Ante Up!

Trade and tariff concerns escalated in early August as the Trump Administration raised the stakes with a new round of tariffs on Chinese goods and an escalation of existing tariffs. To date, the tariffs have had a limited effect on U.S. consumers as the U.S. has focused tariffs on products that are easily substitutable, with multiple origin destinations, and products that are isolated from the U.S. consumer. However, the new tariffs announced in early August will impact consumer-related goods such as apparel and electronics. Although the U.S. pushed back the implementation of the new tariffs after the initial announcement, it represents an escalation in the trade war between the two countries.

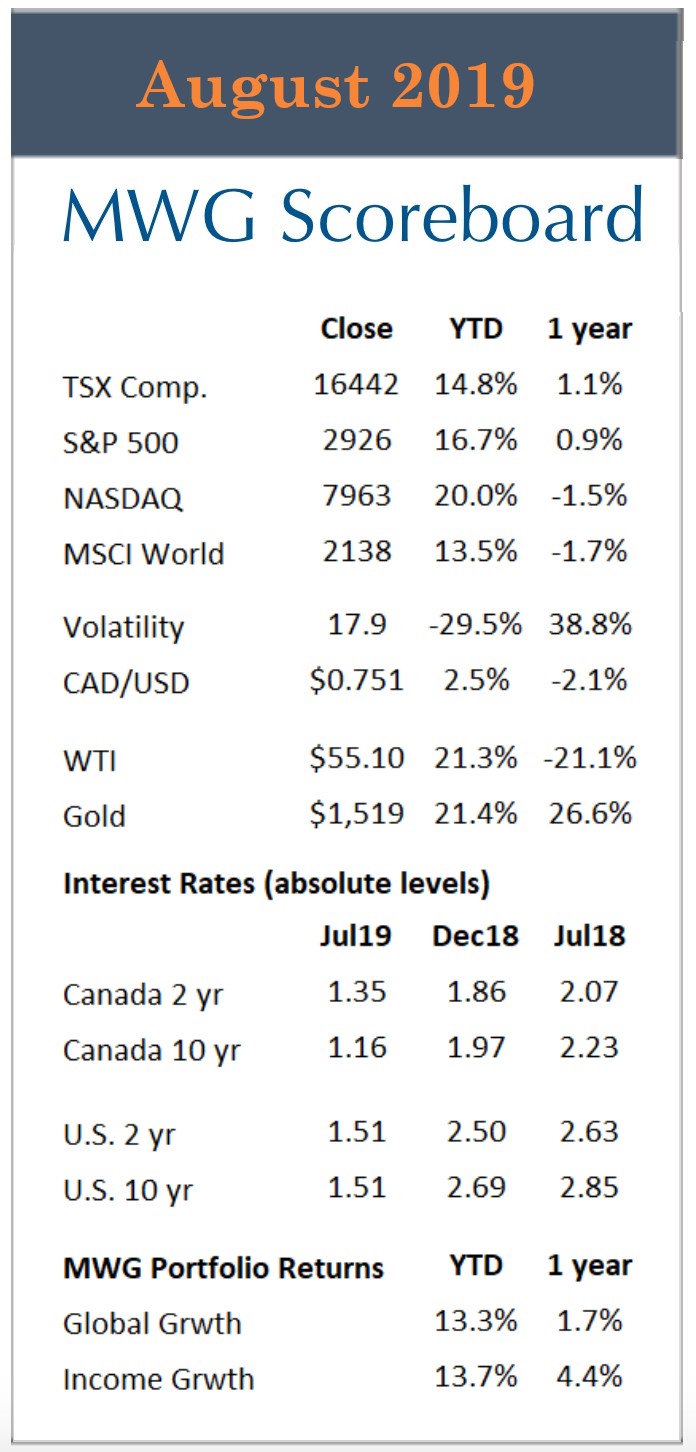

In our view, the macro risks are well reflected in the data we review. The Volatility Index remains elevated, but not out of historical range. Bond yields and interest rates have been pushed lower, indicating that the market expects the Federal Reserve to lower rates in the face of a slowdown in growth. Calls for a recession have increased as the U.S. yield curve has inverted, with the yield on 10-year Treasuries trading below the yield on 2-year Treasuries. There is still some debate about the relationship between the stock market, the bond market and the economy. Recessions tend to follow a decline in long-term yields, while the Fed Funds Rate dictates the short end of the yield curve. Currently, there are US$17 trillion of global assets generating negative yields. There is undoubtedly a significant flow of funds chasing positive yields in the U.S. and this potentially explains the strong move lower in rates. Counterbalancing these risks is increasingly accommodative monetary policy and the fact that the year-over-year comparisons are with a U.S. economy that was benefitting from the Trump tax cuts and, therefore, likely performing above-trend.

In our view, the macro risks are well reflected in the data we review. The Volatility Index remains elevated, but not out of historical range. Bond yields and interest rates have been pushed lower, indicating that the market expects the Federal Reserve to lower rates in the face of a slowdown in growth. Calls for a recession have increased as the U.S. yield curve has inverted, with the yield on 10-year Treasuries trading below the yield on 2-year Treasuries. There is still some debate about the relationship between the stock market, the bond market and the economy. Recessions tend to follow a decline in long-term yields, while the Fed Funds Rate dictates the short end of the yield curve. Currently, there are US$17 trillion of global assets generating negative yields. There is undoubtedly a significant flow of funds chasing positive yields in the U.S. and this potentially explains the strong move lower in rates. Counterbalancing these risks is increasingly accommodative monetary policy and the fact that the year-over-year comparisons are with a U.S. economy that was benefitting from the Trump tax cuts and, therefore, likely performing above-trend.

