Thoughts on the Market: January Edition

2022 Market Outlook

Written by Jamie Murray, CFA

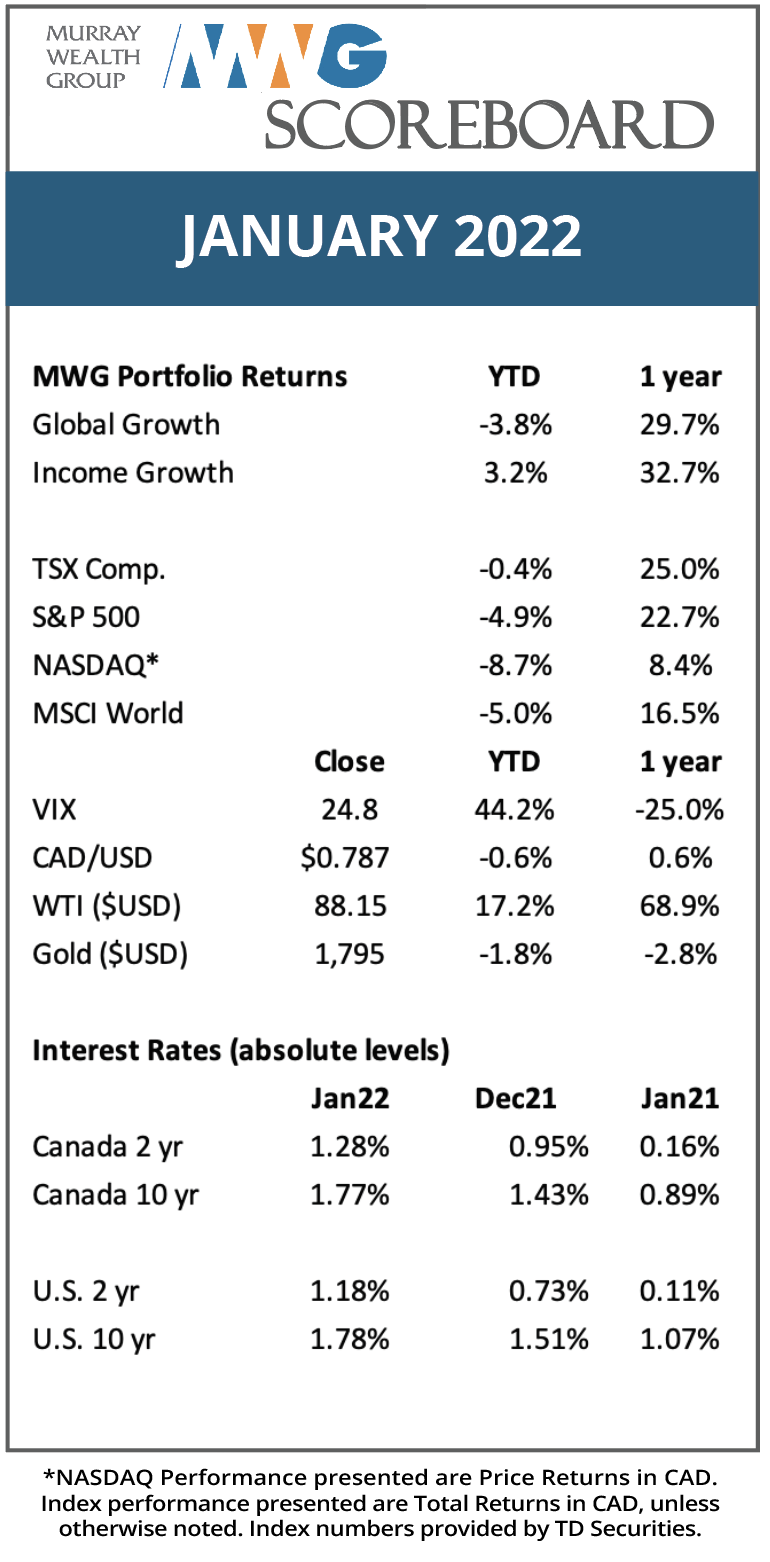

Following a busy January around MWG headquarters (and several rewrites), we present our 2022 outlook in conjunction with our January Portfolio Update. January 2022 was the month “Buy the Dip” died; it was a strategy that had worked endlessly for three years save for the COVID-induced drawdown in March 2020. Both selloffs penetrated the negative 10% levels. Equities did recover off their lowest levels, thanks to two strong days back-to-back to close out the month. Bonds also fell in January, with a 4% fall in the 20-year Bond ETF. There were few hiding spots beyond value stocks.

