After spending parts of October in Hong Kong, Vietnam and Japan, one thing is clear: technology is just as ingrained in Asia as it is in North America.

That in itself is not shocking. We are familiar with successful Chinese firms like Tencent (WeChat), ByteDance (TikTok), Alibaba and Baidu, Japan’s Softbank (how’s that WeWork IPO coming along?) and Indonesia’s GrabCar (essentially an Asian-version of Uber and motorbikes). However, the products and services of technology firms from the West remain very relevant for Asian businesses and consumers.

Below we present some observations from our travels that indicate additional growth potential for our two largest holdings, Facebook and Google.

Facebook is more relevant than ever.

While in Asia, we observed many young people scrolling through their Facebook newsfeeds on subways (unlike in North America, where FB newsfeeds have taken a backseat to Instagram). For business, WhatsApp is the preferred contact method, often eschewing email in favor of a simple text message. Facebook Messenger remains the easiest way to connect with family and friends (the wedding Bruce and I attended for an Australian/South African couple brought together people from 15 countries. With FB Messenger, a group chat was created and information/photos easily shared…..not to mention an invite for a free plan to stay the next time we visit Zambia).

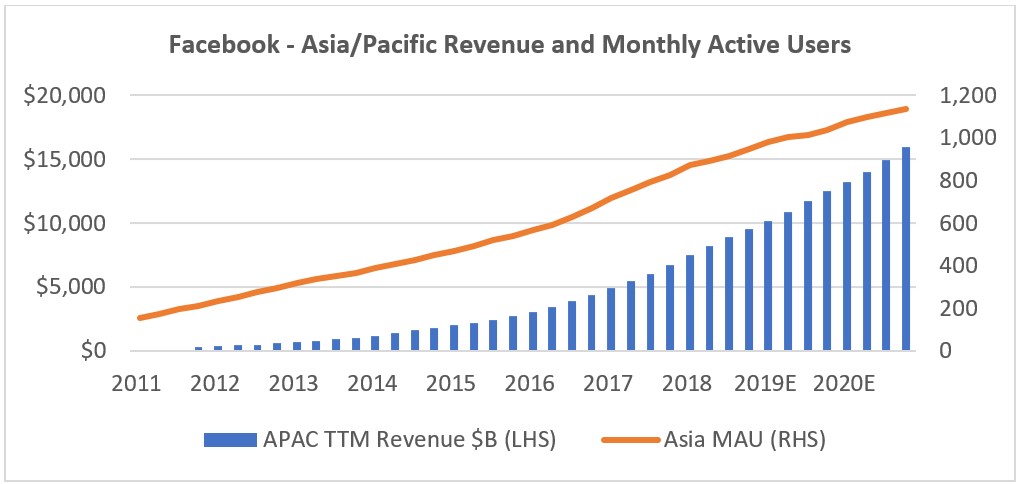

Our observations are reflected in Facebook’s financials. Third quarter 2019 results revealed strong user growth in Asia, with Daily Active Users reaching 627 million (up from 561 million a year earlier). Advertising revenue grew $800 million to US$3.2B. Given the expanding user base and the modest level of revenue currently generated by users in Asia (revenue per user in Asia sits at only US$24 versus $170 in North America), this market represents significant growth potential for the company.

China.

Many Western internet properties, including Facebook, Netflix and Google, are blocked in China due to censorship issues (colloquially referred to as the Great Firewall of China). However, despite this censorship, many Chinese residents still utilize Facebook and Google’s services. In-country, a virtual private network (VPN) can be used to access a computer server outside China to watch Netflix, for example. Although China works hard to crack down on this type of activity, we spoke to several Chinese residents (mostly ex-pats) that use this service. Out of country, many Chinese residents use Facebook’s services by simply creating a user account and accessing the site when travelling. While these user metrics would show up in the financials based on the location of the VPN or country where they were accessed, it is interesting in that it expands the potential Total Addressable Market for these services.

Google Maps – a promising asset.

The Alphabet program remains the standard app for directions in Asia, even providing fastest routes for motorbikes vs. passenger cars in Vietnam. One of Alphabet’s least monetized assets, over one million apps and websites currently integrate Google Maps API into their own programs. The mapping asset has many avenues (pun intended) to drive revenue growth over the long term. Firstly, the ability to search and advertise within the platform should increase as more users become dependent on Google maps (versus satellite GPS). With more than one billion users, it clearly has large advertising potential. Secondly, Google is charging more to third party applications that are using its Map API. A good example of this is the Starbucks app, which shows the locations of all nearby Starbucks. Finally, the transportation applications are particular interesting. Ridesharing applications such as Uber, Lyft and Grab all use Maps API as do many municipal transportation systems. Alphabet’s autonomous driving unit, Waymo, is a leader in driverless vehicle programming and there are likely additional synergies to come from advancement in this development.

Southeast Asia remains a strong growth market for Western internet services. As incomes rise and the world becomes more and more connected, we expect to to see users and revenue per user metrics increase more rapidly versus more established North American markets. Local competition has won the market in several services (for example, it would be tough for Uber to supplant Grab car in Vietnam given its established market share) but the services mentioned above along with new products under development should continue to drive growth in the region.