Our Views on Technology.

The technology sector had a difficult 2022 as share prices fell due to slowing revenue growth, higher interest rates and declining margins. This is exemplified on a sector basis by the 30% decline in the iShares US Technology ETF, which includes Alphabet, Amazon, Apple, Microsoft and other “FAANGM” stocks among its top 10 holdings. What caused the decline? Fundamentally, stocks rise and fall on two metrics, valuation (such as P/E ratios) and earnings (EPS), where the P/E ratio multiplied by the EPS = Price. Let us look at each metric separately.

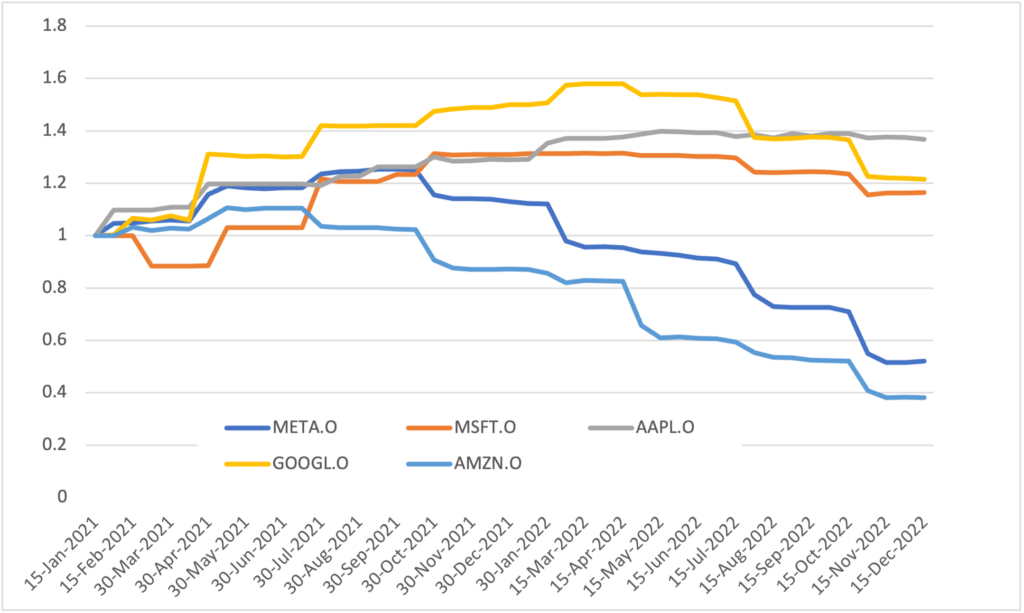

It’s clear that the profit outlook has deteriorated over the past twelve months. The main culprits were economic weakness and the effect of foreign exchange on revenue and an unwillingness to cut costs/spending to match the slowing revenue growth. For example, Alphabet’s expenses through nine months of 2022 rose 19% while revenue only rose 13%. Cost control is becoming a bigger topic for investors, and management teams are now actively trying to achieve significant cost savings in the form of headcount reductions and rationalization of new products. Figure 1 highlights the changes in 2023 earnings per share estimates over the past two years. Notice how the trend changed in late 2021, when interest rates and inflation rose, leading to EPS estimates falling through 2022. The estimates for each company are normalized to ‘1’ in January 2021 to compare across companies.

Figure 1. 2023 Earnings Per Share estimates, normalized to 1, over the last 24 months.