For the first time since 2014, technology companies are leading the market lower while oil and gas companies are hitting five-year highs. The culprit is the U.S. Federal Reserve, which is intent on raising interest rates and slowing down its bond-buying program. It was the expected pace of increase that caught the market off guard, with five rate hikes now expected in 2022. The Federal Reserve is responding to persistent inflation that has been driven by supply shortages and escalating commodity prices. We believe the Fed will be successful in reducing inflation and that this sell-off will prove to be a typical market tantrum. Whether the duration lasts three weeks or three months is unknown, but we do not believe this to be a cataclysmic event that will derail market performance long term. Following three years of strong outperformance, we expect tempered equity market gains in the range of 5% in 2022.

Technology: Is this the bubble popping?

Let us be clear upfront. The largest and leading technology companies of today are much different from the leaders of 2000. An interesting way to frame the technology bubble of 2000 is that there were two separate bubbles, a networking/telecom bubble and a dot-com bubble.

The networking leaders in 2000 were tech titans (think Nortel, Cisco or Qualcomm) with hardware-driven sales (mostly commodity products) and debt-financed balance sheets. In 2001, networking spending slowed with a steep sales cliff when demand fell (similar to what Peloton is experiencing in today’s market). We do not believe sales at any of the mega-cap technology stocks are at risk of declining. Rather, we believe sales growth should continue to be robust in 2022.

The dot-com bubble was also associated with the expansion of the World Wide Web. The famous companies like pets.com that disappeared spent aggressively on marketing with investor-financed capital that eventually dried up and had to pause spending on banner ads on yahoo.com to drive traffic to their websites. We believe there was general skepticism from institutional investors towards the ludicrous valuations of the new-age internet companies, not unlike the recent SPAC boom where companies with no revenue and, in some cases, no product traded at multi-billion dollar valuations. The decline in SPACs actually began in February 2021, with shares of numerous technology companies peaking in that time period.

Figure 1: IPOX SPAC Index

Source: Refinitiv

The second indicator that air is being let out is recent price action in cryptocurrencies. According to Bloomberg, the decline in cryptocurrency prices has wiped out $1 trillion of paper value. While the adoption of cryptocurrencies by institutional investors and venture capitalists has accelerated, their use cases remain limited and fraudulent behaviour remains rampant.

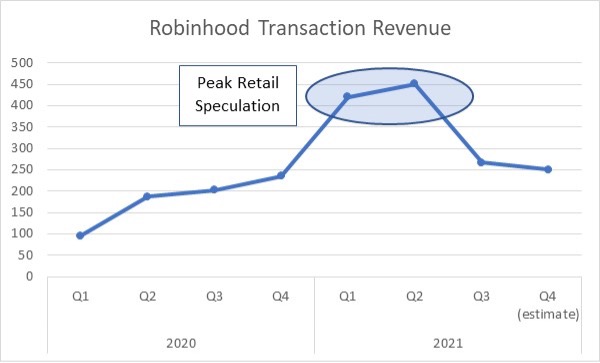

Retail investor withdrawal

Another parallel to the 2000 dot-com bubble is retail investor interest. Robinhood, the retail brokerage that harkens the mantra, “steal from the rich, give to the poor,” and rallied a younger generation of investors with free trading commissions, went public in the second quarter of 2021. Much can be gleaned about retail investor trading levels by using Robinhood’s transaction-based revenue line. It’s clear the retail investor has retreated given the fall in transaction-based revenue, a trend that seems likely to accelerate over the first half of 2022.

