Icarus Complex.

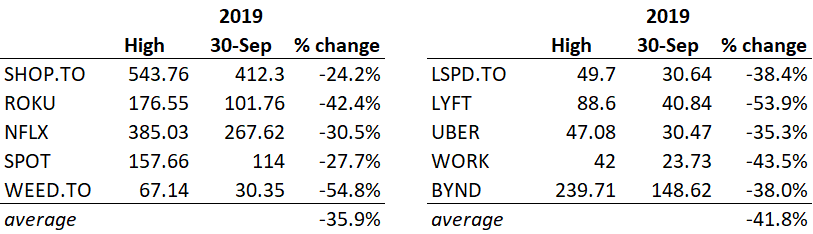

September brought a major rotation in equity markets, with growth stocks suffering substantial pullbacks from peak levels and out-of-favour value stocks rallying. Generally, the more profitable growth companies were able to withstand the volatile markets, but several high-profile growth-at-any-cost stocks (See Figure 1) suffered peak-to-trough pullbacks of 35-40%. With year-to-date gains still strong, long-term investors in high growth stocks are likely barely batting an eye, but the strong IPO slate in the first half of 2019 likely brought an influx of investor interest and new money into the sector.

Figure 1: Select high growth equities trading levels

What caused the pullback in high growth stocks? Many of these companies have had Teflon-like performance through sell-offs, trade tensions and Presidential tweets. Ultimately, it became a case of valuation not mattering….until it did. Most of these companies remain unprofitable and thus were valued on multiples of their sales. When Mr. Market decides these valuations are too high…watch out below.

We believe free cash flow generation is essential for a company, and thus, it is a primary evaluation tool for our investments. For companies that are not currently generating free cash flow, we must understand their path to doing so in order to invest. Netflix is a good example of this. Netflix currently burns through US$3 billion annually. However, this is a strategic effort to build its moat, an increasingly larger content library with enough new titles to retain current subscribers. As its subscriber count grows, it can leverage its content over a larger base. At some point, its content spend will moderate and enough new users will be attracted to the platform to not only cover its content budget but generate free cash flow. This is even before considering potential new revenue lines, such as video games, virtual reality, advertising, and product marketing. And for all the concerns about competition, we conducted a very simple poll of 87 mainly millennial Canadian Netflix subscribers and asked them if they were planning to cancel their Netflix account in the next 12 months. Of those surveyed, 91% indicated they would maintain their Netflix account, a churn rate consistent with 2018 estimates provided by this FT Alphaville article. Assuming that the Netflix model is not broken (we believe it solid and the emergence of major media players going all-in on streaming is validation of the concept), it should reach breakeven in 2022, with cash flow growing from that point on.

We believe free cash flow generation is essential for a company, and thus, it is a primary evaluation tool for our investments. For companies that are not currently generating free cash flow, we must understand their path to doing so in order to invest. Netflix is a good example of this. Netflix currently burns through US$3 billion annually. However, this is a strategic effort to build its moat, an increasingly larger content library with enough new titles to retain current subscribers. As its subscriber count grows, it can leverage its content over a larger base. At some point, its content spend will moderate and enough new users will be attracted to the platform to not only cover its content budget but generate free cash flow. This is even before considering potential new revenue lines, such as video games, virtual reality, advertising, and product marketing. And for all the concerns about competition, we conducted a very simple poll of 87 mainly millennial Canadian Netflix subscribers and asked them if they were planning to cancel their Netflix account in the next 12 months. Of those surveyed, 91% indicated they would maintain their Netflix account, a churn rate consistent with 2018 estimates provided by this FT Alphaville article. Assuming that the Netflix model is not broken (we believe it solid and the emergence of major media players going all-in on streaming is validation of the concept), it should reach breakeven in 2022, with cash flow growing from that point on.

