Thoughts on the Market: January Edition

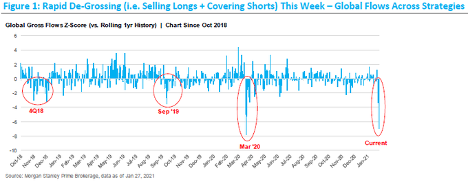

Gamestop is a one-of-a-kind market event that will go down in investment lore. The legendary trade, with roots as early as September 2020; the blow-up, the hedge funds that took it too far; and the cinema, as the entire world watched in awe and spectacle. While the theatrics provide a great reason to break out the popcorn, it’s difficult to see the lessons from the whole debacle beyond the old investment adage, “Short selling has potential for unlimited losses.” The chaos created a large hedge fund de-grossing (selling long positions to fund margin requirements/or reduce short positions) and was responsible for the volatile market that closed out in January.

In 2008, there was a rush to understand CDOs and CDSs* and find the next “Big Short”. In 2011, it was understanding Mediterranean debt (the PIGS*). In March 2020, it was understanding flu epidemiology. In practice, all these fat-tail, low probability events are unlikely to repeat – at least not in the same form. For every Gamestop, there is a Blackberry (the 2011 version), Sears or Blockbuster, where heavily shorted companies with bad fundamentals just go down. Scouring the market for the next Gamestop is likely to yield more of the latter.

While you (ok, us too) were glued to Gamestop, world-class companies were reporting world-class financial results to little fanfare. Microsoft blew past expectations, with 17%/34% revenue/EPS growth. Facebook bested these with 33%/51% growth. Facebook

has invested US$86B in capex/R&D over the past three years and grew at the fastest rate in nine quarters. It just keeps rollin’ along. Trading at a 2022 P/E of just 19x, it appears the market is pricing in peak earnings for Facebook. However, what if Facebook is just getting started? Its ‘other’ revenue, mostly consisting of its Oculus VR headset, rose 156% in Q4 to nearly US$1B. In addition, its CTRL-Labs neural network acquisition makes it a leader in virtual and augmented reality.

Check it out here.

*Footnote – CDS (credit default swaps), CDO (Collateralized Debt Obligation), PIGS (Portugal, Italy, Greece, Spain)