Figure 2: Robinhood Transaction Revenue

Source: Company Reports

Enterprise cloud future bright

Enterprise cloud continues to accelerate. Spending data has confirmed a reversion back to in-person shopping, negatively affecting shares of eCommerce companies from Amazon to Zalando. Enterprise cloud spending, however, continues to accelerate, as indicated by fourth-quarter results from cloud leaders Microsoft and Service Now. It is clear that businesses are still in the early middle innings of their cloud transition, and decisions to accelerate cloud development in 2020 are just coming into spending plans. We believe this subsector of technology will power through any broad-based slowdowns.

COVID economic factors normalize in 2022.

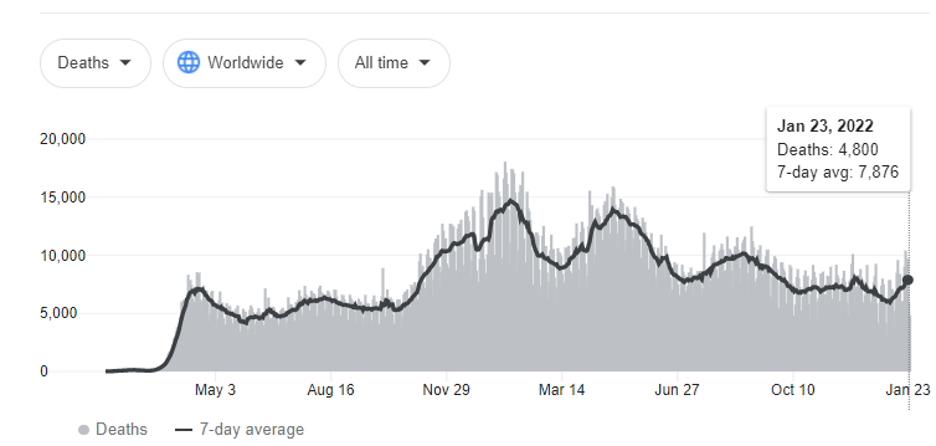

There is a consensus viewpoint that can be best evidenced by the large fall in share prices of COVID beneficiaries such as Zoom, Peloton and Moderna, which are all down 70-80% from 52-week highs. It is certainly possible that a new variant will emerge, but we believe there are several indicators that suggest future outbreaks will be less severe. Obviously, global vaccination rates are much higher in 2022 than they were in 2021, and herd immunity appears higher after the recent omicron wave. Therapeutics and treatments for COVID have also improved tremendously as evidenced by declining population death rates. Finally, we believe there is a large segment of the population with lockdown fatigue that is planning a normalization of their social activity barring the emergence of a dangerous variant.

The effects of normalization should play out through a shift in consumer spending towards travel and services, improved labour availability and improved supply chains. We believe the market is taking more of a wait-and-see approach towards these three shifts, which presents an opportunity for outperformance if they play out as we expect.

Figure 3: Global daily COVID-19 deaths peaked in first half of 2021.

Source: Google

Inflation, interest rates and Valuation.

