Thoughts on the Market: May Edition

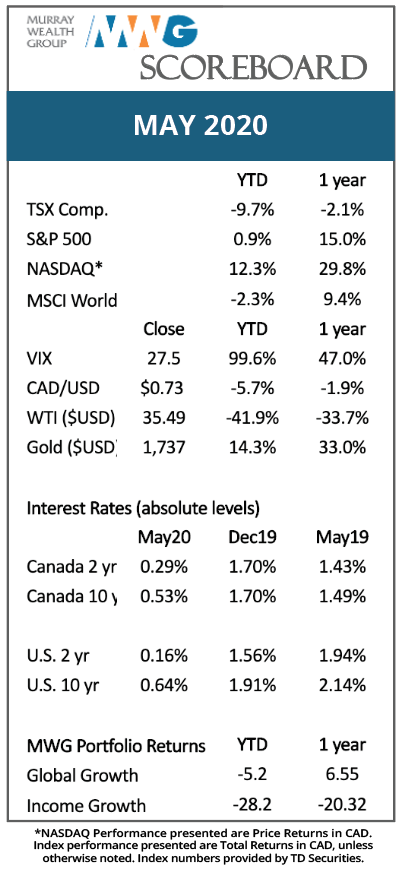

Equity markets posted a second consecutive month of gains in May. Volatility indicators calmed, providing some comfort to investors, and focus shifted to the re-opening of economies. Notably, most companies have reported financial results and were able to provide investors with some clarity regarding the depth and duration of the impact of the Coronavirus. With social distancing measures still in effect as economies re-open, businesses that can generate revenue in the face of depressed foot traffic, through delivery, click-and-collect or digital services, have grown their share of wallet to the detriment of those industries that have been affected to a greater extent.

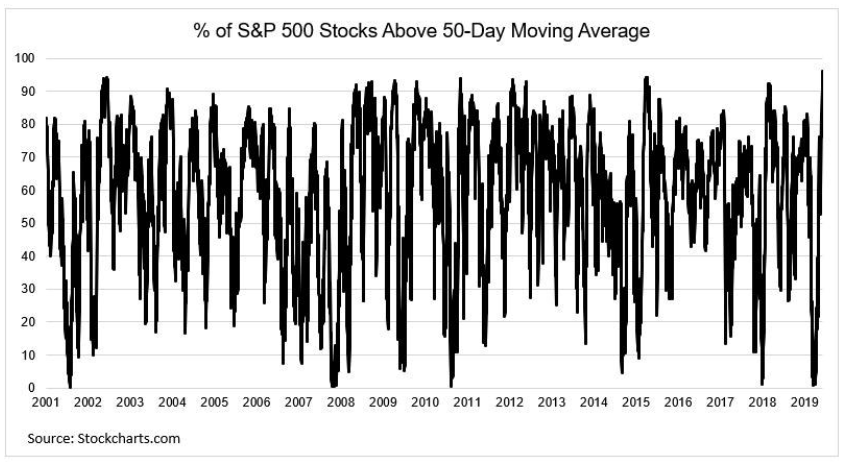

Investors remain anxious, with many in denial of the market recovery. However, tangible data points are pointing to a solid change in both market and economic indicators. From a technical standpoint, more stocks in the S&P 500 are above their 50-day moving averages, a measure of relative short-term stock support, than at any other time in the last 20 years, with a reading of 95%.

At MWG, we often opine the benefits of a recession as a chance for businesses to recalibrate operations, trim excess and win market share from weaker competitors. Similarly, recessions have a wash-out effect on investors as losing positions are dumped once and for all, long-term winners are sold to book profits and new positions are established to benefit from the recovery. This portfolio re-organization creates a musical chairs-like scenario as investors race to position for the recession only to find out they have missed the market bottom. As more and more stocks recover, investors lament on missing the rally, tricked by the market they were so sure they could time, only to later submit and re-enter at higher prices.

To be clear, there will be another sell-off/correction/recession, but it is unlikely to be caused by the Coronavirus. Companies have adjusted operations to manage through lockdown/social distancing measures, governments have a playbook on how to help affected business and better therapies or vaccines should be available in short order. That’s not to say heavily affected industries such as travel and entertainment won’t see further deterioration but growth in other discretionary sectors and digital expansion should persist.

Interest rates remain accommodative, digital growth is fueling economies and households appear apt to start spending and re-opening. We believe we should see markets continue to move higher.

