Have you ever taken an Uber? If so, after you open the Uber app and request service, you receive a text message when your driver accepts the request or when your vehicle is approaching. The app also gives you the ability to communicate with the driver through voice or text. Throughout the process, your identity and phone number remain private. Twillio provides the platform for this type of communication all over the world.

Twilio has created products that are easy to integrate into new software development and are capable of building in communication functionality on a global scale. In so doing, businesses avoid having to develop their own communication capabilities and striking deals with each of the various telecommunication companies on their own. Businesses using Twilio can create multiple communication touchpoints (text messaging, voice, video calling). This has proven particularly useful during the current pandemic, which has required many businesses to move online.

Twilio is a Communications-Platform-As-A-Service (CPaaS) provider (for a more in-depth view of the industry an appendix has been provided at the end of this report). Platforms offer tools that allow software developers to expediently build new services on top of them through APIs. In layman’s terms, API’s are tools that allow the integration of different types of software and electronic functionality. For example, when you see a website with a YouTube video embedded into it, an API connects the website to the YouTube video.

Twilio’s APIs function similarly. Developers can easily embed Twilio’s communication APIs into software code. This allows, for example, the sending of a text message to a customer indicating that a delivery is en route, or the rerouting of an off-hours phone call to a standby team in an emergency (read more use cases on Twilio’s website).

Twilio also offers a cloud call centre product (Twilio Flex) that allows call centres to move to the cloud, eliminating the need for their own physical infrastructure, and manage multiple contact points with customers.

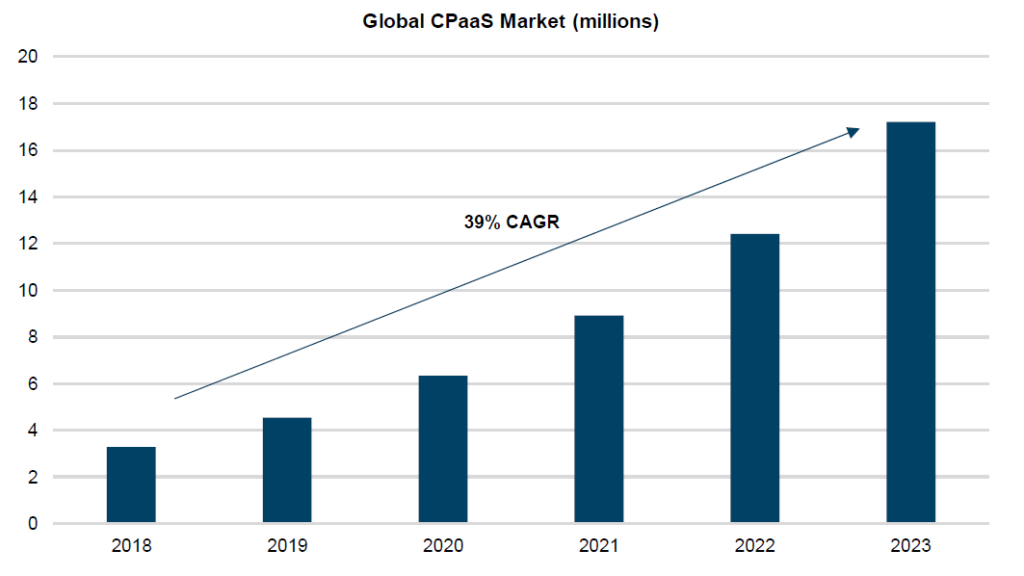

The CPaaS market is growing rapidly, as shown in Figure 1, as the development of new remote technology use cases increases. Looking out over the next five years, we believe the buildout of 5G networks will be a driving force.

Figure 1: Global CPaaS Growth Estimate (2017-2023)

Twilio charges customers on a per-usage basis (such as per text message or per minute of voice calling). This is in contrast to its software peers, which generally charge a monthly or annual fee per account or user. Onboarding a new customer is easy; Twilio simply requires a credit card and authorization to charge the card monthly as usage fees are incurred.

Key to its success is that Twilio continues to make an easy-to-integrate, reliable product that software developers (the decision-makers) will prefer. Cost is likely a secondary component to functionality and breadth of product.

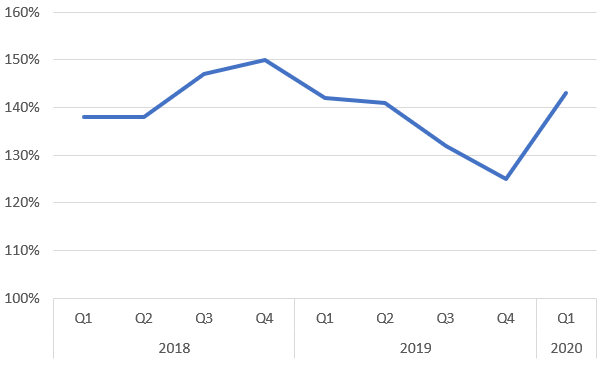

With its usage-based model, Twilio is able to further participate in the evolution of communication software and apps as customers create on top of its platform and expand its use. The company’s expansion rate with existing customers demonstrates this compounding power. Figure 2 below shows Twilio’s Dollar-Based Net Expansion metric, its growth in revenue from existing customer accounts. Values over 100% indicate growing revenue per client.

