The recovery progresses.

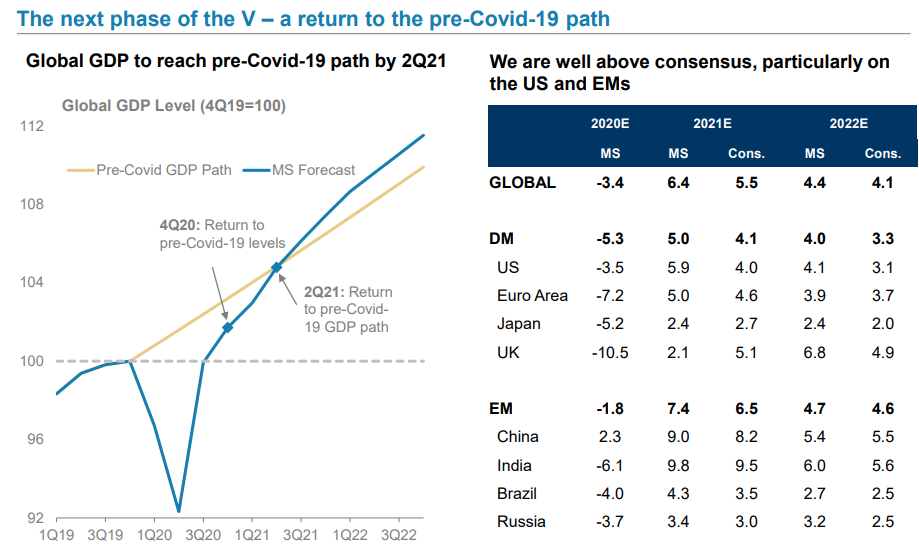

We believe economic activity will start to normalize in summer 2021 with multiple vaccines demonstrating efficacy in building immunity to Covid-19. Global GDP has already recovered to pre-Covid levels, although the composition has changed with a higher contribution from technology and consumer goods versus services. Morgan Stanley estimates point to strong rebounds through 2022, with GDP growth moving above its previous trendline.

Figure 1: Global GDP Growth Forecast Pre & Post-COVID

Domestically, U.S. TSA throughput plateaued in June and has remained flat. Even those that have travelled are travelling much less (personally, I took 25 separate flights in 2019; so far in 2020, I have taken 5). I took a quick Instagram poll to gauge travel sentiment among my followers (mostly a 20-40 year old cohort).

142 people responded to my first question, “Have you taken a commercial flight since lockdowns (excluding return to Canada flights in March)?”. 85% of responders indicated that they have not flown commercially since the onset of lockdowns.

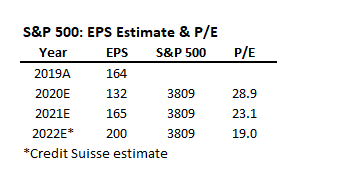

Increasing digital services and fixed asset utilization in 2021 should give rise to higher operating margins. As such, EPS for the S&P500 should rise 14% in 2021, reverting to 2019 levels. Credit Suisse estimates that 80% of companies will exceed 2019 EPS, with the remaining 20% disproportionately affected to the downside (think banks, aerospace, real estate).

Figure 2: EPS Estimate and P/E Ratio for S&P 500.

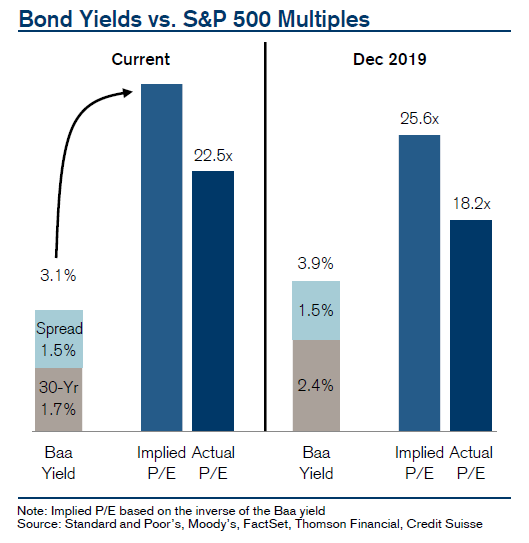

P/E ratios are unquestionably at the higher end of historical levels, but we argue that a combination of stronger earnings quality and low interest rates remains supportive of P/E ratios. While historically low, interest rates have bottomed as the strong snapback in industrial activity and commodity prices have increased expectations for inflation. Government stimulus has undoubtedly helped manage the economic impact of lockdowns, and we expect a normalization of spending patterns as economies reopen. A look at bond yields vs. the S&P 500 multiple is supportive of a 31x multiple versus the current P/E ratio of 23x.