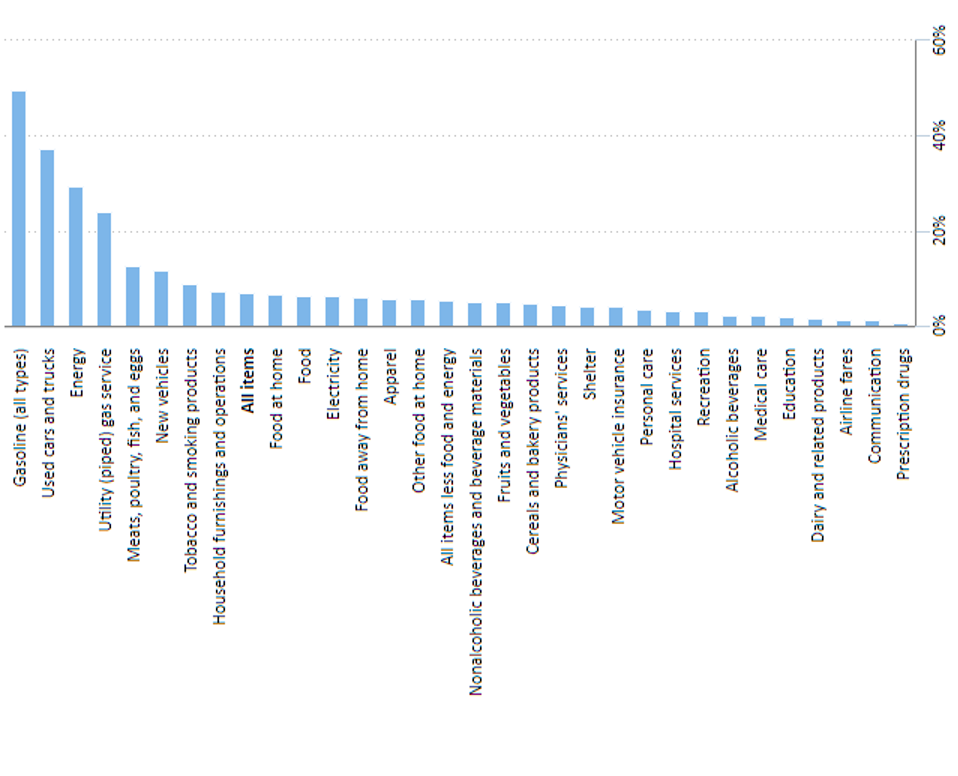

We believe it is necessary to address all three topics in unison, given their interdependence. Inflation expectations drive interest rates that, in turn, form the baseline for valuations. Strong inflation readings in November and December spooked the markets and prompted a more aggressive interest rate hike schedule from the U.S. Federal Reserve. As we wrote in our update to investors earlier this week, these taper tantrums have been quite common over the past 10 years. However, this round is the first instance in which inflation readings have been solidly above 5%, forcing the question as to whether it is transitory or not.

Looking at the December 2021 CPI data, major increases were found in vehicles, food and energy-related products. Other large gainers, including apparel and household furnishings, are also experiencing shortages due to factory closures and freight transportation backlogs. It is possible that we will see continued energy price increases due to a dearth of new investment and commitments by producers to maintain minimum production growth, but we expect many inflationary categories, particularly those around durable and hard goods, to recede in the midterm.

Figure 4: December 2021 CPI Inflation

Source: U.S. BLS

With supply chain constraints exacerbated by omicron-related closures, we believe inflation is primed to remain elevated for at least the first half of 2022. This should ensure that the Fed raises interest rates 2-3 times before July. Current market expectations are for five rate hikes in 2022 and additional 1-2 hikes in 2023. However, we believe there is a possibility that the large fall in technology-related speculation (as witnessed by declining cryptocurrency and valuation levels) as well as improved supply chains post-covid closures can slow inflation. The U.S. 10-year yield has broken out to recent highs but remains well within the range of the past decade.

Figure 5: 10-year government bond yield.

Source: Refinitiv

Commodity prices remain strong in 2022.

Commodities enjoyed a strong 2021, rallying 27% (Bloomberg Commodities Index) off vaccine-driven news flow and supply deficits, and experienced a rare year in which commodity prices outperformed broader markets. Low commodity prices in the dusk of China’s industrialization efforts have led to a prolonged slump in new investment, a trend further exacerbated by covid-restricted activity. As well, several secular elements such as decarbonization and ESG mandates are pushing prices higher.

As existing mines and oil fields decline, new projects are required to meet future demand. These projects, and higher ESG hurdles, will require market prices that offer a suitable return on investment. Thus, we expect commodity prices to remain elevated in 2022. Longer-term, we view prices in excess of marginal cost as a warning sign that additional capacity will likely lower market prices, but this is not in the cards for 2022.