Figure 2: Twilio Dollar-Based Net Expansion

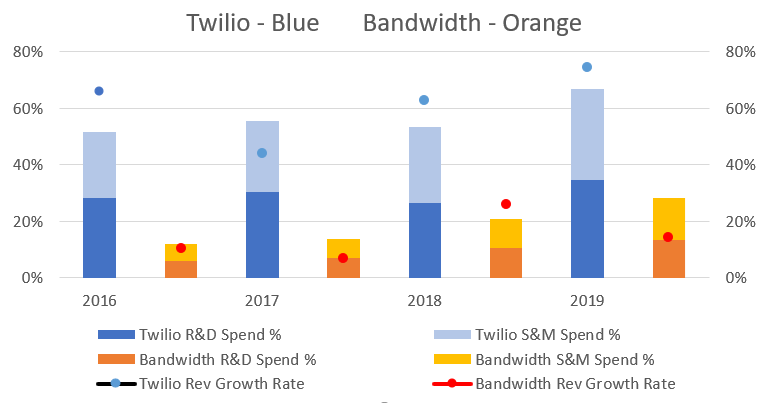

Although Twilio is the leader in the CPaaS market, it is not without competition. Not only does the company have several direct competitors, but a variety of substitute services exist that can achieve similar functionality for certain tasks. Twilio’s playground is in Business-To-Consumer (B2C) apps, making customer experience, reliability and customization key to its success. As a result, the company continues to invest significantly in its business, spending 50-60% of revenue on research & development and sales & marketing. In comparison, its closest competitor, Bandwidth, spends on average 20-25% of sales in these areas as can be seen in Figure 3. This, and its appeal to developers, likely accounts for Twilio’s superior revenue growth.

Bandwidth has also been a successful stock, rising >500% since its 2017 IPO (similar to Twilio’s investment returns), and boasts a strong clientele, led by Amazon, Microsoft, Zoom and Google. Its focus on the enterprise client rather than the consumer leads to higher revenue per client, although sales cycles and adoption can be longer. Bandwidth also has a voice-focused product (utilizing a company-owned voice over IP network) but is broadening its SMS messaging offering. Other competitors are MessageBird and Plivo. We prefer Twilio’s category leadership and higher growth rate.

Figure 3: Comparison of Growth and Spending of Twilio and Bandwidth

With growth rates and demand for CPaaS expected to remain high, we think it makes sense for Twilio to continue investing in growth. Our experience with platforms indicates that they are difficult to replace based on the reluctancy on the part of users to “break” a good thing. Although Twilio is the highest cost option, its reputation and switching costs likely keep users locked in. Moreover, relative to the success of an app or product, the cost is likely a secondary consideration.

Twilio’s revenue multiple has expanded from 10x to 16x following its Q1 results as investors assign a higher multiple for CPaaS services given their resilience in the COVID-19 environment. A 16x sales multiple is daunting in most cases but given the growth in CPaaS (and Twilio specifically) and optionality (in terms of developers inventing apps we cannot at this stage imagine), we believe the shares can continue to move higher through 2020.

The software development tailwinds are what make Twilio, a company that sits at the intersection of communication tools required for software development, an exciting investment.

Appendix: The New World of Software Development

The lexicon of technology is expanding at an astonishing rate. As the industry adapts to increasing interconnectedness, the merging of once separate technology verticals has given rise to a new world in software development.

The IT Stack refers to the layers of hardware, middleware and software that ultimately provide computer output. In a traditional on-premise IT Stack, a company will own and operate its own servers (computing power) that house the company’s operating system, middleware and databases. Local computers are used to access the databases and stored information.

Cloud computing has changed the modern IT Stack by offloading the hardware (and sometimes middleware) requirements to a shared data center, allowing the resources to be accessed by a variety of users through the internet. When hosted by a third party, this service is known as Infrastructure-as-a-Service (IaaS for short). Amazon AWS and Microsoft Azure are the two largest companies in this field.

Third-party cloud hosting provides two benefits. Firstly, IaaS providers enjoy scale and higher utilization by sharing physical infrastructure among multiple users, thus lowering the cost of operation. Secondly, end users can focus on creating software and other applications without having to procure, scale and manage hardware infrastructure. Thus, friction is removed in the software development process and can be sold online as a Software-as-a-Service model (SaaS).

The advance of computing power and software development is evident throughout the economy. Companies are leveraging software applications to augment data collection and analysis, which is increasingly powering decision-making. The decisions can be as broad as determining a path forward for corporate strategy to powering smaller day-to-day decisions such as helping field workers resolve problems. As well, companies are looking to technology to enable multiple touchpoints to clients for service delivery, account management and marketing. Software development is a requirement in almost all use cases.