Stelco: We built this city!

Stelco is an Ontario-based producer of steel products with two facilities in Southern Ontario. The company has existed in some form since its original Hamilton Works facility was first commissioned in 1905! Stelco ownership has changed over the past 20 years, including a couple of stops through bankruptcy. So….what is so exciting about a commodity-producing company that has a history of bankruptcy?

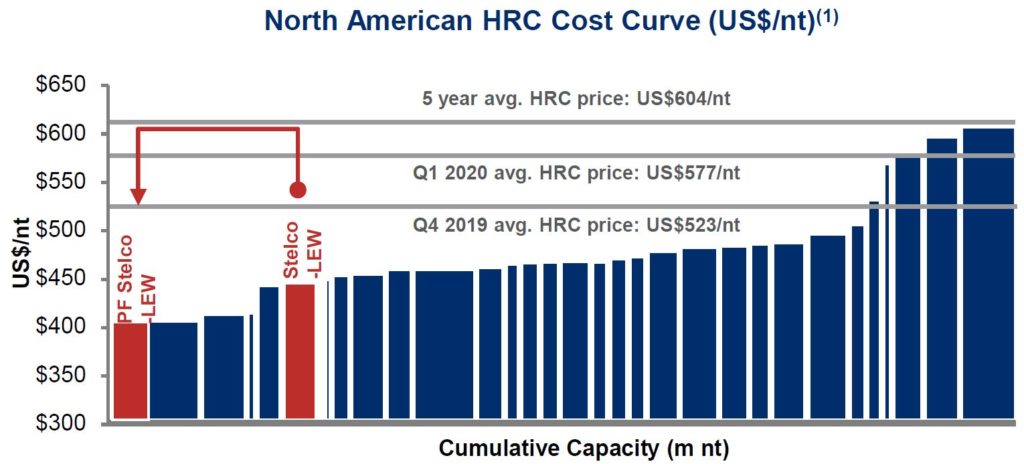

Owing to its most recent emergence from bankruptcy in 2017, Stelco is now one of the leanest, most cost–efficient steelmaking operations in North America. Its Lake Erie Works (LEW) facility, built in 1980, is one of the newest in North America. As well, the company has completed several new investments, such as a blast furnace reline at LEW, to improve its cost structure and output, as well as a re-purposed dock to improve logistics.

With its major investments complete, Stelco anticipates producing steel products at US$400/T as can be seen in the chart above. Spot market prices are north of US$700/T currently and expected to tail off towards US$600/T in late 2021. While the strong steel markets are a clear tailwind, even at US$600/T, we estimate upwards of C$400-500M in EBITDA for Stelco. This is significantly above most investment broker estimates of C$275M for 2021.

Stelco also benefits from a very clean balance sheet. Pension liabilities that have plagued old-school manufacturers have been restructured and the company now has very manageable pension obligations. The company has historically paid special dividends when cash flow exceeds its requirements, and we expect it may resume the practice in 2021.

Finally, Stelco has approximately 500 acres of adjacent land that management believes is suitable for industrial development. Industrial real estate in Hamilton is in short supply due to increased demand from e-commerce activity, film production studios and datacenters. Management believes the land could be worth upwards of C$500m.

We believe Stelco could trade upwards of $30 per share as its financial results benefit from its new investments and the steel market rebounds. We hold a 2% target weighting in the Global Equity Growth Fund.

This Focus Stock is written by our Head of Research, Jamie Murray.

The purpose of this is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.