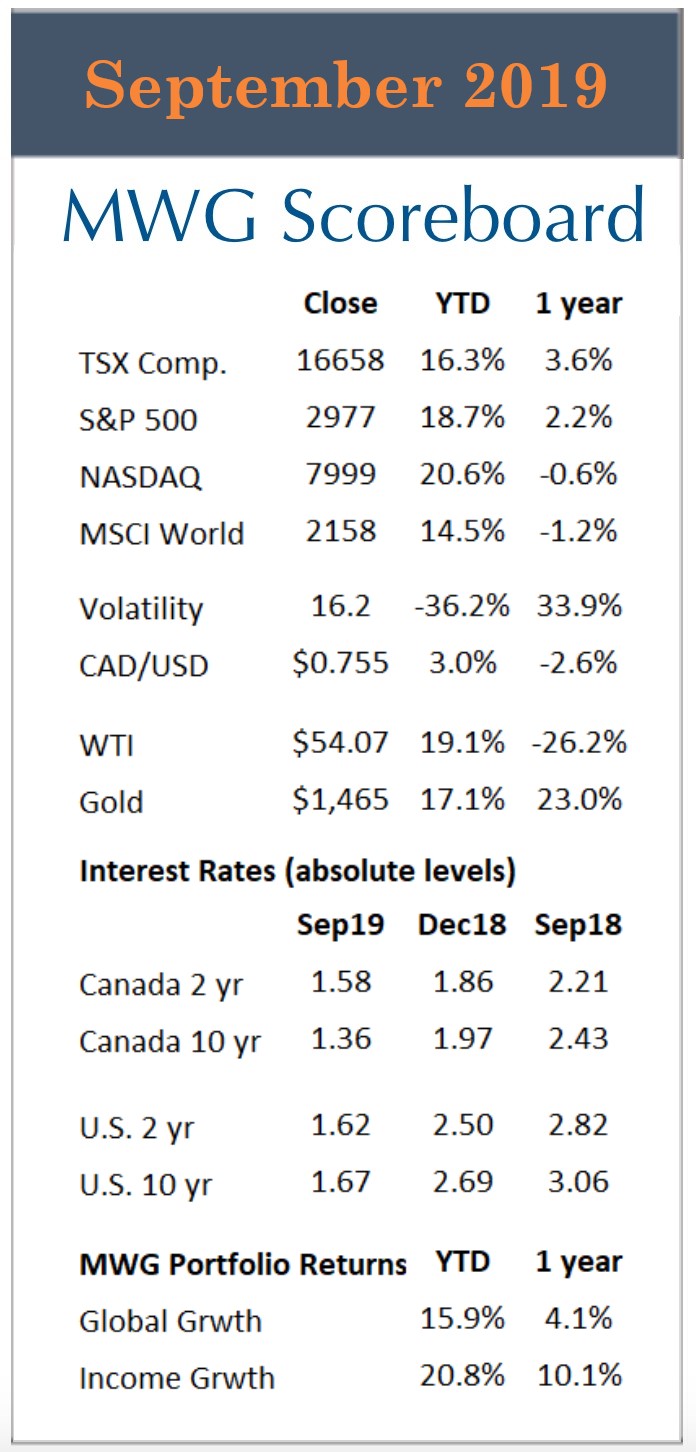

Market Summary. The S&P 500 and NASDAQ Composite Indices rose 1.7% and 0.4% in September, adding to year-to-date gains of 18.7% and 20.6%. One-year returns, at 2.1% and a negative 0.5%, are much less impressive as they lap the start of the October 2018 sell-off.

In Canada, the TSX returned 1.3% in the month, reaching an all-time high in mid-month, and is currently up 16.3% on the year. A mid-month rally in the energy sector stalled out when oil prices sold off.

MWG Global Equity Growth Fund

The MWG Global Growth Fund rose 2.1% in the month and has now returned 15.9% year to date. We did not make any active changes to the portfolio.

During the month, our top-performing stocks were generally those that had been our worst performers on the year, with names such as Tapestry and Newell Brands rising 21% and 13%, respectively. Nike, already a good performer, rose 11% to a 52-week high on strong financial results. On the negative side, Stelco shares (-20%) were weak as the steel sector was impacted by profit warnings from U.S. steel producers. As discussed, Netflix (-8%) was sold down with other high growth technology stocks. The healthcare sector was also impacted by political sentiment as Democratic party front runners indicated a willingness to shift more costs from the public to health care companies through new legislation.

MWG Income Growth Fund

The MWG Income Growth Fund rose 6.2% in the month and has now returned 20.8% year to date. The Fund is currently yielding 6.5%.

The MWG Income Growth Fund rose 6.2% in the month and has now returned 20.8% year to date. The Fund is currently yielding 6.5%.

Tapestry and Newell Brands (discussed above) were two of the primary contributors to performance, in addition to the REIT sector, which continued its strong performance on the year. We added one new name in the REIT space, purchasing units of True North REIT, a small office-focused REIT with a 9% yield. The company operates throughout Canada with exposure to the office market and a strong focus on government and credit-rated companies. We acquired the units in a public offering for $6.60.