Figure 3: Current Bond Yields Imply a P/E of 31x but the Market Only Trades at 23x.

Technology will still rule the world.

Since mid-2020, broad technology has underperformed as the pull-forward effects from COVID were recognized and valuation levels topped out. With improving industrial activity and successful vaccine efforts, cyclical stocks have garnered momentum as the market looks towards the reopening of the economy. But we expect technology will have its day in the sun once again and likely sooner than later. The catalyst for the technology sector has been advances in cloud computing, which reduced friction for start-up software companies at a time when digital engagement emerged as the preferred communication between businesses and consumers.

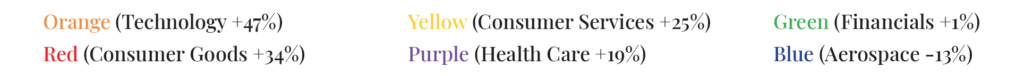

A sampling of U.S. software companies indicates anticipated revenue growth of 27% in 2021 – this includes e-commerce, cloud, business services, and security. Our large/mega cap holdings in the MWG Global Equity Growth Fund (Microsoft, Alphabet, Amazon, Facebook and Netflix) are forecast to grow revenue 18%. In 2022, the story remains the same – 26% revenue growth for the software cos and 16% for the big guys. Thus, expect the orange line in the chart below to continue higher.

Figure 4: Relative Performance of Industry ETFs (iShares)

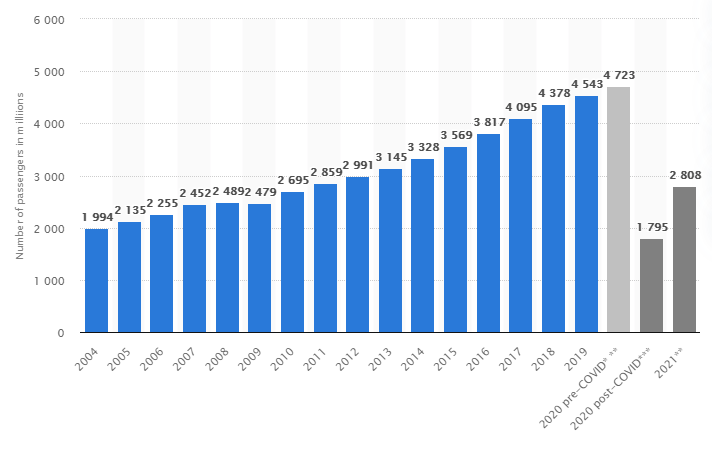

We believe the reopening should benefit lagging sectors such as financials and aerospace. Financial companies should benefit from rising yields as inflationary pressure increases and provisions for loan losses are released. Aerospace markets remain depressed but represent an excellent long-term opportunity as global passenger travel trends revert to their long-term pathway.

Figure 5: Global Commercial Airline Passengers (2004-2021 forecast)