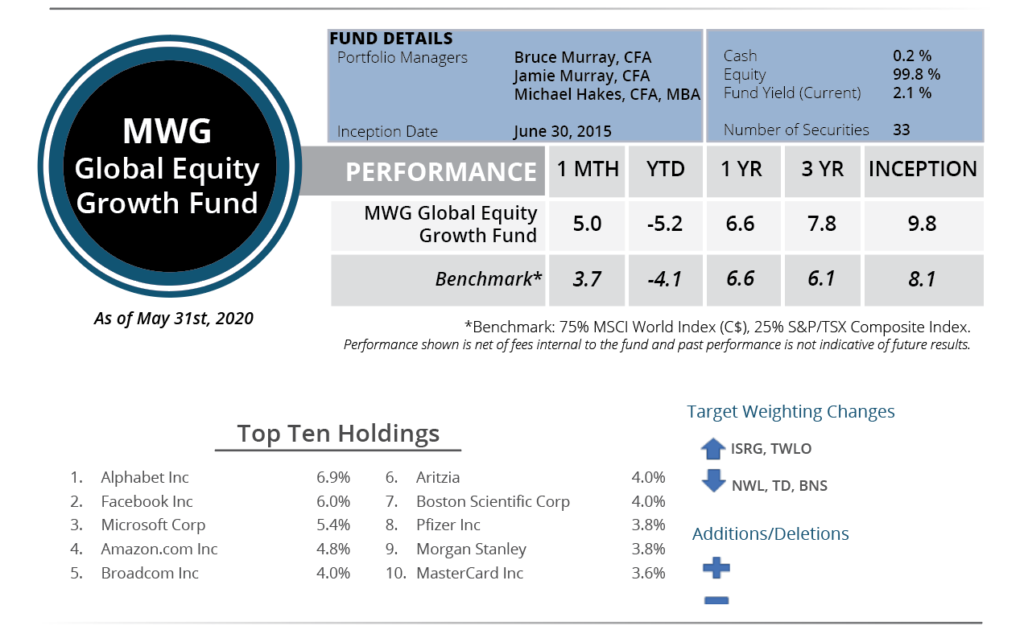

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund rose 5.0% in May, bringing its year-to-date return to –5.2%. Over the past twelve months, the portfolio has returned 6.5%.

The portfolio benefitted from strong returns from our most recent purchase, Twilio, which rose 79% on very strong results, as well as Royal Caribbean (24%) and Linamar (18%) on recovery hopes. Tapestry and Alliance Data were our weakest performers during the month, although we believe both companies will provide lots of torque in an economic recovery (the two companies have returned 23% and 26% in June).

We made no additions or deletions to the Global Equity Growth Fund. Our target weight changes were driven purely by market fluctuations. Upon reviewing each position, we felt the relative performance and new weightings were justified given the outlook for each company.

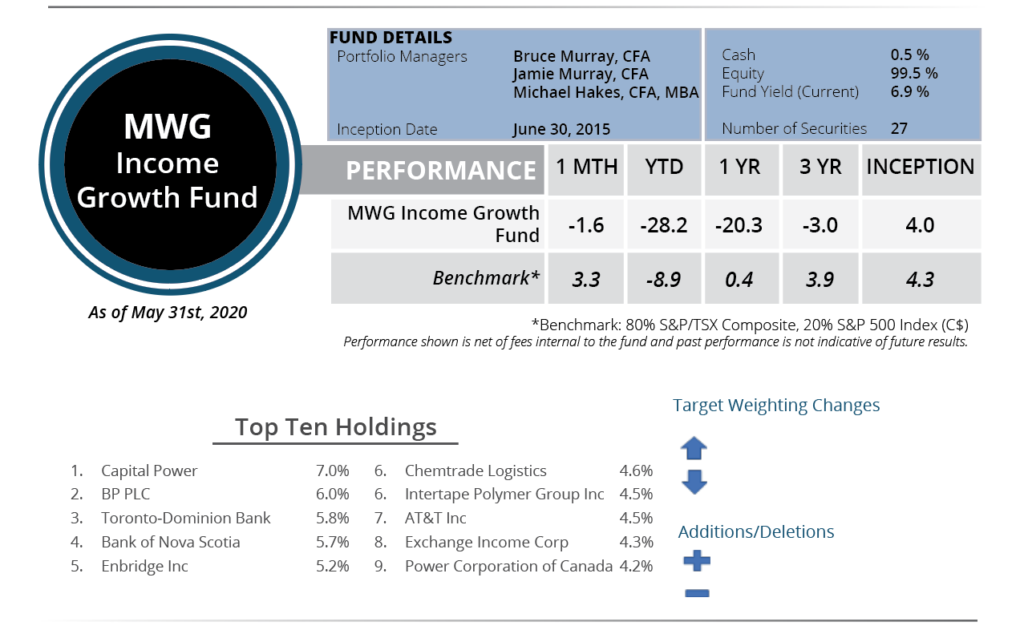

INCOME GROWTH FUND

The MWG Income Growth Fund fell -1.6% in May and is now down 28.2% year to date. Over the past twelve months, the portfolio has returned -20.3%

We made no changes to target allocations during the month. After a strong rebound in April, many positions reversed gains in the first half of May as the market rotated towards growth over value stocks, which compose a large segment of the fund. Real Estate, Financials and Industrials continue to be impacted by COVID-19 concerns; however, we believe there is the potential for above-average returns over the next 18 months. Case-in-point, preliminary data suggests the portfolio has returned 11% in the first week of June.

We have stress-tested all the companies in the portfolio, and we believe that as the economy opens up, business activity will normalize and the profitability of many companies will return to 2019 levels. As such, share prices should follow. We continue to find opportunities for companies paying dividends in the 6%-10% range that are covered by cash flow once adjusted for the impact of COVID-19.