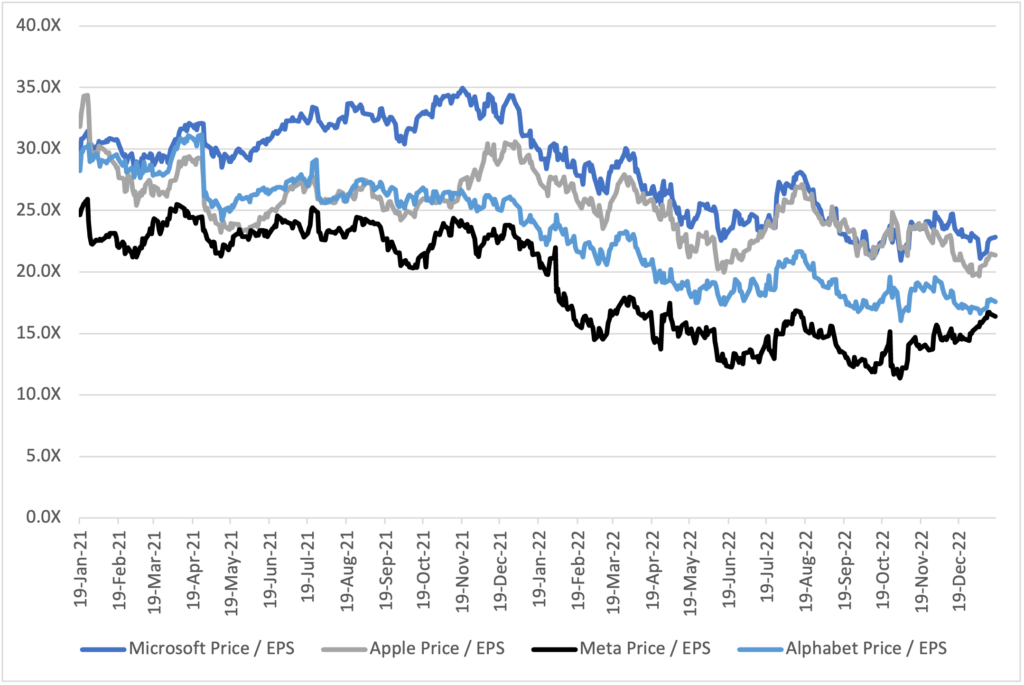

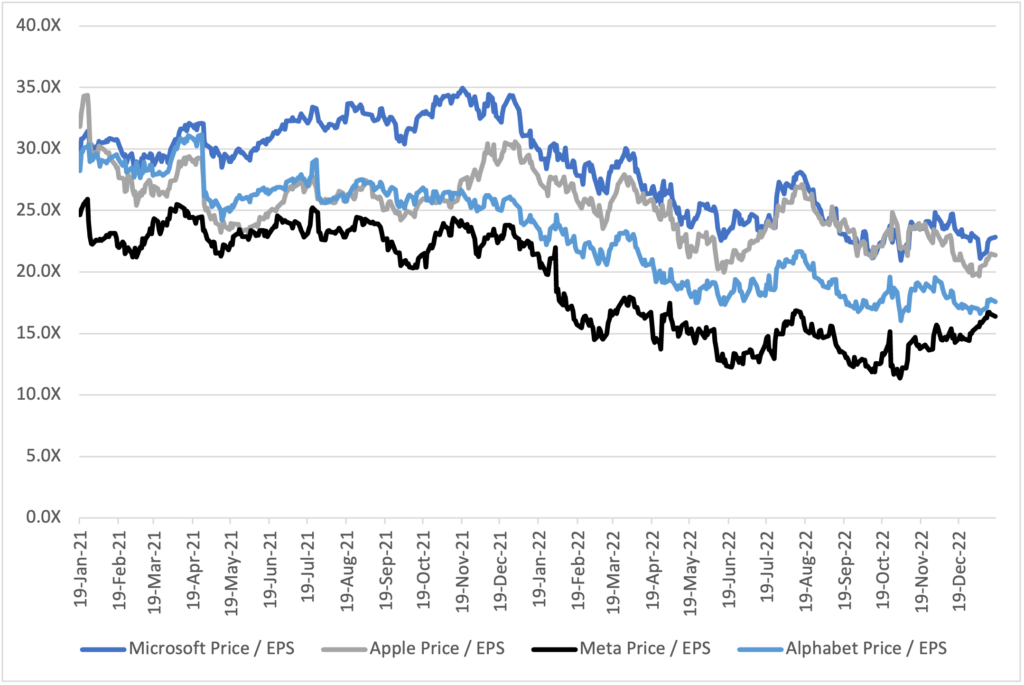

Figure 2 shows the P/E ratios for the group. Market P/E ratios have been under pressure due to the rise in interest rates and uncertainty surrounding inflation. Tech companies have not been spared, with their P/E ratios falling to their lowest levels in years. Historically, this has provided great buying opportunities as the companies leveraged their deep-rooted competitive advantages to emerge stronger. There are always concerns about impairment to a company’s competitive advantage when financial results are weak so we will address these concerns at the company level in the next section.

Figure 2: P/E Ratios for since 2021

Figure 3 attests to the fact that owning the FAANGM stocks over the long term has historically produced stronger returns than the broader market. We believe each company has a strategic moat that provides investors above-market returns, and this is the lens that we will examine in this note.

Figure 3: FAANGM stocks have strongly outperformed over the past decade.