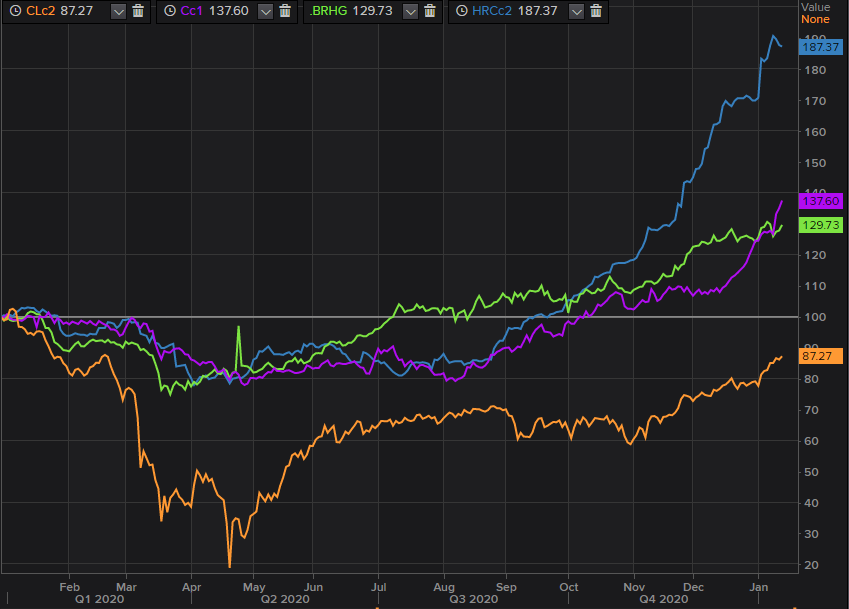

Commodity prices rallied through fall 2020 and into 2021, with steel leading the way, followed by copper and agriculture crop prices. Oil prices lagged on a relative basis but almost recovered to their Jan 2020 baseline. Higher commodity prices support service providers and equipment makers, along with end market producers. After several years of low investment, it is likely that spare capacity and inventory are low. This could create additional tail winds as the industry restocks to meet higher demand.

Figure 6: Commodity Price Returns (rebased to Jan 2019 = 100)

It is also possible that we will see a relative shift in performance as Canada and the Canadian Dollar will benefit from stronger resource prices as the running room could be quite large. One look at the Canadian energy sector equity performance over 20 years is quite a telling chart.

Figure 7: Canadian Energy Sub-Sector

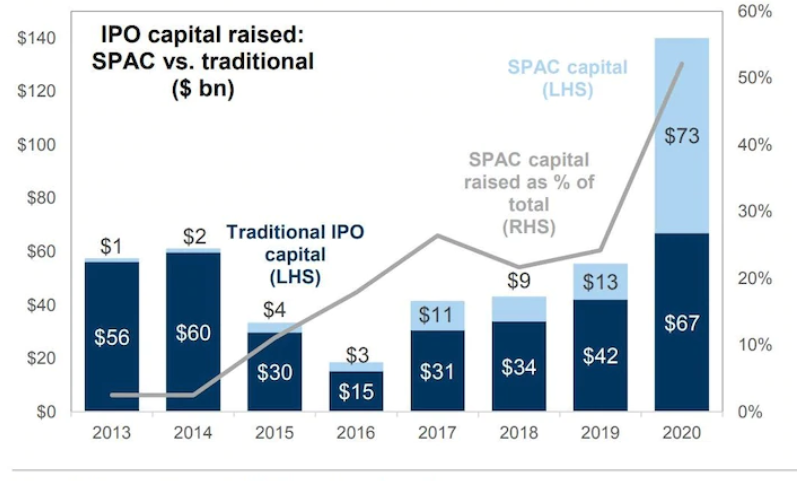

A cautionary note. We see many opportunities and believe the broad market will continue higher as it often does post a recession. However, we would be remiss not to mention the pockets of speculation and easy capital flowing into equity markets via SPACs (special purpose acquisition companies), hot IPOs, extreme valuations in companies in the electric vehicle and environmental technologies sectors, soaring bitcoin/crypto prices and TikTok Investment advice for Gen Z.

Figure 8: IPO & SPAC Capital Raised

We maintain a disciplined approach to our investment process and portfolio construction. Our Global Equity Growth and Income Growth Portfolios maintain P/E ratios of 20x and 13x, respectively, with strong profitability across all companies save for those affected by short-term pandemic related issues.

We continue to see opportunities in equity markets.

Bond yields are topping and higher expectations for inflation should continue to make equities an attractive proposition. Recovering economies should continue to flow through to businesses and markets. Consumer services and industrial companies will benefit from greater mobility. Technology penetration continues to grow with the increasing rate of innovation and productivity. We believe some multiple compression is expected and thus see equity prices rising at a diminished pace compared with profit growth. A year-end target of 4000-4100, representing a 20x multiple on 2022 earnings is a reasonable guess (that no doubt will shortly be proven wrong).