Cogent Communications: An opportunity in Internet Networking

Have you ever wondered where the video comes from when you stream a movie on Netflix? Or the audio when you listen to a song on Spotify? Typically, a nearby data center will house the server and infrastructure software needed to deliver cloud-based content. From there, the relevant data (audio or video) will travel over a broad network of telecom cables owned by various companies and finally over the last mile to the end user through their internet or mobile carrier’s network. While household name telecom companies like AT&T, Bell or Verizon own a large amount of telecom infrastructure, smaller players like Cogent also own network infrastructure that helps the modern internet function.

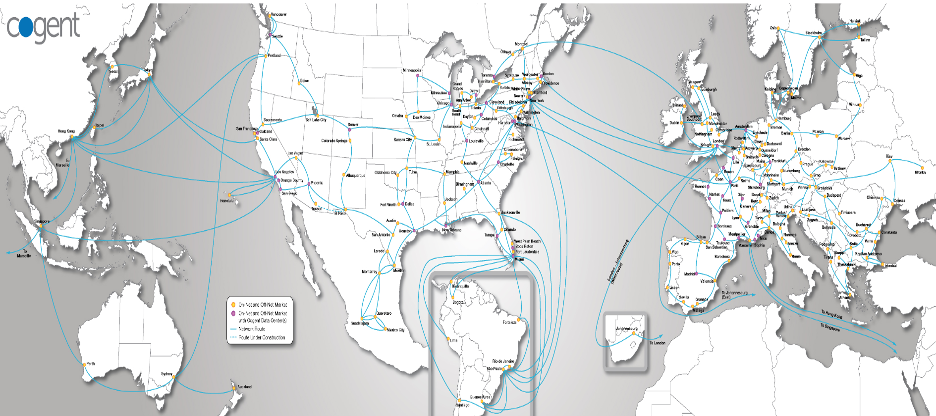

Cogent Communications is a low-cost provider of high-speed internet and network access to business customers. The company emerged from the 2000 tech bust, acquiring swaths of networking assets at distressed prices, and has grown the network over the years through additional acquisitions and long-term leases of networking capacity. It also connects to 3,000+ buildings such as office buildings and data centers across 216 metro areas. The company’s competitive advantages include a broad footprint with network services in 50 countries, high quality service with 100 to 400 Gbps ports in all the data centers it services, and competitive pricing given that Cogent can typically offer higher speeds at an equivalent cost of competition.

Figure 1. Cogent’s Network Map

Cogent breaks its business out into two segments – corporate and net centric. The corporate business provides high-speed internet connections to end-user businesses on a price-per-connection basis. The net-centric business includes the data center and content delivery business. Given that Cogent owns or leases much of the underlying network, there is significant leverage to adding a new customer. Thus, Cogent utilizes an aggressive sales and marketing approach to win new clients through its low-cost product offering. This is evident given that 65% of Cogent’s 1,000 employees are involved in sales. The company does incur capital spending to expand its network footprint, but its capital spending on maintenance is low relative to sales.

T-Mobile Acquisition

We highlight Cogent at this time as the company recently announced the acquisition of T-Mobile’s “Sprint Wireline” business. This is a legacy business line that T-Mobile acquired when it merged with Sprint. However, that merger was predicated on synergies between the wireless/mobile businesses of the two companies. The “Sprint Wireline” business includes legacy product lines that are not competitive with newer telecom services and thus has seen sales fall significantly over the past decade. In addition, the business was losing money as employee layoffs could not keep up with revenue decreases. We will stick to a high level analysis of the acquisition in this piece but invite you to read through the acquisition deck and listen to the conference call for more detail.

Given the poor financial performance and outlook for “Sprint Wireline”, Cogent is paying the princely sum of US$1.00 to acquire the business. In addition, T-Mobile is committing to purchase US$700 million of services from Cogent over a period of 54 months when the acquisition closes (US$350M are due in year 1). Cogent is assuming some minor liabilities in the deal, but they are inconsequential.

So….T-Mobile is basically giving the problem child that is Sprint Wireline to Cogent and saying, “Here, fix this”. It’s clear from T-Mobile’s turnaround efforts to date that Sprint Wireline is not economical. The process Cogent will undertake is closer to an asset transformation than a business turnaround. Cogent will take the following steps.

- Shut down 24 of 28 current product lines. Contractual commitments mean that it could take 3+ years from closing to “end-of-life” the products.

- Repurpose the asset base to expand modern service offering by upgrading the network fiber speeds.

- Connect Cogent’s network to Sprint’s, which will cause additional redundancies that can be eliminated ($15M per year).

- Leverage Cogent’s 600+ salesforce to cross sell new services or Cogent’s existing service to Sprint’s customer base.

At the end of the transformation, Cogent expects to have exited all the negative gross margin businesses, improved product quality for existing customers and expanded capacity for new services. In addition, it will gain 1,200 new business customers. To reiterate, any revenue added on spare network capacity brings extremely high margin, and thus, Cogent can utilize the same low-cost playbook it has for the past two decades.

Cogent has provided some long-term financial goals it believes it can achieve post-closing. At close in 2023, revenue will be ~US$1.1B and grow 5-7% annually. Although margins will be impacted initially given the $500M of Sprint revenue at low margins (prior to the acquisition Cogent’s EBITDA margins were 39%), the company believes it can improve margins to the low-mid 30% range. Longer term, it believes there is an opportunity to expand margins to 45%.

If we assume EBITDA margins can reach 33% in 2028 and revenue grows 6% to US$1.5B that same year, Cogent will generate EBITDA of $500M. For reference, Cogent is expected to generate EBITDA of $235M in 2022. Thus, EBITDA could double over the next six years. This would occur simultaneously with the company returning a significant amount of capital through dividends. At the current dividend yield of 6.5%, it’s possible 50% of the current share price will be paid back through dividends by 2028.

Cogent pays out all its free cash flow and has raised its dividend for the past forty consecutive quarters. Cogent’s CEO David Schaeffer owns 10% of the shares outstanding and manages the corporation as a frugal, sales-focused enterprise. We own shares in our Income Growth portfolio.

This Focus Stock is written by our Head of Research, Jamie Murray.

The purpose of this is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.