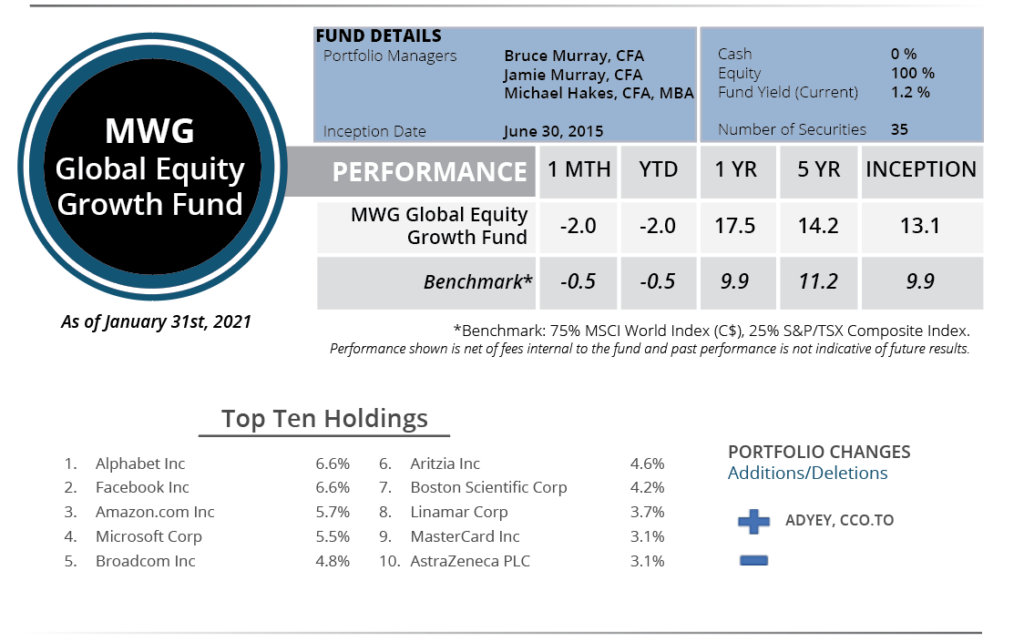

GLOBAL EQUITY GROWTH FUND

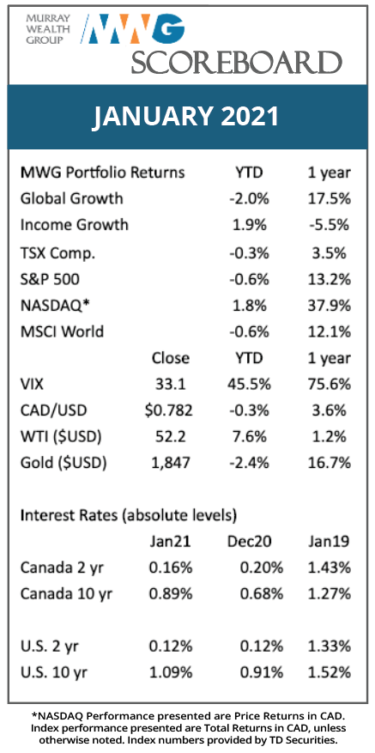

The MWG Global Equity Growth Fund fell -2.0% in January. The top performers in January were Twilio (+6%), Enbridge (+6%) and Alphabet (+5%) while Royal Caribbean (-13%), Air Canada (-12%) and Mastercard (-11%) were the top detractors.

We initiated positions in Adyen and Cameco. Adyen is a payment processor with a superior single code platform that simplifies the payment flow for large multinational retailers. Globally, the payment network consists of consolidated legacy systems and local operators, which makes seamless reporting and payment management difficult. Adyen simplifies this process tremendously and has had major wins, including clients like eBay and Nike. Adyen is making a push into North America and we expect additional business wins in 2021. Adyen offers a rare combination of strong revenue growth and high free cash flow margins, with sales expected to grow five-fold over the next five years and free cash flow margins exceeding 40%.

Cameco is a uranium producer with operations in Saskatchewan. The uranium market has been challenged since the 2011 Fukushima disaster and the phase-out of nuclear power in Germany, which led to years of uranium oversupply. However, it appears the market is turning with increased electrification and decarbonization efforts. Nuclear power is an excellent supply for carbon-free baseload power and Cameco sees 700 million pounds of new contract demand over the next decade. From 2001 to 2007, the contract uranium price increased 10x to $95/lb. With limited investment in new uranium production over the past five years, supply is decreasing. As 55 new nuclear power plants are being built worldwide, we’re betting on a strengthening market in the mid-term.

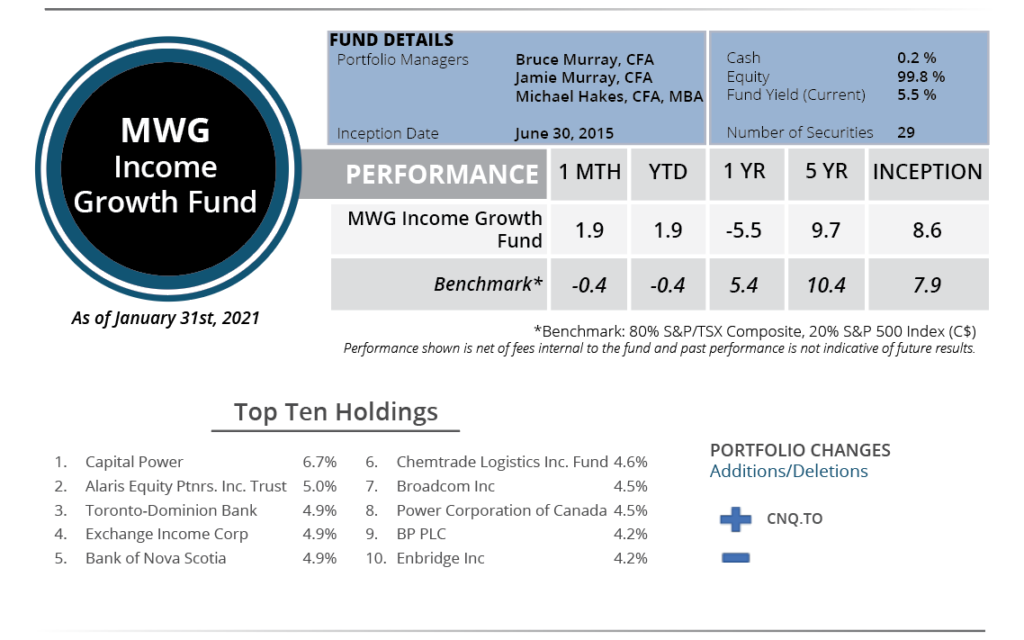

INCOME GROWTH FUND

The MWG Income Growth Fund returned 1.9% in January. The top performers in January were Chemtrade (+16%), Newell (+13%) and Corus (+11%) while Chorus Aviation (-12%), Gibson (-6%) and IBM (-5%) were the top detractors.

Our lone addition was Canadian Natural Resources. As we move through 2021 and the reopening of economies, we believe energy prices and sentiment will remain strong. Canadian Natural Resources is a low-cost producer with low decline assets and a knack for managing the oil cycle. The company completed numerous disciplined acquisitions over the past five years while maintaining a strong balance sheet and free cash flow margin. The company is well-positioned to play defence until oil market conditions improve. The shares yield 5.9%.