Even data regarding confidence remains inconclusive. CEO/CFO confidence in the economy is low, with expectations of a likely recession. On the other hand, consumer confidence indicates that current-day conditions are good (the percentage of consumers indicating that current-day conditions are good increased to 42% in August from 39% in July, while only 10% described business conditions as ‘bad’ versus 11% the prior month). Effectively, consumer data is paradoxical, with economic expectations remaining low at the same time that their read of current conditions is improving.

After an initial decline following the escalation in the trade war (the market was close to its all-time high before the move down), the S&P 500 was range bound for most of August, trading between 2,840 and 2,925. The Index ended the month down 2.0% while the TSX managed to eke out a positive gain (0.2%).

Global Growth Fund

The MWG Global Growth Fund ended the month down 1.9% and has now returned 13.3% year to date. We made several changes to the portfolio during the month, including initiating a 2.5% weighting in IBM. IBM is a controversial company and thus we would like to provide some insight into why we believe the company will be a winner.

The MWG Global Growth Fund ended the month down 1.9% and has now returned 13.3% year to date. We made several changes to the portfolio during the month, including initiating a 2.5% weighting in IBM. IBM is a controversial company and thus we would like to provide some insight into why we believe the company will be a winner.

First of all, a bit of history. IBM has been a massive underperformer for the past decade. With the tech sector continuing to increase its share of GDP, IBM (after several strategic missteps) has been left behind in several categories it should be leading (such as AI and analytics). Its share price has fallen 40% from its peak in 2013. It is widely considered to have a culture problem, whether this was borne out of its lagging technology or the cause of it.

So why did we invest in IBM?

Cloud Phase 2 – IBM services the on-premise server business of many large companies in the banking and healthcare sectors as well as other mature industries. To date, companies with sensitive data have been hesitant to move data stored on their in-house servers to the cloud. As stewards of the data, it would be very difficult for a bank to explain that a data breach was caused by a 3rd party cloud company. However, as the economic benefits of cloud computing continue to build, it is likely that these companies will partner with IBM to assist in their cloud transition. To augment this transition, IBM acquired Red Hat (the deal closed in late July 2019). Red Hat is a leading provider of open source container software that helps companies manage software across multiple server infrastructure. Although full price was paid, IBM will be able to leverage Red Hat over its entire product lineup. As well, Red Hat superstar CEO James Whitehurst will remain with IBM as Senior Vice President of the company and CEO of Red Hat and is widely viewed as a likely replacement for current CEO Ginny Rometty when she retires.

Margin improvement – IBM has taken steps to reduce its exposure to low margin businesses and contracts, and this strategy has already played out positively in its financial results. In Q2, IBM’s gross profit margin rose 100 basis points to 47.4%, year over year, resulting in the company beating Q2 profit expectations. While revenue trends have been weak due to the expiration of these business contracts, we expect revenue growth to improve in subsequent quarters.

Valuation/Expectations – As noted, expectations for IBM could not be much lower. The shares trade at an extremely depressed valuation (P/E of 10x versus the industry, and while we do not expect multiples to approach peer levels (due to differences in growth rates and debt levels), even a 2-3 turn in multiple expansion would provide strong returns. If the company can deliver on its growth objectives, we believe the shares could trade at a 15x P/E multiple, equating to a US$179 target price.

PFE. We also re-initiated a position in Pfizer after the shares fell precipitously on second-quarter results. The company also entered into an arrangement with Mylan to merge its Upjohn division with Mylan, which will be spun out of Pfizer shares in mid-2020. Mylan is widely considered to be one of the worst governed companies and had a series of operational miscues in 2019, leading to the company trading at a significant multiple discount. There is upside if Upjohn management, which will manage the company, can improve culture and governance prior to the spinout (PFE shareholders will receive shares in the new enterprise). The remaining assets in Pfizer represent its higher growth drug assets and thus should command a premium valuation. At US$35 (our purchase price), we believe risk-reward skews favourable.

To fund our purchases, we fully exited our positions in Apple (AAPL), Astra-Zeneca (AZN) and Pivotal Software (PVTL).

We exited our 2.0% Apple position as we saw continued concerns regarding trade with China as a key risk, increasing expectations for service revenue and a strong iPhone cycle. With an 18x P/E and low-profit growth, we believe there is a better upside in IBM.

We sold Astra-Zeneca (2%) as the company rallied on strong Q2 results and preferred Pfizer after the sell-off.

Pivotal, a recent portfolio addition, was sold after it received a buyout offer from VMware on Aug 14th. We do not expect any other bids to emerge.

Income Growth Fund

The MWG Income Growth Fund ended the month down 3.0% and has now returned 13.7% year to date. Much of the underperformance was driven by two positions: Medical Facilities and Tapestry. We reduced our target weightings in both companies as the concerns are company-specific and we will need to see signs of improved execution before we look to add additional capital to the names.

The MWG Income Growth Fund ended the month down 3.0% and has now returned 13.7% year to date. Much of the underperformance was driven by two positions: Medical Facilities and Tapestry. We reduced our target weightings in both companies as the concerns are company-specific and we will need to see signs of improved execution before we look to add additional capital to the names.

Medical Facilities (a company that partners with doctors to operate health care facilities) has had cash flow issues for the past two quarters, which the company is blaming on transient doctor moves and payer mix (Government versus private insurers which pay different rates). Its dividend has been maintained, but it will need to improve its cash flow in subsequent quarters to continue to pay dividends at its current rate.

Tapestry’s dividend and balance sheet remains strong; however, the company has been unable to execute on growth ambitions in its recently acquired Kate Spade brand. The company has brought in a new CEO and we remain optimistic that a turnaround can be implemented as the Kate Spade brand perception remains healthy. There is a tremendous upside if it can normalize growth and margins.