Conclusion

At month end, the S&P 500 Index was trading at 19.6x, slightly below the average 21x the index traded at in 2021. Looking forward, Wall Street consensus calls for 8% profit growth in 2023/24. If we assume that multiples will normalize by 2024, settling back into a range of 18x forward earnings, the upside to equities is limited barring revisions in profit growth. An 18x multiple of 2023 S&P 500 estimated EPS of 240 implies a 4,320 target, 5% below the month end close.

The market is exiting its third year of 20%+ equity market gains. It makes sense that markets would pause into a rate hike cycle, although the volatility has certainly taken investors by surprise in the absence of any poor economic data. However, bull markets typically do not end ahead of a rate hiking cycle and often trade higher 12 months after the first rise in rates. We believe supply-driven inflation will abate with the strong supply chain response in semiconductor capital spending and a fall in demand for durable goods. However, relief on this front is likely six months away, and with labour and housing markets remaining tight, a rate hike cycle starting in March 2022 is almost assured. Longer term, we expect to see increased investment in automation and technology as well as strength in card networks and payments. Travel and experiential spending should perform well, although we acknowledge valuations in these sectors are anticipating a recovery. Finally, commodities should perform well, with limited new investment and strong profitability. Given that we believe valuation multiples will remain mainly stagnant, investors should look for turnaround stories or growth companies that can surprise to the upside on earnings.

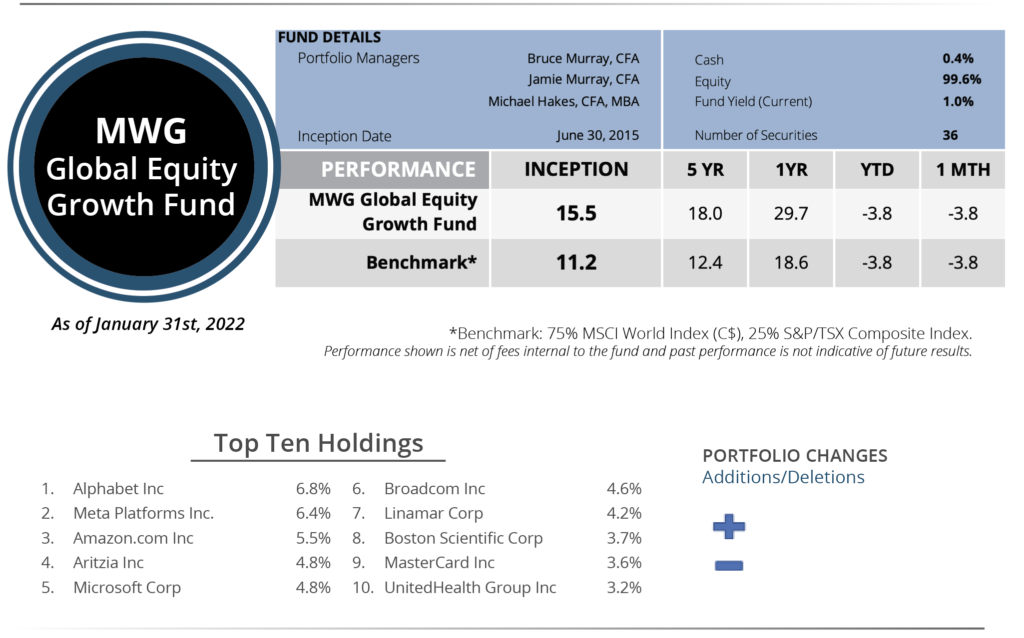

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund fell 3.8% in the month, in line with the benchmark. The top portfolio performers in December were Aritzia (+12%), Manulife (+10%) and Enbridge (+9%), while Netflix (-28%), Adyen (-22%) and Twilio (-21%) were the bottom performers. Over the past year, the Fund has increased 29.7% versus the benchmark return of 18.6%.

We made no changes to our portfolio companies during the month. However, we will use this forum to defend the shares of underperforming technology companies we hold. We own several companies in the technology sector that have chosen a growth over profitability approach to capital allocation. We believe some of these markets are still nascent, and a company’s ability to secure first mover advantage will provide them with a structural stickiness and network effect advantage versus their peers.

