I recently visited with several public and private companies in the Seattle/San Francisco area with a view towards gaining further insight into the future of the auto industry. Major structural changes are expected to occur, with advances in electrification, autonomous vehicles and ridesharing all playing a key role in shaping the future. There were several interesting takeaways from the trip that have huge investment implications for both incumbents and the disruptors.

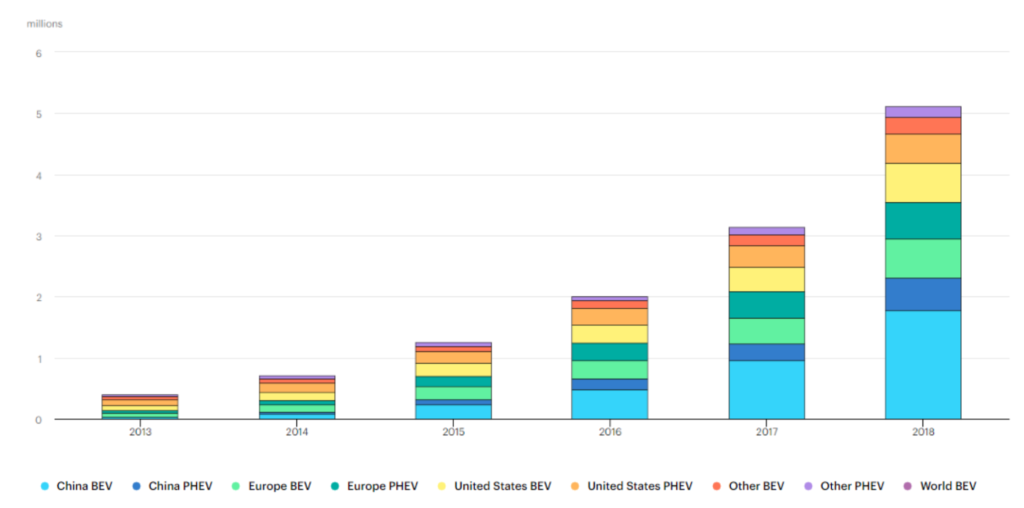

A Wave of electrification is coming… and probably can’t be stopped. Over the next three years, almost every major auto OEM (Original Equipment Manufacturer such as Ford, Volkswagen, Tesla, etc.) will be launching a suite of electric vehicles (EVs) and some of them look pretty cool. Client satisfaction for EVs is high; there are no more stops for gas, a quieter ride, high performance, less maintenance (goodbye oil changes) and they are environmentally friendly. In some jurisdictions, regulation will force the change. Figure 1 highlights the growth of EV sales globally. Including Plug-in Hybrids, sales of EVs increased 60% in 2018. If demand follows a traditional s-curve, we would expect the growth rate to accelerate as adoption grows.

Figure 1: Global EV/PHEV Deployments

The pushback from sceptics remains the same; range is insufficient, upfront costs are too expensive, charging takes too long and the technology is unreliable. Case in point, Mercedes is delaying its EV launch following low sales of Jaguar and Audi.

So…what leads to our conviction that we are closing in on a turning point. In a word, cost. We are getting closer to a lifecycle breakeven for EVs versus Internal Combustion Engines (ICE). Battery technology remains the limiting factor in EV economics. Batteries are expensive, representing about half the cost of an EV. However, the cost of a lithium-ion battery has fallen 50% in the last three years and we likely will see enough cost reduction, given the amount of capital being invested across the industry, to push economics in favour of EVs versus ICEs. EVs also benefit from much longer lives (estimates of 300-400k KM) and higher residual values as the batteries are projected to have 20 year lifespans. Visits to local dealers also indicate that EV sales and repair training has just started to roll out.

EV adoption presents challenges for traditional auto sector. We do not have a position in Tesla as we have been critical of its poor corporate governance and weak manufacturing performance. However, the automaker has one important skillset that is well ahead of traditional OEMs, and that is software. As companies look towards increased autonomous driving capabilities, data will be king. Love them or hate them, Tesla has essentially forced its customers to subsidize a mobile data aggregator that collects vehicle performance, camera views, mapping and autopilot data. This data is then uploaded to its cloud datacenters when the vehicles are plugged in and connected to Wi-Fi at night (EV’s access to power and powerful battery are ideal for mobile compute).

This ability to process data and rethink the sector from a fresh perspective is undoubtedly Tesla’s greatest asset. To catch up, other automakers must now move engineering teams from a manufacturing knowledge base to a software knowledge base. Most OEMs have started the catch-up process by partnering or outsourcing their data collection to 3rd party firms. But in a race where falling behind would prove costly, OEM’s will need to find new ways to differentiate their products to compete.

Autonomous Driving is a 2030 story. While companies are investing billions of dollars in Autonomous and Driver Assisted (ADAS) technology to reach full Level 5 autonomy, the utopian vision of driverless robo-taxis summoned on command, is not in the cards for the upcoming decade. A more likely scenario is Level 4 autonomy, driverless vehicles in tightly controlled geo-fenced environments for specific use cases and more limited events. See this short primer on ADAS Levels for more details.