Our analysis will be limited to our holdings in the Global Equity Growth Fund: Alphabet, Amazon, Meta and Microsoft. How are these companies really doing and are their prospects as strong as the past decade? We will run through each of our four technology holdings hoping to cut through the noise in the media and provide our perspective.

Amazon

Investment Thesis. Our investment in Amazon is predicated on the growing high margin product lines and increasing utilization across its massive footprint. While its core retail business generates large revenue, its profitability has been modest at best. However, Amazon uses its retail division to leverage its sales in other high margin services like Prime memberships and advertising (combined US$52B in sales through Sep 2022, up 15% YoY). AWS, Amazon’s cloud computing business is a crown jewel in our opinion and generates >$20 billion in operating income per year.

What’s happened since 2020. After an e-commerce boom from locked-down Western economies, Amazon embarked on a large expansion of its fulfillment network to carry more product and shorten delivery times. In 2022, as stores reopened, supply chains improved and government stimulus ended, physical goods from appliances to apparel were in oversupply. While Amazon’s retail sales still increased >10% YoY in Q3/22, the company struggled with over-capacity in its retail network.

What’s happening the outlook for 2023? Amazon has delayed some of its allotted investment in fulfilment capacity, with plans to grow into the remaining capacity by 2024. Thus, margins in its core retail division should start to improve this year. While AWS’ growth rate is slowing as Amazon works with its customers to optimize usage, the lower costs and flexibility of cloud computing should lead to long-term growth.

Alphabet

Investment Thesis. Alphabet dominates the online ad market, with an estimated 25% market share. Additionally, it is expanding its Google ecosystem with Andriod, YouTube, Gmail, Maps and G-Suite. Google is also playing catch-up in the cloud computing market, which should bear fruit for years as the product portfolio matures.

What’s happened since 2020. Online ad sales exploded in lockstep with the rise of ecommerce following the pandemic. Google was a beneficiary of this move. The company ramped up investments in R&D and computing equipment, which impacted margins as advertising markets slowed. Alphabet grew revenue 11% in constant currency in Q3/22, but the margin impact outweighed the growth in revenue.

What’s the outlook for 2023? Alphabet believes its current level of investment will set the company up for strong growth for the next decade, with artificial intelligence and cloud computing taking center stage. AI is improving both Google search results and advertiser programs. Google Cloud is now a US$28B revenue (run rate) business, and profitability should improve as customer discounts are reduced in the years ahead and new workflows are moved to the cloud. However, margin growth may be constrained until the online advertising market growth resumes.

Meta Platforms

Investment Thesis. Meta remains the social media service, with nearly 3 billion people using its products daily. Although its Facebook property is a mature cash generator, we believe it has lots of growth left with Instagram and WhatsApp. Historically, the company has been very profitable, with operating margins of 30%, and we believe the company can return to that level once it cycles through its investment period.

What’s happened since 2020. After record setting financial results in 2021 as ecommerce activity increased, 2022 brought a slew of challenges, including the continued rise of TikTok, the implementation of ad tracking on iPhone and a slowdown in the online advertising market. Additionally, increased spending on VR/metaverse at a time when existing profits are being impacted has reduced investor confidence in the company.

What’s the outlook for 2023? The online advertising market remains challenged, but we expect it will continue driving growth for Facebook’s properties as it rolls out new features for users and businesses. Meta has re-architected its advertising recommendation algorithms to improved advertising conversion results. User trends remain healthy as TikTok shows signs of maturation and the Instagram Reels product regains market share. As well, recent cost cuts should flow through to financials in the second half of the year.

Microsoft

Investment Thesis. Microsoft has leveraged its business software and server franchise into a cloud computing behemoth that handles security, software development and data for governments and corporations around the world. It has grown its cash flow per share 480% over the past decade.

What’s happened since 2020. Microsoft’s business was largely insulated as its recurring subscription-based software revenue held firm and cloud computing growth accelerated. The company is in the midst of acquiring Activision Blizzard, the largest gaming developer, although it is hitting regulatory hurdles. More recently, a slowdown in economic growth has impacted its cloud computing outlook.

What’s the outlook for 2023? Microsoft’s 2022 EPS forecast has fallen about 10% as slower growth and foreign exchange have impact its margins. However, the medium-term outlook for Microsoft is unchanged as more companies move and build workloads on its Azure cloud platform. Revenue should grow 10%, with earnings growth outpacing that number over the next few years.

Next month’s research report will detail how Artificial Intelligence and Machine Learning provide new revenue opportunities to these companies.

This Focus Stock is written by our Head of Research, Jamie Murray.

The purpose of this is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.