Twilio and Uber are two prime examples. Both companies continue to extend their lead in markets that benefit from first mover advantage. Twilio provides messaging APIs, virtual contact centers and customer data platform services that customers build processes from. While acquiring a customer can be expensive upfront, the long-term stickiness of their products as well as growth in customer activity trend increasingly profitable over time. Similarly, Uber wins local markets by signing up the most drivers and generating the most trips. The more demand on Uber’s platform, the more supply will respond; the more supply, the better the demand experience. We think both companies win in their respective markets and have the potential to show tremendous profitability in 2023/24 as the businesses scale.

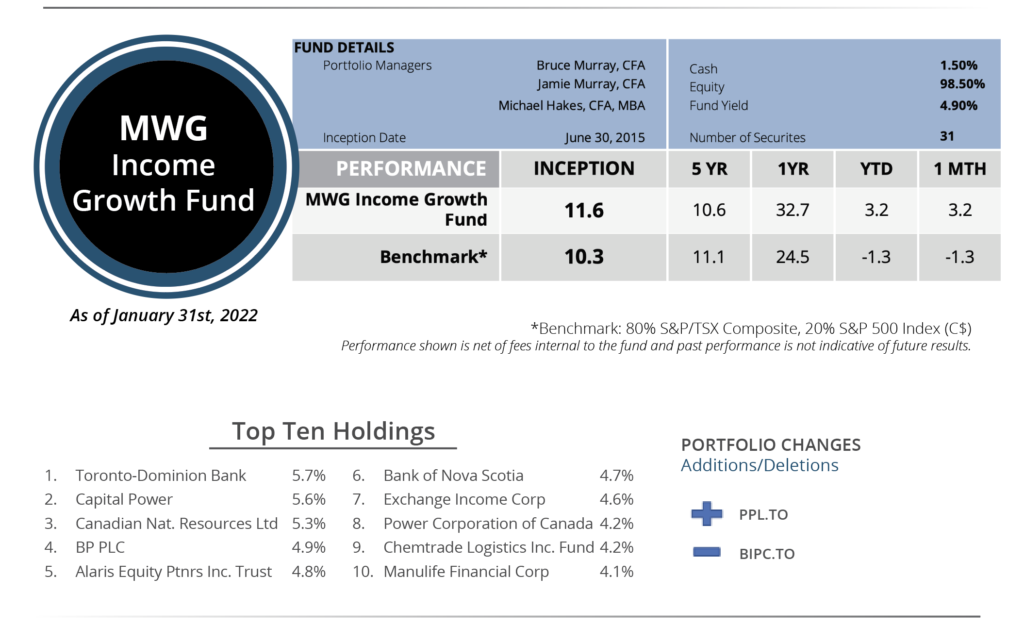

INCOME GROWTH FUND

The MWG Income Growth Fund rose 3.2% in January versus the 1.3% decline in the benchmark return. At month end, the Fund yield was 4.9%. The top three performers in the portfolio were Canadian Natural Resources (+21%), BP (+17%) and Manulife (+10%), while Cogent (-12%), Broadcom (-11%) and Russel Metals (-6%) were the bottom performers. Over the past year, the Fund has increased 32.7% versus the benchmark return of 24.5%

During the month, we acquired shares in Pembina Pipeline. Pembina operates the Alliance Pipeline (natural gas) in addition to a complex of hydrocarbon transportation and processing assets in Western Canada. We believe oil and gas volumes will increase in Western Canada with new export initiatives such as LNG (both West and Gulf Coast) and low global inventories. As well, Alberta is seeing increased processing demand such as the Heartland Petrochemical Complex (polypropylene). The shares yield 6.2% and there is potential for additional share buybacks beyond the committed $200m in the first half of 2022.

To fund the purchase, we sold our position in Brookfield Infrastructure Partners, which we acquired after its acquisition of Inter Pipeline in 2021.