The graphic below, courtesy of Morgan Stanley’s auto team (Figure 2), highlights the vast number of players trying to solve the ADAS riddle. By all accounts, Waymo is the leader in technology and total miles driven, and with Alphabet’s US$100B balance sheet behind it, has the funds to maintain that lead. Many experts also agree that traditional OEMs can catch up by installing the necessary equipment to capture data from their existing passenger sales network fleet. As well, ridesharing companies Uber and Lyft sit at the other end of the spectrum, with large software development teams ready to optimize the logistics of transportation, believing the equipment to facilitate this will be commoditized. As more data is captured through mapping, camera imaging, LiDAR (Light detection and ranging) and internal vehicle performance, the industry should continue to make advances towards full automation.

Figure 2: Licenses Granted for California Autonomous Vehicles

Putting it all together – what this means for the incumbents. Silicon Valley companies have a clear picture of the “Gig Economy” future of transportation. They envision autonomously-operated Electric Vehicles producing a massive amount of data delivered over 5G networks to improve safety, traffic and energy efficiency.

EVs make sense for ridesharing fleets given that the operating cost per mile advantage can more quickly offset the higher upfront cost. As well, as Uber and Lyft try to look for relative advantages in a commoditized product, it seems natural they will shift to greener alternatives to entice Gen Z and millennials to choose their service. And while that vision of a “Gig Economy” may ultimately becomes reality, traditional OEMs still have an opportunity to maintain their share of the market. PSA Peugot CEO Carlos Tavares recently indicated that electrification may be a tailwind for long– term profitability as EV components have more duplication over an automaker’s fleet as opposed to ICE components, which are platform specific (put another way a Nissan Versa and Murano will share more components if both powered by battery). Almost all OEMs are positioning for an ADAS/EV future and are partnering with a wide array of technology firms to bring in expertise and additional capital. And finally, automakers realize the repercussions of a failure to adapt to a new market. The risks of falling behind are strong; current pressures facing auto manufacturers are tougher environmental and carbon laws, shareholder governance demands and obsolete technology.

How we invest in the sector. With a wide range of outcomes possible, we believe it is prudent to maintain exposure to the opportunity created by structural change while investing in companies that can profitability operate and invest through the process.

Alphabet (GOOG.Q). Google’s parent company is the leader in autonomous driving capability, with a full-scale test program outside Phoenix, Arizona. Waymo has partnered with Lyft and Fiat Chrysler to pilot the program, which can likely utilize its Waze and Google Maps apps in the future. Waymo remains focused on the data and software side of autonomous driving, utilizing 3rd party hardware to run its test program. In September, Morgan Stanley valued Waymo at US$20B, but noted it could be worth 5x that if autonomous driving and ridesharing can be proven out.

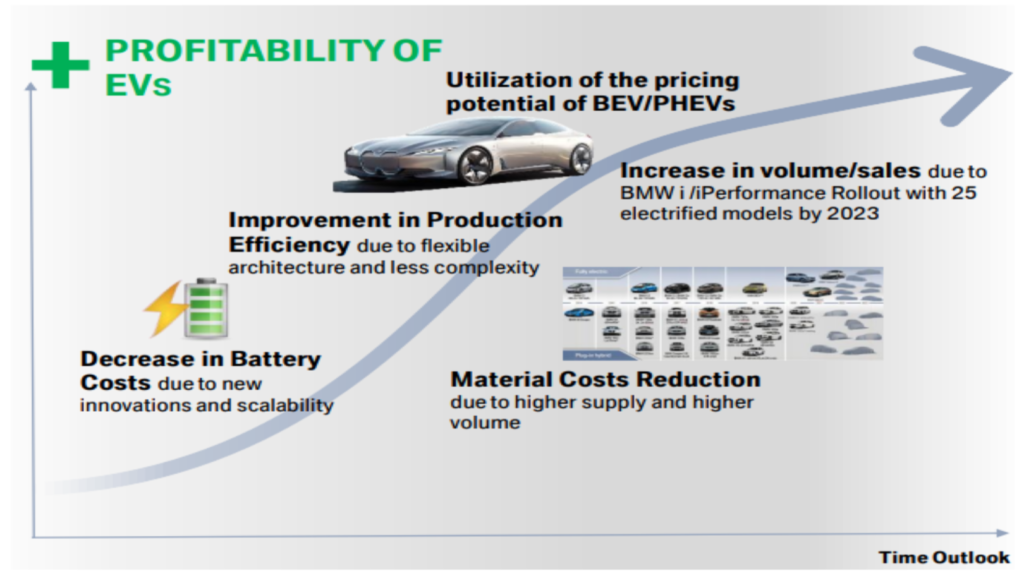

BMW (BMWYY.N). BMW, a luxury automaker with improving cash flow and at a peak level of investment in electrification, trades at an 8x P/E multiple. As indicated above, as scale builds in EV production, larger OEMs may see profitability increase with a simpler powertrain structure and decline in investment commitments. The company is already a leader in hybrid car sales and can leverage this platform into its EV battery production at scale.

Figure 3. BMW Groupe EV Presentation

Linamar (LNR.TO). Linamar is a Canadian manufacturer of auto components, industrial lifts and booms and agriculture equipment. The company is diversifying away from ICE components via acquisition and major new business wins in EV powertrain components. The company trades at 7x earnings, has a strong balance sheet and a free cash flow yield of 12%.