New Year. New MWG.

Happy New Year!

With each new year comes the opportunity to reflect on the months just past, as well as prepare for the year ahead.

Our aim in 2020 is to build upon our successes over the last year and drive further growth of the Murray Wealth Group, while continuing to provide you with the same level of transparency and insight we have always brought. We’re excited about the many new opportunities that await us in 2020, and we look forward to sharing those with you as they come to fruition.

Thoughts on the Market: December Edition

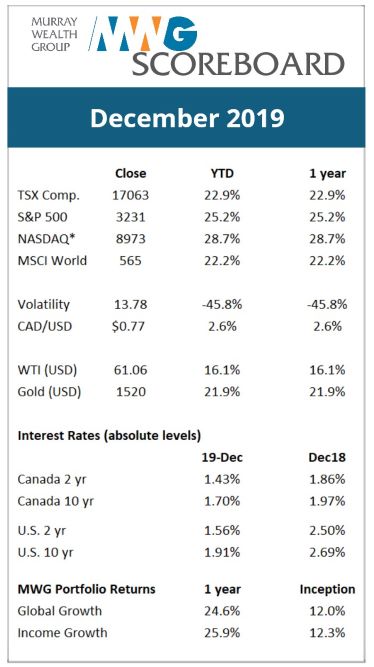

Let’s start off by re-visiting our forecasts from a year ago, following the 9% fall in the S&P 500 in December 2018. Our call at the time was for a 7% gain in markets based on 7% profit growth. There is a very strong correlation long term between profit growth and stock appreciation. What we got instead was a more robust 20-25% appreciation in major markets.

For 2020, profit growth is expected to be muted, with just 3% growth forecasted by market prognosticators. We believe this number to be low and expect earnings growth of over 5%. Logic would lead us to expect 5% market returns plus dividends, which would provide investors with a respectable 7-8% total return.

However, short term, markets do not move on logic or formulas, but rather on the flow of money in and out of assets as well as the emotional response of investors to news events. ETFs have been a major driver of funds flow, as have financial advisers, who often espouse the traditional 60/40 equity/bond allocation for clients approaching retirement. Traditionally, bonds go up when stocks go down, providing a margin of safety. However, events of the past decade have pushed rates extremely low and even negative in some cases. Therefore, we caution long-term bondholders about the concept of duration (more simply, the sensitivity of a bond’s price to changes in interest rates). Long-term Government bonds have the highest duration, which aides returns when interest rates fall, but hampers returns when they rise. Depending on the catalyst (perhaps inflation or a slowing in Central Bank bond purchases), a negative re-rating of fixed income assets is possible and even likely in a strengthening economy, which fuels wage growth and thus inflation.

The U.S. Federal Reserve has continued to support the repo lending market with massive amounts of liquidity. The repo market is an overnight lending market between bank dealers to help meet short term liquidity needs. As global regulators imposed increasingly more capital requirements on banks, lenders have been unable or unwilling to supply the necessary liquidity to the market. As a result, the Fed’s balance sheet has grown by about $400B and will likely continue expanding until an exit plan that leaves the market functioning normally is found (April at the earliest). It’s possible that we will see a correction in the market when the Fed’s liquidity is removed.

As we enter year 12 of the current bull market, we continue to expect leadership from the technology and medical sectors. Our Global Growth portfolio is backstopped by large positions in these industries, with a collection of strong consumer discretionary and financial services companies providing some cyclical leverage. We believe the current technology cycle will be durable in length given the strong cash flow, expanding use cases and dominant market positions these firms have built. Internet technology continues to provide tremendous distribution leverage as software or products can reach billions of users cheaply at scale and provide tremendous value to users. However, as the roots of technology continue to deepen in society, the ability of these companies to generate positive cash flow will come more into focus and thus, is a focus of companies we own in our portfolios.

December Summary.

Markets continued to climb to all-time highs in December. When adjusting for Canadian currency changes, the S&P 500 gained 0.7% and the NASDAQ Composite rose 1.2% in the month. For the year, the indices returned 25% and 29%, respectively.

The TSX returns were less impressive gaining 0.4% for the month and returned 22.9% in 2019.

The Canadian Dollar rose 5% in the year versus the $USD, causing a drag on the performance of U.S. and International equities for Canadian investors.

**Scoreboard Performance presented are Total Returns in CAD, unless otherwise noted.

*NASDAQ Performance presented are Price Returns in CAD.

