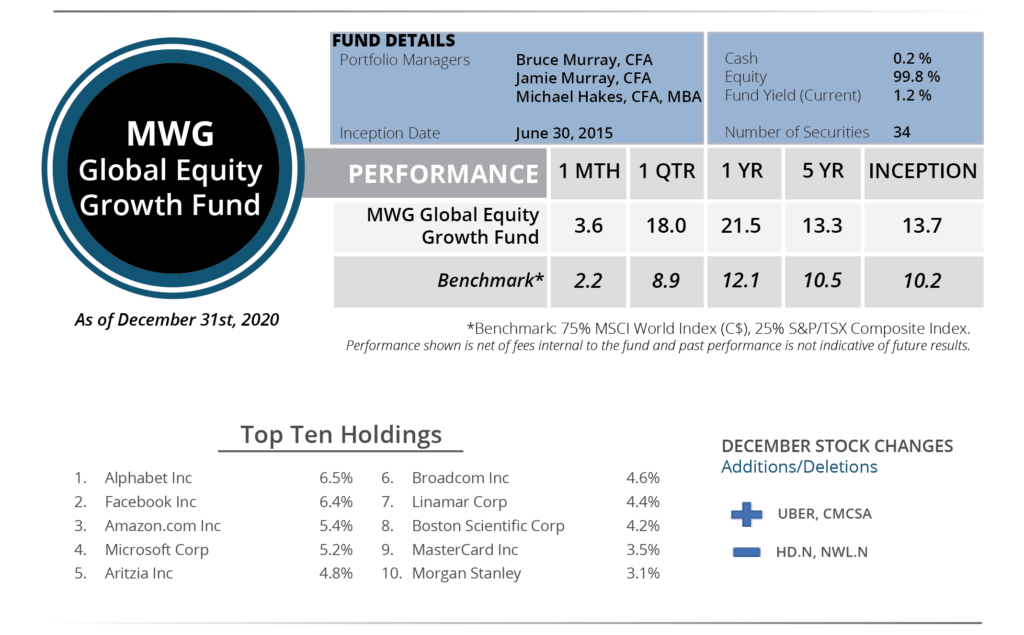

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund rose 3.6% in December and returned 21.5% for the year. The top performers in December were Stelco (+36%), Linamar (+14%) and Aritzia (+11%) while Newell Brands, Air Canada and AstraZeneca (all -8%) were the top detractors.

We initiated new positions in Comcast and Uber during the month. Comcast is a leading cable and entertainment provider in the United States. Its shares should benefit from both an increase in advertising across its NBCUniversal and Sky television networks and increased subscriber growth from its Xfinity cable operations. Uber is a leading ride-hailing and delivery service company with $60 billion of gross bookings. We believe Uber will benefit from the re-opening of the economy as urban mobility rebounds and the company benefits from continued improvement in its operating efficiency stemming from its marketing spend, corporate efficiency and insurance. The Uber Eats market is likely larger post-COVID than had the pandemic not happened given the benefits from lockdowns. Longer term, opportunities exist from advertising, data, new market entry and new business lines (such as logistics). At a 5x revenue multiple, Uber is attractively valued compared with other ‘booking-style’ assets such as AirBNB despite similar economics and growth rates.

To fund the new positions, we exited our investments in Newell and Home Depot. Home Depot has experienced a large pull forward in demand from at-home spending and its beneficial position as an essential service. We believe it will see lower growth on a go-forward basis as at-home spending moderates in 2021/2022. Newell shares rebounded following the turnaround implemented by its new management team; however, the shares were approaching our target price.

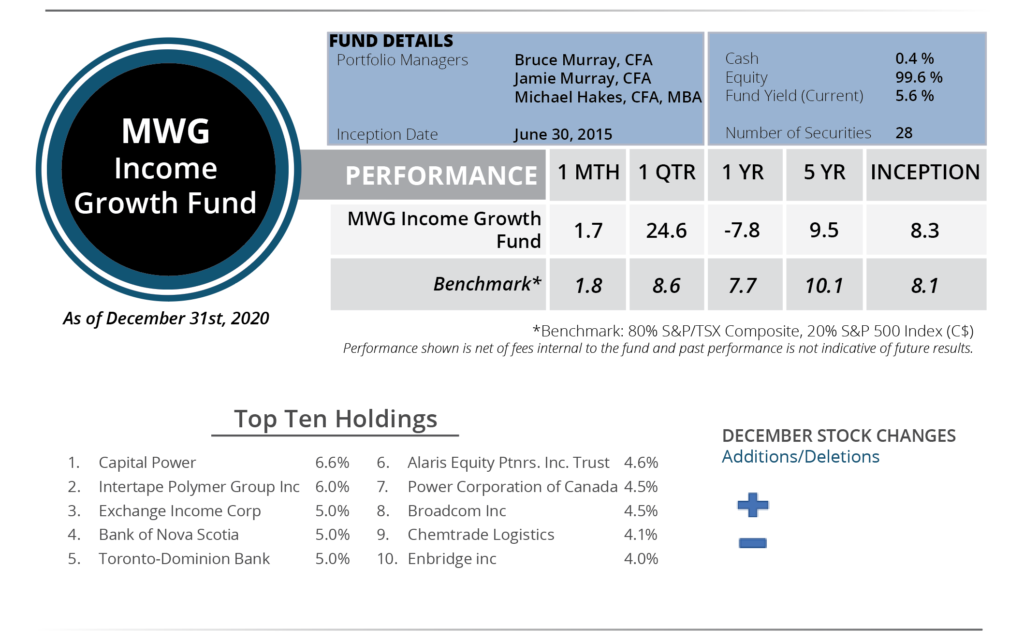

INCOME GROWTH FUND

The MWG Income Growth Fund returned 1.7% in December but still lost 7.7% in 2020. The top performers in December were Chemtrade (+17%), Russel Metals (+9%) and Bank of Nova Scotia (+9%) while American Hotels (-14%), Chorus Aviation (-14%) and Cominar (-9%) were the top detractors.

We made no weighting changes to this portfolio as we continue to expect our holdings to recover with the reopening of the economy.