Thoughts on the Market: November Edition

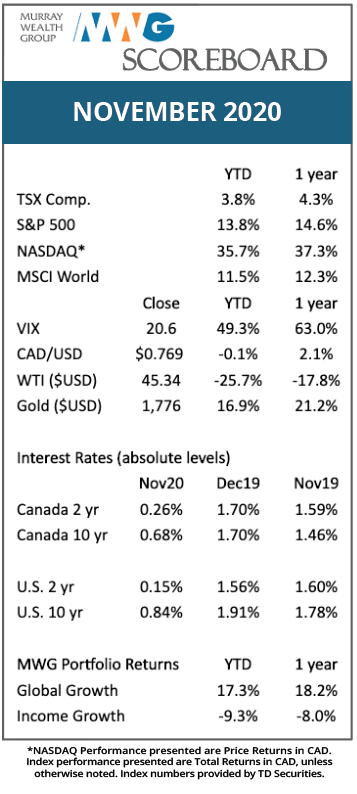

Equity markets surged to new highs in November on a flood of successful COVID-19 vaccine results, with the S&P 500 index rising 8%. With healthcare analysts now forecasting a sufficient level of vaccinations to achieve herd immunity by late spring 2021, markets have been looking through the second wave and the recurrence of social distancing in most of the Western world.

The market also digested the U.S. election, with Biden winning a closer-than-expected race. Spoiler alert! We expect the new administration will be a “the more things change, the more they stay the same” market event and urge investors to look beyond any political noise in the coming six months. The Federal Reserve is a much greater factor in markets currently, and until it changes its lower-for-longer stance on interest rates, equity markets should remain biased to the upside.

One interesting dichotomy is the restarting of the industrial cycle despite the ongoing lockdowns. It’s one thing for equity investors to look through poor data in anticipation of a recovery, such as the rally in airline stocks amid a dead airline traffic market. However, many data points are indicating that a torrid recovery is already underway in industrial activity. Steel prices are back to peak levels last seen in 2018, agriculture prices are at multi-year highs, auto production is back to levels experienced at the start of 2020 and homebuilder sentiment is at record highs. This sentiment is re-enforced by a Q42020 estimate of 10% quarter-over-quarter growth by the Federal Reserve Bank of Atlanta. Thus, we may see economies normalize quickly as governments roll out vaccination programs.

We continue to increase our exposure to recovery plays in both portfolios and expect further outperformance in cyclical and pandemic-affected names into 2021.

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund rose 13.2% in November, outpacing our benchmark by 3.2% and bringing its year-to-date return to 17.3%. Over the past twelve months, the portfolio has returned 18.2%. The top performers in November were Airbus (+40%), Alliance Data (+39%) and Linamar (+38%), while Boston Scientific (-6%), Netflix (+1%) and Home Depot (+2%) contributed the least during the month.

During the month, we added three new names, two of which we believe will benefit from the reopening of economies. Given the pent-up demand for travel and tourism, we started a 1% position in Air Canada following news of success in vaccine trials. The company has done a formidable job of restructuring its cost base and improving its liquidity through the sale and leasebacks of aircraft. We expect a flood of working capital when vacation bookings restart and evidence of its leaner cost base when air traffic improves. The company also increased its exposure to vacation travel by conditionally purchasing Transat A.T.

We also added a 1% position in advertising agency WPP. WPP is in the process of streamlining its divisions after a spurt of acquisitions and should see revenue improve in 2021 as advertising recovers. Professional services firms like advertising generate high returns on capital, and WPP is no exception. When combined with cost cuts, better management incentives and an improved capital structure, we see strong upside in the shares in 2021.

We swapped our shares of Pfizer into Astra-Zeneca (3.0% weighting) after Pfizer (3.5% weighting) rallied sharply on its vaccine results. Astra-Zeneca offers a better growth profile thanks to strong execution from its R&D pipeline.

To fund our other purchases, we sold our position in Tyler Technologies (1.5% target weight). While the shares performed nicely following our initial purchase in the summer, the valuation was near historical highs and we could not see material progress in its outlook.

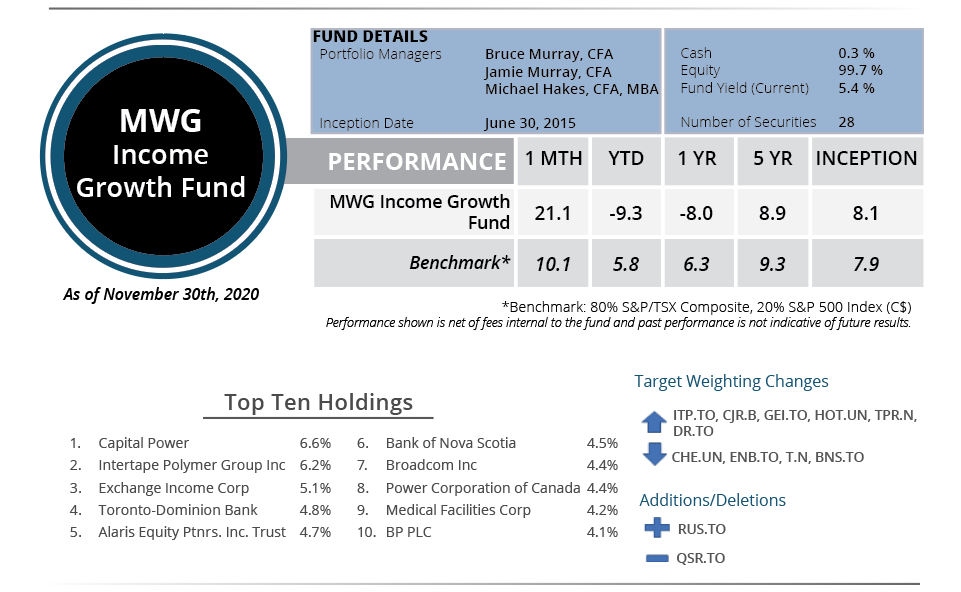

INCOME GROWTH FUND

The MWG Income Growth Fund rose 21.1% in November, outpacing our benchmark by 11% and bringing a much-needed rally to a portfolio broadly impacted by COVID-19 lockdowns. Its year-to-date return is -9.3%. We believe there is additional recovery potential in many of our holdings in the real estate, financial and industrial sectors. Every holding provided a positive return in the month, with the top performers being American Hotels Income Fund (+59%), Intertape Polymer (+55%) and Medical Facilities (+47%), while AT&T (+4%), Gibson Energy (+6%) and Evertz (+9%) contributed the least during the month.

We added Russel Metals to the portfolio at a 2% weighting. Russel Metals is a diversified distributor of metal and steel products and should benefit from a rebound in industrial activity. The shares yield 7.2%. To fund the purchase, we sold our shares in Restaurant Brands International (2% weighting).