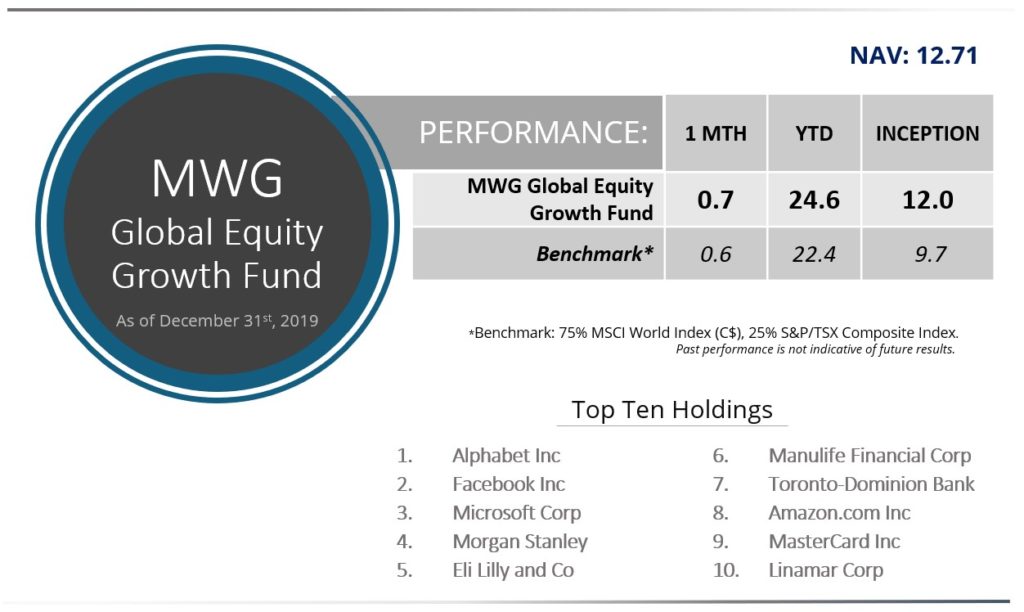

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund rose 0.7 % in the month and returned 24.6% in 2019. We made no adjustments to our target model portfolio in December.

The three top performers in the fund over the month were Eli Lilly (+12%), Royal Caribbean Cruises (+10%) and Linamar (+10%).

The bottom three performers were Cameco (-5%), TD Bank (-5%) and Gilead (-2%).

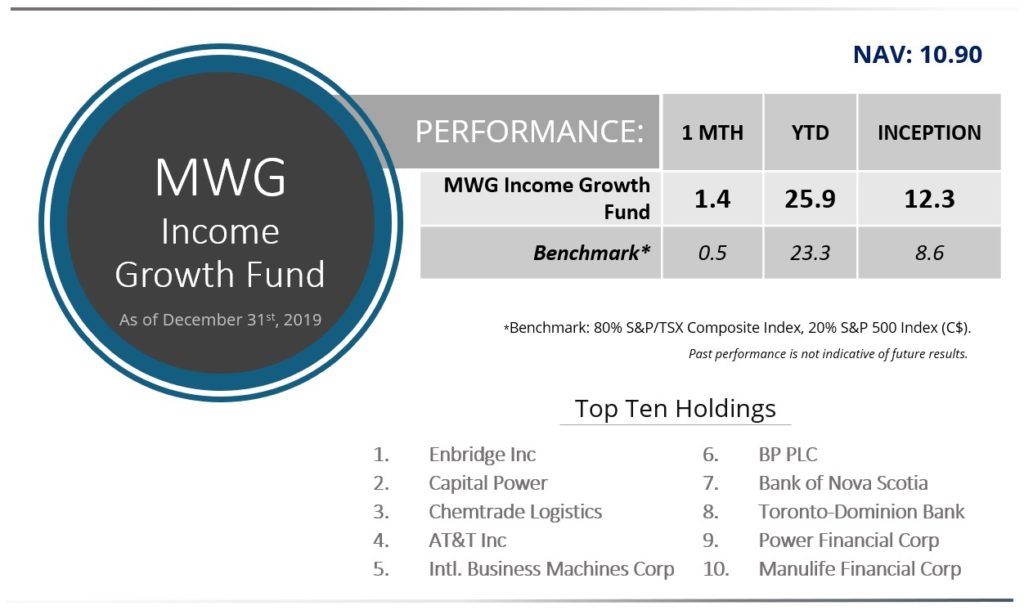

INCOME GROWTH FUND

The MWG Income Growth Fund rose 1.4% last month and returned 25.9% for the year. On the last trading day of November, we purchased a 1% weighting in Cineplex. The shares were the top performer in the Fund, rising 36% after the company received an all-cash takeover offer from Cineworld at $34 per share. We will hold the shares through February on the possibility of a competing bid. Regardless of whether another bid emerges, we will receive dividends through that month. We also raised our target weighting on Capital Power and Intertape Polymer.

To fund our purchases, we sold our position in Automotive Properties REIT as the REIT market appeared fairly frothy and the shares approached our target price. Longer term, we have concerns around auto dealerships despite currently strong profitability. We also sold just under 20% of our large Power Financial holding to re-balance our position when the shares rallied on a proposed re-organization.